|

ALLOCATION AND APPORTIONMENT OF FOH COST |

| << LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST |

| FACTORY OVERHEAD COST:Marketing, Research and development >> |

Cost

& Management Accounting

(MGT-402)

VU

LESSON

# 15

ALLOCATION

AND APPORTIONMENT OF FOH COST

Bases

for apportioning costs

In

selecting a basis for

apportioning an overhead item,

the cost of obtaining a high

degree of

accuracy

must be considered. For

example, the charge for

heat and light could be

shared on the

basis

of a complex formula incorporating

power points, light bulbs

and wattage but you

should be

aware

that the end result

will still be open to question. When

answering examination questions,

you

may

have to use your own

judgment in relation to the

information given as it is impracticable to

provide

a comprehensive list of bases to cover

every situation.

Practice

Question

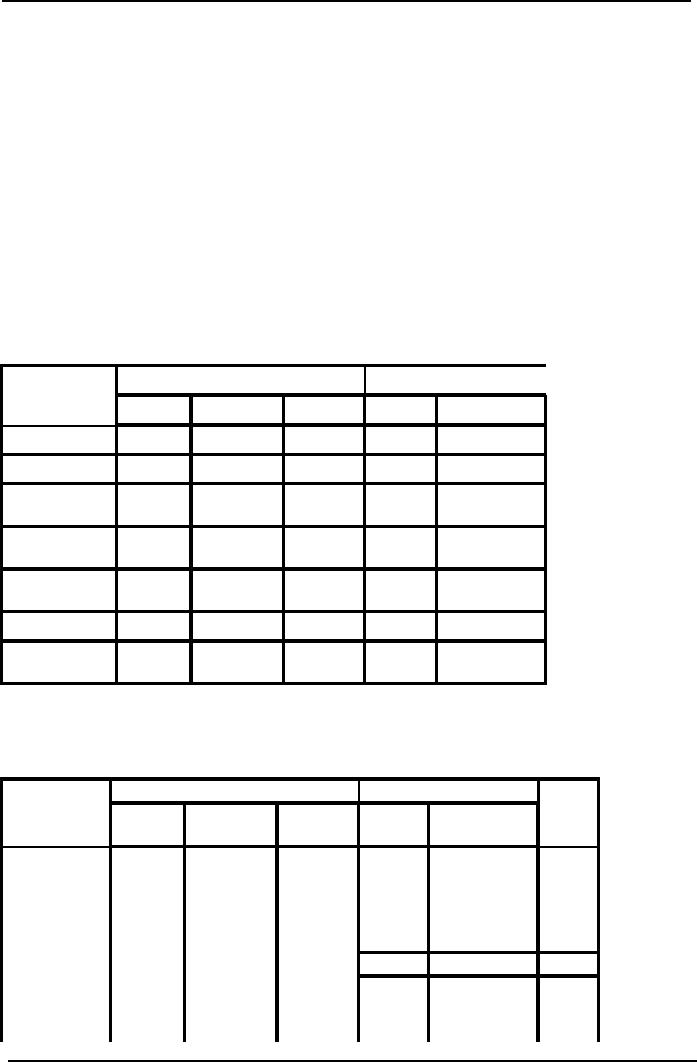

Plastic

Pots & Furniture

Basis

of Apportionment

Production

Department

Service

Department

Molding

Machining Finishing Canteen

Maintenance

Materials

(Rs.)

300,000

130,000

45,000

40,000

75,000

Wages

(Rs.)

400,000

750,000

755,000

95,000

100,000

Cost

of Assets

125,000

250,000

130,000

70,000

75,000

(Rs.)

Horse

Power

700

1,400

600

88

200

Hour

Area

in Sq.

180

180

240

60

60

Yard

Metered

Units

6,000

6,000

7,000

2,000

3,000

No.

of

240

300

380

30

80

Employees

Plastic

Pots & Furniture

Work

Sheet

Apportionment

of Factory Overhead Product Department

Production

Department

Service

Department

Cost

Heads

Total

Machine

Molding

Machining Finishing

Canteen

Maintenance

Allocated

Cost

(Identified)

Materials

40,000

75,000

115,000

Labor

Wages

95,000

100,000

195,000

135,000

175,000

310,000

Electricity

13,500

13,500

15,750

4,500

6,750

54,000

Bonus

Pay

4,000

7,500

7,550

950

1,000

21,000

105

Cost

& Management Accounting

(MGT-402)

VU

Factory

Rent

60,000

60,000

80,000

20,000

20,000

240,000

Power

175,000

350,000

150,000

22,000

50,000

747,000

Depreciation

37,500

75,000

39,000

21,000

22,500

195,000

c/f

203,450

275,250

156,700

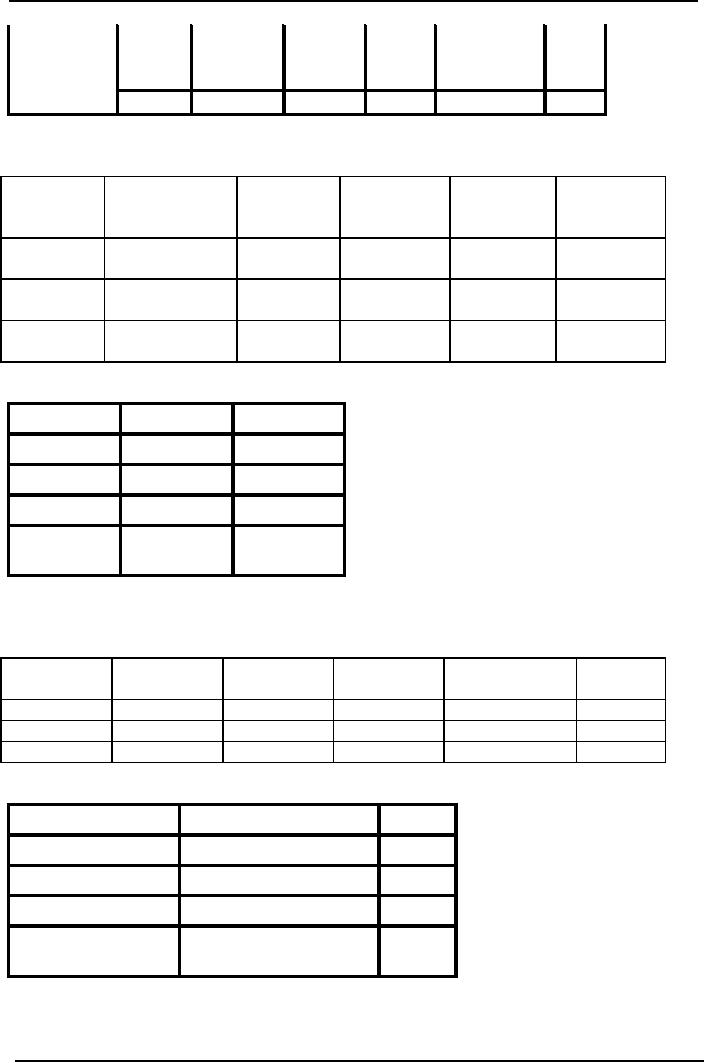

Apportionment

Electricity

Basis:

Metered units

Canteen

Machine

Molding

Machining

Finishing

Total

Maintenance

2,000

3,000

6,000

6,000

7,000

24,000

2

3

6

6

7

24

2/24

3/24

6/24

6/24

7/24

Molding

54,000x

6/24

13,500

Machining

54,000x

6/24

13,500

Finishing

54,000x

7/24

15,750

Canteen

54,000x

2/24

4,500

Machine

54,000x

3/24

6,750

maintenance

Apportionment

Bonus Pay

Basis:

Labor wages

Molding

Machining

Finishing

Canteen

Machine

Total

Maintenance

400,000

750,000

755,000

95,000

100,000

2,100,000

400

750

755

95

100

2100

400/2100

750/2100

755/2100

95/2100

100/2100

Molding

21,000/2100*400

4,000

Machining

21,000/2100*750

7,500

Finishing

21,000/2100*755

7,550

Canteen

21,000/2100*95

950

Machine

maintenance

21,000/2100*100

1,000

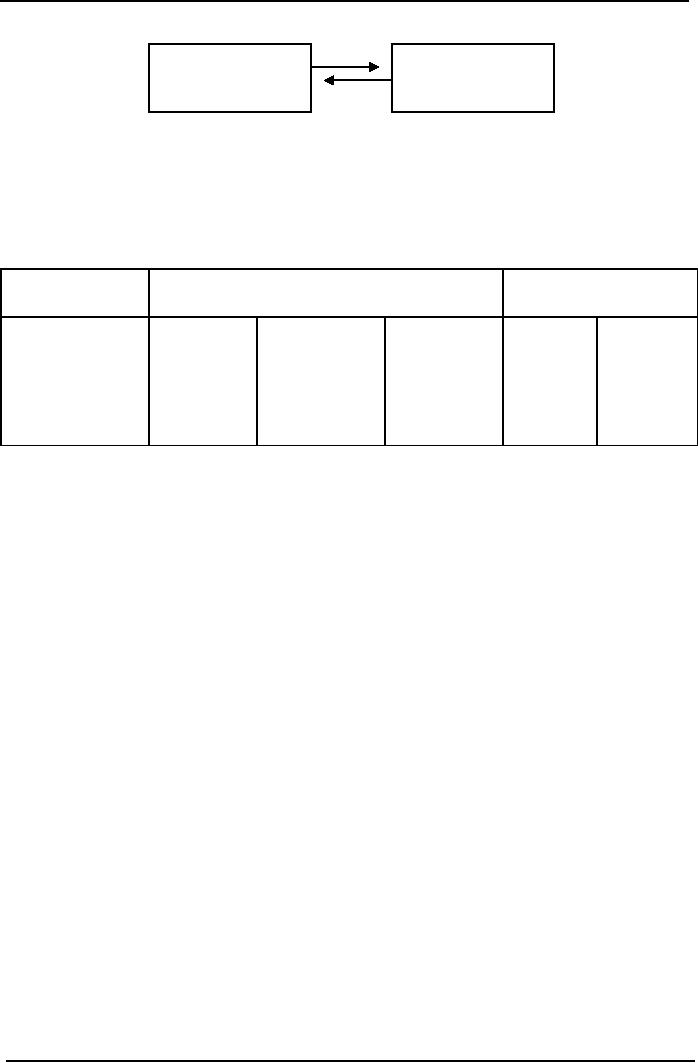

Reciprocal

costs between service

centers

A

particular problem arises

when service centers provide

reciprocal services to each

other

as in the following

figure.

106

Cost

& Management Accounting

(MGT-402)

VU

Maintenance

Payroll

Department

Section

In

this situation, a secondary

allocation of costs arises.

There are a number of methods of

dealing

with

this, of which the simplest,

the repeated distribution

method, is shown

below.

Repeated

distribution method

This

method takes each service

department in turn and

re-allocates its costs to all

departments

which

benefit. The re-allocation

continues until the numbers

being dealt with become

very small.

Problem

Question

Production

Service

Department

A

B

C

P

Q

Costs

Proportion

Rs.3,000

Rs.4,000

Rs.

2,000

Rs.2,500

Rs.2,700

P

Proportion Q

20

30

25

-

25

25

25

30

20

-

Apportion

the cost of Service

department to the Production departments.

To calculate the cost

of

a

cost unit we must include a

fair share of all costs

incurred in its production. If more

than one

product

is made. This will include

allocation and

apportionment.

Blanket

v departmental absorption

rates

Blanket

rates

A

blanket absorption rate is a

single rate of absorption

used throughout an organization's

production

facility and based upon its

total production costs and

activity.

The

use of a single blanket rate

makes the apportionment of

overhead costs unnecessary

since

the

total production costs are

to be used. How ever this is

not recommended for the

following

reasons:

·

It relies on a single activity

measure being appropriate for

the entire production

function.

·

It does not distinguish between

the miming costs of

particular activities or departments

when

absorbing costs into cost

units.

Departmental

rates

A

departmental absorption rate is a rate of

absorption based upon the

particular department's

overhead

cost and activity

level

This

method allows the activity of

each department to be measured using a

basis which is

appropriate.

It also ensures that the

cost attributed to the cost

unit reflects the cost of

the

departmental

resources used in its cost

units.

107

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS