|

SALARY AND ITS COMPUTATION EXERCISES 1 |

| << Investment in Shares |

| SALARY AND ITS COMPUTATION EXERCISES 2 >> |

Taxation

Management FIN 623

VU

MODULE

6

LESSON

6.26

SALARY

AND ITS COMPUTATION

Exercise

1

Compute

taxable income and tax thereon

from following information/

data in respect of Mr. A

an

employee

of XYZ Company for tax year

2007

Basic

salary from 1st Jan-06 to

31st Dec-06

Rs

30,000 per month

Solution

to Exercise 1

Tax

payer: Mr. A

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

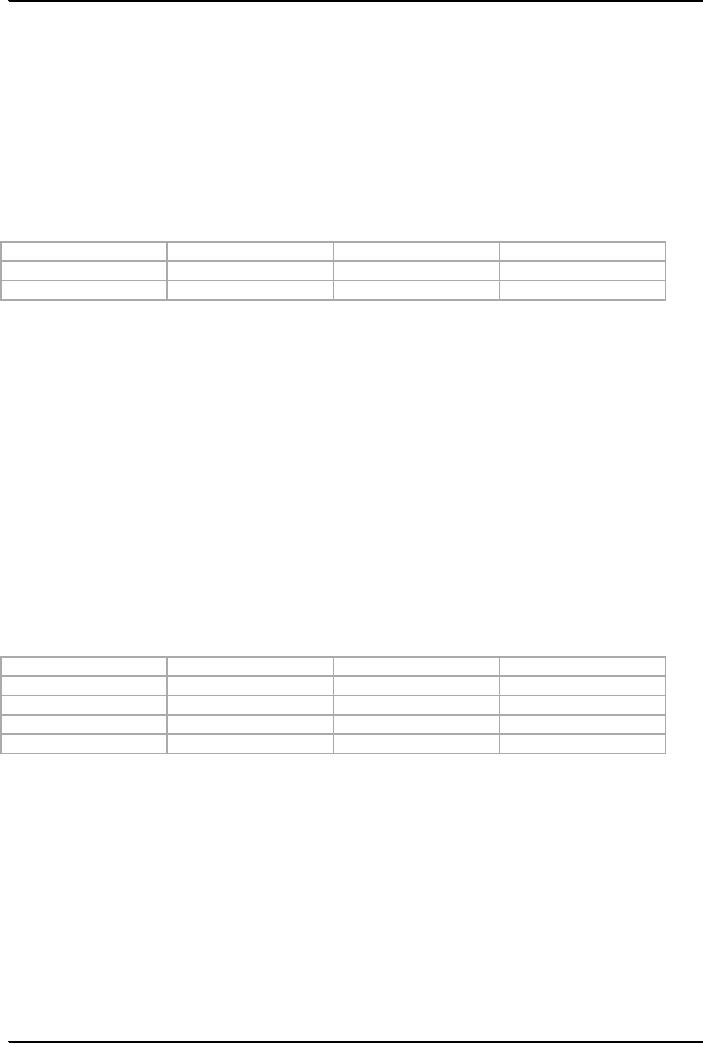

Computation

of taxable income and tax

thereon:

In

Rs

Particulars

Total

income

Exempt

Income

Taxable

Income

Basic

salary

180,000

Nil

180,000

Total

180,000

Tax

liability:

Tax

rate of 0.25 percent shall

apply as given at serial #2 for taxable

income exceeding Rs150,000 up to

Rs

200,000.

Income

tax payable =180,000x0.25%

= Rs

450

Note:

Income

received by Mr. A during

calendar year 2006 (that is

01-01-06 t0 31-12-2006) is Rs 360,000

but

during

tax year 2007, the income of

Mr. A is Rs 180,000 (since tax

year 2007 covers the period

from 01-07-

06 to

30-06-07)

Exercise

2

Compute

taxable income & tax thereon from

following information/ data

pertaining to tax year,2007 in

respect

of Mr. X an employee of a private

Company.

· Salary

Rs

40,000 per month

· Bonuses

Rs

80,000 for tax yr.

· Utilities

paid by employer

Rs

40,000 for tax yr.

Solution

to Exercise 2

Tax

payer: Mr. X

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

Computation

of taxable income and tax

thereon:

In

Rs

Particulars

Total

income

Exempt

Income

Taxable

Income

Basic

salary

480,000

Nil

480,000

Bonuses

80,000

Nil

80,000

Utilities

(Note 1)

40,000

Nil

40,000

Total

600,000

Tax

liability:

Tax

rate of 4.50% percent as given at

serial #8 for taxable income

exceeding Rs 500,000 up to Rs

600,000

Income

tax payable:

600,000

x 4.50% = Rs 27,000

Note

1:

Utilities

were exempt up to 10% of MTS or

Basic salary till 30th June, 2006, vide

clause 38 of part 1 of

Second

Schedule. This clause has

been omitted by Finance Act,

2006. Hence no exemption is

available for

tax

year 2007.

Exercise

3

Compute

taxable income from

following information/ data in

respect of Mr. Y an employee of a

private

Company

for tax year 2007.

· MTS of

Mr. Y

Rs20,000--2000--30,000

· Salary

Rs

24,000 per month

· House

allowance

Rs

2000 per month

Solution

to Exercise 3:

41

Taxation

Management FIN 623

VU

Tax

payer: Mr. Y

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

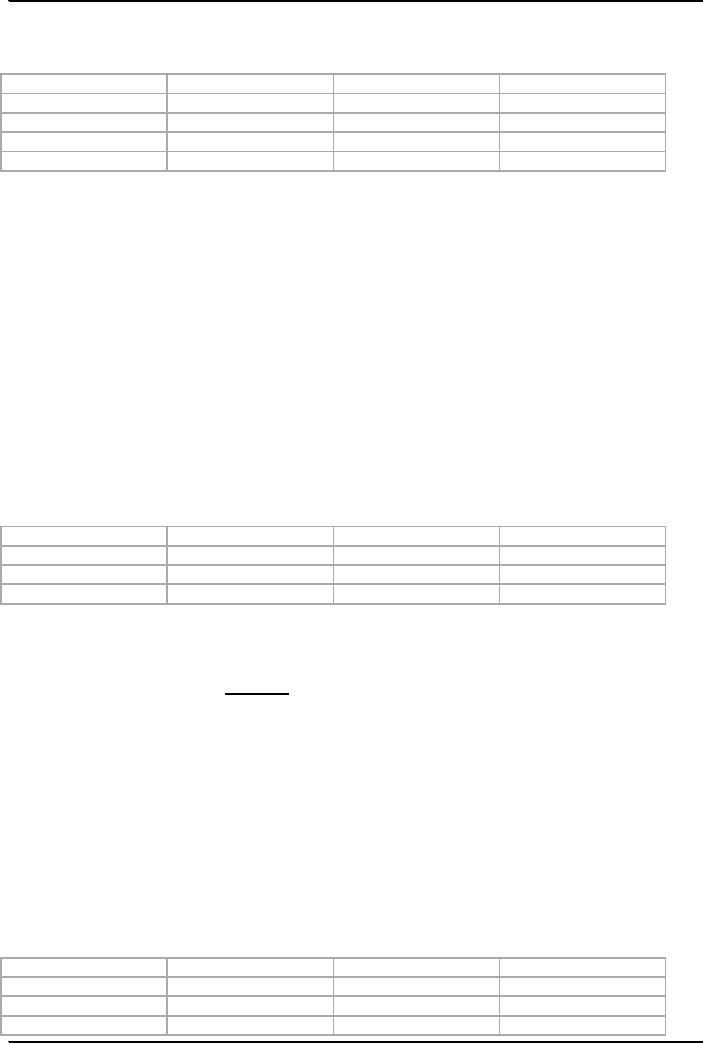

Computation

of taxable income and tax

thereon:

In

Rs

Particulars

Total

income

Exempt

Income

Taxable

Income

Basic

salary

288,000

Nil

288,000

House

Allowance

24,000

Nil

24,000

Utilities

(Note 1)

36,000

Nil

36,000

Total

348,000

Tax

liability:

Tax

rate of 1.50% percent as given at

serial #5 for taxable income

exceeding Rs 300,000 up to Rs

350,000

Income

tax payable:

348,000

x 1.50%= Rs 5,220

Note

1:

Utilities

were exempt up to 10% of MTS or

Basic salary till 30th June, 2006, vide

clause 38 of part 1 of

Second

Schedule. This clause has

been omitted by Finance Act,

2006. Hence no exemption is

available for

tax

year 2007.

Exercise

4:

Compute

taxable income from

following information/ data in

respect of Mr. A an employee of

XYZ

Company

for tax year 2006

· MTS of

Mr. A

Rs

30,000--5000--50,000

· Basic

salary

Rs

40,000 per month

· House

Allowance

Rs120,000

p.a

· Tax

Deducted at Source

Rs

6,000

Solution

to Exercise 4:

Tax

payer: Mr. A

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

Computation

of taxable income and tax

thereon:

Particulars

Total

income

Exempt

Income

Taxable

Income

Salary

480,000

Nil

480,000

House

Allowance

120,000

Nil

120,000

Total

480,000

Tax

liability:

Tax

rate of 4.50% percent as given at

serial #8 for taxable income

exceeding Rs 500,000 up to Rs

600,000

Income

tax payable:

600,000

x 4.50% =

Rs

27,000

Tax

deducted at source

Rs

6,000

Tax

payable: 27,000-6000 =

Rs

21,000

Exercise

5:

Compute

taxable income and tax thereon in

respect of Mr. Yasir (a salaried

individual) for the tax year

2007

from

the following information/

data:

Basic

salary

Rs

20,000 pm

House

rent allowance

Rs

5,000 pm

Medical

Allowance

Rs

5,100 pm

Free

hospitalization services availed under

terms of employment.

Rs

40,000 pm

Driver's

salary paid by employer

Rs

8,000 pm

Dearness

Allowance

Rs

6,000 pm

Solution

to Exercise 5:

Tax

payer: Mr. Yasir

Tax

year: 2007

Residential

Status: Resident

NTN:

000111

Computation

of taxable income and tax

thereon:

In

Rs

Particulars

Total

income

Exempt

Income

Taxable

Income

Salary

240,000

Nil

240,000

House

Allowance

60,000

Nil

60,000

Medical

allowance

61,200

Nil

61,200

(N-1)

42

Taxation

Management FIN 623

VU

Hospitalization

40,000

40,000

Nil

Driver's

Salary

96,000

Nil

96,000

Dearness

Allowance

72,000

Nil

72,000

Total

529,200

Tax

liability:

Tax

rate of 4.50% percent as given at

serial #8 for taxable income

exceeding Rs 500,000 up to Rs

600,000

Income

tax payable:

529,000

x 4.50%= Rs 23,814

Note:

Clause

139(a) & (b) of part 1 of second

schedule:

Free

hospitalization services provided under the

terms of employment are

exempt.

If (a)

not available then 10% of

basic salary is exempt in

case medical allowance

provided.

43

Table of Contents:

- AN OVERVIEW OF TAXATION

- What is Fiscal Policy, Canons of Taxation

- Type of Taxes, Taxation Management

- BASIC FEATURES OF INCOME TAX

- STATUTORY DEFINITIONS

- IMPORTANT DEFINITIONS

- DETERMINATION OF LEGAL STATUS OF A PERSON

- HEADS OF INCOME

- Rules to Prevent Double Derivation of Income and Double Deductions

- Agricultural Income

- Computation of Income, partly Agricultural,

- Foreign Government Officials

- Exemptions and Tax Concessions

- RESIDENTIAL STATUS & TAXATION 1

- RESIDENTIAL STATUS & TAXATION 2

- Important Points Regarding Income

- Geographical Source of Income

- Taxation of Foreign-Source Income of Residents

- Exercises on Determination of Income 1

- Exercises on Determination of Income 2

- SALARY AND ITS COMPUTATION

- Definition of Salary

- Significant points regarding Salary

- Tax credits on Charitable Donations

- Investment in Shares

- SALARY AND ITS COMPUTATION EXERCISES 1

- SALARY AND ITS COMPUTATION EXERCISES 2

- SALARY AND ITS COMPUTATION EXERCISES 3

- Tax treatment of Gratuity

- Gratuity Exercise

- PROVIDENT FUND

- Exemptions on Business income, Treatment of Speculation Business

- Deductions Allowed & Not Allowed

- Deductions: Special Provisions, Depreciation

- Methods of Accounting

- Taxation of Resident Company

- Taxation of Companies: Exercises

- Computation of Capital Gain

- Disposals Not Chargeable To Tax

- TAX RETURNS & ASSESSMENT OF INCOME UNIVERSAL SELF ASSESSMENT SCHEME

- Normal Assessment, USAS, Provisional Assessment, Best Judgment Assessment

- ADVANCE TAX COLLECTION & RECOVERY OF TAX PENALTIES & PROSECUTION

- What is Value Added Tax (VAT)?

- SALES TAX

- SALES TAX RETURNS