|

ANALYSIS OF BALANCE SHEET & INCOME STATEMENT |

| << Financial Consultation Case Study |

| SUMMARY OF FINDGINS >> |

Financial

Statement Analysis-FIN621

VU

Lesson-44

ANALYSIS

OF BALANCE SHEET & INCOME

STATEMENT

5

1

Fixed

Assets

a)

Decreasing.

b) No

depreciation reserve (unable to replace

old

assets

out of its own

resources).

·

Bibo

had made counter claims

6

1

Current

Assets:

·

These

are doubtful debts.

·

No

provision for bad

debts.

m

Bibo:Rs.17 m

·

Liquidity

overstated.

·

Interest

treated

as

miscellaneous

-Book

debt

=

Income.

Rs.6.71

m

·

Treating

interest as misc. income

understated

on

30.06.72

operating

losses by Rs.10.29 million.

·

Accumulated

loss rises from 114

million to 124

-Interest

over the=

million.

Rs.10.29

m

period

1972-80

____

17

m

7

1

Other

Receivables

·

Loans

given to cane growers.

·

Aging

detail.

·

Loans of

Rs.0.5 million outstanding

for 6-10

years.

·

Doubtful/bad

loans.

·

No

provision.

·

Liquidity

overstated.

8

3

Liquidity

·

Current

and quick ratios.

·

Poor

liquidity.

·

Actual

ratios much lower in view of

doubtful

debts.

·

Cannot

repay its current

obligations.

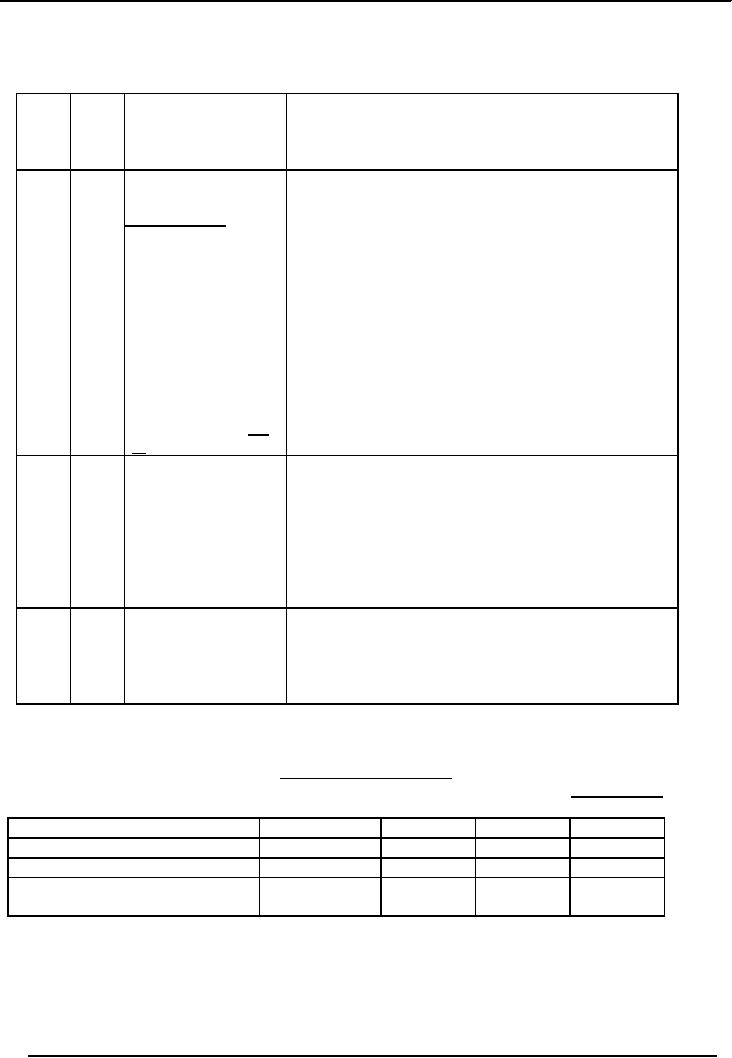

Table-2

ACCUMULATED

LOSS

Rs.

in million

At the end of

year

1976-77

1977-78

1978-79

1979-80

Loss

for the year

9.5

16.0

12.03

19.8

Accumulated

loss

66.0

82.0

94.3

114.1

%

increase in accumulated loss

24%

43%

73%

over

base year (1976-77)

157

Financial

Statement Analysis-FIN621

VU

Table-3

CURRENT

AND QUICK RATIOS

Rs.

in million

Year

end June 30

1977

1978

1979

1980

Current

assets

33

40

35

24

Current

assets less inventory &

pre- 19

19

21

22

paid

Current

liabilities

40

55

53

51

Current

ratio

0.8:1

0.7:1

0.6:1

0.5:1

Quick

ratio

0.5:1

0.3:1

0.3:1

0.4:1

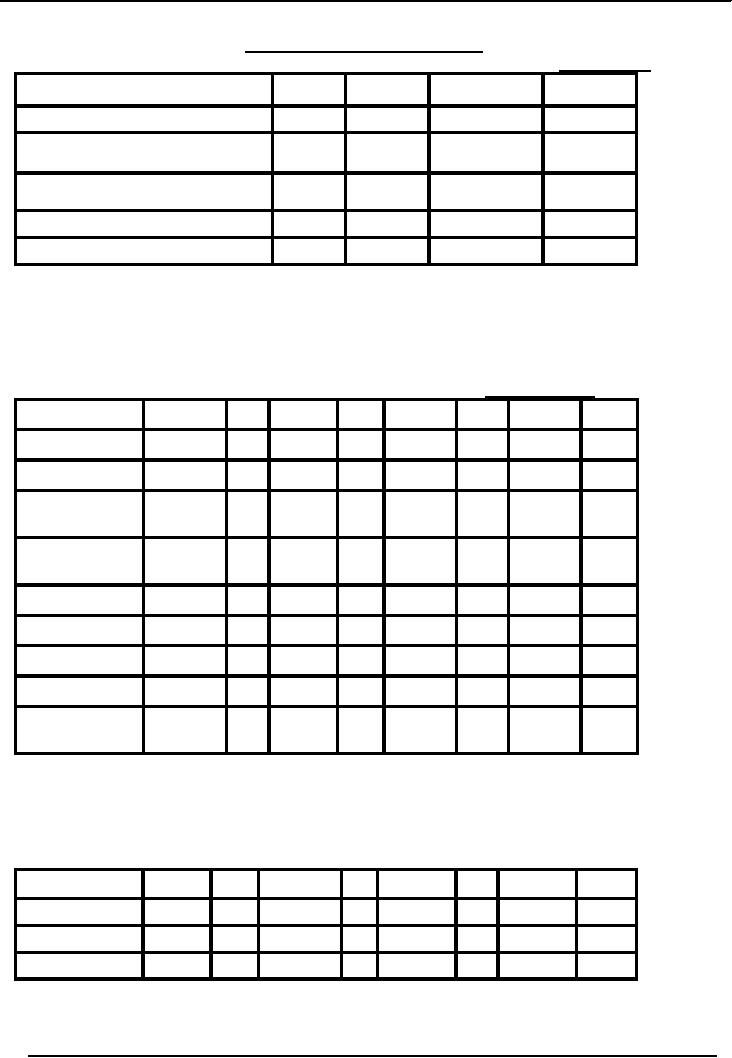

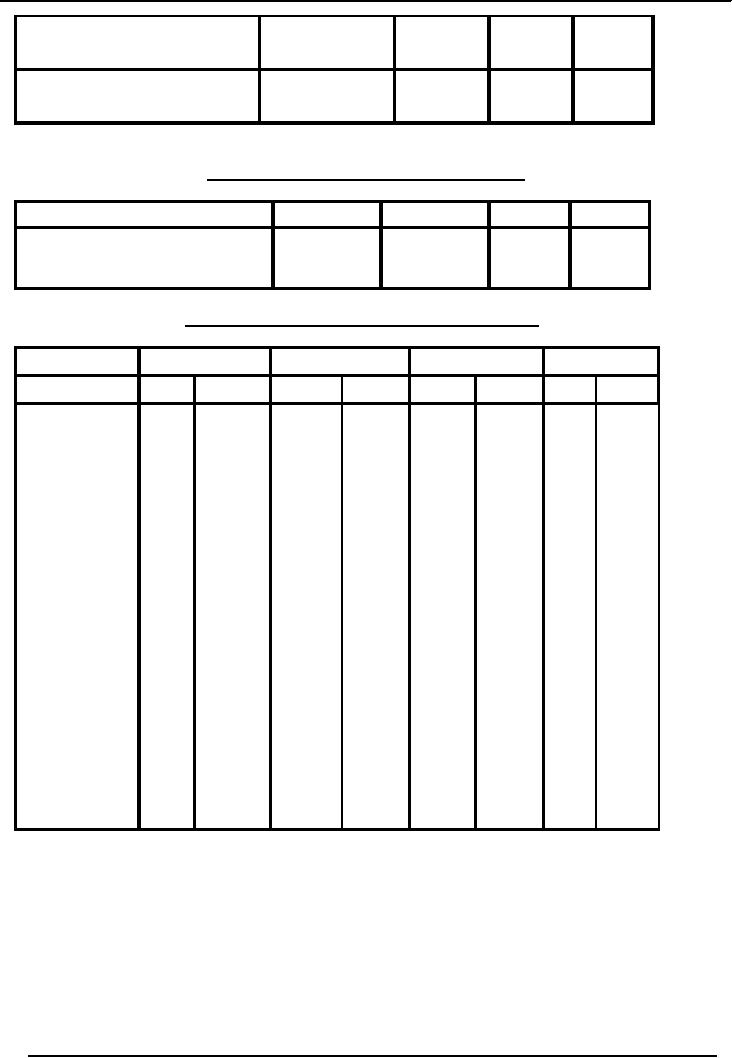

Table-4

XYZ

SUGAR MILLS

PROFIT

AND LOSS ACCOUNT

Rs.

in thousands

Year

1976-77

1977-78

1978-79

1979-80

Sales

58,000

%

52,000

%

42,000

%

20,000

%

Cost

of Sales

Cane,

carriage & 35,000

60

38,000

73

24,000

57

16,000

80

incidentals

Salaries &

Wages 6,000

10

7,000

13

6,000

14

6,000

30

Excise

duty

15,000

26

11,000

21

11,000

26

2,000

10

Depreciation

1,000

2

1,000

2

800

2

800

4

Others

3,000

5

3,400

7

3,000

7

2,000

10

Total:

60,000

103

60,400

116

44,800

106

26,800

134

Gross

Profit (loss) (2,000)

3

(8,400)

16

(2,800)

6

(6,800)

34

Operating

& non-operating expenses

Admin

& selling

3,000

5

3,000

5

4,000

10

5,000

25

Financial

4,500

8

4,600

9

5,500

13

8,000

40

Total:

7,500

13

7,600

14

9,500

23

13,000

65

Operating

(loss)

(9,500)

16

(16,000)

30

(12,300)

29

(19,800)

99

158

Financial

Statement Analysis-FIN621

VU

`Others'

consist of:

-

Cloth

& packing material

-

Stores

& Spares

-

Insurance

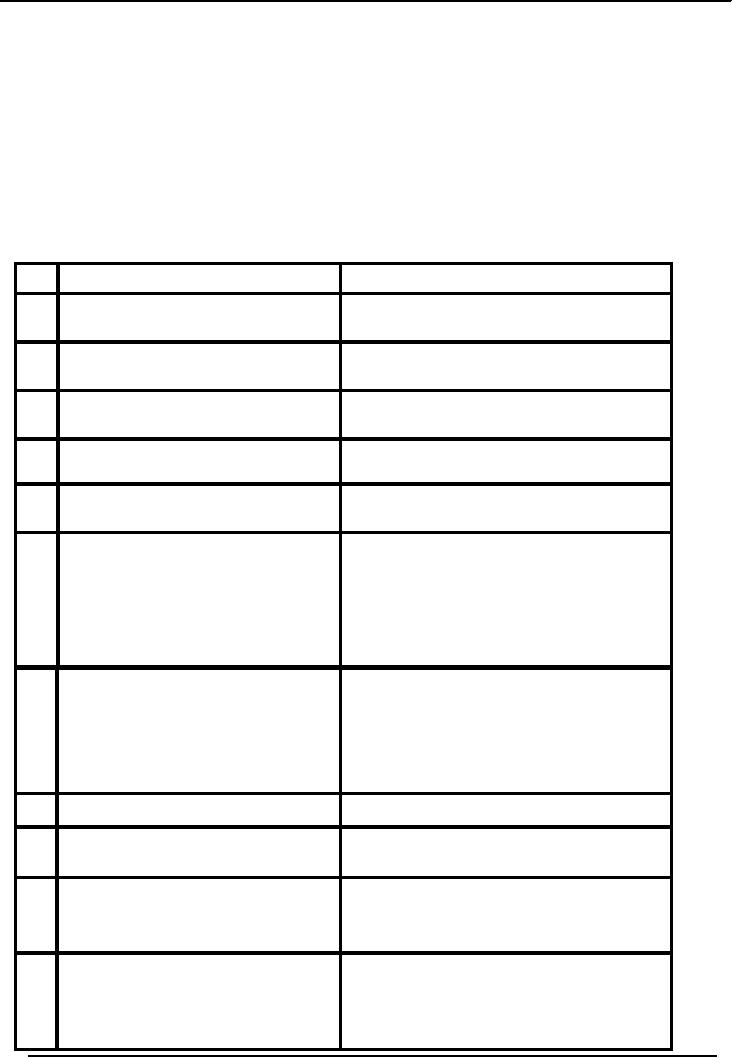

ANALYSIS

OF PROFIT & LOSS ACCOUNT

No.

DATA/FACTS/DOCUMENTS

FINDING

1.

Table-4

Profit & Loss

Accounts

·

Bottom

line figures: operating

losses.

·

Never

made profit.

2.

Table-4

-do-

·

Various

costs as % of sales.

·

Constantly

reducing sales.

3.

Table-5

Production and capacity

·

Reduced

sugar production.

Utilization.

·

Below

capacity utilization.

4.

Non

availability of cane; feasibility

report

·

Erroneous

assumption in PC 1

5.

Table-6

Sugarcane procured locally

·

Only

5 to 44% of plant's requirement

(of

185,000

tons) met locally.

6.

Table-7

Total procurement of cane.

·

Cane

crushing capacity = 1500

tons/day

normal

crushing season = 120

days.

·

Full

requirement of cane never

met.

·

During

1979-80, growers switched to

turmeric,

they also preferred

gurmaking

due to

its high price.

7

Table-8

Area-wise

procurement

of

·

Between

42% to 60% cane brought

from

sugar-cane

far-off

places.

·

Result

was

excessive

cost

of

transportation,

drying up of cane

(less

recovery

percentage).

8

Table-9

Cost of transportation

9% to

14% of cost of cane.

9

Table-10

Per ton cost of

·

Between

Rs.15 to 21.

transportation.

·

Double

the cost of other factories.

10

Table-4

P&L Account

·

High

percentage of sale

revenues.

Cane,

Chemical and

·

Include

increased cost of

transportation.

incidentals.

11

Table-4

Salaries, Wages and

·

Constantly

increasing as % of sales.

benefits.

·

Heavy

fixed cost due to:

-

normal increases.

-

increase in employee strength.

159

Financial

Statement Analysis-FIN621

VU

12

Table-11

Employees strength

·

53-73%

over PC1 strength/seasonal

staff

as

routine.

13

Table-12

Cost of establishment

·

Very

high due to:-

per

ton of sugar produced

-

excess employees.

-

reduced production.

14

Table-13

Productivity per employee

·

Decreasing.

15

Table-4

Administrative expenses

·

Increasing

as % of sales.

·

Excess

employee strength.

16

Table-4

Financial expenses

·

Increasing

as % of sales

Table-14

(range:

8% to 40%)

·

Why?

Because of increased debt

burden,

and

Unit's inability to pay

owing to

persisting

losses: vicious

circle.

Table-5

PRODUCTION

AND CAPACITY UTILISATION

TONS

1976-77

1977-78

1978-79

1979-80

Cane

crushing capacity

185,000

185,000

185,000

185,000

Cane

crushed

140,292

166,271

93,931

14,375

Capacity

utilization

76%

90%

51%

8%

Sugar

produced

11.344

14,015

8,007

1,206

%

recovery

8.08%

8.43%

8.55%

8.38%

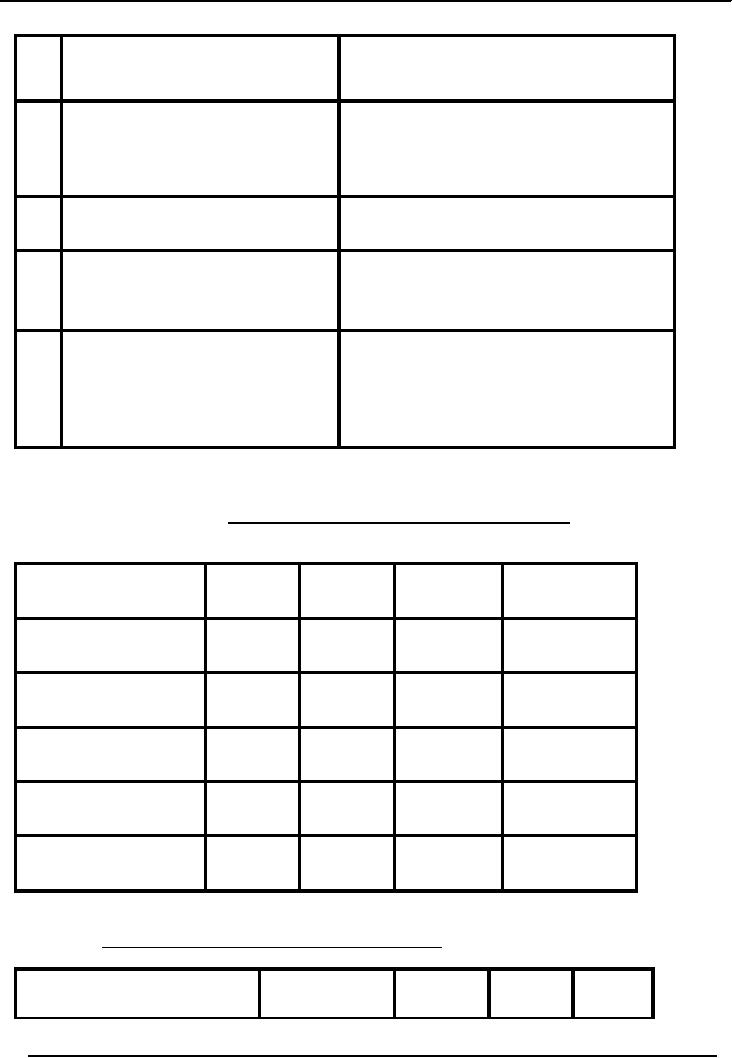

Table-6

PROCUREMENT

OF SUGAR CANE LOCALLY

1976-77

1977-78

1978-79

1979-80

160

Financial

Statement Analysis-FIN621

VU

Quality

procured (Tons)

81,444

81,367

37,857

8,392

Procurement

as

%

of

total

44%

44%

20%

5%

requirements.

Table-7

TOTAL

PROCUREMENT OF SUGAR-CANE

1976-77

1977-78

1978-79

1979-80

·

Cane

procured (tons)

140,292

166,271

93,731

14,375

·

% of

requirement

76%

90%

51%

8%

Table-8

AREA-WISE

PROCUREMENT OF SUGAR-CANE

TONS

1976-77

1977-78

1978-79

1979-80

Qty

%

Qty

%

Qty

%

Qty

%

Sugar-cane

produced

from

· Local

area

40%

49%

37857

81367

58%

81444

58%

8392

17%

27%

15976

44415

20%

Distt.

28316

6%

801

·A

(200km

North)

20%

11%

19164

18361

9%

12395

17%

2439

·B

Distt.

(150km

14%

11%

12870

18268

12%

16707

18%

2627

South)

·C

Area

9%

7864

2%

3860

1%

(150km

East) 1430

1%

116

·D

Area

(300km

100%

100%

93,731

166,271

140,292

100%

100%

14,375

West)

Total:

161

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS