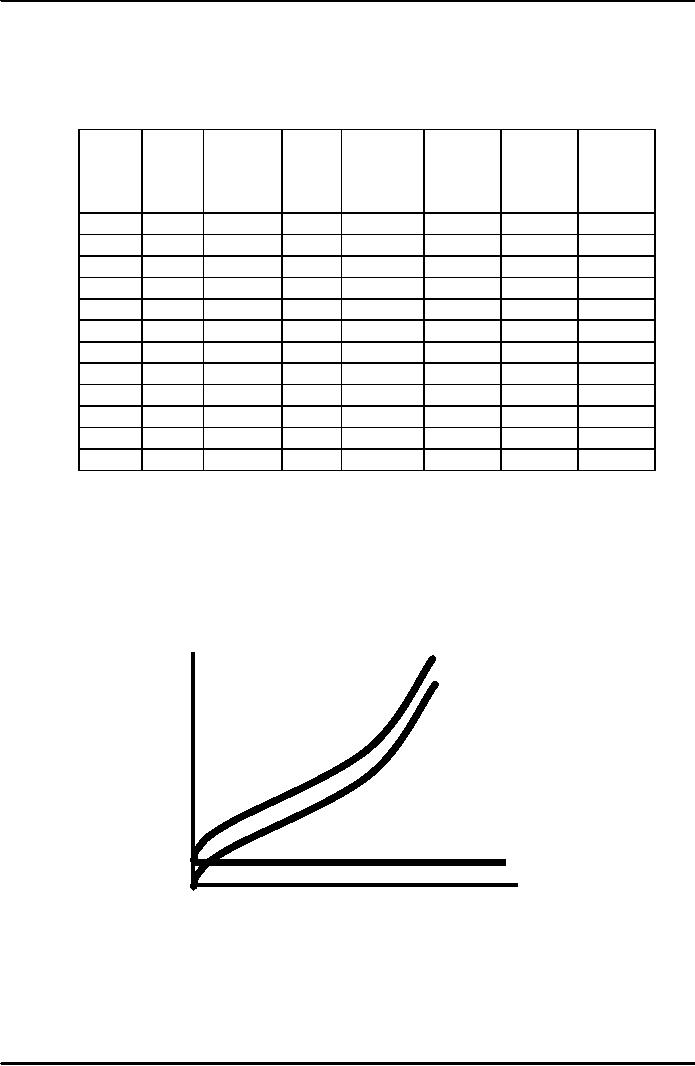

|

Microeconomics

ECO402

VU

Lesson

19

A

Firm's Short-Run Costs

($)

Rate

Fixed

Variable

Total

Marginal

Average

Average

Average

of

cost

cost

cost

cost

fixed

variable

total

output

FC

VC

TC

MC

cost

cost

cost

AFC

AVC

ATC

0

50

0

50

1

50

50

100

50

50

50

100

2

50

78

128

28

25

39

64

3

50

98

148

20

16.5

32.7

49.3

4

50

112

162

14

12.5

28

40.5

5

50

130

180

18

10

26

36

6

50

150

200

20

8.3

25

33.3

7

50

175

225

25

7.1

25

32.1

8

50

204

254

29

6.3

25.5

31.8

9

50

242

292

38

5.6

26.9

32.4

10

50

300

350

58

5

30

35

11

50

385

435

85

4.5

35

39.5

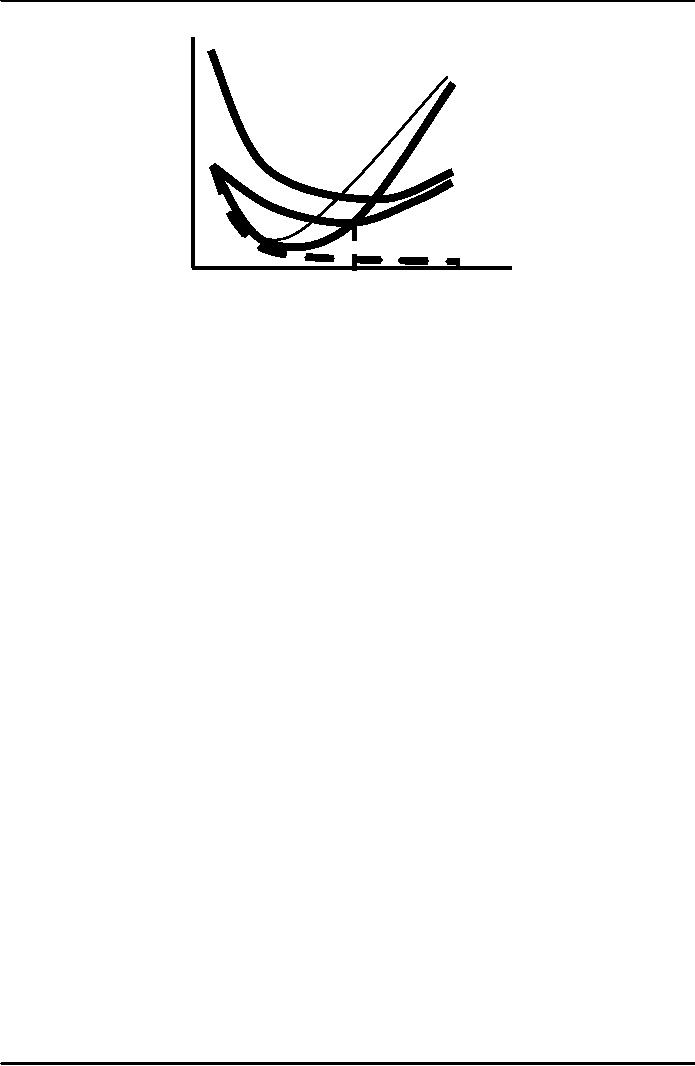

Consequently

(from the table):

MC decreases

initially with increasing

returns

∑

0 through 4

units of output

MC increases

with decreasing

returns

∑

5 through 11

units of output

Total

cost

TC

is

the vertical

Cost

sum

of FC

($

per 400

and

VC.

VC

year)

Variable

cost

increases

with

300

production

and

the

rate varies with

increasing

&

decreasing

returns.

200

Fixed

cost does not

100

vary

with output

FC

50

Output

0

1

2

3

4

5

6

7

8

9

10

11

12

13

95

Microeconomics

ECO402

VU

Cost

100

($

per

unit)

MC

75

50

ATC

AVC

25

AFC

1

0

2

3

4

5

6

7

8

9

10

11

Output

(units/yr.)

The

line drawn from the

origin to the tangent of the

variable cost curve:

Its

slope equals AVC

The

slope of a point on VC equals

MC

Therefore,

MC = AVC at 7 units of output (point

A)

Unit

Costs

AFC

falls continuously

When

MC < AVC or MC < ATC, AVC & ATC

decrease

When

MC > AVC or MC > ATC, AVC & ATC

increase

MC

= AVC and ATC at minimum AVC and

ATC

Minimum

AVC occurs at a lower output

than minimum ATC due to

FC

The

User Cost of Capital

User

Cost of Capital = Economic

Depreciation + (Interest Rate)(Value of

Capital)

Example

∑

An Airline

buys a Boeing 737 for

$150 million with an

expected life of 30

years

Annual economic

depreciation = $150 million/30 = $5

million

Interest rate

= 10%

∑

User

Cost of Capital = $5 million +

(.10) ($150 million

depreciation)

Year 1 = $5

million + (.10)($150 million) =

$20 million

Year 10 = $5

million + (.10) ($100

million) = $15

million

Rate per

dollar of capital

∑

r = Depreciation

Rate + Interest Rate

Airline

Example

∑

Depreciation

Rate = 1/30 = 3.33/yr

∑

Rate of

Return = 10%/yr

User Cost of

Capital

∑

r = 3.33 + 10 =

13.33%/yr

96

Microeconomics

ECO402

VU

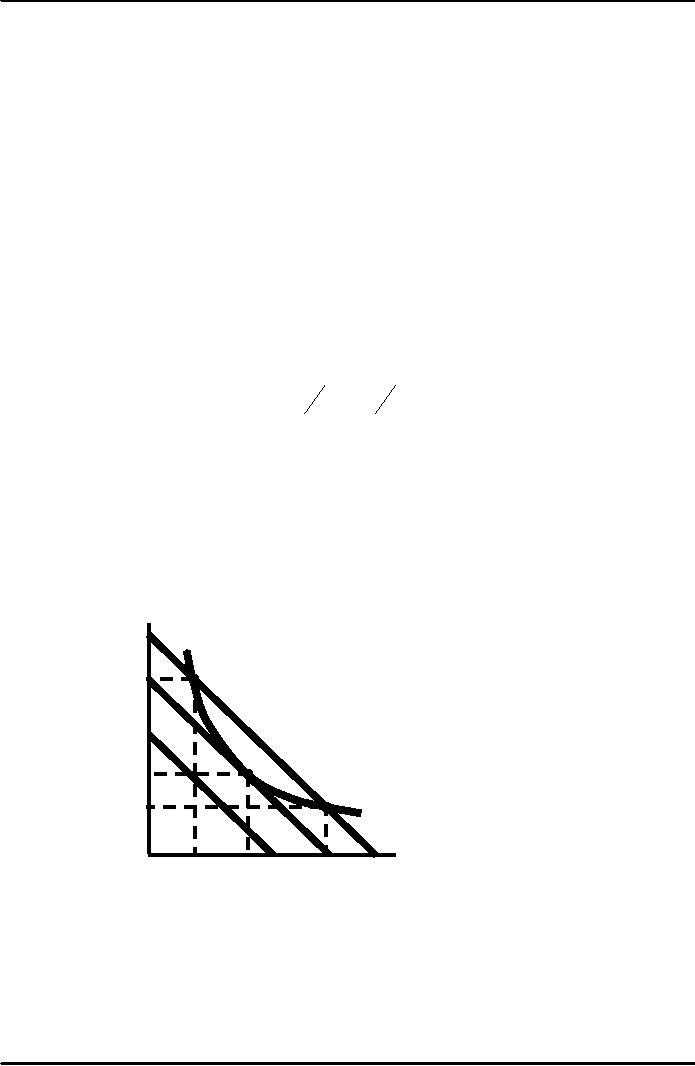

The

Cost Minimizing Input

Choice

Assumptions

∑

Two

Inputs: Labor (L) &

capital (K)

∑

Price of

labor: wage rate

(w)

∑

The price

of capital

R = depreciation

rate + interest rate

Question

∑

If capital

was rented, would it change

the value of r ?

The

Isocost Line

C

= wL + rK

Isocost: A line

showing all combinations of L & K

that can be purchased for

the same

cost

Rewriting

C

as

linear:

∑

K = C/r -

(w/r)L

∑

Slope of

the Isocost:

()

ΔK

=-

w

ΔL

r

is

the ratio of the wage

rate to rental cost of

capital.

This

shows the rate at which

capital can be substituted

for labor with no

change

in cost.

Choosing

Inputs

∑

We

will address how to minimize

cost for a given level of

output.

∑

We

will do so by combining Isocosts

with Isoquants

Producing

a Given Output at Minimum

Cost

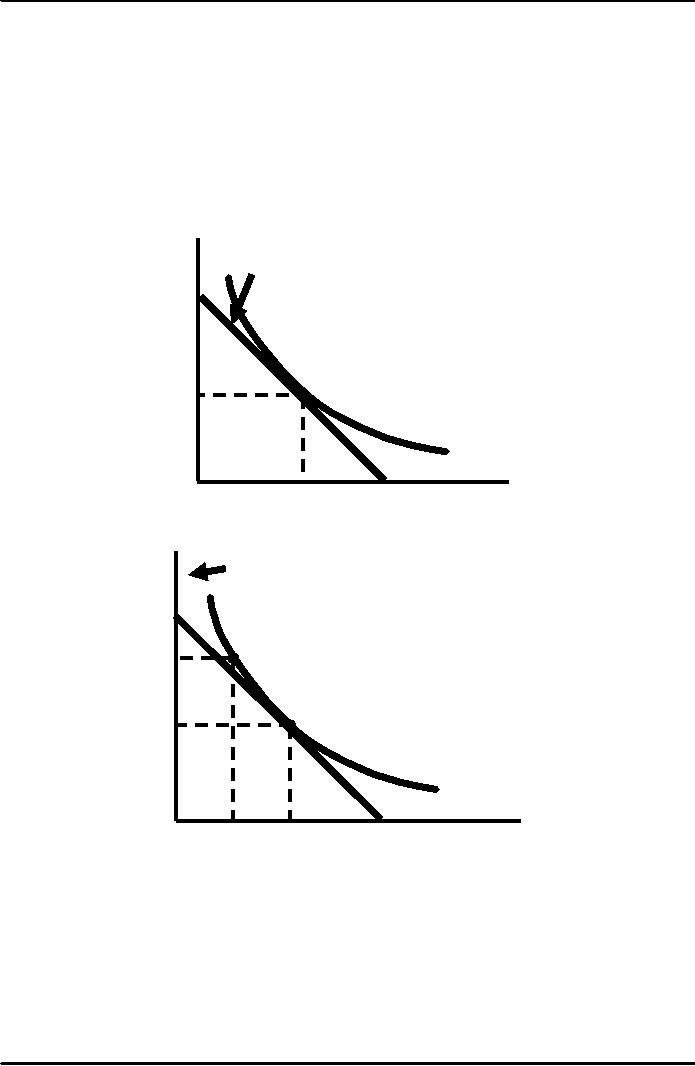

Q1 is an

isoquant

Capital

for

output Q1.

per

Isocost

curve C0 shows

year

all

combinations of K

and

L

K2

that

can not produce Q1 at

this

Isocost

C2 shows

quantity

CO C1

C2 are

Q1 can

be produced with

three

combination

K2L2 or

K3L3.

Isocost

lines

A

However,

both of these

K1

are

higher cost

combinations

than

K1L1.

Q1

K3

C0

C1

C2

L2

L1

L3

Labor

per year

97

Microeconomics

ECO402

VU

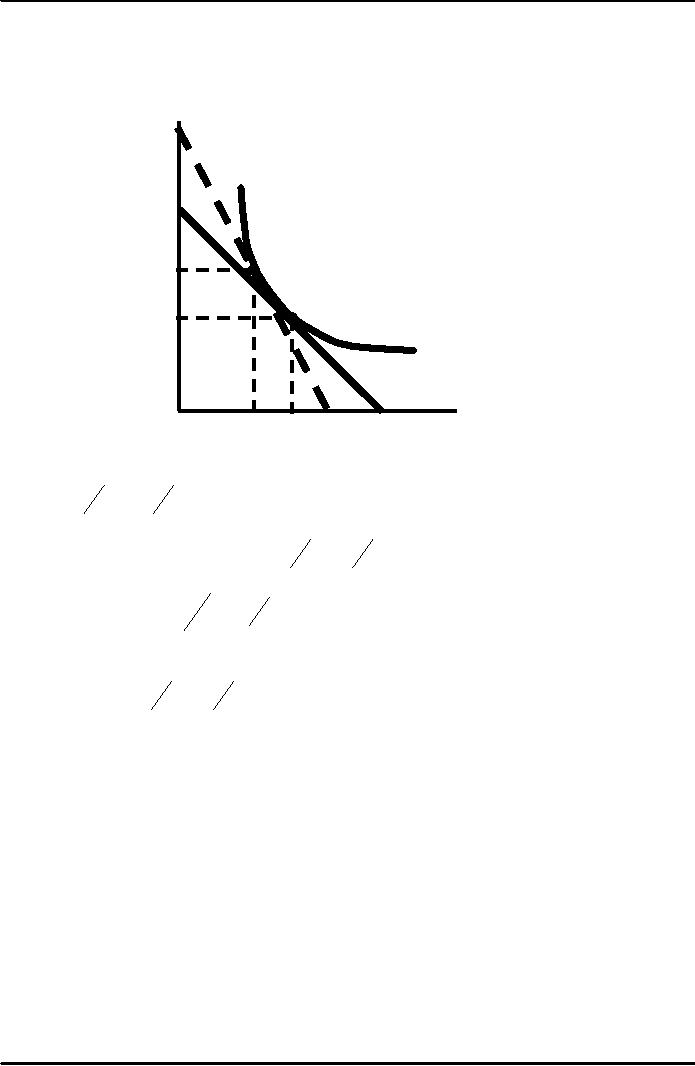

Input

Substitution When an Input Price

Change

Isoquants

and Isocosts and the

Production Function

Capital

If

the price of labor

changes,

the Isocost curve

per

becomes

steeper due to

year

the

change in the slope -(w/L).

This

yields a new

combination

of

K

and

L

to

produce Q1.

Combination

B

is

used in place

B

of

combination A.

K2

The

new combination

represents

the

higher cost of labor

relative

A

to

capital and therefore

capital

K1

is

substituted for labor.

Q1

C2

C1

L2

Labor

per year

L1

MRTS

=

-ΔK

=

MPL

ΔL

MPK

Slope

of isocost line =

ΔK

=

-w

ΔL

r

MPL

=w

and

=

MPK

r

The

minimum cost combination can

then be written as:

MPL

=

MPK

w

r

Minimum cost

for a given output will

occur when each dollar of

input added to the

production

process will add an

equivalent amount of

output.

Question

If w = $10, r =

$2, and MPL

= MPK,

which input would the

producer use more of?

Why?

The

Effect of Effluent Fees on

Firms' Input

Choices

The

Effect of Effluent Fees on

Firms' Input

Choices

Firms

that have a by-product to

production produce an

effluent.

An

effluent fee is a per-unit

fee that firms must

pay for the effluent

that they emit.

How

would a producer respond to an

effluent fee on

production?

The

Scenario: Steel

Producer

98

Microeconomics

ECO402

VU

1)

Located on a river: Low cost

transportation and emission

disposal

(effluent).

2)

EPA imposes a per unit

effluent fee to reduce the

environmentally harmful

effluent.

3)

How should the firm

respond?

The

Cost-Minimizing Response to an Effluent

Fee

Capital

(machine

Slope

of

hours

per

Isocost

= -10/40

5,000

month)

=

-0.25

4,000

3,000

A

2,000

Output

of 2,000

1,000

Tons

of Steel per

Month

Waste

Water

5,000

10,000

12,000 18,000

20,000

0

(gal./month)

Capital

(machine

Prior

to regulation the

Slope

of

hours

per

firm

chooses to produce

Isocost

= -

month)

an

output using 10,000

20/40

5,000

gallons

of water and 2,000

=

-0.50

machine-hours

of capital at A.

F

4,000

Following

the imposition

B

of

the effluent fee of $10/gallon

3,500

the

slope of the Isocost changes

3,000

which

the higher cost of water

to

capital

so now combination B

A

is

selected.

2,000

1,000

Output

of 2,000

Tons

of Steel per

Month

C

E

Waste

Water

0

5,000

(gal./month)

10,000

12,000 18,000

20,000

Observations:

The more

easily factors can be

substituted; the more

effective the fee is in

reducing the

effluent.

The

greater the degree of

substitutes, the less the

firm will have to pay

(e.g.: $50,000 with

combination

B instead of $100,000 with

combination A).

99

Table of Contents:

- ECONOMICS:Themes of Microeconomics, Theories and Models

- Economics: Another Perspective, Factors of Production

- REAL VERSUS NOMINAL PRICES:SUPPLY AND DEMAND, The Demand Curve

- Changes in Market Equilibrium:Market for College Education

- Elasticities of supply and demand:The Demand for Gasoline

- Consumer Behavior:Consumer Preferences, Indifference curves

- CONSUMER PREFERENCES:Budget Constraints, Consumer Choice

- Note it is repeated:Consumer Preferences, Revealed Preferences

- MARGINAL UTILITY AND CONSUMER CHOICE:COST-OF-LIVING INDEXES

- Review of Consumer Equilibrium:INDIVIDUAL DEMAND, An Inferior Good

- Income & Substitution Effects:Determining the Market Demand Curve

- The Aggregate Demand For Wheat:NETWORK EXTERNALITIES

- Describing Risk:Unequal Probability Outcomes

- PREFERENCES TOWARD RISK:Risk Premium, Indifference Curve

- PREFERENCES TOWARD RISK:Reducing Risk, The Demand for Risky Assets

- The Technology of Production:Production Function for Food

- Production with Two Variable Inputs:Returns to Scale

- Measuring Cost: Which Costs Matter?:Cost in the Short Run

- A Firmís Short-Run Costs ($):The Effect of Effluent Fees on Firmsí Input Choices

- Cost in the Long Run:Long-Run Cost with Economies & Diseconomies of Scale

- Production with Two Outputs--Economies of Scope:Cubic Cost Function

- Perfectly Competitive Markets:Choosing Output in Short Run

- A Competitive Firm Incurring Losses:Industry Supply in Short Run

- Elasticity of Market Supply:Producer Surplus for a Market

- Elasticity of Market Supply:Long-Run Competitive Equilibrium

- Elasticity of Market Supply:The Industryís Long-Run Supply Curve

- Elasticity of Market Supply:Welfare loss if price is held below market-clearing level

- Price Supports:Supply Restrictions, Import Quotas and Tariffs

- The Sugar Quota:The Impact of a Tax or Subsidy, Subsidy

- Perfect Competition:Total, Marginal, and Average Revenue

- Perfect Competition:Effect of Excise Tax on Monopolist

- Monopoly:Elasticity of Demand and Price Markup, Sources of Monopoly Power

- The Social Costs of Monopoly Power:Price Regulation, Monopsony

- Monopsony Power:Pricing With Market Power, Capturing Consumer Surplus

- Monopsony Power:THE ECONOMICS OF COUPONS AND REBATES

- Airline Fares:Elasticities of Demand for Air Travel, The Two-Part Tariff

- Bundling:Consumption Decisions When Products are Bundled

- Bundling:Mixed Versus Pure Bundling, Effects of Advertising

- MONOPOLISTIC COMPETITION:Monopolistic Competition in the Market for Colas and Coffee

- OLIGOPOLY:Duopoly Example, Price Competition

- Competition Versus Collusion:The Prisonersí Dilemma, Implications of the Prisoners

- COMPETITIVE FACTOR MARKETS:Marginal Revenue Product

- Competitive Factor Markets:The Demand for Jet Fuel

- Equilibrium in a Competitive Factor Market:Labor Market Equilibrium

- Factor Markets with Monopoly Power:Monopoly Power of Sellers of Labor