|

Accelerated-Depreciation method |

| << Depreciation Accounting Policies |

| Auditor’s Report, Opinion, Certificate >> |

Financial

Statement Analysis-FIN621

VU

Lesson-22

NOTES

TO FINANCIAL STATEMENTS

(Continued)

Depreciation

expenses for year would be:

=cost-(estimated) Residual value =

17,000-2000 = 3000

*(Estimated

years of useful life-5)

ii)

Accelerated-Depreciation

method: In

this method higher depreciation rate is

charged

in

early years and lower rate

in later years. Since new plants

are most efficient in

early

years,

matching principle demands

that higher depreciation may

be charged in earlier

years.

Depreciation

= Book Value x Accelerated

Dep. Rate

Example:

Taking the above case of plant

asset acquired for Rs.17,

000

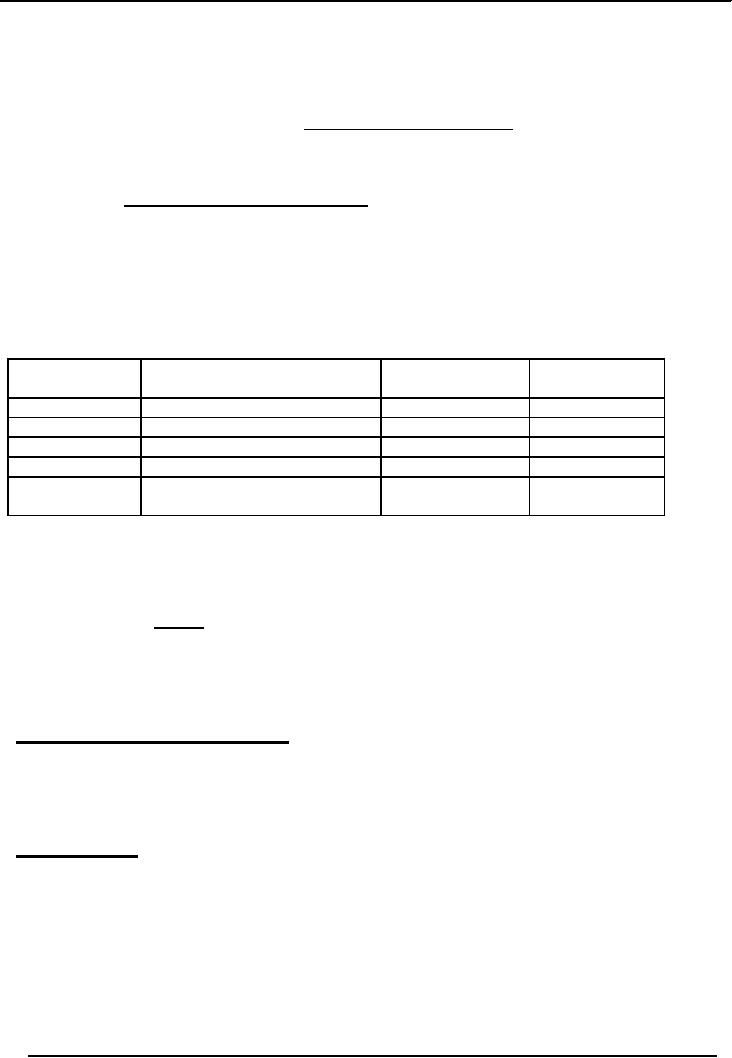

Year

Depreciation

Accumulated

Book

Value

Depreciation

1

17,000

X 40%

6800

6800

10200

2.

10,200

X 40%

4080

10880

6120

3.

6,120

X 40%

2448

13328

3672

4.

3,672

X 40%

1469

14797

2203

5.

2,203

X 40%

881

15000

2000

(reduced to

203)

Note

that sine total depreciation

in five years is Rs.15, 000

(Rs.17, 000 2,000), the

depreciation for the

last

year is reduced from 881 to

203 to bring the total

depreciation amount in 5 years to Rs.17,

000.

Principles

of disclosure and Consistency of Accounting Methods.

This is the basic

concept

underlying reliable financial

statements, i.e. consistently

following the Inventory

valuation/

pricing

and Depreciation calculation Methods.

Disclosure of the Accounting methods

used, in Balance

Sheet

or in the Notes is also an essential

requirement of Disclosure Principle. If

however, Accounting

Method

(s) are changed disclosure

must be made of reasons for

such change, and of the effect of

change

upon

the company's net income.

Annual

Report Generated By Business

Annual

Report is part of Financial

Reporting Process which contains

Financial

Statements,

Notes to financial statements,

Auditors' Report, Five-year summary of

key financial and

non-financial

data, and Management's discussion and analysis of

operations (MD&A).

Auditor's

Report

Audit

of financial statements is independent of

the business issuing these.

Financial

Statements

preparation is Management's

responsibility, whereas expressing

opinion as to their fairness

is the

Auditor's responsibility, Audit

Report is issued along with

financial statements to persons

outside

the

business. It provides assurance to

outside users about the

completeness and reliability

(not

necessarily

accuracy) of Financial

Statements.

Auditor

is hired by the company being audited.

Usually a Management letter is

also

issued

by Auditors to Company's management,

recommending steps for improving

company's internal

control

structures.

98

Financial

Statement Analysis-FIN621

VU

Fairness' in the

context of Auditor's Report

means that financial

statements

are

not

misleading.

Audit is conducted according to Generally

Accepted Auditing Standards.

During Audit, the

Auditors

obtain reasonable assurance

that financial statements

are free of "material"

misstatements.

Audit

is conducted by examining, on a test

basis, evidence supporting the amounts

and disclosures in

the

financial statements. It assesses the

accounting principles used and

significant estimates made

by

management.

It must also be noted that

Audit`s purpose is to determine fairness

of financial statements

and

not to detect frauds, as such. In the

context of materiality, it is to be noted

that an item is material

if

knowledge

of this might reasonably be expected to

influence user's decisions. Also to be

noted is the

fact

an auditor can also make

errors like a physician does

in diagnosis.

End

product of every audit is the

auditor's report. An audit

involves collection of audit evidence

about

the

truth and fairness of

financial statements or other

proposition under review. By

careful examination

of the evidence so

called the auditor draws

appropriate conclusions and forms his

opinion. The

auditor's

report

summarizes results of the work conducted

by the auditor and formally communicates

the

auditor's

opinion.

It is

important to note that the

auditor's report simply

expresses the auditor's opinion on

truth and

fairness

of financial statements as absolutely

correct. An auditor's report is a formal

statement that

includes

the reporting auditor's opinion

formed after careful

examination of books of accounts

and

related

documents. Where as, a certificate is

written conformation of absolute accuracy

of the facts

stated

therein and does not involve

any estimate or

opinion.

Types

of auditor's opinion

An

auditor's opinion may be

unqualified, qualified or adverse. In

certain circumstances the auditor

may

disclaim

an opinion i.e states his

inability to express an

opinion.

Unqualified

opinion

Opinion

of an auditor is termed as unqualified

when the auditor concludes

that that the

financial

statements

give a true and fair view in

accordance with the identified

financial reporting

framework.

There

is no statuary definition of the words "true

and fair". However, true and

fair has been taken

to

mean

the following: (I) free from

prejudice or bias, (II) presentation of an

objective picture, (III) in

accordance

with generally accepted

accounting principles, (IV) consistent

and having clarity,(V)

not

misleading

and understandable by the reader of financial

statements,. (V) presented

fairly, in all

material

respects.

Identified

financial reporting framework

means the set of statutes,

rulers, and standards etc.

That apply

to the

preparation and presentation and presentation of such

financial statements.

According

to the companies ordinance 1984, in an

unqualified audit report the

auditor is required to

make

some statutory affirmations

without reservations, as prescribed in section

255(3).

In an

unqualified opinion the auditor

also impliedly undertakes that

any changes in

accounting

principles

or in the method of their application, and the effects

thereof, have been properly

determined

and

disclosed in the financial

statements.

Modified

opinion

An

auditor may not be able to

express an unqualified opinion.

When either of the

following

circumstances

exists and, in the auditor's judgment, the

effect of which is or may be

material to the

financial

statements:-

99

Financial

Statement Analysis-FIN621

VU

(a)

There is a limitation on the scope of the

auditor's work; or

(b)

There is a disagreement with management

regarding the acceptability of the

accounting policies

selected,

the method of their application or the

adequacy of financial statement

disclosures.

The

circumstances described in (a) could

lead to a qualified opinion or a

disclaimer of opinion.

The

circumstances

described in (b) could lead

to a qualified opinion or an adverse

opinion.

(i)

Qualified Opinion

Opinion

of an auditor is termed as qualified

opinion when the auditor

concludes that an

unqualified

opinion

cannot be expressed but that the

effect of any disagreement with

management, or limitation on

scope

is not so material and pervasive as to

require and adverse opinion or a

disclaimer of opinion. A

qualified

opinion is expressed as being `except

for' the effects of the matter to which the

qualification

relates.

(ii)

Disclaimer of opinion

A

disclaimer of opinion should be

expressed when possible effect of a

limitation on scope of audit is

so

material

and pervasive that the

auditor has not been

able to obtain sufficient

appropriate audit evidence

an

accordingly is unable to express an

opinion on the financial

statements

(iii)

Adverse opinion.

An

adverse opinion should be

expressed when the effect of a

disagreement is so material and

pervasive

to the

financial statements that the

auditor concludes that a

qualification of the report is not

adequate to

disclose

the misleading or incomplete nature of the

financial statements.

100

Table of Contents:

- ACCOUNTING & ACCOUNTING PRINCIPLES

- Dual Aspect of Transactions

- Rules of Debit and Credit

- Steps in Accounting Cycle

- Preparing Balance Sheet from Trial Balance

- Business transactions

- Adjusting Entry to record Expenses on Fixed Assets

- Preparing Financial Statements

- Closing entries in Accounting Cycle

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Preparing Cash Flows

- Additional Information (AI)

- Cash flow from Operating Activities

- Operating Activities’ portion of cash flow statement

- Cash flow from financing Activities

- Notes to Financial Statements

- Charging Costs of Inventory to Income Statement

- First-in-First - out (FIFO), Last-in-First-Out (LIFO)

- Depreciation Accounting Policies

- Accelerated-Depreciation method

- Auditor’s Report, Opinion, Certificate

- Management Discussion & Analyses (MD&A)

- TYPES OF BUSINESS ORGANIZATIONS

- Incorporation of business

- Authorized Share Capital, Issued Share Capital

- Book Values of equity, share

- SUMMARY

- SUMMARY

- Analysis of income statement and balance sheet:

- COMMON –SIZE AND INDEX ANALYSIS

- ANALYSIS BY RATIOS

- ACTIVITY RATIOS

- Liquidity of Receivables

- LEVERAGE, DEBT RATIOS

- PROFITABILITY RATIOS

- Analysis by Preferred Stockholders

- Efficiency of operating cycle, process

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 1

- STOCKHOLDERS’ EQUITY SECTION OF THE BALANCE SHEET 2

- BALANCE SHEET AND INCOME STATEMENT RATIOS

- Financial Consultation Case Study

- ANALYSIS OF BALANCE SHEET & INCOME STATEMENT

- SUMMARY OF FINDGINS