|

NON-PROFIT ORGANIZATIONS |

| << ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS |

| PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 7

NON-PROFIT

ORGANIZATIONS

Preparing

financial statements with

incomplete records

Most of

the non-profit organizations

operate in medium scale and do not

prepare

proper

books of accounts. The only

accounting record that is

maintained in such

sized

organizations

is cash book along with year

end adjustments. The

management also

keeps

Statement of Affairs as on opening

date to maintain during the

year movements

in

the balance sheet

items.

o Cash

Book (Receipt and Payment

Account)

o Statement

of Affairs (as on opening

date)

o Year

end Adjustments

Accrued

incomes and expenses

Advance

receipts and payments

Depreciation

rate

Like

business entities, these few

accounting records are used

to convert the

information

into double entry system and to produce

Income & Expenditure

Account

and

Balance Sheet.

The

technique of preparing financial

statements of a non-profit organization

is similar

to

that used for preparing

financial statements of a business

entity.

While

preparing Income

& Expenditure Account following

shall be assumed to

calculate

expenses

and incomes

Calculation

of incomes

For

non-profit organizations the

incomes are picked up from

the cash books and

amended

with the year end

adjustment:

Cash

based incomes

Cash

based incomes are the

revenue receipts that are

picked up from its origin

cash

book

and are processed into the

filter of accruals, like

this:

Rs.

Cash

received during the

year

***

Less

Opening balance of accrued

income

***

Add

Closing balance of accrued

income

***

Add

Opening balance of advance

receipts

***

Less

Closing balance of advance

receipts

***

***

Fixed

Assets based

incomes

Profit/gain

on disposal of Assets are

calculated with the help of

sales proceeds

appearing

in receipts side of Cash

Book and some relevant

information appearing in

the

year-end adjustments like

cost and accumulated depreciation of

the asset disposed

off.

Calculation

of expenses

For

non-profit organizations the

expenses are picked up from

the cash books and

amended

with the year end

adjustment:

Cash

based expenses

Cash

based expenses are the

revenue payments that are

picked up from its origin

cash

book

and are processed into the

filter of accruals, like

this:

31

Advance

Financial Accounting

(FIN-611)

VU

Rs.

Expenses

paid in cash during the

year

***

Less

Opening balance of accrued

expenses

***

Add

Closing balance of accrued

expenses

***

Add

Opening balance of prepaid

expenses

***

Less

Closing balance of prepaid

expenses

***

Expense

for the year to be shown in the

Income Statement

***

Fixed

Assets based expenses

1.

Depreciation is calculated based on

the depreciation rate

mentioned in the

Year-end

Adjustments

2.

Loss on disposal of an asset

are calculated with the help

of sales proceeds

appearing

in receipts side of Cash

Book and some relevant

information

appearing

in the year-end adjustments

like cost and accumulated

depreciation

of

the asset disposed

off.

Balance

Sheet of a

non-profit organization is prepared in

the usual way and

contains

particulars

of all assets and liabilities of the

organization on the date on which it

is

prepared.

Net assets of non-profit organization are

represented by Capital Fund in

the

balance

sheet. This Capital Fund

replaces the owner's

equity.

The

opening balance of Capital Fund is

calculated through the Statement of

Affairs as

on

the opening date. Such

opening Capital Fund is then adjusted

with the surplus or

deficit

in the Balance Sheet.

Capital

receipt like; specific

donations, funds, grants

etc. for purchase/acquisition or

construction

of assets are also included in

the Capital Fund of the

organization.

Calculating

Subscription Income

Although

calculating subscription income is not a

separate issue apart from

the

calculation

of incomes for the year

originating from the cash

book, but even then

its

calculations

are being shown over here

just to give confidence through

practice.

Subscription

is cash based income and

like other revenue receipts

it appears in receipts

side

of the cash book summary. It

is picked up from there and then amended

with the

opening

and closing balances of subscriptions

accrued and received in

advance.

Solved

Problem # 1

Rupees

Subscription

received during the year

2007

7,000

Subscription

outstanding at the beginning of

2007

1,400

Subscription

outstanding at the closing of

2007

1,600

Calculate

the amount of subscription

income for the year

2007.

Working:

Subscription

received during the

year

7,000

Less

Opening due

1,400

Add

Closing due

1,600

Income

for the year

7,200

32

Advance

Financial Accounting

(FIN-611)

VU

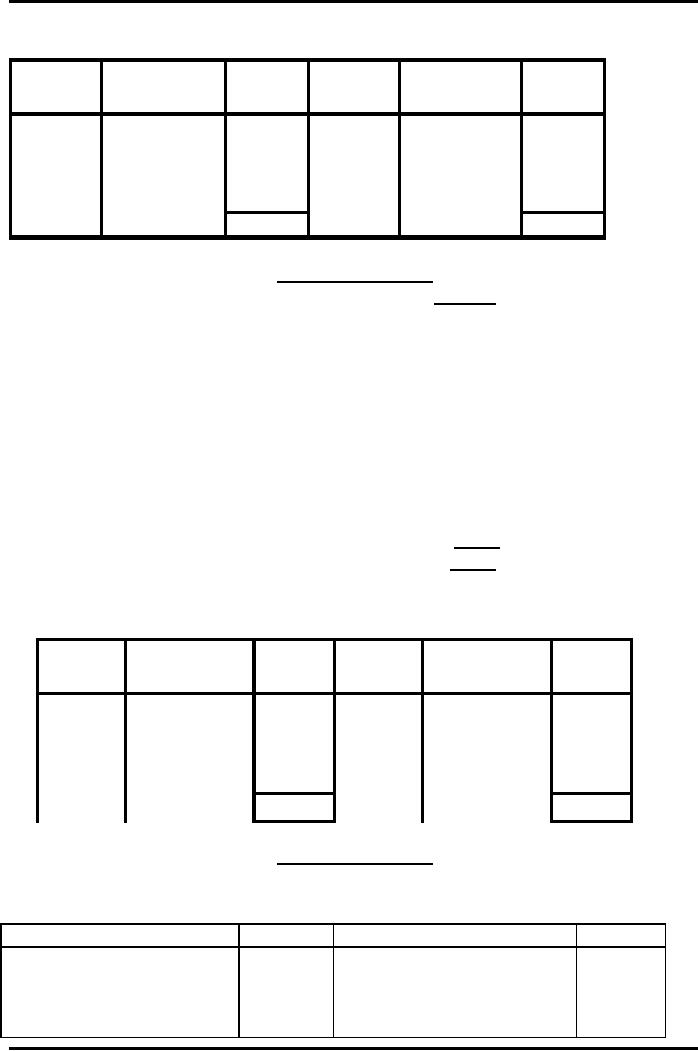

Subscription

Income Account

Date

Particulars

Amount

Date

Particulars

Amount

Rs.

Rs.

1/1/07

Subscription

DTY

Cash

7,000

opening

due

1,400

31/12/07 Subscription

7,200

31/12/07

Subscription

closing

due

1,600

income

8,800

8,800

Solved

Problem # 2

Rupees

Subscription

received during the year

2007

12,000

Subscription

received in advance for 2008

1,400

Subscription

outstanding at the beginning of

2007

1,600

Subscription

outstanding at the closing

2007

700

Calculate

the amount of subscription at

the closing of

2007.

Working:

Subscription

Received during the year

2007

12,000

Less

Opening due

2,000

Less

Closing advance

1,600

Add

Closing due

700

Income

for the year

9,100

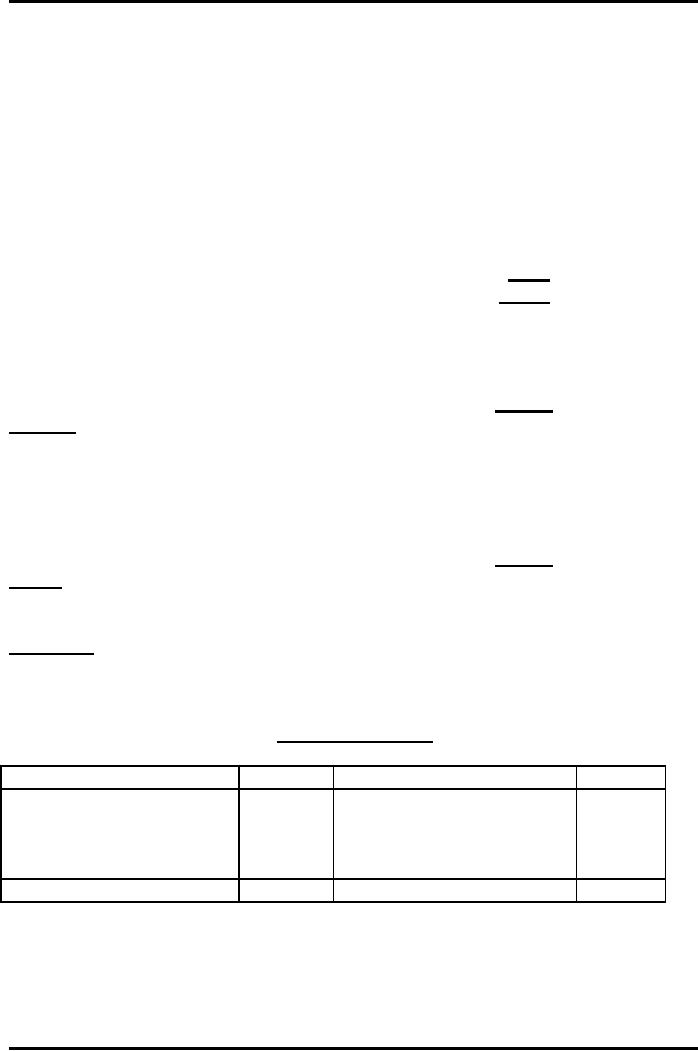

Subscription

Income Account

Date

Particulars

Amount

Date

Particulars

Amount

Rs.

Rs.

1/1/07

Opening

due

2,000

DTY

Subscription

12,000

31/12/07

Closing

1,600

31/12/07 received

31/12/07

advance

9,100

Subscription

700

Income

for the

closing

due

year

12,700

12,700

Solved

Problem # 3

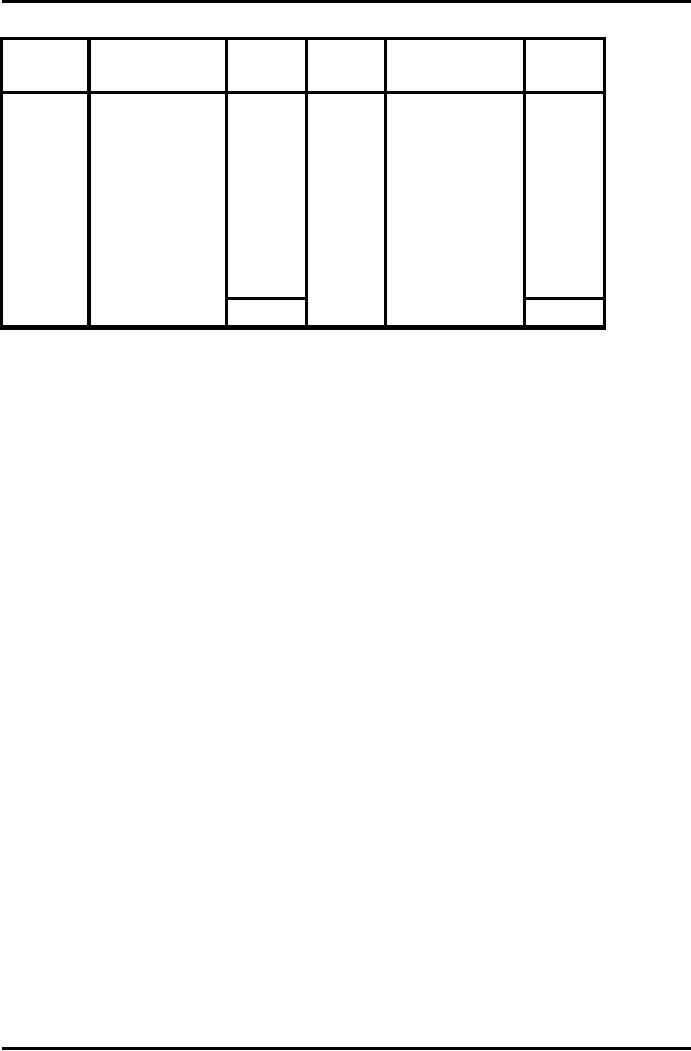

Receipts

and Payment Account

For

the year ended December

31, 2008

Receipts

Rs.

Payments

Rs.

Subscription

2007

Rs.2,000

2008

6,000

2009

2,000

10,000

33

Advance

Financial Accounting

(FIN-611)

VU

Additional

information:

1.

Subscription due on 31-12-2007

Rs.

2,000

2.

Subscription due on 31-12-2008

Rs.

4,000

3.

Subscription received in advance as on

31-12-2007

Rs.

3,000

4.

Subscription received in advance as on

31-12-2008

Rs.

2,000

Working:

Rupees

Cash

received during the

year

10,000

Less

Opening balance of accrued

income

2,000

Add

Closing balance of accrued

income

4,000

Add

Opening balance of advance

receipts

3,000

Less

Closing balance of advance

receipts

2,000

Income

for the year

13,000

Income

and Expenditure

Account

For

the year ended December

31, 2008

(Extract)

Rupees

Incomes

Subscription

income

13,000

Balance

Sheet

As at

December 31, 2008

(Extract)

Rupees

Assets

Subscription

receivable

4,000

Liabilities

Subscription

received in advance

2,000

Solved

Problem # 4

Receipts

Rs.

Payments

Rs.

Subscription

2007

Rs.

1,800

2008

10,000

2009

4,000

15,800

Additional

information:

1.

Subscription due on 31-12-2007

Rs.

2,000

2.

Subscription due on 31-12-2008

Rs.

3,000

3.

Subscription received in advance as on

31-12-2007

Rs.

2,000

4.

Subscription received in advance as on

31-12-2008

Rs.

4,000

34

Advance

Financial Accounting

(FIN-611)

VU

Working:

Rupees

Cash

received during the

year

15,800

Less

Opening balance of accrued

income

2,000

Add

Closing balance of accrued

income

3,000

Add

Opening balance of advance

receipts

2,000

Less

Closing balance of advance

receipts

4,000

Income

for the year

14,800

Income

and Expenditure

Account

For

the year ended December

31, 2008

(Extract)

Rupees

Incomes

Subscription

income

14,800

Balance

Sheet

As at

December 31, 2008

(Extract)

Rupees

Assets

Subscription

receivable

3,000

Liabilities

Subscription

received in advance

4,000

Solved

Problem # 5

Following

is the data relating to

membership fee of HF Club for the

accounting year

April 2007 to

March 2008.

1.

Cash/Cheque received during the

year totaled Rs.

100,000.

2. As on April

1, 2007 Rs. 2,000 was in

arrears for March 31, 2007 and Rs. 800

was

received

in the previous year as

advance membership

fee.

3.

Received Rs. 1,500 towards

the next year's membership

fee, but could not yet

recovered

Rs. 1,700 from current year

members.

Calculate

"Membership Fee" for the

year 2007-08

Working:

Membership

fee received during the

year

Rs.

100,000

Opening

advance

Rs.

800

Closing

advance

Rs.

1,500

Opening

due

Rs.

2,000

Closing

due

Rs.

1,700

35

Advance

Financial Accounting

(FIN-611)

VU

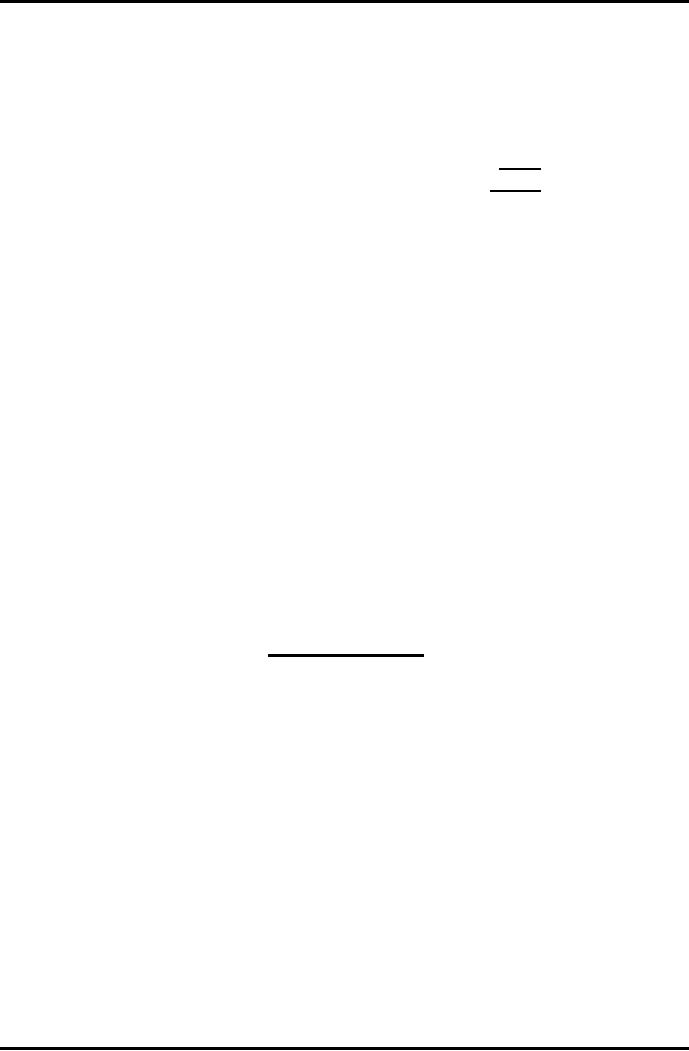

Membership

fee Account

Date

Particulars

Amount

Date

Particulars

Amount

(Rs.)

(Rs.)

1/4/07

Opening

due

2,000

1/4/07 Opening

800

1,500

DTY

31/3/07

Closing

advance

100,000

9,100

31/3/08 Cash

31/12/07

advance

700

Income

for the

Closing

due

year

12,700

12,700

36

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASBíS FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet