|

Corporate

Finance FIN 622

VU

Lesson

16

PORTFOLIO

& DIVERSIFICATION

The

following topics will be

discussed in this lecture.

Portfolio

and Diversification

Portfolio

and Variance

Risk

Systematic &

Unsystematic

Beta

Measure of systematic risk

Aggressive

& defensive stocks

Modern

Portfolio Theory (MPT)

proposes how rational

investors will use

diversification to optimize

their

portfolios,

and how an asset should be priced given

its risk relative to the market as a whole.

The basic

concepts

of the theory are Mark with

diversification, the efficient frontier,

capital asset pricing model

and

beta

coefficient, the Capital Market Line and

the Securities Market

Line.

MPT

models the return of an asset as a random

variable and a portfolio as a weighted

combination of

assets;

the return of a portfolio is thus

also a random variable and consequently

has an expected value and

a

variance.

Risk in this model is identified with the

standard deviation of portfolio

return. Rationality is

modeled

by supposing that an investor choosing

between several portfolios

with identical expected

returns

will

prefer that portfolio which

minimizes risk.

Risk

and Reward

The

model assumes that investors

are risk averse. This means

that given two assets that

offer the same

return,

investors will prefer the less risky

one. Thus, an investor will

take on increased risk only

if

compensated

by higher expected returns. Conversely,

an investor who wants higher returns

must accept

more

risk. The exact trade-off

will differ by investor. The

implication is that a rational investor

will not

invest in a

portfolio if a second portfolio

exists with a more favorable

risk-return profile - i.e. if

for that level

of risk an

alternative portfolio exists which

has better expected

returns.

Mean

and Variance

It is

further assumed that

investor's risk / reward preference

can be described via a quadratic

utility

function.

The effect of this assumption is that

only the expected return and

the volatility (i.e. mean

return

and

standard deviation) matter to the

investor. The investor is indifferent to

other characteristics of the

distribution

of returns, such as its

skew. Note that the theory

uses a historical parameter, volatility,

as a

proxy

for risk while return is an expectation

on the future.

Under

the model:

· Portfolio

return is the component-weighted return (the

mean) of the constituent assets.

Return

changes

linearly with component weightings,

wi.

· Portfolio

volatility is a function of the

correlation of the component assets. The

change in volatility

is

non-linear as the weighting of the component

assets changes.

Diversification

An investor

can reduce portfolio risk simply by

holding instruments which

are not perfectly correlated.

In

other

words, investors can reduce

their exposure to individual

asset risk by holding a diversified

portfolio of

assets.

Diversification will allow

for the same portfolio

return with reduced risk.

For diversification to

work

the component

assets must not be perfectly

correlated, i.e. correlation

coefficient not equal to

1.

Capital

Allocation Line

The

Capital

Allocation Line (CAL) is the

line that connects all

portfolios that can be

formed using a risky

asset

and a risk-less asset. It

can be proven that it is a straight

line and that it has the

following equation.

In this

formula P is the risky portfolio, F is the

risk-less portfolio and C is a

combination of portfolios P

and

F.

The

Efficient Frontier

Every

possible asset combination

can be plotted in risk-return

space, and the collection of

all such possible

portfolios

defines a region in this space. The

line along the upper edge of this region is

known as the

efficient

frontier (sometimes "the

Mark witz"). Combinations along this line

represent portfolios for

which

there

is lowest risk for a given level of

return. Conversely, for a given amount of

risk, the portfolio lying

on

the

efficient frontier represents the

combination offering the best

possible return. Mathematically

the

50

Corporate

Finance FIN 622

VU

Efficient

Frontier is the intersection

of the Set of Portfolios with

Minimum Variance and the Set

of

Portfolios

with Maximum Return.

The

efficient frontier will be

concave this is because the

risk-return characteristics of a

portfolio change in

a

non-linear fashion as its component

weightings are changed. (As

described above, portfolio risk is

a

function

of the correlation of the component assets,

and thus changes in a

non-linear fashion as the

weighting of

component assets changes.)

The

region above the frontier is unachievable

by holding risky assets alone. No

portfolios can be

constructed

corresponding to the points in this region. Points

below the frontier are suboptimal. A

rational

investor

will hold a portfolio only

on the frontier.

The Risk-Free

Asset

The

risk-free asset is the (hypothetical) asset

which pays a risk-free rate - it is

usually provied by an

investment in

short-dated Government bonds. The

risk-free asset has zero

variance in returns (hence

is

risk-free); it is

also uncorrelated with any

other asset (by definition:

since its variance is zero).

As a result,

when

it is combined with any other

asset, or portfolio of assets, the

change in return and also in

risk is

linear.

Because

both risk and return change

linearly as the risk-free asset is

introduced into a portfolio,

this

combination

will plot a straight line in risk

return space. The line

starts at 100% in cash and weight of

the

risky

portfolio = 0 (i.e. intercepting the

return axis at the risk-free rate)

and goes through the

portfolio in

question

where cash holding = 0 and

portfolio weight = 1.

Portfolio

Leverage

An investor

can add leverage to the

portfolio by holding the risk-free asset.

The addition of the risk-free

asset

allows for a position in the region

above the efficient frontier.

Thus, by combining a risk-free

asset

with

risky assets, it is possible to construct

portfolios whose risk-return

profiles are superior to those on

the

efficient

frontier.

· An investor

holding a portfolio of risky assets,

with a holding in cash, has

a positive risk-free

weighting

(a de-leveraged portfolio). The

return and standard

deviation will be lower than

the

portfolio

alone, but since the

efficient frontier is convex, this

combination will sit above

the

efficient

frontier i.e. offering a higher

return for the same risk as the

point below it on the

frontier.

· The

investor who borrows money to fund

his/her purchase of the risky assets

has a negative risk-

free

weighting -i.e. a leveraged

portfolio. Here the return is

geared to the risky portfolio.

This

combination

will again offer a return

superior to those on the frontier.

The

Market Portfolio

The

efficient frontier is a collection of

portfolios, each one optimal

for a given amount of risk. A

quantity

known

as the Sharp ratio represents a

measure of the amount of additional

return (above the risk-free

rate)

a

portfolio provides compared to the risk it

carries. The portfolio on the

efficient frontier with the

highest

Sharpe

Ratio is known as the market portfolio,

or sometimes the super-efficient portfolio. This

portfolio

has

the property that any

combination of it and the risk-free asset

will produce a return that

is above the

efficient

frontier - offering a larger

return for a given amount of risk than a

portfolio of risky assets on the

frontier

would.

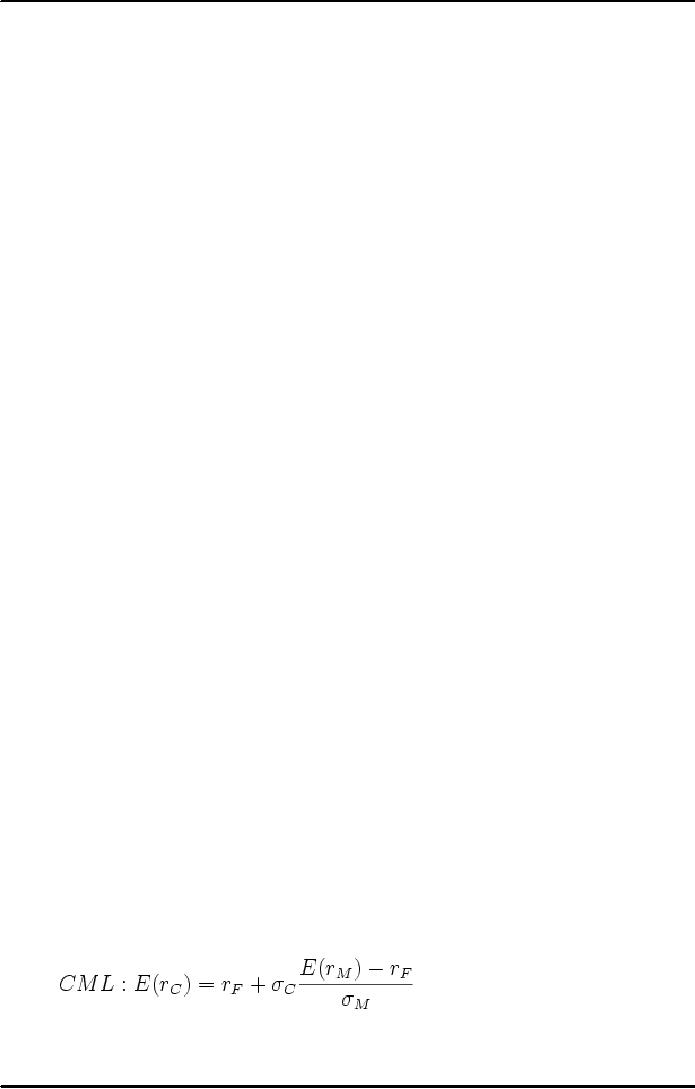

Capital

Market Line

When

the market portfolio is combined with the

risk-free asset, the result is the Capital

Market Line. All

points

along the CML have superior risk-return

profiles to any portfolio on the

efficient frontier. (A

position

with zero cash weighting is

on the efficient frontier - the market

portfolio.)

The

CML is illustrated above, with

return μp on the y

axis, and risk σp on the x

axis.

One

can prove that the CML is

the optimal CAL and that

its equation is:

Asset

Pricing

A

rational investor would not invest in an

asset which does not

improve the risk-return characteristics

of his

existing

portfolio. Since a rational investor

would hold the market

portfolio, the asset in question will

be

added

to the market portfolio. MPT

derives the required return for a

correctly priced asset in this context.

51

Corporate

Finance FIN 622

VU

Systematic

Risk and Specific

Risk

Specific

risk is the risk associated with

individual assets - within a

portfolio these risks can be

reduced

through

diversification (specific risks

"cancel out"). Systematic risk, or

market risk, refers to the risk

common to

all securities - except for

selling short as noted below, systematic

risk cannot be diversified away

(within

one market). Within the

market portfolio, asset

specific risk will be diversified

away to the extent

possible.

Systematic risk is therefore equated with

the risk (standard deviation) of the

market portfolio.

Since

a security will be purchased

only if it improves the risk / return

characteristics of the market

portfolio,

the risk of a

security will be the risk it adds to the

market portfolio. In this context, the

volatility of the asset,

and

its correlation with the

market portfolio, is historically

observed and is therefore a given (there

are

several

approaches to asset pricing

that attempt to price assets by modeling

the stochastic properties of the

moments

of assets' returns - these

are broadly referred to as conditional

asset pricing models).

The

(maximum)

price paid for any particular

asset (and hence the return

it will generate) should also

be

determined

based on its relationship with the

market portfolio.

Systematic

risks within one market

can be managed through a

strategy of using both long

and short

positions

within one portfolio,

creating a "market neutral"

portfolio.

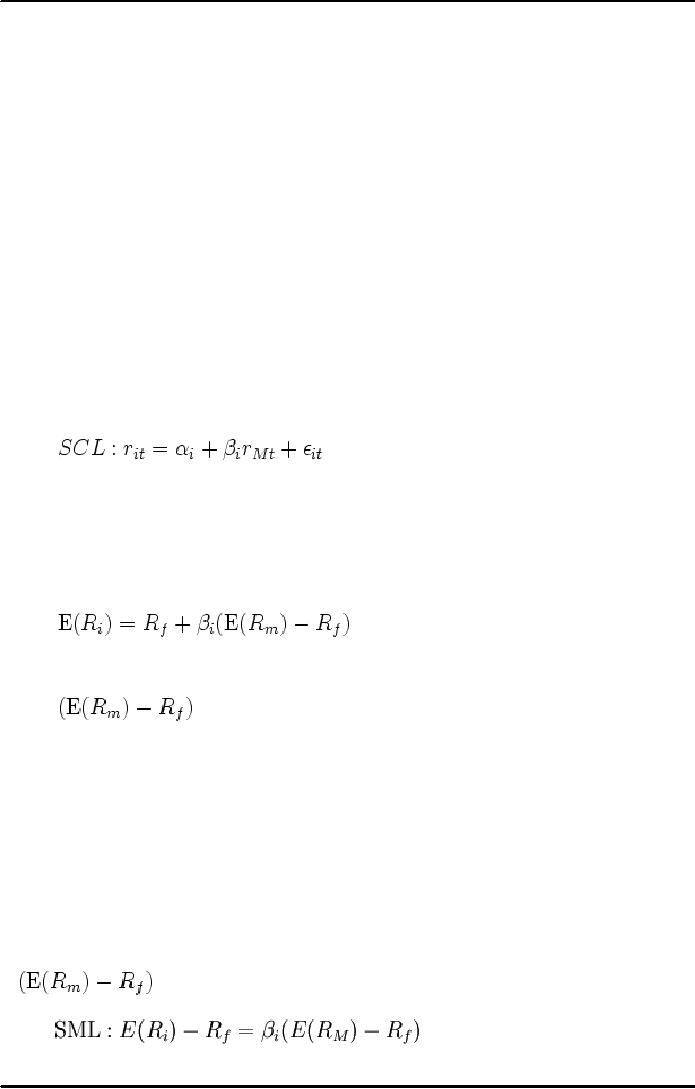

Security

Characteristic Line

The

Security

Characteristic Line (SCL)

represents the relationship between the

market

return (rM) and

the

return of a given asset i (ri) at a given time t. In general, it is

reasonable to assume that the

SCL is a

straight

line and can be illustrated as a

statistical equation:

where

αi is called the

asset's alpha coefficient

and βi the asset's beta

coefficient.

Capital

asset pricing

model

The

asset return depends on the amount paid

for the asset today. The

price paid must ensure that

the

market

portfolio's risk / return characteristics

improve when the asset is

added to it. The CAPM is a

model

which

derives the theoretical required return

(i.e. discount rate) for an

asset in a market, given the

risk-free

rate

available to investors and the risk of

the market as a whole.

The

CAPM is usually

expressed:

·

β,

Beta, is the measure of asset sensitivity

to a movement in the overall market; Beta

is usually

found

via regression on historical data. Betas

exceeding one signify more

than average "risk

ness";

betas

below one indicate lower than

average.

·

is the

market premium, the historically observed

excess return of the

market

over

the risk-free rate'

Once

the expected return, E(ri), is calculated using CAPM,

the future cash flows of the

asset can be

discounted

to their present value using

this rate to establish the correct

price for the asset. (Here

again, the

theory

accepts in its assumptions

that a parameter based on

past data can be combined

with a future

expectation.)

A more

risky stock will have a higher

beta and will be discounted

at a higher rate; less sensitive

stocks will

have

lower betas and be

discounted at a lower rate. In theory, an

asset is correctly priced when its

observed

price

is the same as its value

calculated using the CAPM derived

discount rate. If the observed price

is

higher

than the valuation, then the

asset is overvalued; it is undervalued for a

too low price.

Securities

Market Line

The

relationship between Beta & required

return is plotted on the securities

market line (SML) which

shows

expected

return as a function of β. The

intercept is the risk-free rate available

for the market, while the

slope

is

. The

Securities market line can

be regarded as representing a single-factor model

of

the

asset price, where Beta is

exposure to changes in value of the

Market. The equation of the SML is

thus:

52

Corporate

Finance FIN 622

VU

Comparison

with Arbitrage Pricing Theory

The

SML and CAPM are

often contrasted with the

Arbitrage pricing theory

(APT), which holds that

the

expected

return of a financial asset

can be modeled as a linear function of

various macro-economic

factors,

where

sensitivity to changes in each factor is

represented by a factor specific

bets coefficient.

The

APT is less restrictive in its

assumptions: it allows for an explanatory

(as opposed to statistical)

model

of

asset returns, and assumes

that each investor will hold

a unique portfolio with its

own particular array of

betas,

as opposed to the identical "market

portfolio". Unlike the CAPM, the

APT, however, does not

itself

reveal

the identity of its priced factors - the

number and nature of these

factors is likely to change

over time

and

between economies.

53

Table of Contents:

- INTRODUCTION TO SUBJECT

- COMPARISON OF FINANCIAL STATEMENTS

- TIME VALUE OF MONEY

- Discounted Cash Flow, Effective Annual Interest Bond Valuation - introduction

- Features of Bond, Coupon Interest, Face value, Coupon rate, Duration or maturity date

- TERM STRUCTURE OF INTEREST RATES

- COMMON STOCK VALUATION

- Capital Budgeting Definition and Process

- METHODS OF PROJECT EVALUATIONS, Net present value, Weighted Average Cost of Capital

- METHODS OF PROJECT EVALUATIONS 2

- METHODS OF PROJECT EVALUATIONS 3

- ADVANCE EVALUATION METHODS: Sensitivity analysis, Profitability analysis, Break even accounting, Break even - economic

- Economic Break Even, Operating Leverage, Capital Rationing, Hard & Soft Rationing, Single & Multi Period Rationing

- Single period, Multi-period capital rationing, Linear programming

- Risk and Uncertainty, Measuring risk, Variability of return–Historical Return, Variance of return, Standard Deviation

- Portfolio and Diversification, Portfolio and Variance, Risk–Systematic & Unsystematic, Beta – Measure of systematic risk, Aggressive & defensive stocks

- Security Market Line, Capital Asset Pricing Model – CAPM Calculating Over, Under valued stocks

- Cost of Capital & Capital Structure, Components of Capital, Cost of Equity, Estimating g or growth rate, Dividend growth model, Cost of Debt, Bonds, Cost of Preferred Stocks

- Venture Capital, Cost of Debt & Bond, Weighted average cost of debt, Tax and cost of debt, Cost of Loans & Leases, Overall cost of capital – WACC, WACC & Capital Budgeting

- When to use WACC, Pure Play, Capital Structure and Financial Leverage

- Home made leverage, Modigliani & Miller Model, How WACC remains constant, Business & Financial Risk, M & M model with taxes

- Problems associated with high gearing, Bankruptcy costs, Optimal capital structure, Dividend policy

- Dividend and value of firm, Dividend relevance, Residual dividend policy, Financial planning process and control

- Budgeting process, Purpose, functions of budgets, Cash budgets–Preparation & interpretation

- Cash flow statement Direct method Indirect method, Working capital management, Cash and operating cycle

- Working capital management, Risk, Profitability and Liquidity - Working capital policies, Conservative, Aggressive, Moderate

- Classification of working capital, Current Assets Financing – Hedging approach, Short term Vs long term financing

- Overtrading – Indications & remedies, Cash management, Motives for Cash holding, Cash flow problems and remedies, Investing surplus cash

- Miller-Orr Model of cash management, Inventory management, Inventory costs, Economic order quantity, Reorder level, Discounts and EOQ

- Inventory cost – Stock out cost, Economic Order Point, Just in time (JIT), Debtors Management, Credit Control Policy

- Cash discounts, Cost of discount, Shortening average collection period, Credit instrument, Analyzing credit policy, Revenue effect, Cost effect, Cost of debt o Probability of default

- Effects of discounts–Not effecting volume, Extension of credit, Factoring, Management of creditors, Mergers & Acquisitions

- Synergies, Types of mergers, Why mergers fail, Merger process, Acquisition consideration

- Acquisition Consideration, Valuation of shares

- Assets Based Share Valuations, Hybrid Valuation methods, Procedure for public, private takeover

- Corporate Restructuring, Divestment, Purpose of divestment, Buyouts, Types of buyouts, Financial distress

- Sources of financial distress, Effects of financial distress, Reorganization

- Currency Risks, Transaction exposure, Translation exposure, Economic exposure

- Future payment situation – hedging, Currency futures – features, CF – future payment in FCY

- CF–future receipt in FCY, Forward contract vs. currency futures, Interest rate risk, Hedging against interest rate, Forward rate agreements, Decision rule

- Interest rate future, Prices in futures, Hedging–short term interest rate (STIR), Scenario–Borrowing in ST and risk of rising interest, Scenario–deposit and risk of lowering interest rates on deposits, Options and Swaps, Features of opti

- FOREIGN EXCHANGE MARKET’S OPTIONS

- Calculating financial benefit–Interest rate Option, Interest rate caps and floor, Swaps, Interest rate swaps, Currency swaps

- Exchange rate determination, Purchasing power parity theory, PPP model, International fisher effect, Exchange rate system, Fixed, Floating

- FOREIGN INVESTMENT: Motives, International operations, Export, Branch, Subsidiary, Joint venture, Licensing agreements, Political risk