|

Strategic

Management MGT603

VU

Lesson

18

TYPES

OF STRATEGIES

Objectives:

This

lecture brings strategic

management to life with many

contemporary examples. Sixteen types

of

strategies

are defined and exemplified,

including Michael Porter's

generic strategies: cost

leadership,

differentiation,

and focus. Guidelines are

presented for determining when

different types of

strategies

are

most appropriate to pursue. An overview

of strategic management in nonprofit

organizations,

governmental

agencies, and small firms is

provided. After reading this

lecture you will be able to

know

about:

Long

term objectives:

Types

of Strategies

Integration

strategies

Strategies

in Action:

Even

if you're on the right track,

you'll get run over if you just

sit there.

--

Will Rogers

Hundreds

of companies today embrace strategic

planning because:

∑

Quest

for higher revenues

∑

Quest

for higher profits

Many

firms have to use strategic

planning in order to earn

revenues and more

profits.

Long

term objectives

Long-term

objectives represent

the results expected from pursuing

certain strategies.

Strategies

represent

the actions to be taken to accomplish

long-term objectives. The time

frame for objectives

and

strategies

should be consistent, usually from

two to five years.

The

Nature of Long-Term

Objectives

Objectives

should be quantitative, measurable,

realistic, understandable, challenging,

hierarchical,

obtainable,

and congruent among organizational units.

Each objective should also be associated

with a

time

line. Objectives are commonly

stated in terms such as

growth in assets, growth in

sales,

profitability,

market share, degree and

nature of diversification, degree

and nature of vertical

integration,

earnings

per share, and social

responsibility. Clearly established

objectives offer many

benefits. They

provide

direction, allow synergy,

aid in evaluation, establish priorities,

reduce uncertainty, minimize

conflicts,

stimulate exertion, and aid

in both the allocation of resources and

the design of jobs.

Long-term

objectives are needed at the corporate,

divisional, and functional

levels in an organization.

They

are an important measure of

managerial performance.

Clearly

stated and communicated

objectives are vital to

success for many reasons.

First, objectives help

stakeholders

understand their role in an

organization's future. They also

provide a basis for

consistent

decision

making by managers whose values

and attitudes differ. By

reaching a consensus on

objectives

during

strategy-formulation activities, an organization can

minimize potential conflicts later

during

implementation.

Objectives set forth organizational

priorities and stimulate

exertion and

accomplishment.

They serve as standards by which

individuals, groups, departments,

divisions, and

entire

organizations can be evaluated.

Objectives provide the basis

for designing jobs and

organizing

activities

to be performed in an organization. They

also provide direction and

allow for organizational

synergy.

Without

long-term objectives, an organization

would drift aimlessly toward

some unknown end! It

is

hard

to imagine an organization or individual being

successful without clear

objectives. Success

only

rarely

occurs by accident; rather, it is the

result of hard work directed

toward achieving

certain

objectives.

Not

Managing by Objectives

Strategists

should avoid:

Managing

by Extrapolation

Managing

by Crisis

78

Strategic

Management MGT603

VU

Managing

by Subjective

Managing

by Hope

Strategists

should avoid the following alternative

ways to "not managing by

objectives."

∑

Managing

by Extrapolation--adheres to the principle "If it

ain't broke, don't fix

it." The idea is to

keep

on doing about the same things in the

same ways because things are

going well.

∑

Managing

by Crisis--based on the belief that the true

measure of a really good

strategist is the

ability

to solve problems. Because

there are plenty of crises

and problems to go around for

every

person

and every organization, strategists

ought to bring their time

and creative energy to bear

on

solving

the most pressing problems of the

day. Managing by crisis is actually a

form of reacting

rather

than acting and of letting

events dictate what's and

when's of management

decisions.

∑

Managing

by Subjective--built on the idea that

there is no general plan for

which way to go and

what

to do; just do the best you

can to accomplish what you

think should be done. In short,

"Do

your

own thing, the best way

you know how" (sometimes

referred to as the

mystery approach to decision

making

because

subordinates are left to

figure out what is happening and

why).

∑

Managing

by Hope--based on the fact that the

future is laden with great

uncertainty, and that if we

try

and do not succeed, then we

hope our second (or third)

attempt will succeed. Decisions

are

predicted

on the hope that they will work

and the good times are

just around the corner, especially

if

luck and good fortune

are on our side!

Types

of Strategies

Defined

and exemplified in Table, alternative

strategies that an enterprise could

pursue can be

categorized

into thirteen actions--forward

integration, backward integration,

horizontal integration,

market

penetration, market development, product development,

concentric diversification,

conglomerate

diversification, horizontal

diversification, joint venture,

retrenchment, divestiture, and

liquidation--and

a combination strategy. Each alternative

strategy has countless variations.

For

example,

market penetration can include adding

salespersons, increasing advertising

expenditures,

coopering,

and using similar actions to

increase market share in a given

geographic area.

A

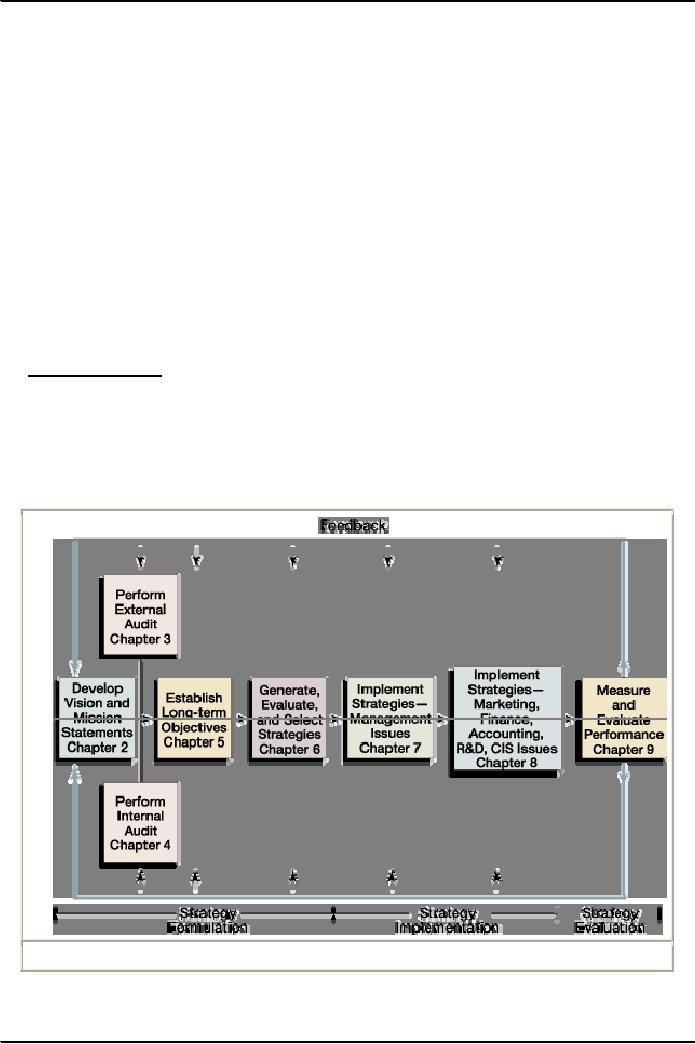

Comprehensive Strategic-Management

Model

79

Strategic

Management MGT603

VU

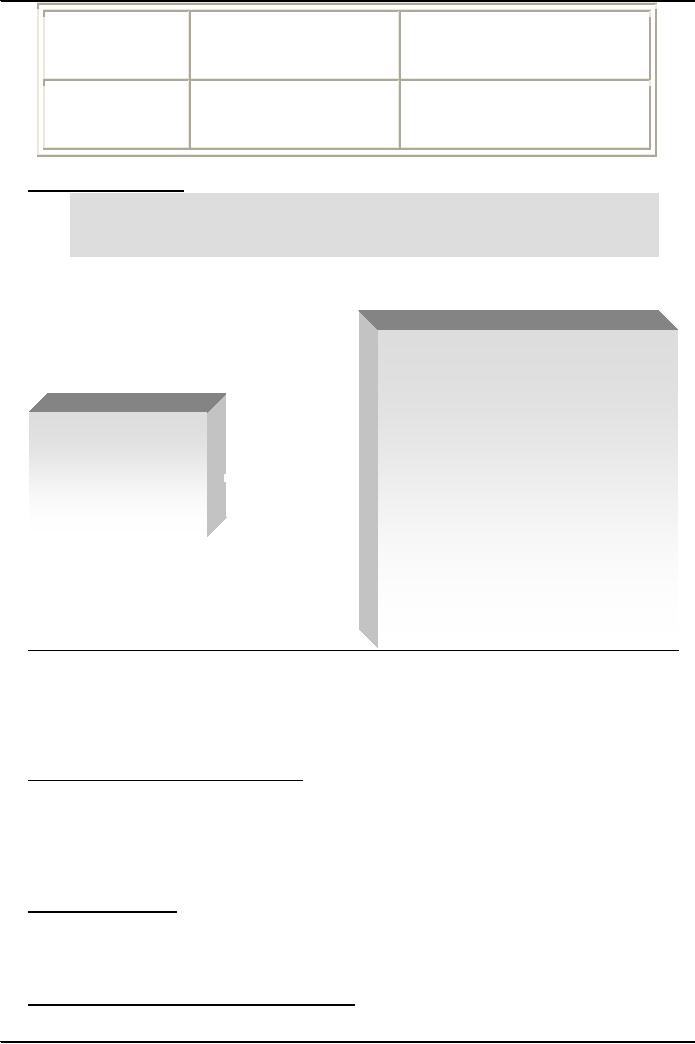

Alternative

Strategies Defined and

Exemplified

Strategy

Definition

Example

Forward

Gaining

ownership or

General

Motors is acquiring 10

Integration

increased

control over

percent

of its dealers.

distributors

or retailers

Backward

Seeking

ownership or

Motel-8

acquired a furniture

Integration

increased

control of a

manufacturer.

firm's

suppliers

Horizontal

Seeking

ownership or

Hilton

recently

acquired

Integration

increased

control over

Promos.

competitors

Market

Seeking

increased market

Ameritrade,

the online broker,

Penetration

share

for present products

tripled

its annual advertising

or

services in present

expenditures

to $200 million to

markets

through greater

convince

people they can make

their

own investment decisions.

marketing

efforts

Market

Introducing

present

Britain's

leading supplier of

Development

products

or services into

buses,

Henlys PLC, acquires

new

geographic area

Blue

Bird

Corp.,

North

America's

leading school bus

maker.

Product

Seeking

increased sales by

Apple

developed the G4 chip

Development

improving

present

that

runs at 500

megahertz.

products

or services or

developing

new ones

Concentric

Adding

new, but related,

National

Westminister Bank

Diversification

products

or services

PLC

in Britain buys the

leading

British

insurance company,

Legal

& General Group PLC.

Conglomerate

Adding

new, unrelated

H&R

Block, the top

tax

Diversification

products

or services

preparation

agency, said it will

buy

discount stock brokerage

Olde

Financial for $850

million

in

cash.

Horizontal

Adding

new, unrelated

The

New York Yankees

baseball

Diversification

products

or services for

team

is merging with the

New

present

customers

Jersey

Nets basketball team.

Joint

Venture

Two

or more sponsoring

Lucent

Technologies and Philips

firms

forming a separate

Electronics

NV formed Philips

organization

for

Consumer

Communications to

cooperative

purposes

make

and sell telephones.

Retrenchment

Regrouping

through cost

Singer,

the sewing

machine

and

asset reduction to

maker,

declared bankruptcy.

reverse

declining sales and

profit

80

Strategic

Management MGT603

VU

Divestiture

Selling

a division or part

Harcourt

General, the large U.S.

of

an organization

publisher,

selling its Neiman

Marcus

division.

Liquidation

Selling

all of a company's

Ribol

sold all its assets

and

assets,

in parts, for their

ceases

business.

tangible

worth

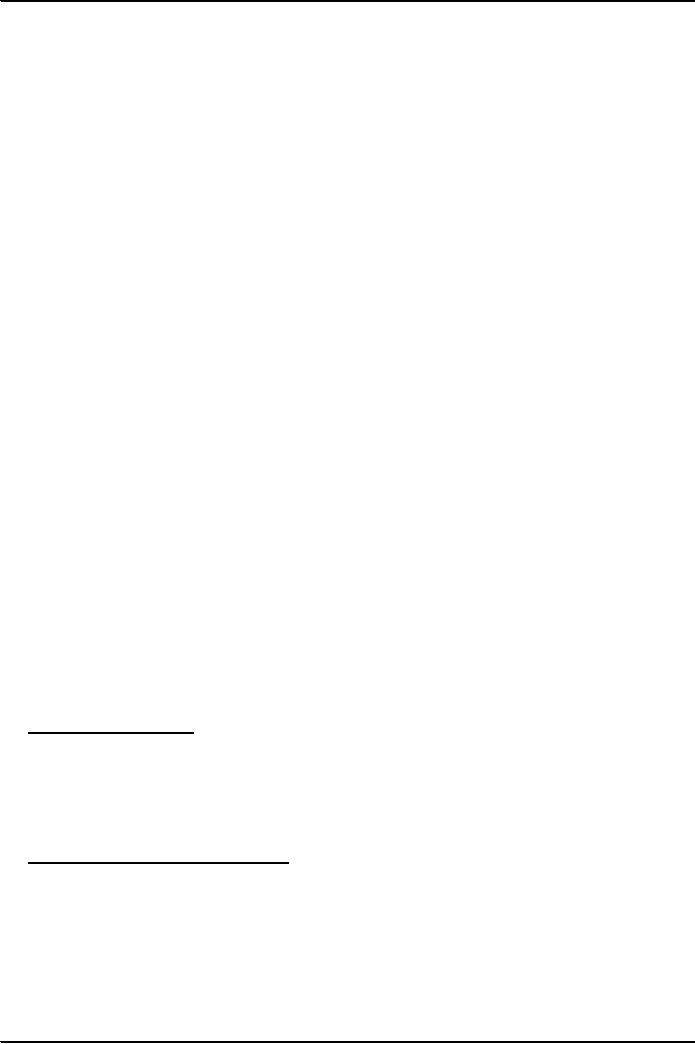

Integration

Strategies:

Integration

Strategies

Forward

Integration

Vertical

Integration

Backward

Integration

Strategies

Horizontal

Integration

Forward

integration, backward integration,

and horizontal integration

are sometimes collectively

referred

to as vertical

integration strategies.

Vertical integration strategies

allow a firm to gain control

over

distributors,

suppliers, and/or competitors. Forward

integration strategy refers to the

transactions

between

the customers and firm. Similarly, the

function for the particular supply which

the firm is being

intended

to involve itself will be

called backward integration.

When the firm looks that

other firm

which

may be taken over within the

area of its own activity is

called horizontal

integration.

Benefits

of vertical integration

strategy:

Allow

a firm to gain control

over:

Distributors

(forward integration)

Suppliers

(backward integration)

Competitors

(horizontal integration)

Forward

integration: Gaining

ownership or increased control over

distributors or retailers

Forward

integration involves gaining

ownership or increased control over

distributors or retailers.

You

can gain ownership or control

over the distributors, suppliers

and

Competitors

using forward

integration.

Guidelines

for the use of integration

strategies:

Six

guidelines when forward

integration may be an especially

effective strategy are:

81

Strategic

Management MGT603

VU

Present

distributors are expensive, unreliable,

or incapable of meeting firm's

needs

Availability

of quality distributors is

limited

When

firm competes in an industry

that is expected to grow

markedly

Organization

has both capital and

human resources needed to

manage new business of

distribution

Advantages

of stable production are

high

Present

distributors have high

profit margins

When

your present distributors

are expensive and you

think that without affecting the

quality of the

goods

you have to carry own the

operations, forward integration is

advisable.

Similarly,

if distributors are unreliable, they can

not deliver with a sustained

degree of timeliness or they

are

not in a proper way to meet

the needs of the firm, forward

integration is advisable.

Availability

of quality distributors is limited or it

is difficult to get the quality of

goods, then this need

for

a quality distributor, forward

integration is best alternative.

Suppose

you have two industries,

computers and mobile telephone

which are progressing

tremendously,

it is advisable to think of forward

integration due to the changing

environment of the

business.

Organization

has both capital and

human resources needed to

manage new business of

distribution. A

firm

has all the basic elements

to run the business safely in

that case forward

integration is best

alternate.

For

stable production, stable supply is

necessary. If you think that

present distributors are

charging high

mark

up, you may do that

operation your self in order

to avoid the mark up charges. It is

advisable that

firm

itself involve in the operations. By

gaining control, stability will be

more and profitability will

be

enhanced.

∑

When

an organization's present distributors

are especially expensive, or unreliable,

or incapable of

meeting

the firm's distribution needs

∑

When

the availability of quality distributors

is so limited as to offer a competitive

advantage to

those

firms that integrate forward

∑

When

an organization competes in an industry

that is growing and is

expected to continue to grow

markedly;

this is a factor because forward

integration reduces an organization's

ability to diversify if

its

basic industry falters

∑

When

an organization has both the capital

and human resources needed

to manage the new

business

of distributing its own

products

∑

When

the advantages of stable production

are particularly high; this is a consideration

because an

organization

can increase the predictability of the

demand for its output

through forward

integration

∑

When

present distributors or retailers

have high profit margins;

this situation suggests that a

company

profitably could distribute its

own products and price them

more competitively by

integrating

forward

Backward

Integration

Seeking

ownership or increased control of a

firm's suppliers

Both

manufacturers and retailers

purchase needed materials

from suppliers. Backward

integration is

a

strategy

of seeking ownership or increased control

of a firm's suppliers. This strategy can

be especially

appropriate

when a firm's current suppliers are unreliable,

too costly, or cannot meet the firm's

needs.

Guidelines

for Backward

Integration:

Six

guidelines when backward

integration may be an especially

effective strategy are:

When

present suppliers are

expensive, unreliable, or incapable of

meeting needs

Number

of suppliers is small and number of

competitors large

High

growth in industry

sector

Firm

has both capital and

human resources to manage

new business

Advantages

of stable prices are

important

Present

supplies have high profit

margins

∑

When

an organization's present suppliers

are especially expensive, or unreliable,

or incapable of

meeting

the firm's needs for parts,

components, assemblies, or raw

materials

82

Strategic

Management MGT603

VU

∑

When

the number of suppliers is small and the

number of competitors is large

∑

When

an organization competes in an industry that is

growing rapidly; this is a factor

because

integrative-type

strategies (forward, backward,

and horizontal) reduce an

organization's ability to

diversify

in a declining industry

∑

When

an organization has both capital

and human resources to

manage the new business of

supplying

its own raw

materials

∑

When

the advantages of stable prices

are particularly important; this is a

factor because an

organization

can stabilize the cost of

its raw materials and the

associated price of its

product

through

backward integration

∑

When

present supplies have high

profit margins, which

suggests that the business of

supplying

products

or services in the given industry is a worthwhile

venture

∑

When

an organization needs to acquire a needed

resource quickly

83

Strategic

Management MGT603

VU

Lesson

19

TYPES

OF STRATEGIES

Objectives:

This

lecture brings strategic

management to life with many

contemporary examples. Sixteen types

of

strategies

are defined and exemplified,

including Michael Porter's

generic strategies: cost

leadership,

differentiation,

and focus. Guidelines are

presented for determining when

different types of

strategies

are

most appropriate to pursue. An overview

of strategic management in nonprofit

organizations,

governmental

agencies, and small firms is

provided. After reading this

lecture you will be able to

know

about:

Types

of Strategies

Integration

strategies

Horizontal

Integration:

Seeking

ownership or increased control over

competitors

Horizontal

integration refers

to a strategy of seeking ownership of or

increased control over a

firm's

competitors.

One of the most significant trends in

strategic management today is the

increased use of

horizontal

integration as a growth strategy.

Mergers, acquisitions, and

takeovers among competitors

allow

for increased economies of

scale and enhanced transfer

of resources and

competencies.

Increased

control over competitors means

that you have to look

for new opportunities either by

the

purchase

of the new firm or hostile take

over the other firm. One organization

gains control of

other

which

functioning within the same

industry.

It

should be done that every firm

wants to increase its area

of influence, market share and

business.

Guidelines

for Horizontal

Integration:

Four

guidelines when horizontal integration

may be an especially effective strategy

are:

Firm

can gain monopolistic

characteristics without being challenged

by federal government

Competes

in growing industry

Increased

economies of scale provide major

competitive advantages

Faltering

due to lack of managerial

expertise or need for particular

resources

When

an organization can gain monopolistic

characteristics in a particular area or region

without being

challenged

by the federal government for "tending

substantially" to reduce

competition

When

an organization competes in a growing

industry

When

increased economies of scale

provide major competitive

advantages

When

an organization has both the capital

and human talent needed to

successfully manage an

expanded

organization

When

competitors are faltering due to a

lack of managerial expertise or a

need for particular

resources

that

an organization possesses; note that

horizontal integration would

not be appropriate if competitors

are

doing poorly because overall

industry sales are

declining

84

Table of Contents:

- NATURE OF STRATEGIC MANAGEMENT:Interpretation, Strategy evaluation

- KEY TERMS IN STRATEGIC MANAGEMENT:Adapting to change, Mission Statements

- INTERNAL FACTORS & LONG TERM GOALS:Strategies, Annual Objectives

- BENEFITS OF STRATEGIC MANAGEMENT:Non- financial Benefits, Nature of global competition

- COMPREHENSIVE STRATEGIC MODEL:Mission statement, Narrow Mission:

- CHARACTERISTICS OF A MISSION STATEMENT:A Declaration of Attitude

- EXTERNAL ASSESSMENT:The Nature of an External Audit, Economic Forces

- KEY EXTERNAL FACTORS:Economic Forces, Trends for the 2000ís USA

- EXTERNAL ASSESSMENT (KEY EXTERNAL FACTORS):Political, Governmental, and Legal Forces

- TECHNOLOGICAL FORCES:Technology-based issues

- INDUSTRY ANALYSIS:Global challenge, The Competitive Profile Matrix (CPM)

- IFE MATRIX:The Internal Factor Evaluation (IFE) Matrix, Internal Audit

- FUNCTIONS OF MANAGEMENT:Planning, Organizing, Motivating, Staffing

- FUNCTIONS OF MANAGEMENT:Customer Analysis, Product and Service Planning, Pricing

- INTERNAL ASSESSMENT (FINANCE/ACCOUNTING):Basic Types of Financial Ratios

- ANALYTICAL TOOLS:Research and Development, The functional support role

- THE INTERNAL FACTOR EVALUATION (IFE) MATRIX:Explanation

- TYPES OF STRATEGIES:The Nature of Long-Term Objectives, Integration Strategies

- TYPES OF STRATEGIES:Horizontal Integration, Michael Porterís Generic Strategies

- TYPES OF STRATEGIES:Intensive Strategies, Market Development, Product Development

- TYPES OF STRATEGIES:Diversification Strategies, Conglomerate Diversification

- TYPES OF STRATEGIES:Guidelines for Divestiture, Guidelines for Liquidation

- STRATEGY-FORMULATION FRAMEWORK:A Comprehensive Strategy-Formulation Framework

- THREATS-OPPORTUNITIES-WEAKNESSES-STRENGTHS (TOWS) MATRIX:WT Strategies

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- BOSTON CONSULTING GROUP (BCG) MATRIX:Cash cows, Question marks

- BOSTON CONSULTING GROUP (BCG) MATRIX:Steps for the development of IE matrix

- GRAND STRATEGY MATRIX:RAPID MARKET GROWTH, SLOW MARKET GROWTH

- GRAND STRATEGY MATRIX:Preparation of matrix, Key External Factors

- THE NATURE OF STRATEGY IMPLEMENTATION:Management Perspectives, The SMART criteria

- RESOURCE ALLOCATION

- ORGANIZATIONAL STRUCTURE:Divisional Structure, The Matrix Structure

- RESTRUCTURING:Characteristics, Results, Reengineering

- PRODUCTION/OPERATIONS CONCERNS WHEN IMPLEMENTING STRATEGIES:Philosophy

- MARKET SEGMENTATION:Demographic Segmentation, Behavioralistic Segmentation

- MARKET SEGMENTATION:Product Decisions, Distribution (Place) Decisions, Product Positioning

- FINANCE/ACCOUNTING ISSUES:DEBIT, USES OF PRO FORMA STATEMENTS

- RESEARCH AND DEVELOPMENT ISSUES

- STRATEGY REVIEW, EVALUATION AND CONTROL:Evaluation, The threat of new entrants

- PORTER SUPPLY CHAIN MODEL:The activities of the Value Chain, Support activities

- STRATEGY EVALUATION:Consistency, The process of evaluating Strategies

- REVIEWING BASES OF STRATEGY:Measuring Organizational Performance

- MEASURING ORGANIZATIONAL PERFORMANCE

- CHARACTERISTICS OF AN EFFECTIVE EVALUATION SYSTEM:Contingency Planning