|

PROCESS COSTING SYSTEM:Normal Loss at the End of Process |

| << PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule |

| PROCESS COSTING SYSTEM:PRACTICE QUESTION >> |

Cost

& Management Accounting

(MGT-402)

VU

Normal

Loss at the End of

Process:

Preceding

discussion of normal loss is

for a situation where units

are lost at the beginning

or

during

manufacturing process in the department.

In many industries, lost units

are identified by

quality

inspectors at the end of

manufacturing process when

all production costs have

been

incurred

by the department. In such cases cost of

units lost is charged to completed

units only and

no

portion of loss is absorbed by

Units in work in process ending

inventory

For

this purpose lost units

are included in equivalent

production and the

adjustment for lost

units

is

not required, cost of lost

units is included in cost of

units completed and transferred

out or still

in

the department. This treatment

increases unit cost of completed

units only.

Assuming

that in department 2 lost

units are discovered in

final inspection at the end of

process,

cost

of production report of the

department will be as

follow:

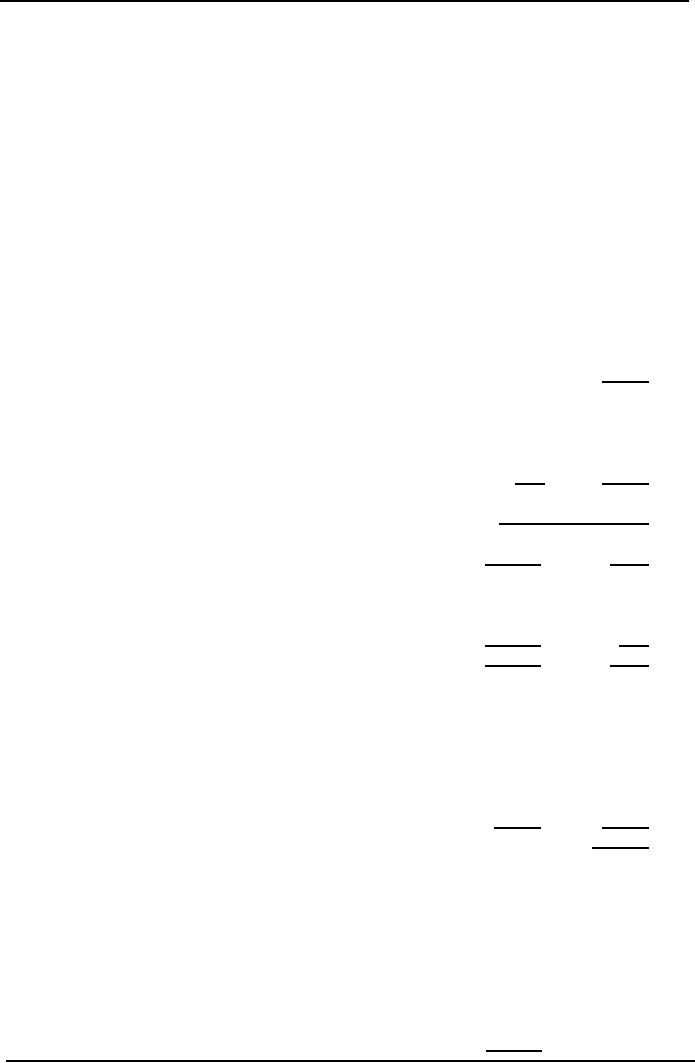

Ginza

Beauty products

Department

2

Cost

of Production Report

For

the Month of January

2006

Quantity

Schedule.

Units

received from preceding

department

20,000

Units

transferred to next

department

16,000

Units

still in process

(80%

direct labor & factory

overhead)

3,500

Units

lost in process

Normal

loss (at the end of

process)

500

20,000

Total

Unit

Cost

Charged to Department.

Rupees

Rupees

Cost

from preceding

department

390,000

19.50

Cost

added by department:

Direct

labor

36,284

1.88

Factory

overhead

72,568

3.76

Total

cost added by

department

108,852

5.64

Total

cost to be accounted for

498,852

25.14

Cost

Accounted for as Follow

Rupees

Rupees

Transferred

to next department

(16,000

units x Rs. 25.93)

414,810

Work

in process ending inventory

Cost

from preceding

department

(3,500

units x Rs. 19.50)

68,250

Direct

labor (3,500 units x 80% x

Rs 1.88)

5,264

FOH

(3.500 units x 80% x Rs.

3.76)

10,528

84,042

Total

cost accounted for

498,852

Equivalent

units produced

16,000

+ (3,500 x 80%) + 500 = 19,300

units

Cost

per unit

Direct

labors

36,284/19,300

units

1.88

Factory

overhead

72,568/19,300

units

3.76

Cost

transferred to next department

16000

units x Rs. 25.14

402,240

Add

cost of lost units

500

units x Rs. 25.14

12,570

143

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS