|

TYPES OF BUDGET:Format of Cash Budget, |

| << FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses |

| Complex Cash Budget & Flexible Budget:Comparing actual with original budget >> |

Cost

& Management Accounting

(MGT-402)

VU

changes

inversely with changes in

activity level Assume that

for an estimated activity

level of

50,000

machine hours budgeted factory

overhead is Rs. 150,000

which includes Rs 100.000 of

fixed

cost. The absorption rate

and its composition in this

case is as follow:

FOH

absorption rate:

Rs,

150,000/ 50.000 machine

hrs

=

Rs. 3 per machine hr.

The

fixed rate:

Rs.

100,000/50.000 machine hrs

=

Rs. 2 per machine hr.

The

variable rate:

Rs

3 per machine hr less Rs. 2

per machine hr = Rs. 1 per machine

hr.

It

is very easily understood

that Rs, 100.000 of fixed

factory overhead can be

absorbed only when

capacity

attained till the end of

year is 50,000 machine hours If

capacity attained is less

than the

budgeted

capacity it means an unfavorable

capacity variance, which

will be signified by unabsorbed

fixed

factory overhead. Assume

that the capacity attained

is 48,000 machine hours. At this

capacity

level

only Rs 96,000 of fixed

factory overhead is absorbed

(i.e. 48,000 hrs x Rs. 2)

and the under

absorbed

fixed cost of Rs 4,000(i.e.

Rs. 100,000 less Rs.

96,000) represents the

portion of factory

overhead

variance cause by unfavorable

capacity variance. Similarly, where

capacity attained is

more

than the budgeted capacity

it is a favorable capacity variance which

will be signified by over

absorbed

fixed factory overhead. In

other words capacity

variance can be computed by

multiplying

the

difference in capacity (budgeted and

attained) by the fixed rate.

The same result is obtained

by

taking.

the difference between

absorbed factory overhead

and budgeted factor*

overhead for

capacity

attained.

Budget/Spending

Variance

Budget

variance is the difference

between budgeted factory

overhead for capacity

attained and

actual

factory overhead incurred. It

represents either over-spending or

under-spending.

If

actual factory overhead is

more than the budgeted, it

is unfavorable budget variance. On

the

other

hand if actual factory

overhead is less than the

budgeted it is favorable budget

variance.

In

order to determine exact causes of budget

variance, the difference between

actual and budgeted

figures

of each item of factory

overhead is computed and

communicated to the responsible

person

for

the purpose of control. The

budget variance may be due to

fixed factory overhead items

or it

may

be due to the variable items

or the both.

Following

practice question explains the

computation and presentation of the

variance and its

analysis.

123

Cost

& Management Accounting

(MGT-402)

VU

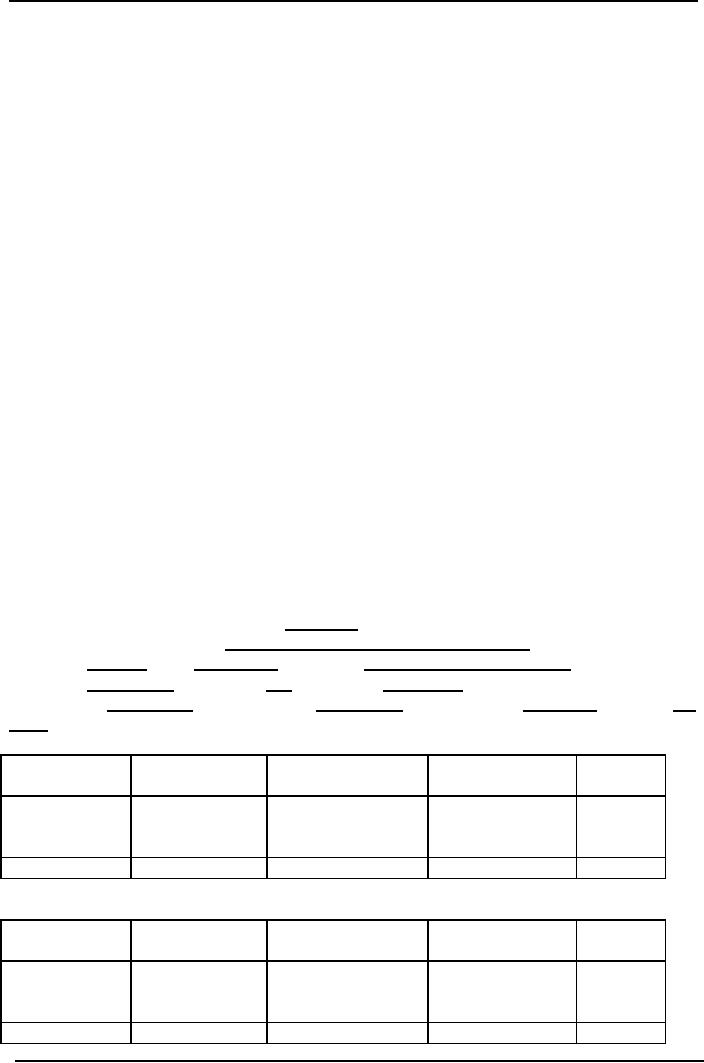

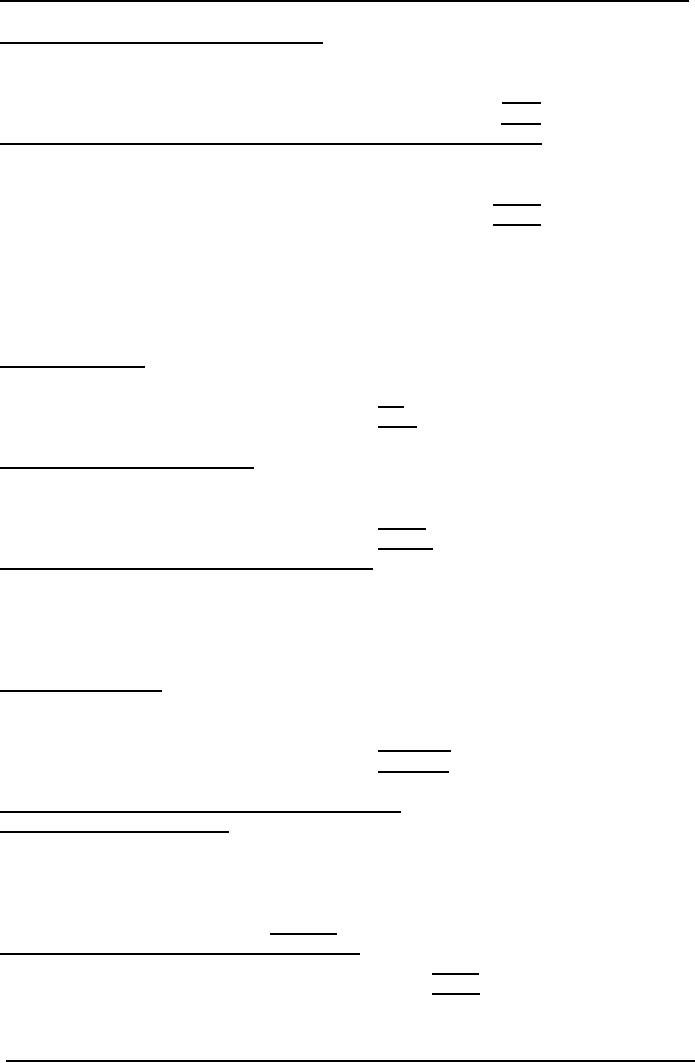

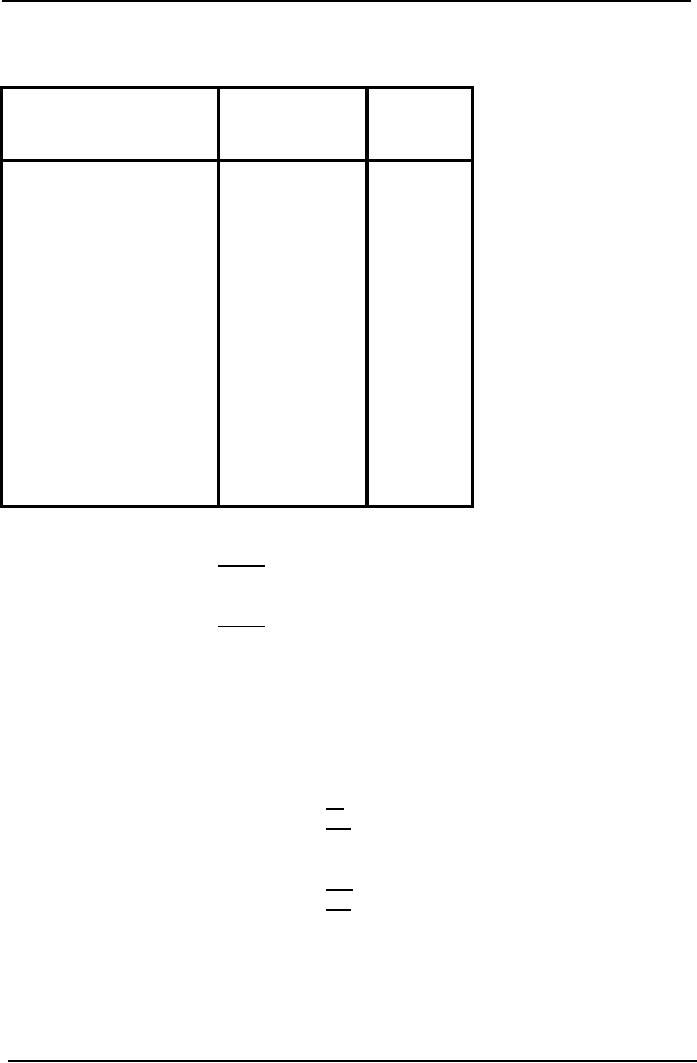

PRACTICE

QUESTION

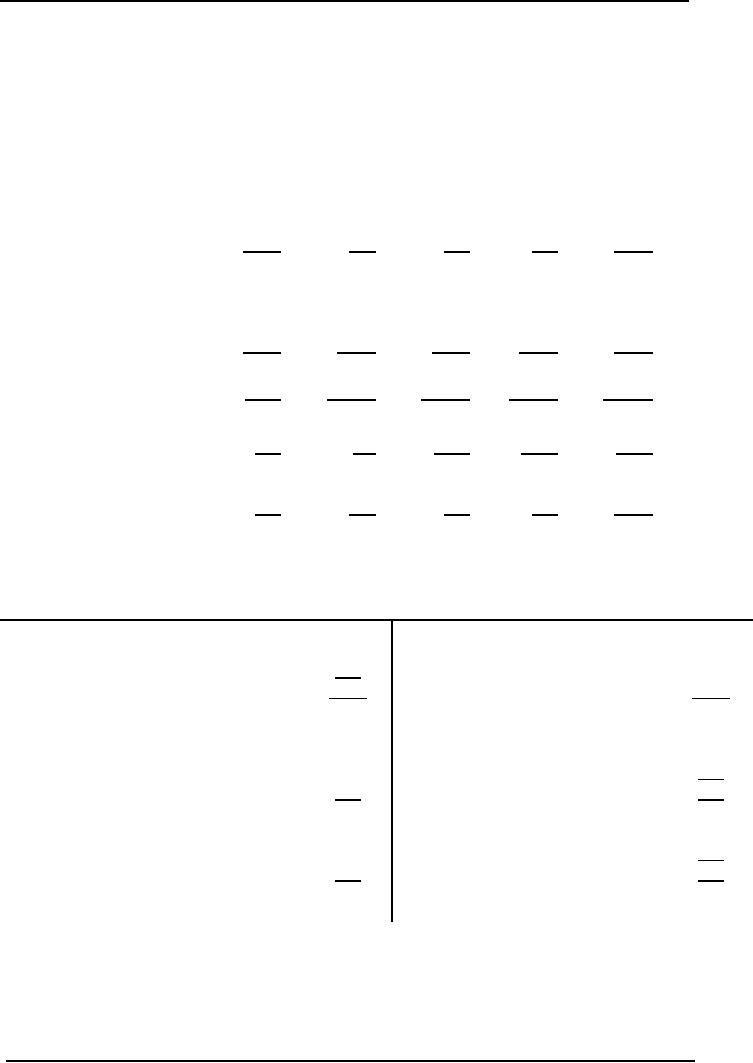

Shahzewaz

Associates prepared following

estimates for the year

2006.

Fixed

factory overhead

Variable

factory overhead

Direct

labor hours Actual results

for the year 19xx

were as follow:

Fixed

factory overhead

Rs.

450,000

Variable

factory overhead

Rs.

600,000

Direct

labor hours

200,000

Required:

Calculate

(i)

Total

factory overhead

variance.

(ii)

Capacity

variance.

(iii)

Budget

variance.

Solution:

(i)

Total

Factory Overhead

Variance

Actual

factory overhead

Fixed

FOH + Variable FOH

Rs.

450.000 + Rs. 680,000

Rs.

1,130,000

Absorbed

factory overhead

Capacity

attained x Absorption

rate

220,000

hours x Rs. 5.25

1,155,000

Over

applied

25,000

(ii)

Capacity

Variance

Absorbed

factory overhead (220,000 x

5.25)

Rs.

1.155.000

Budgeted

factory overhead for

capacity attained

Fixed

factory overhead + (Capacity

attained x Variable rate)

(Rs.

450,000 + 220,000 hours x

Rs. 3)

1,110,000

Favorable

45,000

(iii)

Budget

Variance

Budgeted

factory overhead for

capacity attained

Rs.

1,110,000

Actual

factory overhead

1,130,000

Unfavorable

20,000

Supporting

Calculations

Absorption

rate = (Rs 450.000 + Rs.

600,000)

200.000

direct labor hours

=

Rs. 5.25 per direct labor

hour

Variable

rate

=

Rs. 600.000

2,00,0000

direct labor hours

=

Rs. 3 per direct labor

hour

It

should be remembered here

that no definite conclusions can be

drawn only on the basis

of

factory

overhead variance analysis, as

presented above Analysis of factory

overhead variance is a

part

of whole process of variance

analysis whereby direct materials

variance and direct

labor

variance

are also computed and

analysed. Complete study of variance

analysis is a part of

advanced

courses

of cost accounting.

In

the above practice question

capacity attained in terms of direct

labor hours is greater than

the

budgeted

capacity. This seemingly favorable

capacity variance may, in

fact, be due to

unfavorable

factors.

For example, direct labor

may be less efficient and as

a result same quantity of

output is

124

Cost

& Management Accounting

(MGT-402)

VU

produced

by working greater number of

hours, or it may be due to defective

materials which

require

more conversion time and as

such the hours worked over

and above the budgeted

capacity

have

not resulted in extra output Similarly an

unfavorable budget variance may be on

account of

higher

spending on preventive repairs

and maintenance or higher spending on

training of workers,

which

is in effect beneficial for the

organisation.

Here

a practice question is discussed to

explain High and Low

Point Method. This method is

a

technique

to segregate fixed and

variable portions of a

total/semi-variable cost.

Practice

Question

Predetermined

factory overhead absorption

rate computed by AI-Nasr

Associates Rs. 6 per

machine

hour. Budgeted factory

overhead for activity level

of 150.000 machine hours is

Rs.

800,000

and for activity level of

100,000 machine hours it is Rs.

700,000. Actual factory

overhead

incurred

during the year is Rs.

710,000 at an actual volume of

120,000 machine hours.

Required:

(i)

Variable

factory overhead absorption

rate.

(ii)

Budgeted

fixed factory

overhead,

(iii)

Budgeted

activity level on which the

absorption rate is

based

(iv)

Over

or under absorbed factory

overhead.

(v)

Volume

variance

(vi)

Spending

variance

Solution:

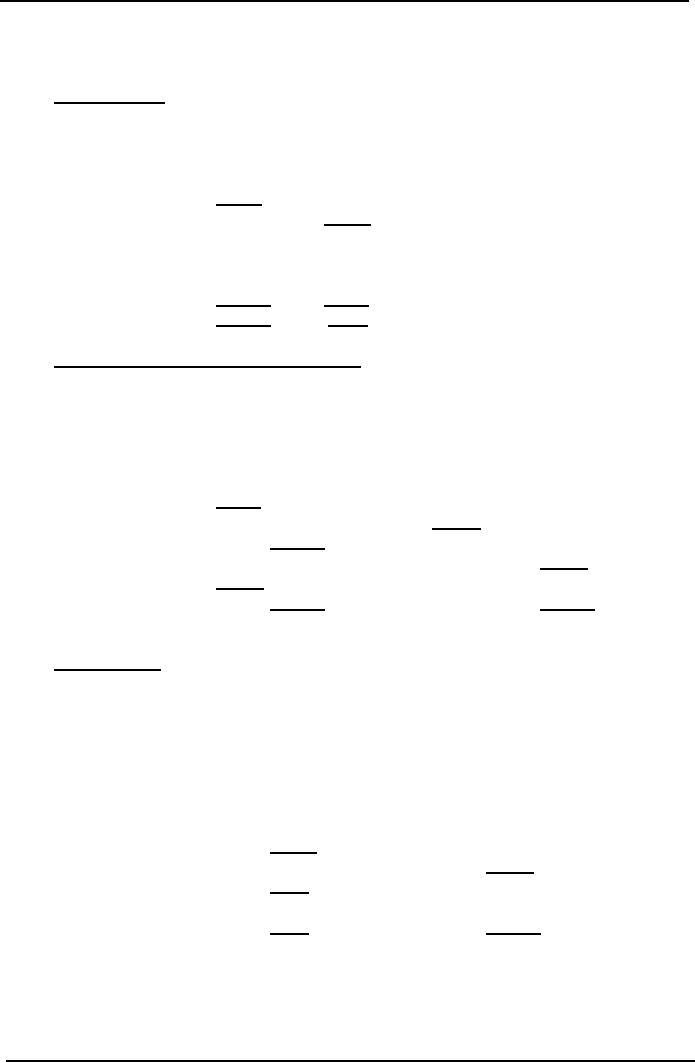

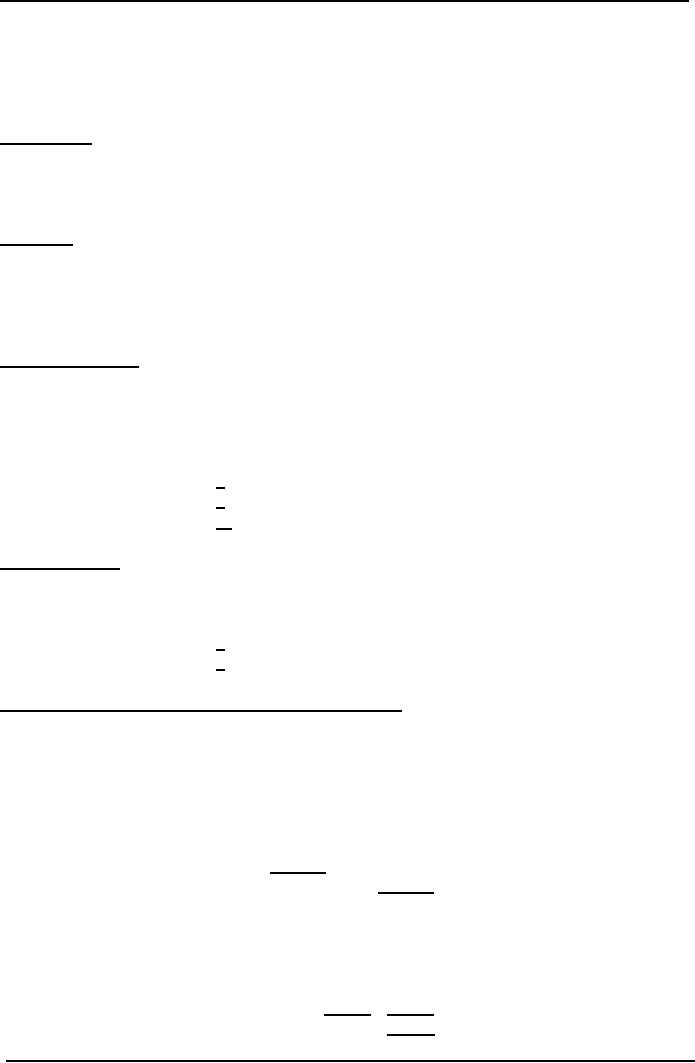

(i)

Variable

Factory Overhead Absorption Rate:

Activity

Level

Budgeted

FOH

(Machine

Hours)

(Rs.)

High

150,000

800,000

Low

100,000

700.000

50,000

100,000

For

a change of 50,000 machine hour's m

activity level there is a

change of Rs, 100,000

in

budgeted

factory overhead. This

change in budgeted factory

overhead is due to variable

factory

overhead.

Therefore,

Variable

rate

=

Change

in budgeted FOH

Change

in activity level

Rs

100,000/50,000 machine hours

Rs.

2 per machine hour

125

Cost

& Management Accounting

(MGT-402)

VU

(ii)

Budgeted Fixed Factory

Overhead:

Total

FOH for 150,000 machine

hours

=

Rs. 800.000

Budgeted

variable FOH = 150,000 hrs Rs

2

=

Rs. 300,000

Budgeted

fixed FOH = Rs 800.000 less

Rs. 300,000

=

Rs. 500.000

OR

Total

FOH for 100.000 machine

hours

=

Rs 700.000

Budgeted

variable FOH =100.000 hrs x Rs.

2

=

Rs 200.000

Budgeted

fixed FOH = Rs, 700.000 less

Rs. 200,000

=Rs.

500.000

(iii)Budgeted

Activity Level

Budgeted

activity level = Fixed FOH

Fixed

rate

=

Rs. 500.000/ (Rs. 6 less

Rs. 2)

=125,000

machine hours

(iv)

Over or under absorbed

Factory Overhead:

Actual

factory overhead

Rs.

710.000

Absorbed

factory overhead

Actual

volume x FOH absorption

rate

120,000

hrs x Rs. 6

720.000

Over

absorbed

10,000

(v)

Volume

Variance:

Absorbed

factory overhead

Rs.

720,000

Budgeted

FOH for actual volume

Fixed

FOH + (Actual volume x Variable

rate)

Rs,

500.000 + (120.000 hrs, x

Rs. 2)

740,000

Unfavorable

20,000

(vi)

Spending

Variance:

Budgeted

FOH for actual volume

Rs.

740,000

Actual

factory overhead

710,000

Favorable

30,000

126

Cost

& Management Accounting

(MGT-402)

VU

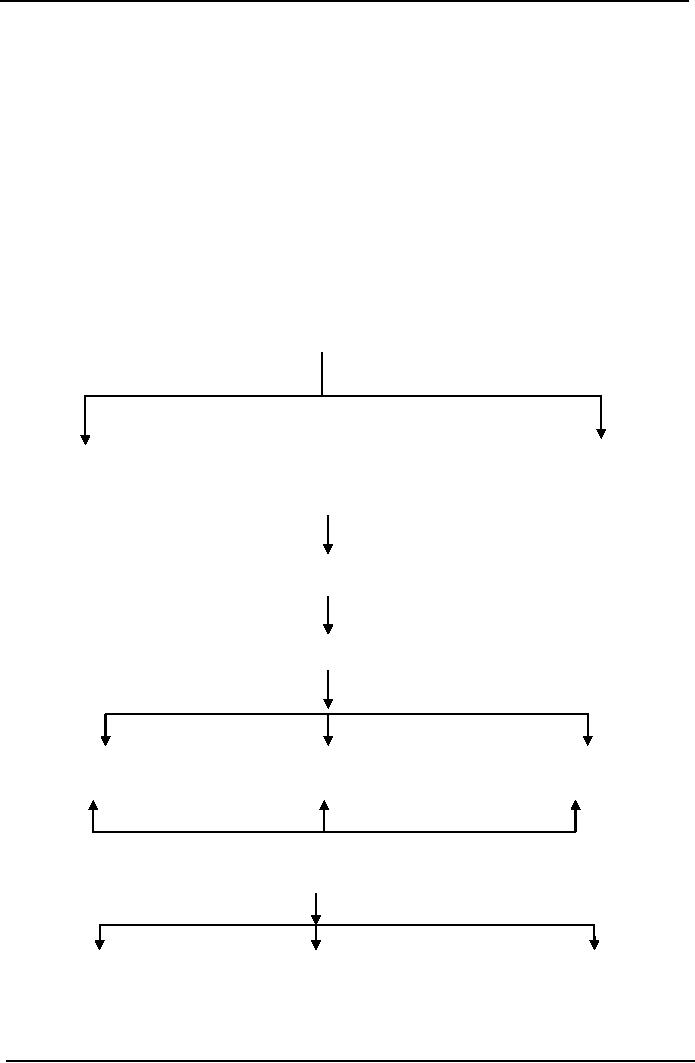

LESSON#

18

JOB

ORDER COSTING

SYSTEM

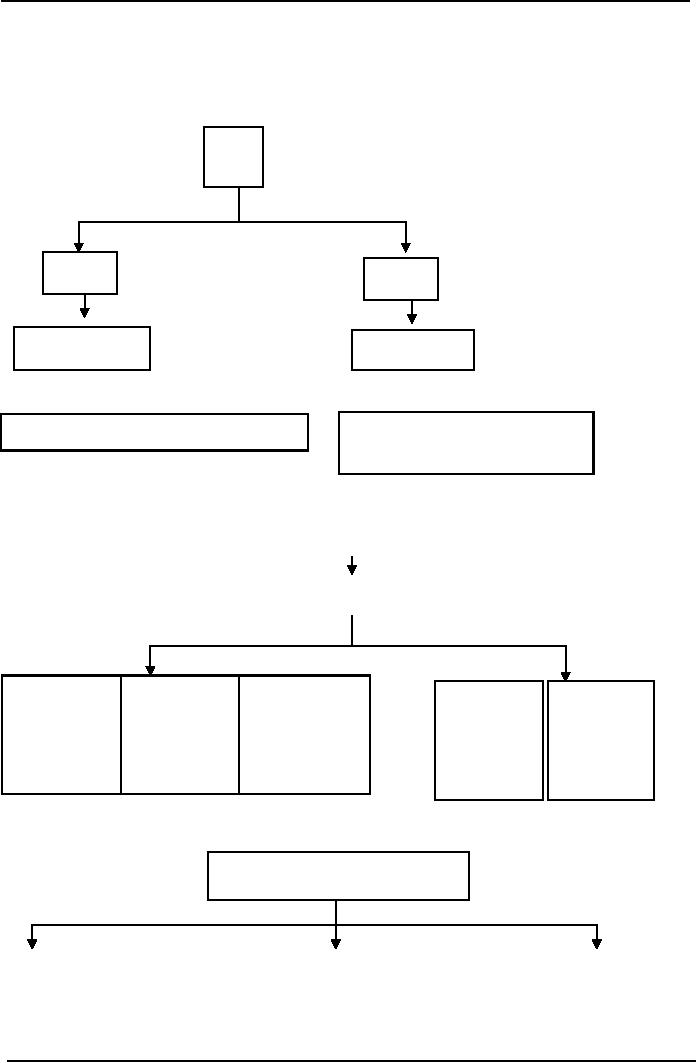

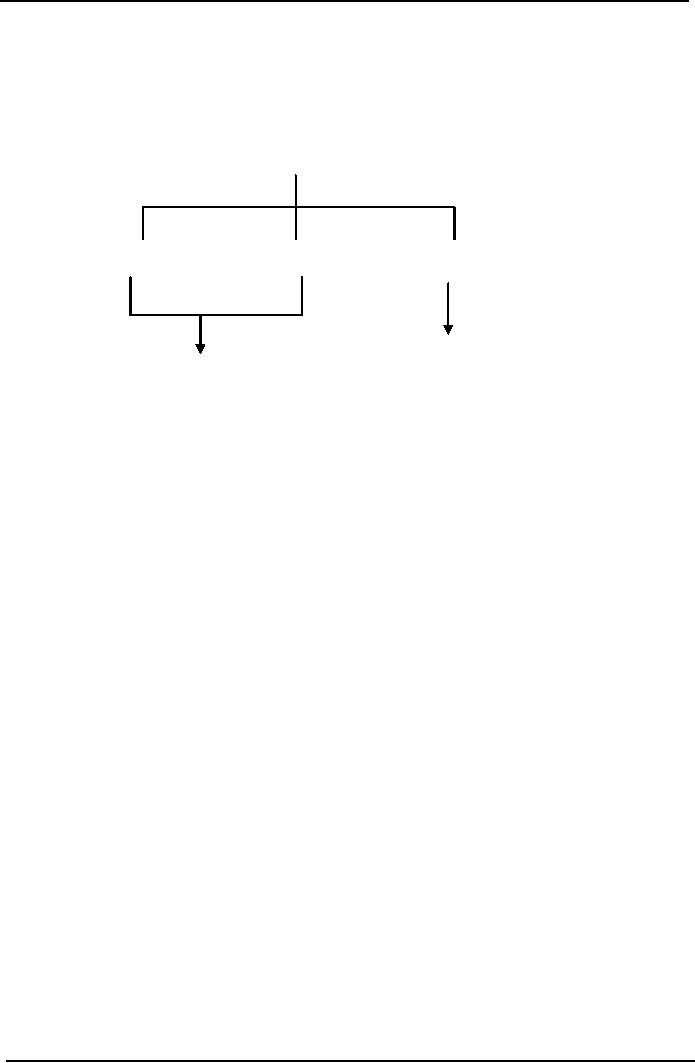

It

has been explained that a

cost accounting system is

composed of two

sub-systems:

(i)

A

system of recording and summarizing

costs and

(ii)

A

costing system.

Costing

system means "the

ascertainment of costs ", It includes

determination of total cost as

well as

unit

cost. A costing system determines

and reports to management

total and unit cost of

product

or

project of service with

details of cost

components

Costing

is compulsory for satisfying at least

three important needs of

management.

I.

Unit cost must be known to

assist the management in making

price decisions.

II.

Ascertainment of cost at every stage of

production is important for

exercising control

over

costs.

III.

In order to operate a system of

accounting for costs,

management needs to know

cost of

materials,

labor and overhead to be

charged to work in process,

cost of work completed

and

transferred to finished goods

and the cost of goods sold

so that necessary debit

and

credit

entries can be

passed.

Choice

of a Costing System

Job

Order Costing or Process

Costing?

What

type of costing system an accounting

entity should adopt? It

depends upon:

(1)

Nature

of operations and

(2)

Information

needs of management.

Take

the example of a construction

company that produces houses

in response to customers'

orders

and according to their

specifications. All the

times, the company remains

engaged in the

construction

of many houses at different

sites for different customers.

Such a company

definitely

wants

to know the cost incurred on

each house separately so

that customers' can be billed

properly

and

profit (or loss) on each

contract may be ascertained.

Here the nature of operations is such

that

each

house is clearly distinguishable from the

other and separate

calculation of cost for each

house

is

desirable and practically possible.

This company will employ

job costing system.

On

the other hand take

the example of a company

producing cement. All of the

bags of cement

produced

are quite similar. Here

separate calculation of cost of cement

supplied to each

customer

is neither desirable nor

feasible. The company can

calculate cost per bag of

cement

produced

by dividing total cost

incurred during the

accounting period by total number of

bags

produced

during the period.

Accordingly,

the company can fix

the price per bag

and bill each customer

according to the

number

of bags supplied to him. This

company will use process

costing system.

Job

costing and process costing are

two basic types of costing

systems and can be

viewed

as

two ends of a spectrum or range. In

practice we find companies

employing either one of

these

two or some combination of

features of the two both of

these at the same time.

For

example,

a ready made garments

manufacturer employs process costing to

accumulate and

determine

the cost of free size shirts

produced by him in large quantity. At

the same time he

uses

job costing to accumulate the

cost of waiters' uniforms supplied to a

hotel under a

contract.

Job

costing may be

defined:

The

costing system that separately

accumulates costs incurred to produce each job in a

situation where each job is

distinguishable

from the other throughout the

production process.

The

job may be a single unit or

a multi unit batch, a contract or a

project, program or a service.

Job

costing

is employed by organisations possessing

following characteristics:

1.

Production is generally in response of customers'

orders.

2.

Every order has its own

manufacturing specifications. Therefore,

every job is different from

the

other

and requires different

amounts materials, labor and

overhead.

127

Cost

& Management Accounting

(MGT-402)

VU

3.

Each job is clearly distinguishable from

the other at all stages

production process which

makes

job-wise

accumulation of possible.

4.

Job-wise accumulation of cost is

desirable and/or necessary

for and profit determination

and

5.

Each job is generally of high

value.

Following

are the examples of

organisations employing job costing

include:

a)

Accounting firms

b)

Civil engineering

c)

Furniture manufacturing

d)

Medical care

e)

Printing press

f)

Ship-building

g)

Advertising agencies

h)

Computer programming

i)

Jewellery manufacturing

j)

Movie studios

k)

Repair shops

As

the costs are accumulated

separately for each job,

therefore, job costing requires

considerable

amount

of clerical work. Where production is

carried in different departments of a

factory,

department

wise cost accumulation is

also necessary for

performance evaluation of

departmental

management.

In this way clerical work is

further increased. Consequently,

job costing is more

expensive

as

compared with process costing.

Job costing is also called

specific order costing or

production

order costing.

Job

order costing

procedures

Most

of the times, organisations

employing job order costing

are required to submit

quotation

before

finalization of customer's order.

Therefore, naturally, the

first step in job order

costing is to

prepare

an estimate of cost likely to be

incurred to produce the job.

The estimation is done by

coordination

of sales, designing and

production departments. On the basis of

estimated cost price

is

quoted. When customer's order has

been initialized production

planning and control

department

takes the first step towards

execution of the

order.

On

receipt of production order,

cost accounting department

prepares a job cost sheet

for each

job.

Job cost sheet may be

defined as a

document used for accumulating costs

incurred to produce a job.

Design

and contents of job cost

sheet vary widely depending

on customs of manufacturing

operations

and information needs of

management.

However,

generally, a job cost sheet is

designed to show the

following information:

1.

Job number

2.

Name of the customer

3.

Description and specifications of

the job

4.

Date of commencement of production

5.

Date of completion of job.

6.

Direct materials cost

incurred on the job

7.

Direct labor cost incurred

on the job

8.

Factory overhead applied to

the job

9.

Total cost of the

job

10.

Selling and administration

expenses chargeable to the

job

11.

Sales price of the

job

12.

Profit (or loss) on the

job

13.

Where the job consists of a batch,

the quantity produced and

unit cost

14.

Where cost estimates are

prepared before production, estimated

cost should also be shown

for

comparison

and efficiency

evaluation.

128

Cost

& Management Accounting

(MGT-402)

VU

Job

cost sheet is one of the

basic

documents used

in job order costing. Upto

the time the job

is

incomplete;

job

cost sheet serves as a

subsidiary

record .for work in process control

account and is

placed in

work

in process subsidiary ledger. On

completion

of

job, the relevant job

cost sheet is removed

from

work in process subsidiary

ledger.

Now

it reveals the cost of completed

job and serves as source

document for

debiting finished goods

account

(or completed jobs control account)

and for crediting work in

process account.

Then

it is placed in finished goods

subsidiary ledger and serves

as subsidiary

record .for finished

goods

account.

When

completed job is shipped to the

customer, relevant job cost

sheet serves as source

document

for

debiting cost of goods sold account

and for crediting finished

goods account. Then

it

is

placed in cost of goods sold

subsidiary ledger where the

same job cost sheet

serves as subsidiary

record

for cost of goods sold

account.

Manufacturing

process is, most of the

times, divided into departments. This

departmentalization

is

the logical result of different

types of operations performed to produce a

product. For example,

furniture

manufacturing is divided into cutting,

assembling and finishing and

polishing

departments;

readymade garments manufacturing is

divided into cutting, stitching

finishing and

packing

departments.

These

departments are regarded as cost

centers. Cost

Centre means

a

division or segment for which

a

separate

individual is made responsible .for

incurrence of cost. Accumulation

of cost for each department

is

necessary

to achieve better control

over cost. In job order

costing it is necessary to identify

cost

not

only with the department

but also with the

relevant job.

Direct

materials, direct labor and

factory overhead to be charged to

each job and to

each

department

are recorded in the

following manners:

Direct

Materials: Every

materials requisition issued to

secure direct materials bears

the name of

department

and job number for

which materials are required.

Periodically (weekly or fortnightly

etc)

a summary of materials requisitions is

prepared. Materials requisition

summary analyses cost

of

materials issued and

ascertains cost of materials

chargeable to each department

and to each job.

Indirect

materials issued cannot be

associated with particular jobs,

therefore, these are

summarised

only

by department. Instead of posting each

individual materials issue to

job cost sheets,

the

periodic

totals are recorded on

relevant job cost

sheets.

The

periodic

grand total are

debited to work in process

and factory overhead

-control accounts and

credited

to materials control

account.

Direct

Labor: Primary

labor cost data are

accumulated on Job Time Tickets.

Job time tickets

contain

names of departments and job

numbers for which labor

time is used. A labor cost

analysis

sheet

is prepared periodically that analyses

the direct labor cost by departments

and by jobs. As

indirect

labor cost cannot be

identified with particular jobs,

therefore, labor cost

analysis sheet

analyses

it only by departments. The periodic

totals are

posted to job cost sheets

and debited to

work

in process and factory

overhead control accounts.

Factory

Overhead:

Factory overhead is applied to jobs on

the basis of predetermined

departmental

factory overhead applied

rates. Factory overhead is

also periodically

applied

to the

jobs

and entered in job cost

sheets. Total applied

factory overhead is debited to

work in process

control

account and credited to

factory overhead applied

account.

Practice

Question

Job

Order Costing. Shah

Taj Engineering Works on April 5,

2006 started production of

100 lawn

mower

of model EG- 72 ordered by

Capital Development Authority.

Islamabad, vide Order

No.

2119-M

dated April 1, 2006 at a

price of Rs. 3,600 per

lawn mower.

Production

Planning Department allotted

Job No. J-832-LM and

instructed the factory

to

complete

production by April 20,

2006. However, the factory

completed production on April

18,

2006.

129

Cost

& Management Accounting

(MGT-402)

VU

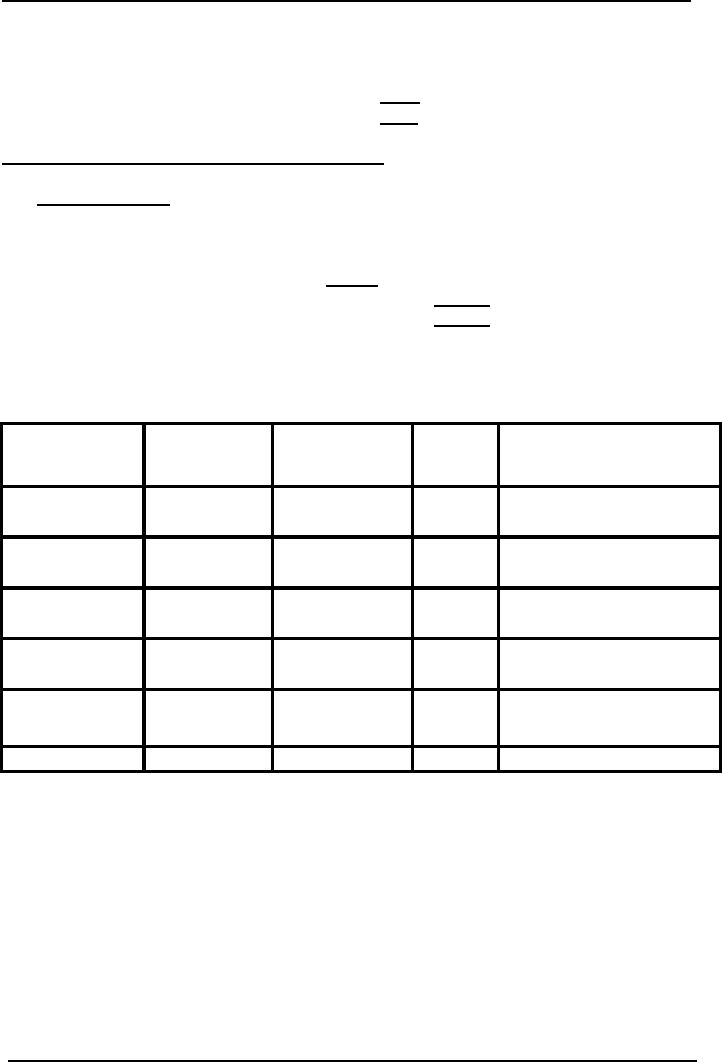

On

April 11, weekly Materials Requisitions

Summary. No. MRS-16 and

weekly Labor Cost

Analysis

Sheet No.LAS-16 showed

following charges to Job No.

J-832-LM.

.

Department

101

Department

102

Direct

materials

Rs.

58,500

11,700

Direct

labor

Rs.

13,500

15,750

(900

hours)

Materials

Requisitions Summary No. MRS-17 and

Labor Cost Analysis Sheet

No. LAS-17

prepared

on April 18 revealed following direct

costs for the

job.

Department

101

Department

102

Direct

materials

Rs.71,500

Rs.

14,300

Direct

labor

Rs.

16,500

Rs.

19,250

(1100

hours)

In

department 101 factory

overhead is applied @ 50% of direct

labor cost and in department

102

@

Rs. 12 per direct labor

hour. Marketing and

administration expenses chargeable to

the job were

respectively

7.5 % and 5% of the sale

price. The lawn mowers were

delivered to customer on

April

22,

2006

Required:

(i)

Prepare a Job Cost Sheet

for Job No.

J-832-LM.

(ii)

Assuming that J-832-LM was

the only job worked on

during the two weeks period,

pass

account

entries in General Journal form to

record:

(a)

Cost incurred on the

job:

(b)

Completion of the job;

and

(c)

Sale of the job.

Solution

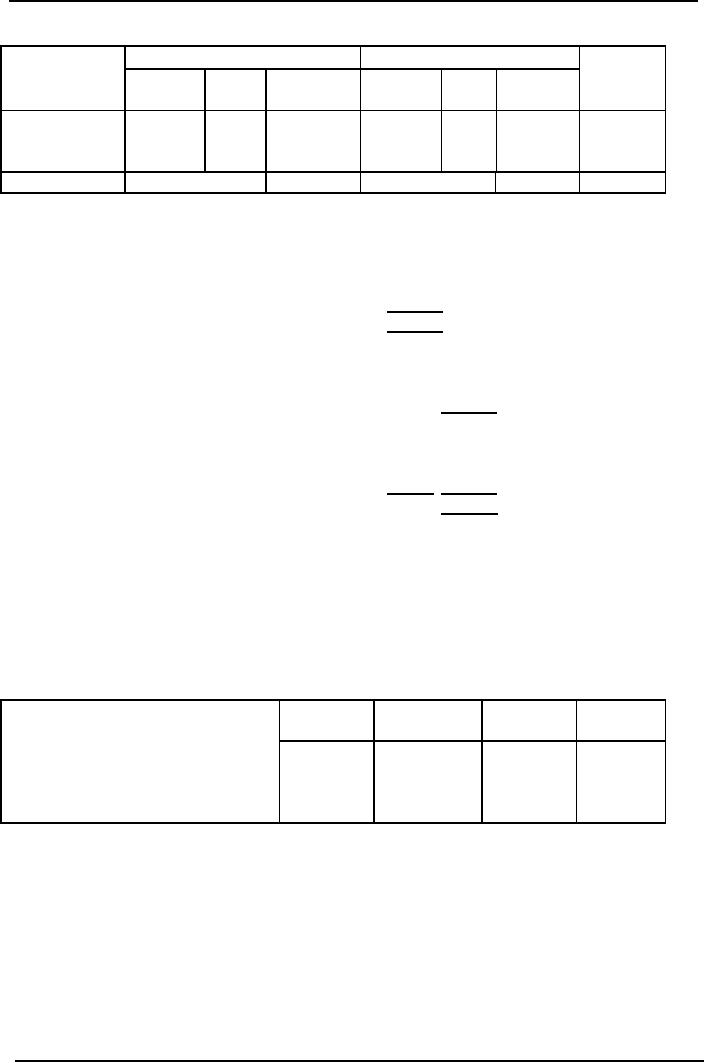

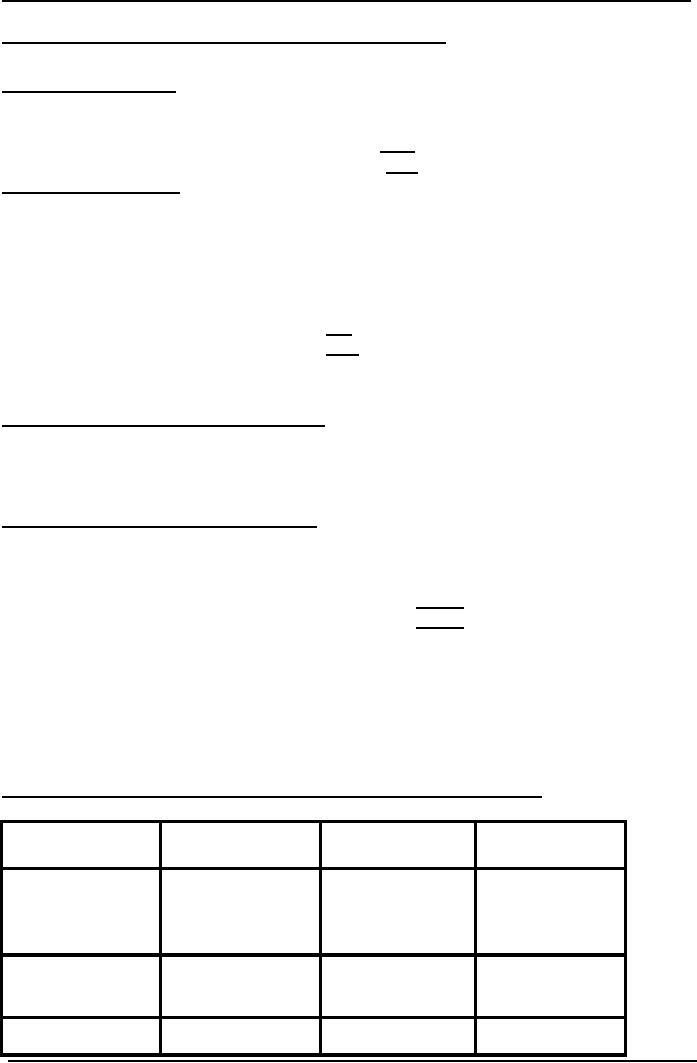

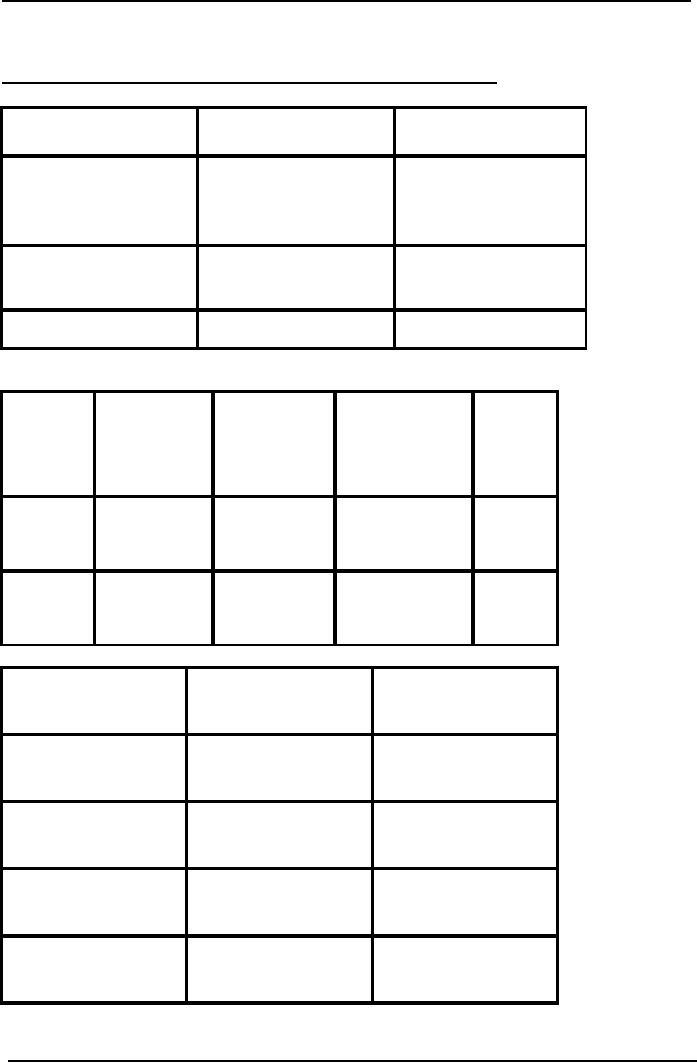

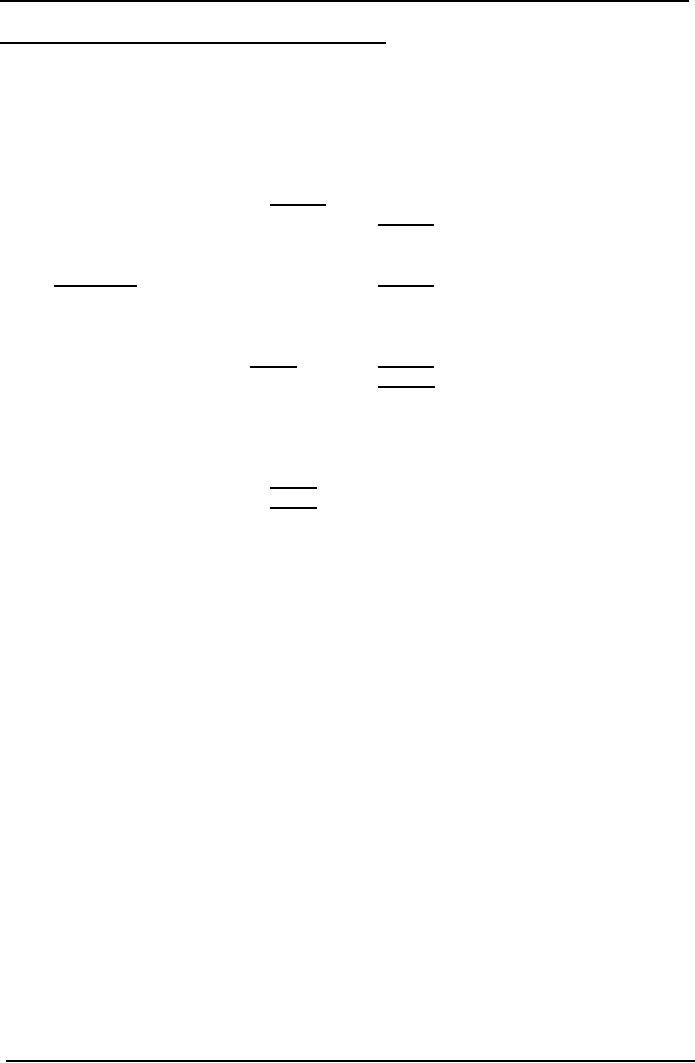

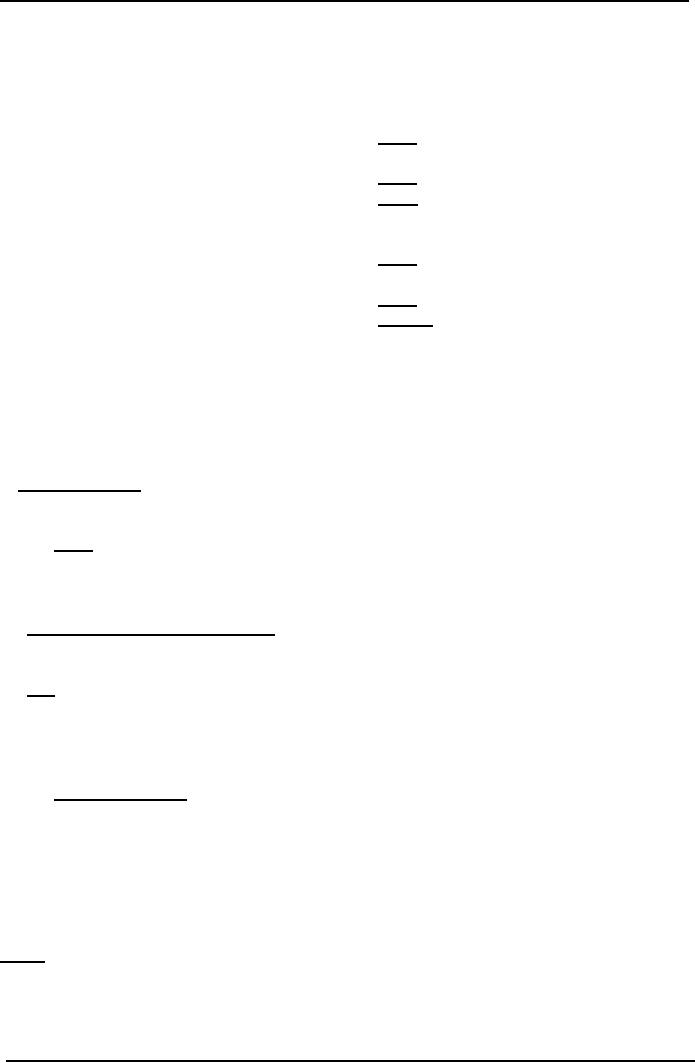

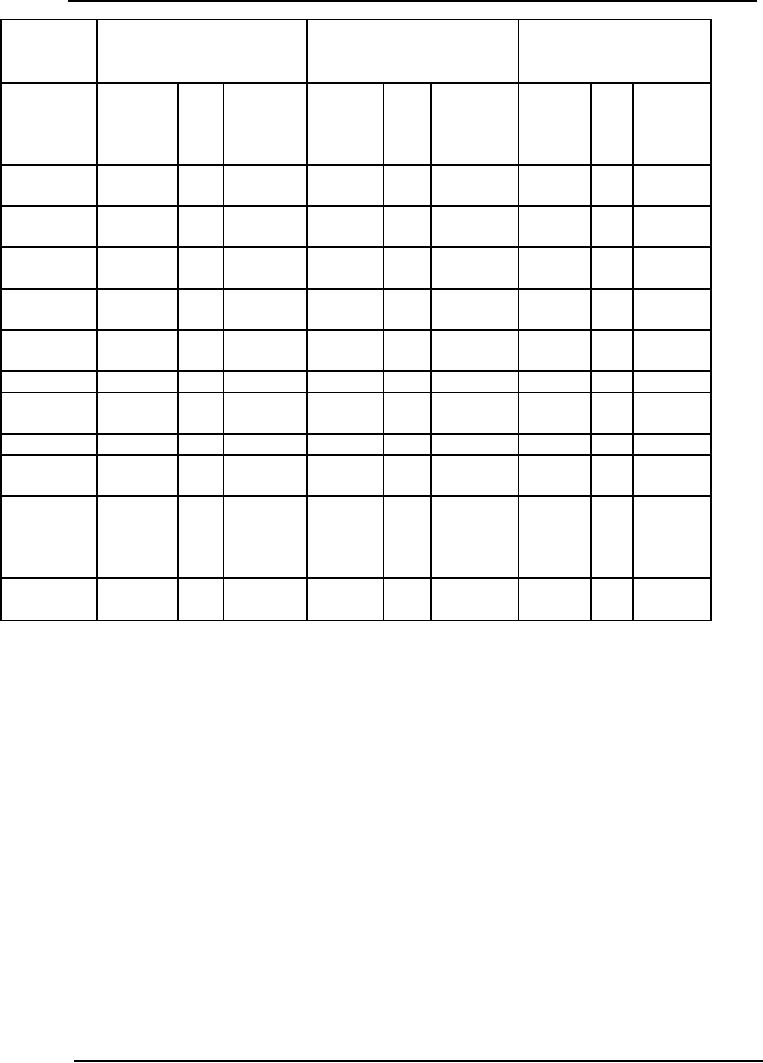

SHAH

TAJ ENGINEERING WORKS LIMITED

JOB

COST SHEET FOR JOB NO.

J-832-LM

Customer's

Name:

Capital

Development Authority.

Islamabad.

Order

No. 2119-M Dated 02-04-2006

Description Lawn Mowers

Model EG- 72

Total

Cost Rs. 260.000 No. of

units. 100Date Started

05-04-2006

Date

wanted 20-04-2006 Date Completed 18-04-2006

Unit Sales Price Rs.

3,600 Unit Cost

Rs.

2,600

DIRECT

MATERIALS

Date

Mat.

Req. Sum. Department

101

Department

102

Total

No

11-04-2006

MRS-16

Rs.

58,500

11,700

70,200

18-04-2006

MRS-17

71,500

14,300

85,800

Total

130,000

26,000

156,000

DIRECT

LABOR

Date

Lab

Analysis

Department 101

Department

102

Total

Sheet

No.

11-04-2006

LAS-16

Rs.

13,500

15,750

29,250

18-04-2006

LAS-17

16,500

19,250

35,750

Total

30,000

35,000

65,000

130

Cost

& Management Accounting

(MGT-402)

VU

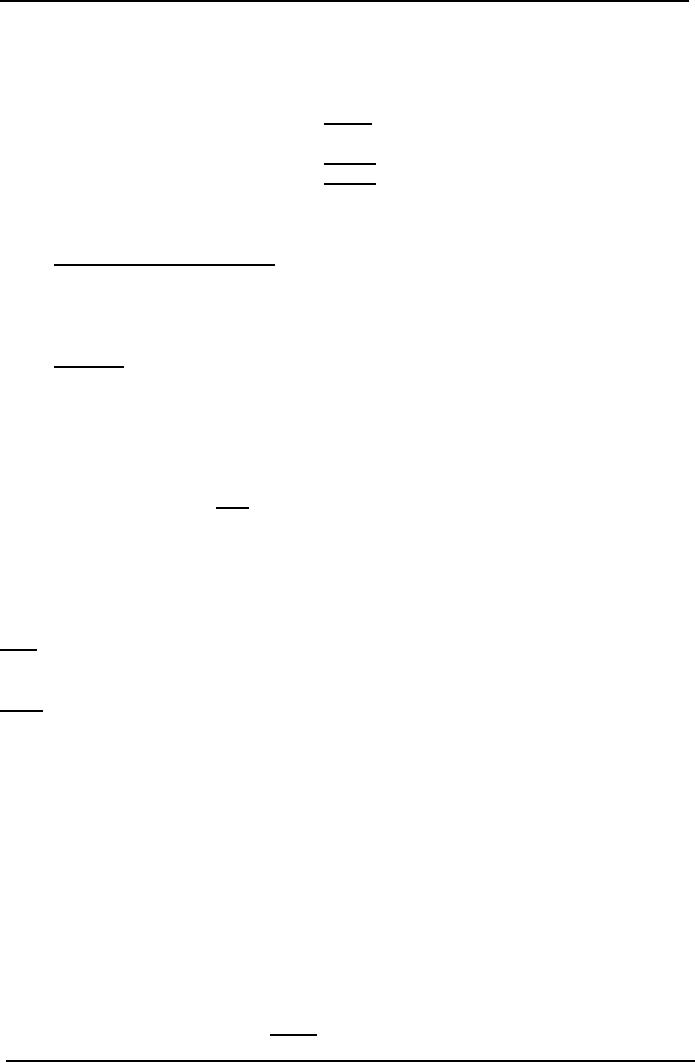

FACTORY

OVERHEAD APPLIED

Date

Department

101

Department

102

Total

D.L

Rate

Amount

D.L

Rate

Amount

Cost

Hours

11-04-2006

13,500

50%

6,750

900

12

10,800

17,750

18-04-2006

16,500

50%

8,250

1,100

12

13,200

21,450

Total

15,000

24,000

39,000

Total

Production Cost

Direct

material cost

156,000

Direct

labor cost

65,000

Factory

overhead cost

39,000

260,000

Income

Statement

Sales

price 100 units @ Rs.

3,600

360,000

Cost

of production

260,000

Gross

profit

100,000

Operating

expenses

Marketing

Expenses (Rs. 360,000 x

7.5%)

27,000

Administration

Expenses (Rs. 360,000 x 5%)

18,000

45,000

Net

Income/profit

55,000

Problem

Questions

Q.

1

Arman

Advertisers on November 15, 2006

received an order from

Pheasent Cosmetics Limited

for

manufacturing

and installation of a huge

neon sign for a contract

price of Rs. 180,000. Job

No.

676-PN

was allotted and

manufacturing was begun on November

21, 2006 .The costs

are charged

to

the jobs periodically by means of weekly

summaries.

Following

costs were related to Job

No. 676-PN

WEEK

ENDED

Nov.

23

Nov.

30

Dec.7

Dec.

14

Rs.

Rs.

Rs.

Rs.

Direct

materials

13,300

24,800

16,400

12,600

Direct

labor

1,800

12,400

20,100

14,200

Factory

overhead is applied @ 25% of

prime cost. The Job

was completed on December 14,

2006

Selling

expenses are applied to the

job @ 3 % of contract price

and administration expenses @

2%

of

contract price.

Required:

Prepare a job cost sheet

containing above

information

Q.

2

In

order to submit quotation

for air conditioning of Hina

Shopping Centre, management of

Indus

Electrical

Industries made following

estimates:

Direct

materials Rs.

280,000;

Direct

labor Rs. 120,000;

Predetermined

overhead applied rate is 50%

of direct labor cost;

131

Cost

& Management Accounting

(MGT-402)

VU

Predetermined

rates for charging marketing and

administration expenses are respectively

3% and

2%

of the contract

price.

On

the basis of above estimates

contract price was quoted as

Rs. 575,000

The

quotation was accepted by

the owners of Hina Shopping Centre and

the order was

finalized

on

October 6, 2006.

Job

No. 1617 was assigned to

the order and the

work was started on October

12, 2006. Weekly

materials

requisition summaries and

labor cost analysis sheets

showed following charges to

Job

No.

1617.

Date

Direct

Material

Direct

labor

October

17

Rs.

120,000

Rs.

46,000

October

24

Rs.

96,000

Rs.

44,000

October

31

Rs.

60,000

Rs.

48,000

The

job was completed on October

31. However, the time

allowed for completion of job

was upto

November

4.

Required

(i)

Prepare

job cost sheet for

Job No. 1617.

(ii)

Assuming

that Job No. 1617

was the only job

worked on during the above

period, pass

entries

in general journal form to record

production and sale of the

job. Job was accepted by

the

customer

on November 4 and cash

received for the contract

price.

Q.

3

Hussain

Engineering Co. Ltd. produces

machines as per customer's

specifications. The

following

data

pertains to Job Order No. K

101:

Customer:

Azam Banking Co.

Date

Started: 06-08-2006.

Customer

Order No. C 467.

Date

Finished: 20-08-2006.

Dated:

31-07-2006. Total Cost of

manufacture?

Sales

Price?

Description:

6 Banking Machines.

Week

End 13/08

Week

End 20/08

Materials

used. Dept. A.

Rs.

4,800

Rs.

2,600

Direct

labor rate. Dept. A.

Rs

40 per hour

Rs.

40 per hour

Labor

hours used, Dept. A.

1,200

800

Direct

labor rate, Dept. B.

Rs

42 per hour

Rs.

42 per hour

Labor

hour uses, Dept. B.

600

280

Machine

hours. Dept. B.

400

240

Applied

factory overhead Dept. A.

Rs. 20/labor hr.

Rs.

20/labor hr.

Applied

factory overhead Dept. B Rs.

18/machine hr

Rs.18/machine

hr

Marketing

and administrative costs are

charged to each order @ 20%

of the cost to

manufacture

Required:

a)

Prepare

a job order cost

sheet

b)

Calculate

sales price of the job,

assuming that it has been

contracted with a

markup

of 40%

132

Cost

& Management Accounting

(MGT-402)

VU

LESSON#

19

PROCESS

COSTING SYSTEM

(An

introduction)

Definition

Process

costing system applies when

standardised goods are produced

tom a series of

inter-

connected

operations.

In

some industries, the output produced

emerges from a continuous

process. An example might

be

an

oil refinery; Oil in a raw

state is input and subjected

to a process of purification. Refined

oil

emerges

at the end of the

process.

Problems

that arise in such situations include

the attribution of materials

costs and conversion

costs

to units of finished output

and the occurrence of losses

during the process (spoilt

or lost

production).

The

characteristics and application of

process costing

Continuous

production

In

the job order costing, costs

were directly allocated to a

particular job. When

standardised goods

or

services result from a

sequence of repetitive and continuous

operations, it is useful to work

out

the

cost of each operation. Then

because every unit produced may be

assumed to have

involved

the

same amount of work, costs

for a period are charged to

processes or operations, and unit

costs

are

ascertained by dividing process

costs by the quantity of

output units produced This is

know n

as

process costing.

Series

of interconnected operations

Process

costing applies when standardised

goods are produced from a

series of interconnected

operations.

Process costing system is employed by industries

possessing following

characteristics:

1.

There is mass production of a

single product or two or

more products in successive

runs

of

scheduled duration e.g.,

vegetable canning or fruit juice

bottling.

2.

All units of output are

exactly similar and are produced by the

same manufacturing

process.

3.

Entire manufacturing process is divided

into departments or processes, each

performing a

specific

set of operations.

4.

Completed output of each department,

except the last one, is the

raw materials for the

next

department.

5.

Manufacturing operations may result in

production of joint products or by

products.

6.

Production is not in response to

customers' orders but in anticipation of

demand.

Examples

of industries using

Process Costing include:

Bottling,

Pharmaceuticals, Cement, Paint, Coal, Distilleries

Electricity, Ice, Soap,

Sugar, Canning,

Chemicals,

Cooking oil, Electric

appliances, Flour, Natural

gas, Petroleum Products, Rubber,

Steel,

Textile.

Under process costing, for

the purpose of cost control,

each department involved

in

manufacturing

process is regarded as a cost centre

and product costs are

accumulated separately

for

each department. Cost

Centre means a

division or segment for which an

individual is made responsible

.for

the incurrence of cost

Departmental

costs are passed through

department work in process accounts

and not through a

single

work in process control

account as in job costing. As all

units are produced from the

same

raw

materials and by same

manufacturing operations, therefore, it is

assumed that same cost

is

chargeable

to each unit. Instead of accumulating

cost of individual units, an

average unit cost is

computed

by dividing total cost by

total output of the period.

Cost is associated only

with

departments

and not with jobs. It

reduces clerical efforts for

accumulation and analysis of

cost. In

this

way process costing is less

expensive, as

compared with job

costing.

133

Cost

& Management Accounting

(MGT-402)

VU

The

Process Cost Sheet also

called Cost

of Production Report is the

basic document in process

costing.

This document is prepared

for each department and

shows the quantities processed,

total

and

unit cost, and cost of

work transferred out, and

still in process. .

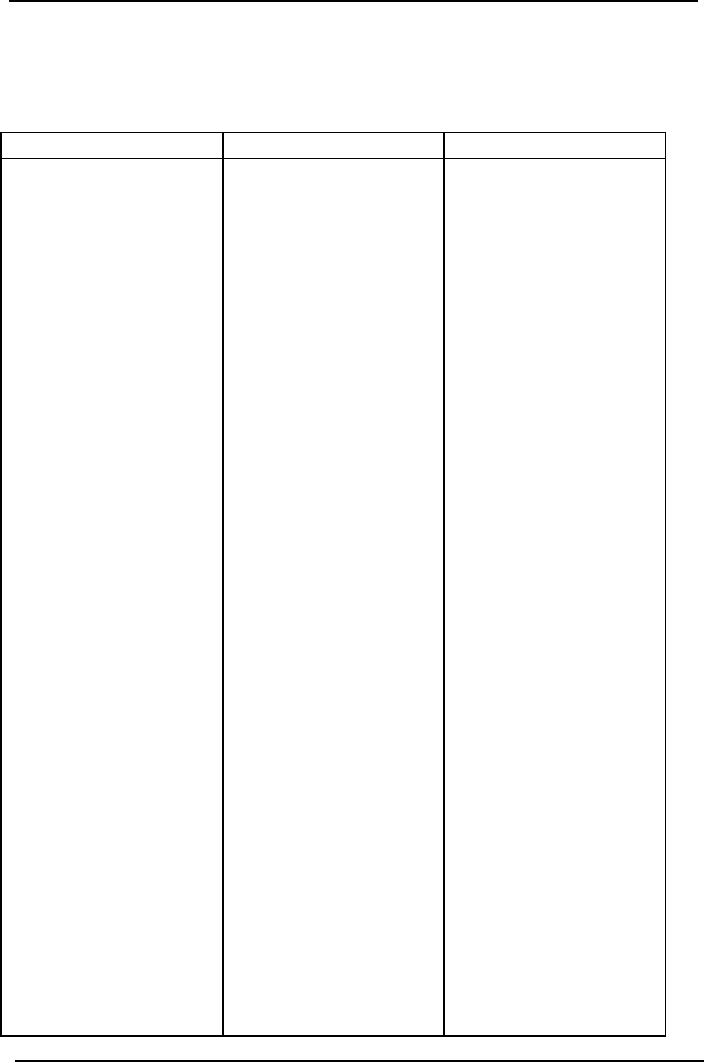

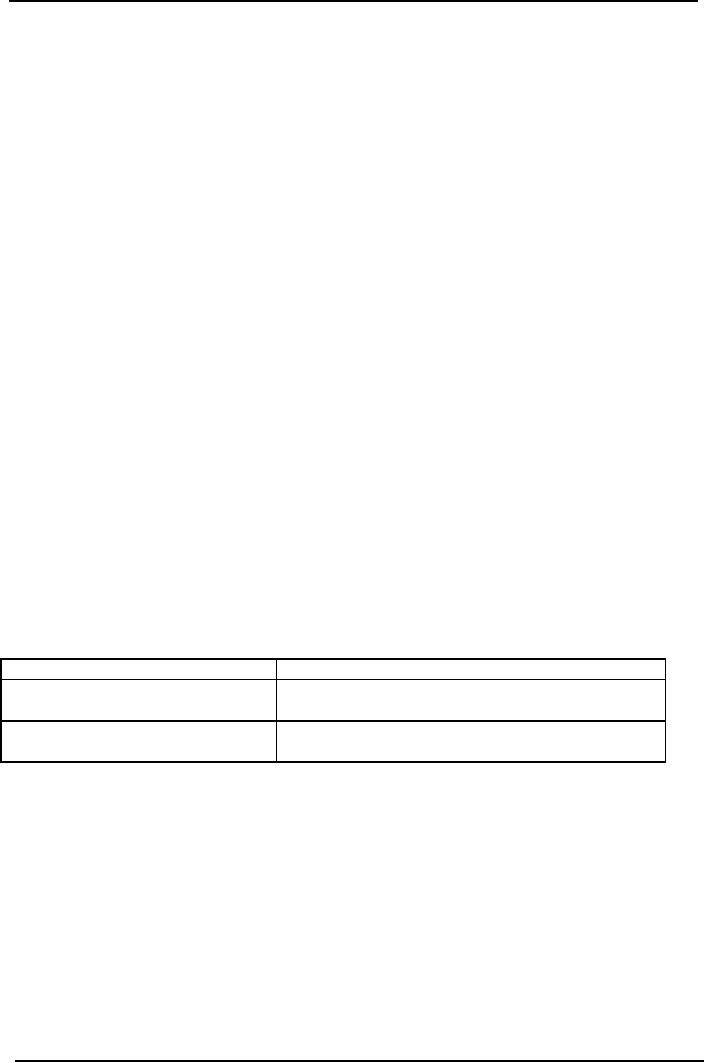

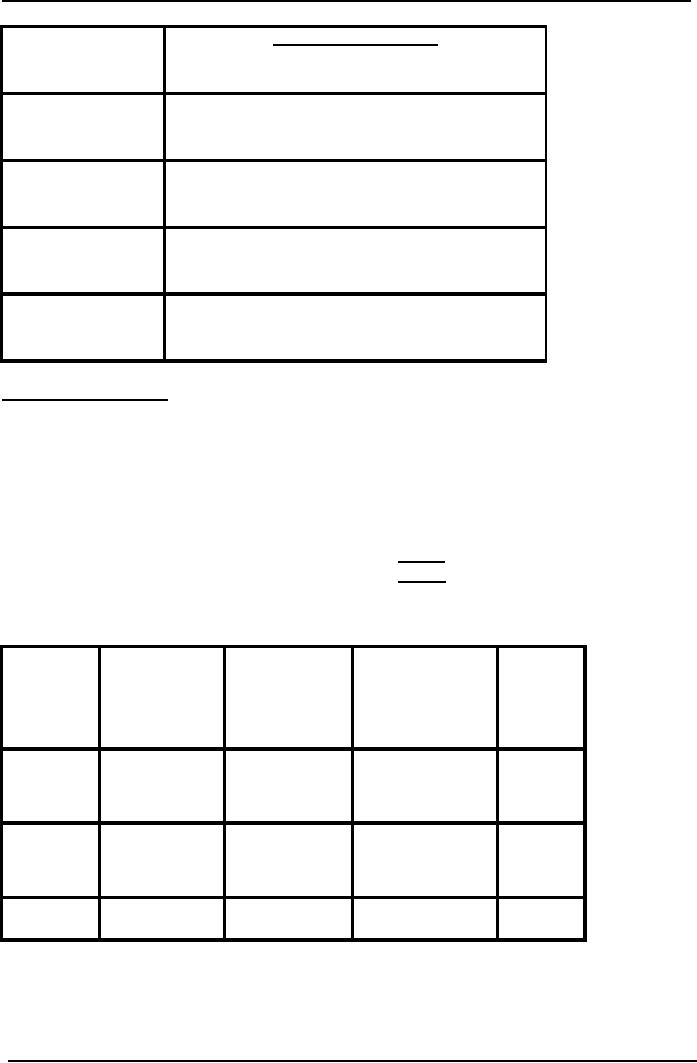

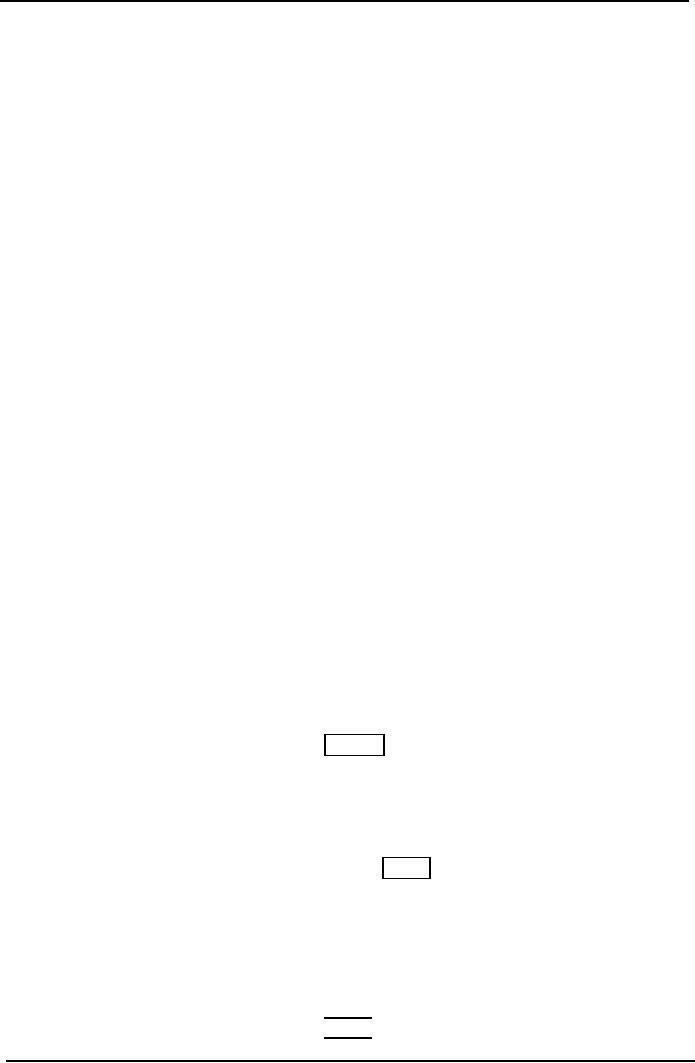

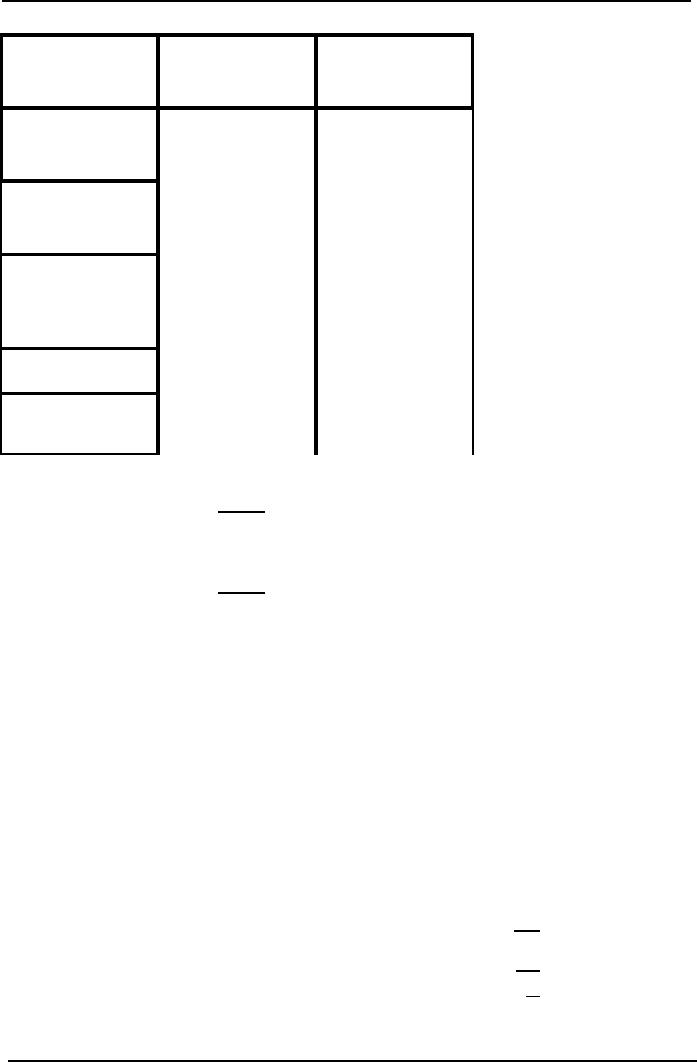

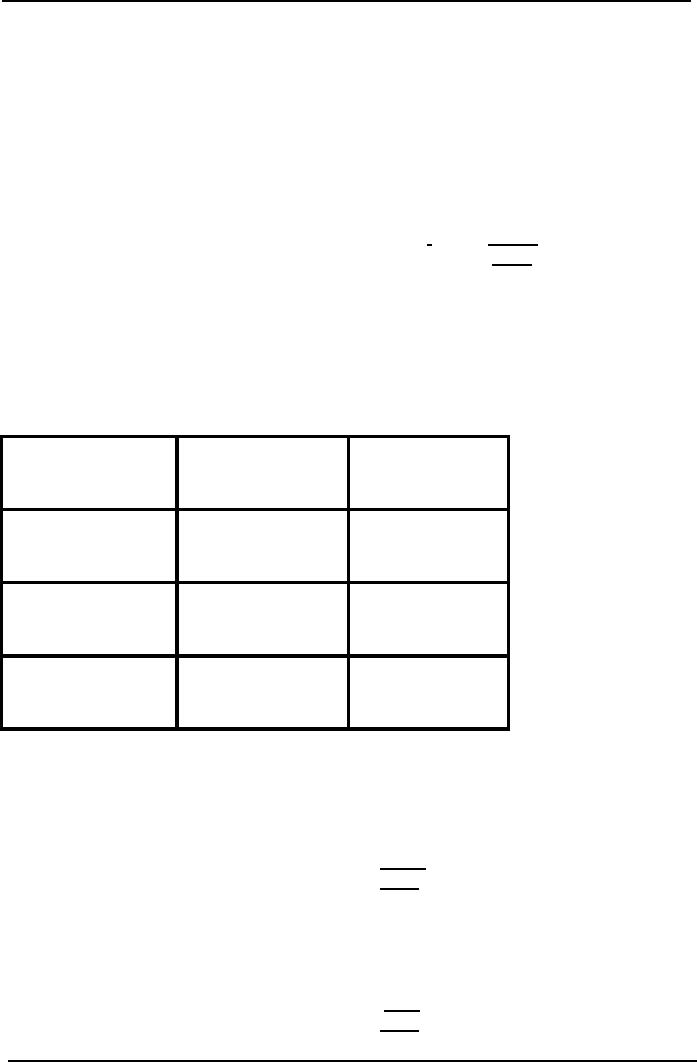

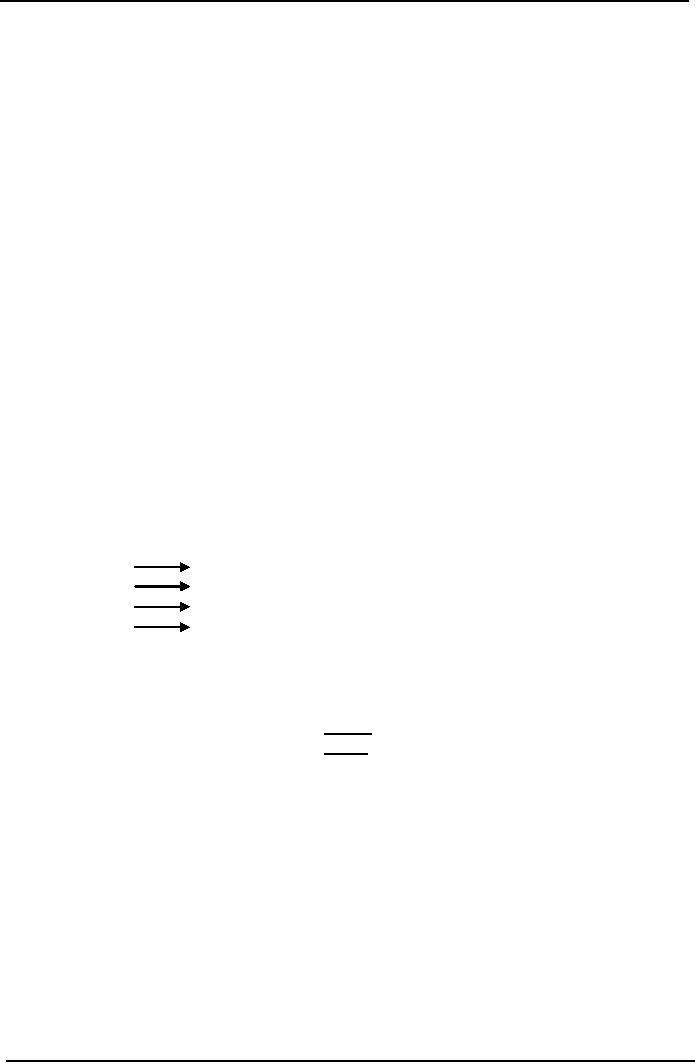

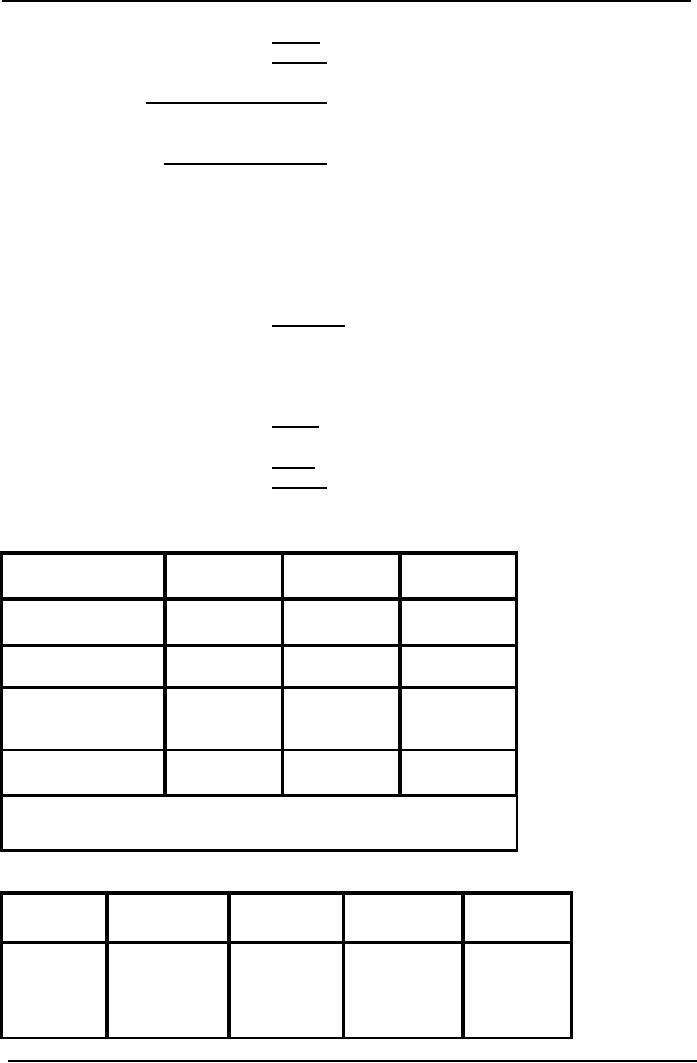

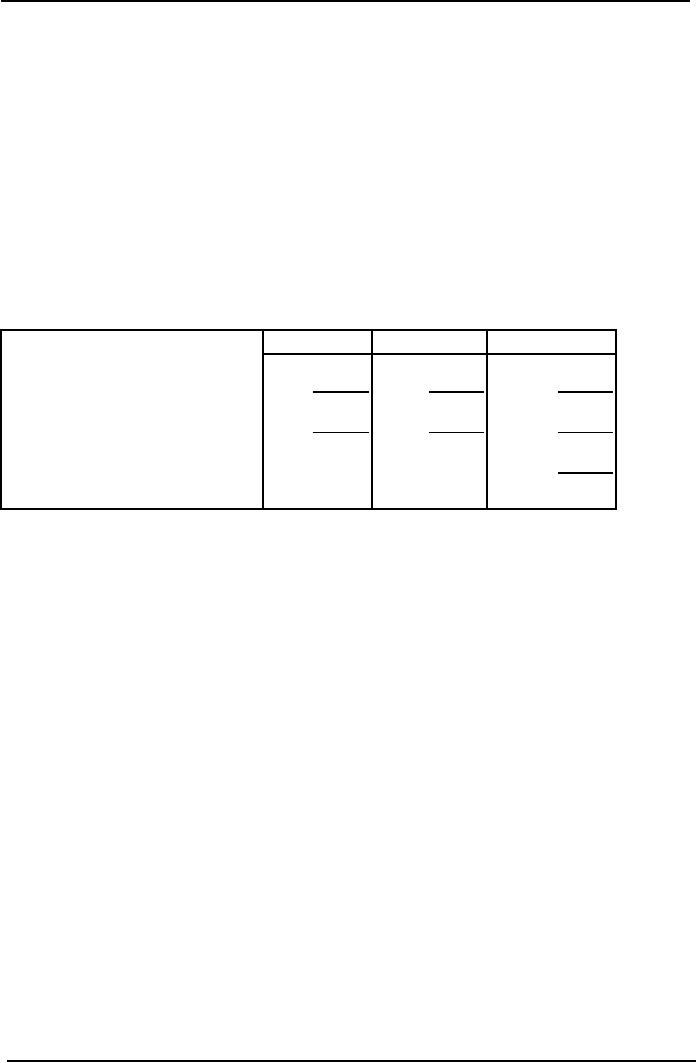

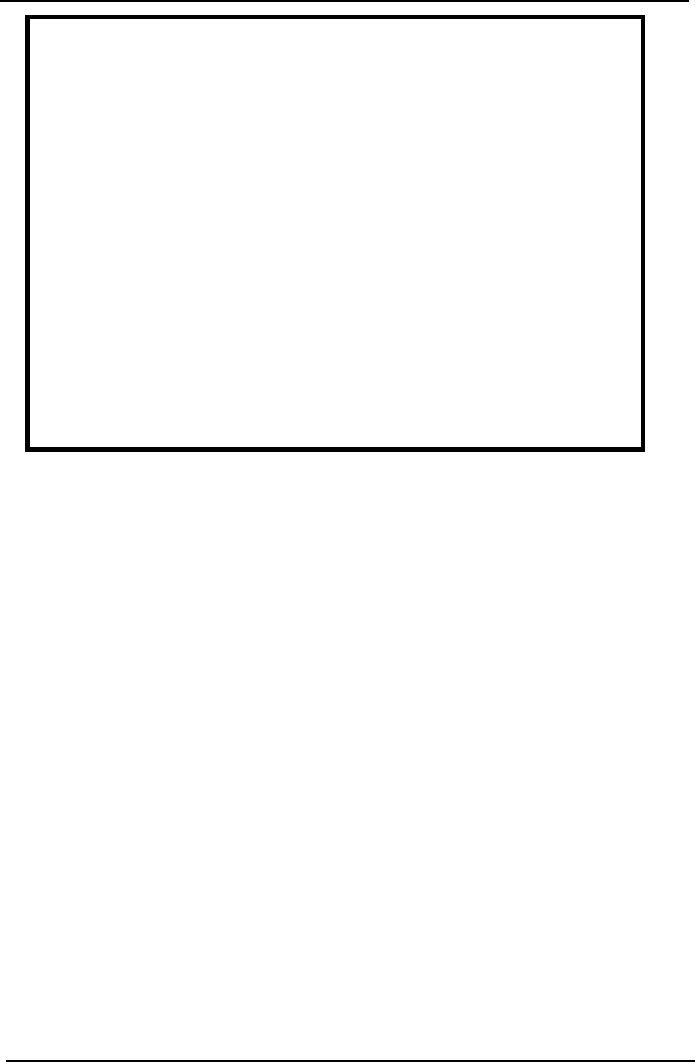

Following

table is meant to make the

difference between the two

costing systems more

clear.

Job

order costing system

Process

costing system

Where

different products

Application

Where

single standard

having

peculiar

product

is produced or

specifications

are produced

two

or more standard

against

customers' orders

products

are produced in

successive

runs.

Production

is for stock

and

in anticipation of

demand.

In

order to determine cost

Accumulation

of Cost

of

each job, costs

are

Costs

are associated

only

compiled

job wise. At the

same

time, to evaluate

with

departments

efficiency

of departmental

management

cost are also

compiled

department wise

Unit

cost is computed on

completion

of job. The job

may

itself be a single

cost

Cost

per unit

unit

e.g. a machine or it may

An

average unit cost is

be

a multi unit

computed

at the end of

costing

period by dividing

total

cost by units of

output

Only

one work in process

of

the period.

control

account is

maintained

A

separate work in process

control

account

is

More

clerical efforts are

Work

in process a/c

maintained

for

each

needed

to accumulate costs

producing

department

by

jobs and by departments,-

therefore,

the system is more

Cost

accumulation is simple

expensive

as

costs are accumulated

only

Cost

of operating the system

by

departments; therefore,

the

system is comparatively

less

expensive.

134

Cost

& Management Accounting

(MGT-402)

VU

Process

costing procedures

In

process costing industries standard

products are produced in accordance

with production

budget.

Therefore, it becomes unnecessary to

issue a production order.

Production Planning

and

Control

Department communicates production

targets to departmental heads by means of

written

letters.

Data of quantities produced by each department are

collected and compared with

budgeted

quantities

for control purposes. These

information are collected by departmental

supervisors or

quality

inspectors may recording these

data. Each producing department is a

cost centre because

for

the purpose of cost control

management is interested in ascertaining

departmental costs.

In

process costing, generally, a separate

work in process account is maintained

for each producing

department.

Data

Collection

Collection

of departmental cost figures of direct materials,

direct labor and factory

overhead is

based

on similar procedure as for, job order

costing. However, the source

documents used for

the

data

collection are comparatively simple.

These documents identify

costs only with

departments

and

not with jobs as

well.

Direct

Materials:

Production

people secure materials by

issuing properly authorised Materials

Requisitions. At the

end

of each month, these requisitions

are sorted and a Materials Requisition

Summary indicating

cost

of direct and indirect materials

issued to each department is

prepared. Monthly totals

of

direct

and indirect materials

issued are debited to departmental

work in process control

accounts

and

factory overhead control

account respectively and credited to

materials control

account.

Direct

Labor:

Instead

of using Job Time Tickets,

labor cost data are

accumulated on Clock Cards and

Daily

Time

Sheets. These documents show

labor time utilized by each

department and classification of

labor

cost as direct and indirect. At

the end of each month,

labor cost data accumulated on

these

source

documents are summarised in

Labor Cost Analysis Sheet indicating

direct and indirect

labor

cost for each department.

Monthly totals of direct labor

are debited to departmental work

in

process

accounts and indirect labor is

debited to factory overhead

control account.

Factory

Overhead:

Factory

overhead costs, other than

indirect materials and

indirect labor discussed earlier,

are

accumulated

in Voucher Register and in General

Journal by means of adjusting entries

for

depreciation,

expired insurance etc, Monthly

total, are debited to

factory overhead

control

account.

Factory

overhead is charged to production

through predetermined departmental factory

overhead

applied

rates. Some industries using process

costing charge actual factory

overhead to

departments.

This method gives satisfactory results if

production is stable from

month to month,

But

if there are fluctuations in

production volume, charge of

actual factory overhead

is

unsatisfactory

especially when considerable

portion of factory overhead is a

fixed cost,

Cost

of Completed Output:

Cost

of completed output of each production

department is calculated in Cost of

Production

Report.

Cost of units completed and

transferred out is credited to

work in process control

account

of

the respective department

and debited to work in

process control account of

the department

receiving

the units. Cost transferred

out by the last department

is, however, debited to

finished

goods

control account

135

Cost

& Management Accounting

(MGT-402)

VU

Cost

of Production Report

In

process costing Cost of Production

Report also called Process

Cost Sheet is the

key

document.

At the end of costing period, generally a

month, a Cost of Production

Report is

prepared.

It summarizes the data of

quantity produced and cost

incurred by each

producing

department.

It also serves as a source

document for passing

accounting entries at the

end of

costing

period.

Cost

of production report is divided into

five

sections.

Each section is meant to provide

specific

information.

A brief description of these sections is

presented below:

1.

Quantity

schedule.

2.

Cost

accumulated in the department/process.

3.

Calculation

of equivalent units produced.

4.

Calculation

of cost per unit.

5.

Accounting

treatment / apportionment of the accumulated

cost

Quantity

Schedule:

The

first section Quantity

Schedule contains input and

output data in terms of quantities.

The

information

is presented in the following

order.

(i)

Units

in process at the beginning of costing

period.

(ii)

Units

started in process or received

from preceding department

during the period.

(Total

of (i) and (ii) constitutes

total units to be accounted

for)

(iii)

Units

completed and transferred to next

department or to finished

goods.

(iv)

Units

completed but still in the

department.

(v)

Units

in process at the end of the

period and their degree of

completion.

(vi)

Units

lost in process during the

period indicating whether normal loss or

abnormal loss.

The

stage of completion at which

the loss occurs is also

specified.

(Total

of (iii) , (iv) , (v) and

(vi) is again the total

units to be accounted for)

The

quantity schedule assists

management to look at a glance

production performance of

departments

as well as it provides necessary data

for preparing remaining sections of the

report.

Cost

accumulated in the department/process.

The

second section Cost

Accumulated to Departments shows

total cost for which

the

departments

are accountable. Total costs

include cost of beginning work in

process inventory,

cost

transferred in from the

preceding department and

cost of direct materials, direct labor

and

factory

overhead added by the

department. If there is normal

loss of units, unit cost

received

from

preceding department requires

adjustment. This adjustment

for lost units is also

shown in

this

section. This section provides

data for debiting work in

process control accounts of

the

departments.

Calculation

of equivalent units produced.

In

order to arrive at cost per

unit of output, total of

each cost element is divided by the

number of

units

produced, For this purpose, where at the

end of costing period, there are

some partially

completed

units in process, these

units must be stated in terms of

equivalent completed units,

For

example,

if 4,000 units. are in

process at the end of month

estimated as 50% complete, these

will

be

equivalent to 2,000 completed units.

These equivalent units are

added to units completed by

the

department to arrive at equivalent

production. Then total cost

is divided by this equivalent

production

figure to calculate unit

cost.

136

Cost

& Management Accounting

(MGT-402)

VU

Calculation

of cost per unit

In

process costing, costs are

averaged over the units

produced. The costs accumulated to a

process

for

a period are collected and divided by the

number of units equally produced during

the period.

Accounting

treatment / apportionment of the

accumulated cost

The

last section presents a

summary to the explaining

the accounting treatments of the

costs

incurred

in the department. This includes

(i)

Adjustment

for lost units for

normal loss, if any.

(ii)

Cost

transferred out.

(iii)

Cost

of abnormal loss, if

any.

(iv)

Cost

of work in process ending inventory

and

(v)

Any

other accounting adjustment, if

necessary to present.

Cost

of production report is generally

presented to management with

supplementary reports of

usage

of materials, labor and

factory overhead.

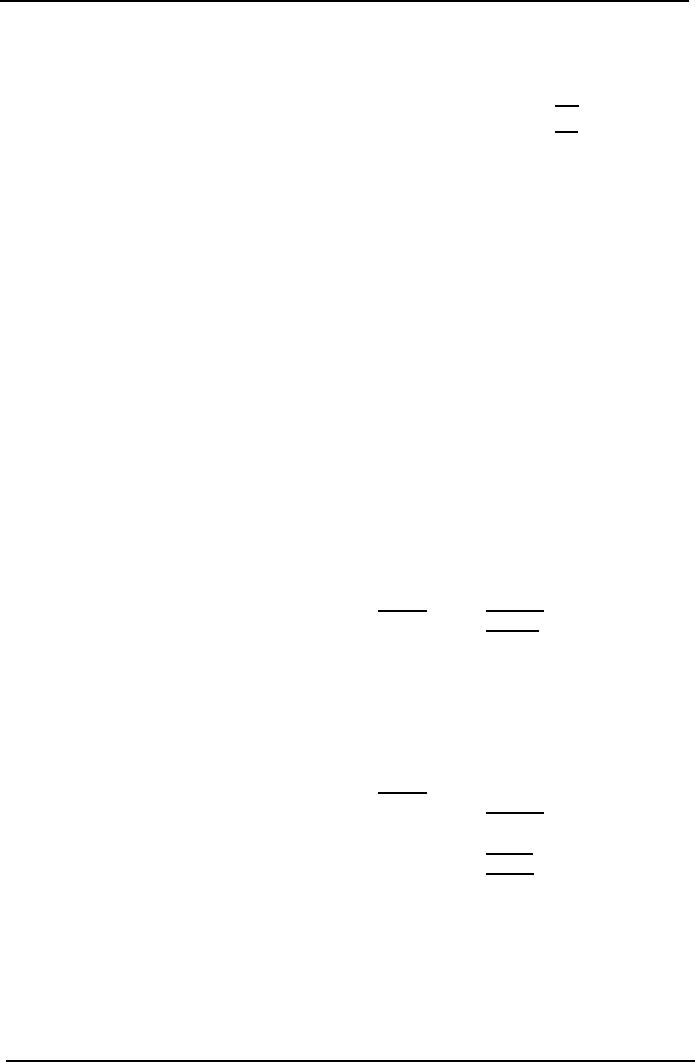

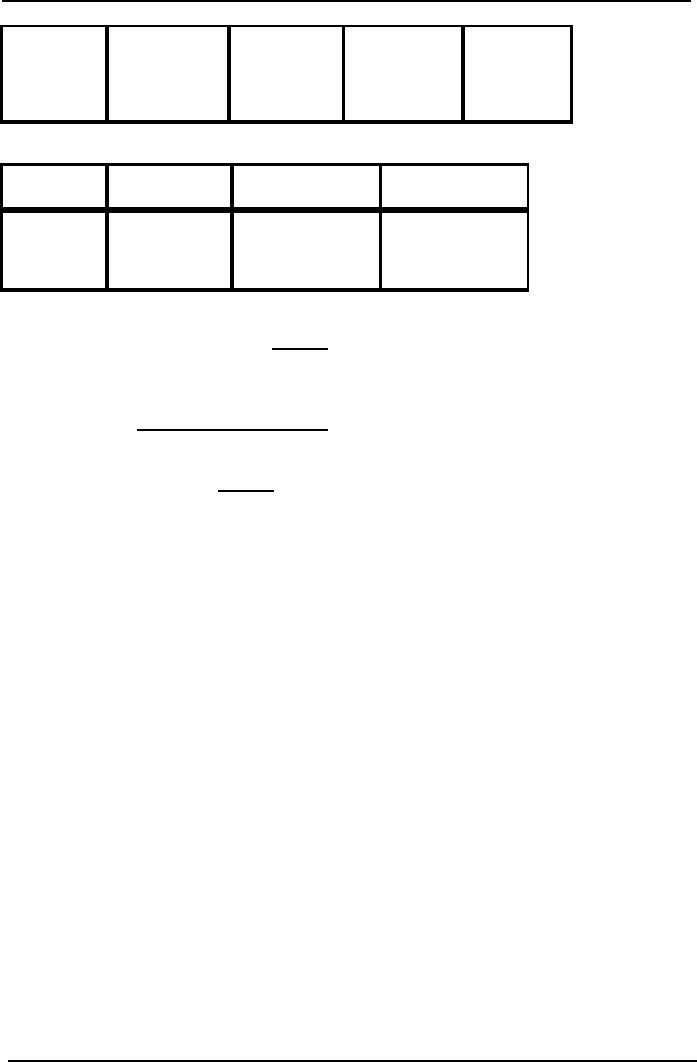

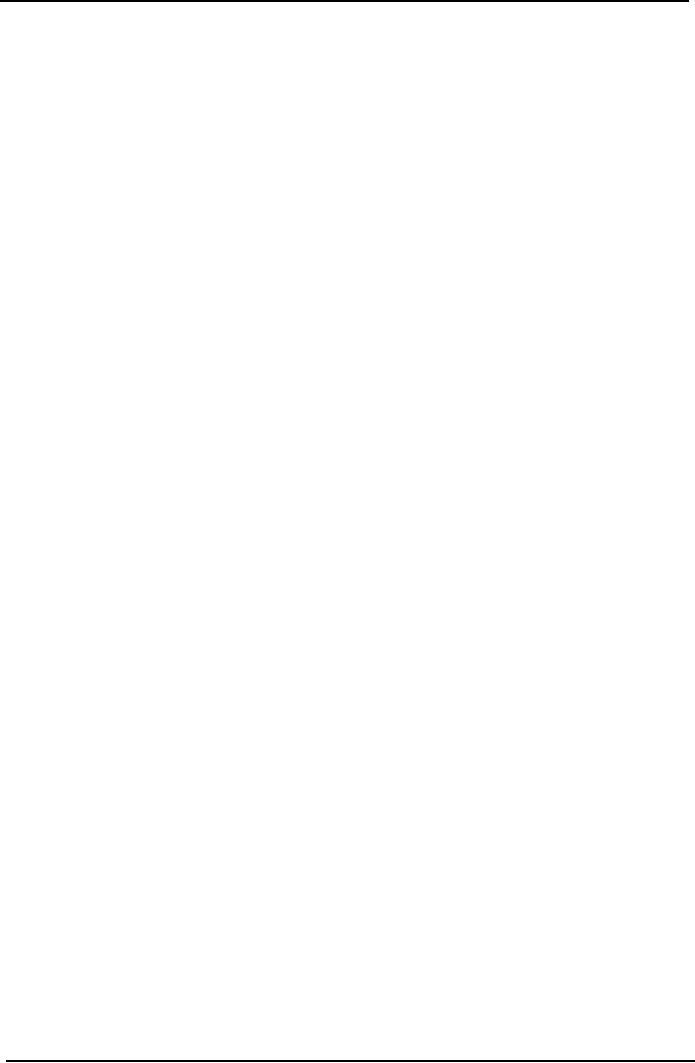

Standard

format of a simple

Cost

of Production Report

I-

Quantity Schedule:

Units

put into the

process

***

Units

completed in this process &

transferred

to

next department.

***

Units

not yet completed at the end

of the

Period.

***

***

II-

Cost Accumulated In The

Department / Process:

Direct

Material Cost

***

Direct

Labor

***

Factory

Overhead (Applied)

***

***

III-

Calculation of Equivalent Units

Produced

100%

of completed units + % completed of the in

process units

IV-

Calculation Of Per Unit

Cost

=

Total

Cost

.

Equivalent

Units Produced

V-

Accounting

Treatment

1-

Finished goods

2-

Closing Work in process

137

Cost

& Management Accounting

(MGT-402)

VU

Problem

Questions

Q.

1

Heera

Manufacturing Company manufactures a

product. Production made and

manufacturing

costs

incurred in the first

department during the month

of October .are given

below:

10,000

units were started in

process out of which 9,400

units were transferred to

next department

and

remaining 600 units were 1/2

complete as to materials, labor and

overhead. Direct

materials

Rs.

19,400, direct labor Rs.

24,250 and factory overhead

Rs. 14,550 was charged to

production.

Required: Cost

of production report for the

month.

Q.

2

Production

and cost data of first

production department of Excellent

Manufacturing Company

for

the

month of March 2006 are as

follow:

Units

started in process were

5,000. Units completed and

transferred to second department

were

4,500.

Remaining units were in process

estimated to be 50%, 40%,

60% completed as to materials,

labor

and factory overhead respectively.

Costs of materials, labor

and overhead were Rs.

50,000,

Rs.

60,000 and Rs. 40,000

respectively.

Required:

Cost

of production report.

138

Cost

& Management Accounting

(MGT-402)

VU

LESSON#

20, 21, & 22

PROCESS

COSTING SYSTEM

Practice

Question

Q.

1

Mini

Soap Manufacturing unit completed

and transferred out 600

soaps to department-11 at

the

end

of the week. In department-11

500 soaps completed and

transferred out. Units which

were

still

in process 100 (100% material,

Conversion cost 60%).

Rs.

Cost

received from preceding

department

540

Following

costs were incurred by

department-11:

Direct

Material

150

Direct

Labor

112

Factory

overhead

168

430

970

Required:

Prepare cost of production

report

Cost

of Production Report

Department-II

I-Quantity

Schedule:

Units

received previous

department

600

Unites

completed and transfer to

next

department

500

Units

still in process

100

600

II-Cost

Accumulated in the Department /

Process:

Cost

received from preceding

department

Rs.

540

Cost

added by department-11:

Direct

Material

150

Direct

Labor

112

Factory

overhead

168

430

970

III-Calculation

of Equivalent Units

Produced:

(100%

of completed units + % of units in

process)

Units

completed in department-I = 500 + 100 =

600

Direct

Material:

500+(100x100%)

=

600

Direct

Labor :

500+(100x60%)

=

560

F.O.H

:

500+(100x60%)

=

560

IV-

Unit Cost:

As

to Previous department:

Total

cost / Number of Equivalent

units produced = 540 / 600 =

0.90

As

to Direct Material:

150

/ 600 = 0.25

As

to Direct Labor:

112

/ 560 = 0.20

As

to F.O.H:

135

/ 900 = 0.15

1.65

V-

Apportionment of the Accumulated

Cost:

Cost

of units transferred to the

next department

No

of completed units x Total cost

per unit:

500

x

1.65

=

825

Units

in process:

Cost

of preceding department 100 x

0.9

=

90

Direct

Material

100

x 0.25

=

25

139

Cost

& Management Accounting

(MGT-402)

VU

Direct

Labor

60

x 0.20

=

12

F.O.H

60

x 0.30

=

18

145

970

Q.

2

Mini

Soap Manufacturing unit

started to incurring cost in

first department for 1000

soaps. At the

end

of the week 600 soaps

were completed, 300 still in

process and 100 units

lost. 100% of direct

material

had been incurred but

75% conversion cost was

yet incurred on the

incomplete work.

The

detail of costs incurred by

the department:

Rs.

Direct

material 500

Direct

labor

225

Factory

overhead

135

Required:

Prepare cost of production

report

Cost

Of Production Report

Department-I

I-Quantity

Schedule:

Units

started in process

1000

Units

completed in the department

600

Units

still in process

300

Units

Lost (Normal)

100

1,000

II-Cost

Accumulated in the Department /

Process:

Total

Rs

Direct

Material

500

Direct

Labor

225

F.O.H

135

860

III-Calculation

of Equivalent Units

Produced:

Direct

material 600+ (300x100%)

=

900

Direct

labor

600+

(300x75%)

=

825

F.O.H

600+

(300x75%)

=

825

IV-

Unit Cost:

Direct

material

500/900

=

0 .555

Direct

labor

225/825

=

0.27272

F.O.H

135/825

=

0.163636

0.992

V-

Apportionment of the Accumulated

Cost:

Cost

of units transferred to the

next department

600

x

0.992

595

Work

in process:

Direct

Material

300

x 0.5555 = 167

Direct

Labor

300

x 0.2727 = 61

F.O.H

300

x 0.16363 = 37

265

860

140

Cost

& Management Accounting

(MGT-402)

VU

Normal

Loss in First

Department.

Loss

of units during manufacturing

process is, in many industries, a

normal condition. This

loss

may

be due to unavoidable spoiled work or

wastage, evaporation or shrinkage etc. In

other words,

normal

loss represents the

lost units expected to arise even

under efficient operating

conditions.

Such

a loss is inherent in manufacturing

operations and cannot be avoided,

for this reason; cost

of

normal

loss is absorbed by the good

units produced. It has the

affect of increasing unit

cost of

good

output. Total cost of the

department is not divided by all

units processed, instead. It

is

divided

only by the good units

produced.

Practice

Question

During

the month of January 2006

direct materials worth Rs.

300,000 were issued to

produce

26,000

units of finished product.

Direct labor to process

these materials totaled Rs.

110,000 and

factory

overhead Rs. 55,000. During

the month processing of

20,000 units were completed

and

these

units were transferred to

next department, whereas, 1,000

units were lost during

processing

(the

loss is regarded as normal).

All of the direct materials

had been issued for

the units in process

at

the end of month, but

these units were only

40% converted. Cost of

Production Report for

the

month

'based on above inforn1ation is given

below:

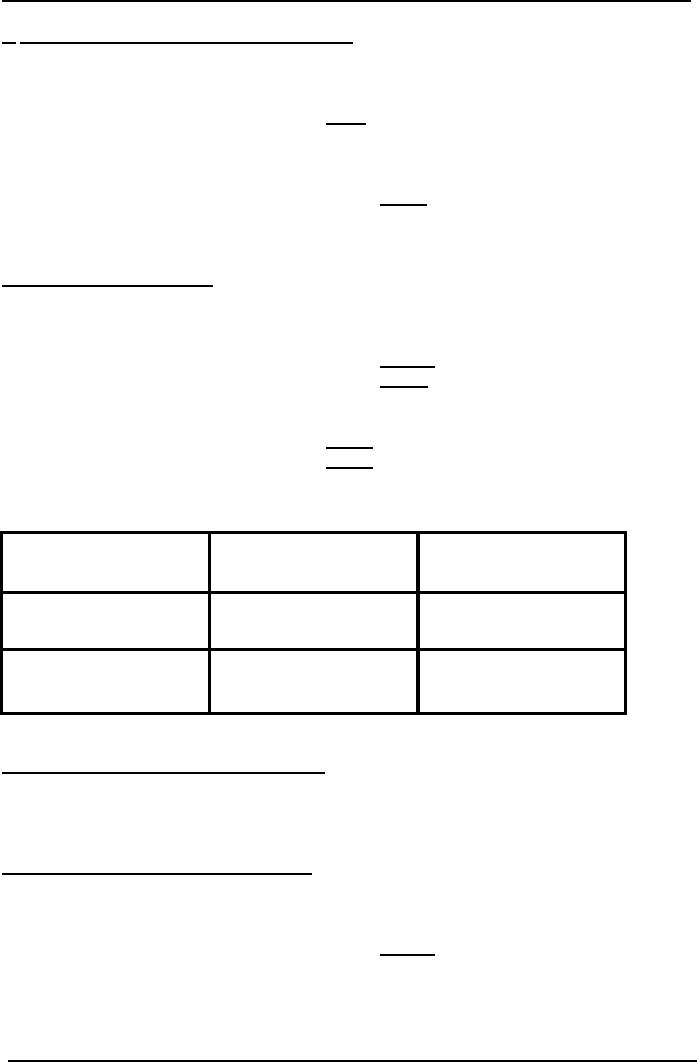

Ginza

Beauty products

Department

I

Cost

of Production Report

For

the Month of January,

2006.

Quantity

Schedule

Units

started in process

26,000

Units

transferred to next

department

20,000

Units

still in process

5,000

(100%

materials,

40% labor & FOH)

Units

lost in process

Normal

loss

1,000

26,000

Cost

accumulated to Department

Total

Units

Rs.

Rs.

Cost

added by the department:

Direct

materials

300,000

12

Direct

labor

110,000

5

Factory

overhead

55,000

2.50

Total

cost to be accounted for

465,000

19.50

Cost

Apportioned

Transferred

to next department

(20,000

units x Rs. 19.50)

Rs.

390,000

Rs.

Work

in process ending inventory:

Direct

materials (5000 units x Rs.

12.00)

60,000

141

Cost

& Management Accounting

(MGT-402)

VU

Direct

labor (5000 units x 40% x

Rs. 5.00)

10,000

FOH

(5000 units x 40% x Rs.

2.50)

5,000

75,000

465,000

Whenever,

normal loss occurs in the

first department, it requires no

separate calculation.

Number

of

units so lost is ignored while

computing equivalent production.

The result is a decrease

in

equivalent

production quantity (the

denominator) and an increase in

unit cost.

In

the above cost of production

report, equivalent production of

department I include

20,000

completed

units plus 5,000 units in

work in process ending inventory

adjusted for their stage

of

completion.

Normal

Loss in Departments Subsequent to the

First.

It

is stated earlier that cost

of normal loss is absorbed by

the good units produced and

this is done

by

omitting lost units from

equivalent production quantity.

Same procedure applies when

units are

lost

during processing in a department

subsequent to the

first.

However,

here an adjustment

in unit cost from preceding department

is

also necessary. In the above

report

total

cost of Rs. 390,000 received

from department I was for

20,000 units. Out of these

20,000

units,

500 units were lost.

Now total cost of Rs.

390,000 applies only to

19,500 remaining good

units.

This decrease

in

number of units will cause

an increase

in

unit cost from preceding

department.

In

department 2, after the lost

units have been taken into

account, unit cost from

department I

come

to Rs. 20.00 (i.e. Rs.

390,000 + 19,500 units).

This increase of Rs. 0.50

(i.e. Rs. 20.00 less

Rs.

19.50)

is called adjustment for

lost units.

The

adjustment for lost units

can be computed by anyone of the

following two methods. For

the

purpose

of explanation assume the

following:

Assembling

department received from

cutting department 32,000 units at a

total cost of

Rs.120,000

resulting in a unit cost of

Rs. 3.75. During processing

in assembling department

2,000

units

were lost. The lost

units are considered as

normal.

First

Method: Firstly

find unit cost received

from preceding department

after adjustment for

lost

units

and then deduct it from the

unit cost before adjustment;

the difference is adjustment

per unit.

Unit

cost after adjustment is

calculated by dividing total

cost from preceding

department by good

units

left after the

loss.

Computations

are illustrated as

follow:

Rs

Unit

cost after adjustment

Rs.

120,000/30,000 units

4.00

Unit

cost before adjustment

3.75

Adjustment

per unit

0.25

Second

Method: Find

total cost of lost units at

which they are received by

the department. This

total

cost is now to be absorbed by

the remaining good units.

How much cost is to be

absorbed by

each

good unit is computed by

dividing remaining good units

into total cost of lost

units. The

resulting

figure is adjustment per

good unit.

These

computations are explained as

follows:

Cost

of lost units accumulated upto

preceding department

2,000

units x Rs. 3.75

Rs.

7,500

Adjustment

per unit Rs. 7.500/30,000

units

Rs.

0.25

142

Cost

& Management Accounting

(MGT-402)

VU

Normal

Loss at the End of

Process:

Preceding

discussion of normal loss is

for a situation where units

are lost at the beginning

or

during

manufacturing process in the department.

In many industries, lost units

are identified by

quality

inspectors at the end of

manufacturing process when

all production costs have

been

incurred

by the department. In such cases cost of

units lost is charged to completed

units only and

no

portion of loss is absorbed by

Units in work in process ending

inventory

For

this purpose lost units

are included in equivalent

production and the

adjustment for lost

units

is

not required, cost of lost

units is included in cost of

units completed and transferred

out or still

in

the department. This treatment

increases unit cost of completed

units only.

Assuming

that in department 2 lost

units are discovered in

final inspection at the end of

process,

cost

of production report of the

department will be as

follow:

Ginza

Beauty products

Department

2

Cost

of Production Report

For

the Month of January

2006

Quantity

Schedule.

Units

received from preceding

department

20,000

Units

transferred to next

department

16,000

Units

still in process

(80%

direct labor & factory

overhead)

3,500

Units

lost in process

Normal

loss (at the end of

process)

500

20,000

Total

Unit

Cost

Charged to Department.

Rupees

Rupees

Cost

from preceding

department

390,000

19.50

Cost

added by department:

Direct

labor

36,284

1.88

Factory

overhead

72,568

3.76

Total

cost added by

department

108,852

5.64

Total

cost to be accounted for

498,852

25.14

Cost

Accounted for as Follow

Rupees

Rupees

Transferred

to next department

(16,000

units x Rs. 25.93)

414,810

Work

in process ending inventory

Cost

from preceding

department

(3,500

units x Rs. 19.50)

68,250

Direct

labor (3,500 units x 80% x

Rs 1.88)

5,264

FOH

(3.500 units x 80% x Rs.

3.76)

10,528

84,042

Total

cost accounted for

498,852

Equivalent

units produced

16,000

+ (3,500 x 80%) + 500 = 19,300

units

Cost

per unit

Direct

labors

36,284/19,300

units

1.88

Factory

overhead

72,568/19,300

units

3.76

Cost

transferred to next department

16000

units x Rs. 25.14

402,240

Add

cost of lost units

500

units x Rs. 25.14

12,570

143

Cost

& Management Accounting

(MGT-402)

VU

Total

cost

414,840

Unit

Cost of Units Transferred

out:

Rs.

414,840

=

25.9256

16,000

units

The

logic of charging cost of normal loss at

the end of process only to

completed units is that

these

units have goon through

quality inspection, whereas, units

still in process are yet to

pass the

inspection,

of-course, units till in

process include spoiled

units as well. Therefore,

units in work in

process

ending inventory shall be charged with

the cost of spoiled units,

.1cluded therein, only

after

these units will have

goon through quality inspection. In

many industries units

being

processed

in a department are checked at a

definite stage before the

end of process, say at 75%

or

90%

stage of completion. In this

case cost of normal loss is

charged only to those nits

which have

passed

through the stage at which

quality check is made. These

units may be still in

process or may

have

been completed and transferred

out.

Abnormal

Loss

Abnormal

loss is the loss of units

not expected to arise under

efficient operating conditions. It

is

not

inherent in the manufacturing

process; instead, it is on account of

some accident or

carelessness.

The reasons of abnormal loss

include defective materials or poor

workmanship,

machine

breakdown or some other contingency.

Abnormal loss represents inefficiencies

in the

manufacturing

process; therefore, it is improper to

treat it as a part of product cost of

good units.

Cost

of abnormal loss is treated as

separate

unfavorable item and is

shown as such in cost of

production

report. It is debited to factory

overhead control account or to a

separate expense

account

to be charged directly against

revenues of the period and is

credited to the departmental

work

in process control account. Being an

indicator to inefficiency, abnormal

loss requires

immediate

attention of management.

For

the purpose of computing unit

cost, units of abnormal loss

are, included in

equivalent

production

after adjustment for degree

of completion. Consequently unit cost

represents, cost per

unit

as if there were no

loss.

PRACTICE

QUESTION

Q.

3

Mini

Soap Manufacturing unit completed

and transferred out 600

soaps to department-11 at

the

end

of the week. In department-11

450 soaps completed and

transferred to finished goods.

Units

which

were still in process 100

and 50 units lost (Normal).

Units in process 100% with

the

reference

of material and 60% with

conversion cost.

Rs.

Cost

received from preceding

department

540

Following

costs were incurred by

department-II:

Direct

Material

150

Direct

Labor

112

Factory

overhead

168

430

970

Required:

Prepare cost of production

report

Solution:

Cost

of Production Report

Department-II

I-Quantity

Schedule:

Units

received previous

department

600

144

Cost

& Management Accounting

(MGT-402)

VU

Units

completed and transfer to

Finished

goods

450

Units

still in process

100

Units

lost (Normal)

50

600

II-Cost

Accumulated in the Department /

Process:

Rs.

Cost

received from preceding

department

540

Cost

added by department-11:

Direct

Material

150

Direct

Labor

112

Factory

overhead

168

430

970

III-Calculation

of Equivalent Units

Produced:

(100%

of completed units + % of units in

process)

Units

completed in department-I = 450 + 100 =

550

Direct

Material:

450+(100x100%)

=

550

Direct

Labor :

450+(100x60%)

=

510

F.O.H

:

450+(100x60%)

=

510

IV-

Unit Cost:

Previous

department = 540 / 550 =

0.98182

Direct

Material

150

/ 550 = 0.272727

Direct

Labor

112

/ 510 = 0.21961

F.O.H

135

/ 510 = 0.32941

1.80357

V-

Apportionment of the Accumulated

Cost :

Transferred

to finished goods

450

x

1.80357

812

Work

in process:

Cost

of preceding department

(100

x 0.98182)

98

Direct

Material

(100

x0.272727)

27

Direct

Labor

(60

x 0.21961)

13

F.O.H

(60

x 0.32941)

20

158

970

Transfer

to Finished Goods

Cost

of preceding department (450 x

0.98182)

442

Direct

Material

(450

x0.272727)

123

Direct

Labor

(450

x 0.21961)

99

F.O.H

(450

x 0.32941)

148

812

145

Cost

& Management Accounting

(MGT-402)

VU

Q.

4

Mini

Soap Manufactures Co.

started to incurring cost in

first department for 1000

soaps. At the

end

of the week 600 soaps

were completed and 300 still

in process . 100% of direct material

had

been

incurred. But 75% conversion

cost was yet incurred on

the incomplete work. Remaining

100

units

were abnormally lost (completed

100% material, 50% conversion

cost)

Following

in the detail of cost

incurred:

Direct

material Rs.

500

Direct

labor

225

Factory

Overhead

135

860

Required:

Prepare cost of production

report

Cost

Of Production Report

Department-I

III-Calculation

of Equivalent Units

Produced:

Direct

material:

600+(400x100%)+(100x100%)

= 1000

Direct

labor : 600+(300x75%)+(100x50%) =

875

F.O.H

:

600+(300x75%)+(100x50%)

= 875

IV-

Unit Cost:

Direct

material:

500/1,000

=

0 .50

Direct

labor :

225/875

=

0.25714

F.O.H

:

135/875

=

0.15428

0.91142

V-

Apportionment Of the Accumulated

Cost to Finished Goods:

Cost

of units transferred to the

next department

600

x

0.91142

=

547

Closing

W.I.P Inventory:

Direct

Material

300

x 0.50

=

150

Direct

Labor

300

x 75% x 0.25714

=

58

F.O.H

300

x 75% x 0.15428

=

34

242

Abnormal

Loss

Direct

Material = 100 x 0.5

=

50

Direct

Labor = 50 x 0.25714

=

13

FOH

=

50 x 0.15428

= 8

71

860

Problem

Question

Q.

1

Orient

Industries. Limited produces a

product that passes through

two departments. Production

data

for the first month of its

operations are as follow:

Department

A Department B

Production

Costs:

Rupees

Rupees

Direct

materials

140,000

28,000

Conversion

costs

200,000

70,000

Units

Units

Production

units:

Started

/ received in process

23,000

13,000

Transferred

out

18,000

13,000

Still

in process

2/3

complete

3,000

146

Cost

& Management Accounting

(MGT-402)

VU

1/5

complete

2,500

In

department B there is an abnormal

loss of 1,500 units when

1/3 complete.

Required:

Prepare

cost of production report

for the month

Q.

2

Delight

Food Products produces 'Squash

Cubes" by continuous processing.

During February 19 -'

producing

department XYZ

received

8,000 cubes from the

preceding department aI1d

after

processing,

transferred 5,500 cubes to

next department. During the

month there was normal

loss

of

400 cubes at the end of

process. 600 cubes, 75%

converted, were lost due to

negligence of a

worker.

There was no work in process

beginning inventory, the ending inventory

was estimated as

60%

converted. Following product

costs were charged to the

department during February:

Rs.

Cost

from preceding

department

16,400

Direct

materials

2,000

Direct

labor

3,625

Factory

overhead

5,075

Rs.

27,000

In

department XYZ

all

materials are added at the

start of process.

Required: Cost