|

Strategic

Management MGT603

VU

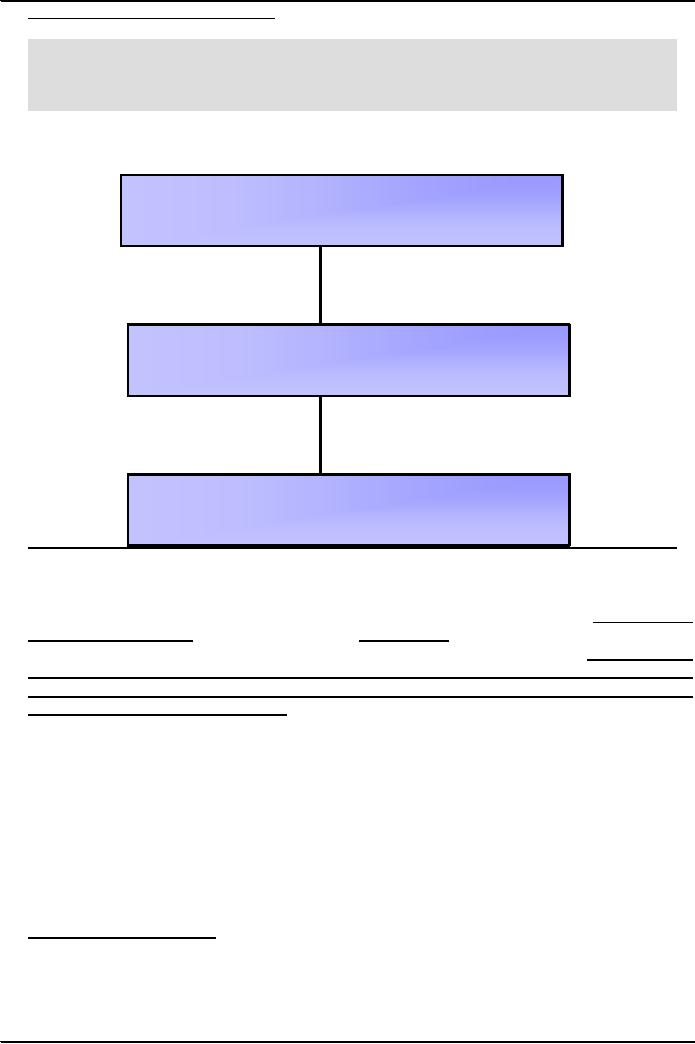

Michael

Porter's Generic

Strategies

Michael Porter's

Generic Strategies

Cost

Leadership Strategies

Differentiation

Strategies

Focus

Strategies

Probably

the three most widely read

books on competitive analysis in the

1980s were Michael

Porter's

Competitive

Strategy,

Competitive

Advantage and

Competitive

Advantage of Nations.

According to Porter,

strategies

allow organizations to gain

competitive advantage from

three different bases: cost

leadership,

differentiation,

and focus. Porter calls

these bases generic

strategies. Cost leadership

emphasizes

producing

standardized

products at very low per-unit cost

for consumers who are

price-sensitive. Differentiation

is

a

strategy

aimed at producing products and

services considered unique industry wide

and directed at

consumers

who are relatively price-insensitive.

Focus

means

producing products and services

that fulfill

the

needs of small groups of

consumers.

Porter's

strategies imply different organizational

arrangements, control procedures,

and incentive

systems.

Larger firms with greater

access to resources typically

compete on a cost leadership

and/or

differentiation

basis, whereas smaller firms

often compete on a focus

basis.

Porter

stresses the need for

strategists to perform cost-benefit

analyses to evaluate "sharing

opportunities"

among a firm's existing and potential

business units. Sharing activities and

resources

enhances

competitive advantage by lowering

costs or raising differentiation. In

addition to prompting

sharing,

Porter stresses the need for firms to

"transfer" skills and

expertise among autonomous

business

units

effectively in order to gain

competitive advantage. Depending

upon factors such as type

of

industry,

size of firm, and nature of

competition, various strategies could

yield advantages in

cost

leadership,

differentiation, and

focus.

Cost

Leadership Strategies

This

strategy emphasizes efficiency. By

producing high volumes of

standardized products, the

firm

hopes

to take advantage of economies of

scale and experience curve

effects. The product is

often a

basic

no-frills product that is produced at a

relatively low cost and made

available to a very large

customer

base. Maintaining this strategy

requires a continuous search for

cost reductions in all

aspects

85

Strategic

Management MGT603

VU

of

the business. The associated

distribution strategy is to obtain the

most extensive

distribution

possible.

Promotional strategy often

involves trying to make a

virtue out of low cost

product features.

To

be successful, this strategy usually

requires a considerable market

share advantage or preferential

access

to raw materials, components,

labour, or some other

important input. Without one

or more of

these

advantages, the strategy can

easily be mimicked by competitors. Successful

implementation also

benefits

from:

Process

engineering skills

Products

designed for ease of

manufacture

Sustained

access to inexpensive

capital

Close

supervision of labour

Tight

cost control

Incentives

based on quantitative

targets

Market

of many price-sensitive

buyers

Few

ways of achieving product

differentiation

Buyers

not sensitive to brand

differences

Large

number of buyers with bargaining

power

Pursued

in conjunction with

differentiation

Economies

or diseconomies of scale

Capacity

utilization achieved

Linkages

with suppliers and

distributors

A

primary reason for pursuing forward,

backward, and horizontal

integration strategies is to gain

cost

leadership

benefits. But cost

leadership generally must be

pursued in conjunction with

differentiation. A

number

of cost elements affect the relative

attractiveness of generic strategies,

including economies or

diseconomies

of scale achieved, learning and

experience curve effects, the

percentage of capacity

utilization

achieved, and linkages with

suppliers and distributors. Other

cost elements to consider

in

choosing

among alternative strategies include the

potential for sharing costs

and knowledge within the

organization,

R&D costs associated with

new product development or modification

of existing

products,

labor costs, tax rates,

energy costs, and shipping

costs.

Striving

to be the low-cost producer in an industry can be

especially effective when the market

is

composed

of many price-sensitive buyers, when

there are few ways to

achieve product

differentiation,

when

buyers do not care much

about differences from brand to brand, or

when there are a

large

number

of buyers with significant bargaining

power. The basic idea is to

under price competitors and

thereby

gains market share and

sales, driving some competitors

out of the market

entirely.

A

successful cost leadership

strategy usually permeates the entire

firm, as evidenced by high

efficiency,

low

overhead, limited perks, intolerance of

waste, intensive screening of budget

requests, wide spans of

control,

rewards linked to cost containment,

and broad employee participation in

cost control efforts.

Some

risks of pursuing cost leadership

are that competitors may imitate the

strategy, thus

driving

overall

industry profits down; technological breakthroughs in

the industry may make the

strategy

ineffective;

or buyer interest may swing to

other differentiating features

besides price. Several

example

firms

that are well known

for their low-cost leadership

strategies are Wal-Mart,

BIC, McDonald's,

Black

and

Decker, Lincoln Electric, and Briggs

and Stratton.

Low

Cost Producer

Advantages

The

first point depends upon the

condition of the price fluctuation in the

market; this can also

be

understood

with the help of elasticity of

demand. In any market, the

demand is sensitive to price this

is

called

price sensitivity of demand.

For

example, if price of any

commodity increases, the customer

carry on to buy the things. It

means

these

customers neither are price

sensitive. Other is the case

where customers move towards

the

alternates

with an increase in

demand.

The

second is the case where

there are few ways of

achieving product differentiation either

by changing

features,

price, cost or quality of the

product.

86

Strategic

Management MGT603

VU

Where

there are high end

products, there are the

customers who are brand

sensitive, because, people

want

to express their choices or personality

through that brand.

In

Bargaining power, low price

products have more

customers, more suppliers

and more bargaining

but

high

priced products there are low bargaining

power due to the fewer

customers.

Differentiation

Strategies:

Differentiation

involves creating a product

that is perceived as unique. The unique

features or benefits

should

provide superior value for the

customer if this strategy is to be

successful. Because

customers

see

the product as unrivaled and

unequaled, the price elasticity of

demand tends to be reduced

and

customers

tend to be more brands loyal. This

can provide considerable

insulation from

competition.

However

there are usually additional

costs associated with the

differentiating product features

and this

could

require a premium pricing

strategy.

To

maintain this strategy the firm should

have:

Strong

research and development

skills

Strong

product engineering

skills

Strong

creativity skills

Good

cooperation with distribution

channels

Strong

marketing skills

Incentives

based largely on subjective

measures

Be

able to communicate the importance of the

differentiating product

characteristics

Stress

continuous improvement and

innovation

Attract

highly skilled, creative people

Greater

product flexibility

Greater

compatibility

Lower

costs

Improved

service

Greater

convenience

More

features

Differentiation

strategies Allow firm to charge

higher price gain customer

loyalty

In

the differentiation focus strategy, a

business aims to differentiate

within just one or a small

number

of

target market segments. The

special customer needs of the

segment means that there

are

opportunities

to provide products that are

clearly different from competitors

who may be targeting a

broader

group of customers. The

important issue for any

business adopting this strategy is to

ensure

that

customers really do have

different needs and wants -

in other words that there is

a valid

basis for

differentiation

- and

that existing competitor products are

not meeting those needs

and wants.

Focus

Strategy - Cost

Focus

In

this strategy the firm concentrates on a

select few target markets. It is

also called a focus strategy

or

niche

strategy. It is hoped that by focusing

your marketing efforts on one or

two narrow market

segments

and tailoring your marketing

mix to these specialized

markets, you can better meet

the needs

of

that target market. The

firm typically looks to gain a

competitive advantage through

effectiveness

rather

than efficiency. It is most suitable

for relatively small firms but

can be used by any company.

As a

focus

strategy it may be used to

select targets that are

less vulnerable to substitutes or where

a

competition

is weakest to earn above-average

return on investments.

Industry

segment of sufficient

size

Good

growth potential

Not

crucial to success of major

competitors

Consumers

have distinctive

preferences

Rival

firms not attempting to specialize in the

same target segment

Here

a business seeks a lower-cost

advantage in just on or a small number of

market segments. The

product

will be basic - perhaps a

similar product to the higher-priced and

featured market leader,

but

acceptable

to sufficient consumers. Such

products are often called

"me-too's".

87

Strategic

Management MGT603

VU

Niche

strategies

Here

the organization focuses its effort on

one particular segment and

becomes well known

for

providing

products/services within the segment.

They form a competitive

advantage for this

niche

market

and either succeeds by being a low

cost producer or differentiator within

that particular

segment.

Recent

developments

Michael

Treacy and Fred Wiersema

(1993) have modified

Porter's three strategies to

describe three

basic

"value disciplines" that can

create customer value and

provide a competitive advantage.

They are

operational

excellence, product innovation,

and customer intimacy.

Criticisms

of generic strategies

Several

commentators have questioned the

use of generic strategies claiming they

lack specificity, lack

flexibility,

and are limiting. In many

cases trying to apply generic

strategies is like trying to

fit a round

peg

into one of three square

holes: You might get the

peg into one of the holes,

but it will not be a

good

fit.

In

particular, Millar (1992) questions the

notion of being "caught in the middle". He

claims that there is

a

viable middle ground between

strategies. Many companies,

for example, have entered a

market as a

niche

player and gradually

expanded. According to Baden-Fuller and

Stop ford (1992) the

most

successful

companies are the ones that

can resolve what they call

"the dilemma of opposites".

88

Table of Contents:

- NATURE OF STRATEGIC MANAGEMENT:Interpretation, Strategy evaluation

- KEY TERMS IN STRATEGIC MANAGEMENT:Adapting to change, Mission Statements

- INTERNAL FACTORS & LONG TERM GOALS:Strategies, Annual Objectives

- BENEFITS OF STRATEGIC MANAGEMENT:Non- financial Benefits, Nature of global competition

- COMPREHENSIVE STRATEGIC MODEL:Mission statement, Narrow Mission:

- CHARACTERISTICS OF A MISSION STATEMENT:A Declaration of Attitude

- EXTERNAL ASSESSMENT:The Nature of an External Audit, Economic Forces

- KEY EXTERNAL FACTORS:Economic Forces, Trends for the 2000ís USA

- EXTERNAL ASSESSMENT (KEY EXTERNAL FACTORS):Political, Governmental, and Legal Forces

- TECHNOLOGICAL FORCES:Technology-based issues

- INDUSTRY ANALYSIS:Global challenge, The Competitive Profile Matrix (CPM)

- IFE MATRIX:The Internal Factor Evaluation (IFE) Matrix, Internal Audit

- FUNCTIONS OF MANAGEMENT:Planning, Organizing, Motivating, Staffing

- FUNCTIONS OF MANAGEMENT:Customer Analysis, Product and Service Planning, Pricing

- INTERNAL ASSESSMENT (FINANCE/ACCOUNTING):Basic Types of Financial Ratios

- ANALYTICAL TOOLS:Research and Development, The functional support role

- THE INTERNAL FACTOR EVALUATION (IFE) MATRIX:Explanation

- TYPES OF STRATEGIES:The Nature of Long-Term Objectives, Integration Strategies

- TYPES OF STRATEGIES:Horizontal Integration, Michael Porterís Generic Strategies

- TYPES OF STRATEGIES:Intensive Strategies, Market Development, Product Development

- TYPES OF STRATEGIES:Diversification Strategies, Conglomerate Diversification

- TYPES OF STRATEGIES:Guidelines for Divestiture, Guidelines for Liquidation

- STRATEGY-FORMULATION FRAMEWORK:A Comprehensive Strategy-Formulation Framework

- THREATS-OPPORTUNITIES-WEAKNESSES-STRENGTHS (TOWS) MATRIX:WT Strategies

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- BOSTON CONSULTING GROUP (BCG) MATRIX:Cash cows, Question marks

- BOSTON CONSULTING GROUP (BCG) MATRIX:Steps for the development of IE matrix

- GRAND STRATEGY MATRIX:RAPID MARKET GROWTH, SLOW MARKET GROWTH

- GRAND STRATEGY MATRIX:Preparation of matrix, Key External Factors

- THE NATURE OF STRATEGY IMPLEMENTATION:Management Perspectives, The SMART criteria

- RESOURCE ALLOCATION

- ORGANIZATIONAL STRUCTURE:Divisional Structure, The Matrix Structure

- RESTRUCTURING:Characteristics, Results, Reengineering

- PRODUCTION/OPERATIONS CONCERNS WHEN IMPLEMENTING STRATEGIES:Philosophy

- MARKET SEGMENTATION:Demographic Segmentation, Behavioralistic Segmentation

- MARKET SEGMENTATION:Product Decisions, Distribution (Place) Decisions, Product Positioning

- FINANCE/ACCOUNTING ISSUES:DEBIT, USES OF PRO FORMA STATEMENTS

- RESEARCH AND DEVELOPMENT ISSUES

- STRATEGY REVIEW, EVALUATION AND CONTROL:Evaluation, The threat of new entrants

- PORTER SUPPLY CHAIN MODEL:The activities of the Value Chain, Support activities

- STRATEGY EVALUATION:Consistency, The process of evaluating Strategies

- REVIEWING BASES OF STRATEGY:Measuring Organizational Performance

- MEASURING ORGANIZATIONAL PERFORMANCE

- CHARACTERISTICS OF AN EFFECTIVE EVALUATION SYSTEM:Contingency Planning