|

LOW, STABLE INFLATION:High, Stable Real Growth |

| << THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation |

| MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK >> |

Money

& Banking MGT411

VU

Lesson

31

LOW,

STABLE INFLATION

Many

central banks take as their

primary job the maintenance of price

stability; they strive

to

eliminate

inflation.

The

rationale for keeping the economy

inflation-free is that money's

usefulness as a unit of

account

and as a store of value is

enhanced when its purchasing

power is maintained.

Inflation

degrades the information content of

prices and impedes the market's

function of

allocating

resources to their best

uses.

The

higher the inflation is, the less

predictable it is, and the more

systematic risk it

creates.

Also,

high inflation is bad for

growth.

While

there is agreement that low

inflation should be the primary

objective of monetary

policy,

there

is no agreement on how low

inflation should be.

Zero

inflation is too low,

because it brings the risk of

deflation (a drop in prices) which in

turn

results

in increased defaults on loans and a

threat to the health of banks.

Furthermore,

if inflation were zero, an employer

wishing to cut labor costs

would need to cut

nominal

wages, which is difficult to

do.

A

small amount of inflation

may actually make labor

markets work better, at

least from the

employer's

point of view.

High,

Stable Real Growth

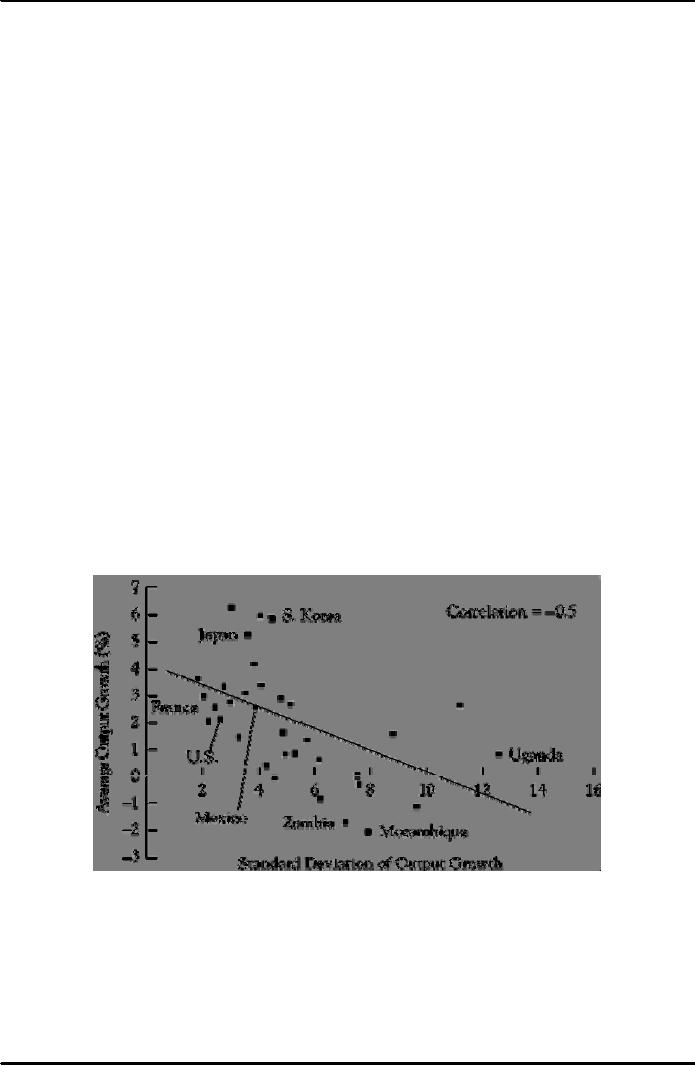

Central

bankers work to dampen the

fluctuations of the business cycle;

booms are popular

but

recessions

are not.

Central

bankers work to moderate

these cycles and stabilize

growth and employment by

adjusting

interest rates.

Monetary

policymakers can moderate

recessions by lowering interest rates and

can moderate

booms

by raising them (to keep growth at a

sustainable level).

Along

with growth and employment,

stability is also important,

because fluctuations in general

business

conditions are the primary

source of systematic

risk.

Financial

System Stability

Financial

system stability is an integral

part of every modern central

banker's job.

The

possibility of a severe disruption in the

financial markets is a type of

systematic risk that

central

banks must control.

Interest

Rate and Exchange Rate

Stability

Interest

rate stability and exchange rate

stability are a means for

achieving the ultimate goal

of

stabilizing

the economy; they are not

ends unto themselves.

96

Money

& Banking MGT411

VU

Interest

rate volatility is a problem

because:

it

makes output unstable as borrowing and

expenditure fluctuate with

changing rates.

it

means higher risk and a

higher risk premium and

makes financial decisions more

difficult.

Even

though the exchange rate affects the

prices of imports and exports,

stabilizing exchange

rates

is the last item on the list of central

bank objectives.

Different

countries have different priorities when

it comes to the exchange rate;

Stable

exchange rates are more

important in developing countries because

imports and exports

are

central to their

economies.

The

objectives of a Modern Central

Bank

Inflation

creates confusion and makes

planning difficult.

When

Low

Stable Inflation

inflation

is high, growth is

low

Stable

predictable growth is higher

than unstable, unpredictable

High

Stable growth

growth

A

stable financial system is

necessity for an economy to

operate

Financial

System

efficiently

Stability

Interest

rate volatility creates risk

for both lenders and

borrowers

Stable

Interest Rates

Stable

Exchange Rates Variable

exchange rates make the revenues from

foreign sales and the

cost

of purchasing imported goods hard to

predict

Meeting

the Challenge: Creating a Successful

Central Bank

The

boom in the past decade with

its associated decrease in

volatility may have

happened

because

technology sparked a boom

just as central banks became

better at their jobs.

Policymakers

realized that sustainable growth had gone

up, so interest rates could be

kept low

without

worrying about inflation,

and central banks were

redesigned.

Today

there is a clear consensus about the best

way to design a central bank and

what to tell

policymakers

to do.

A

central bank must be

Independent

of political pressure,

Accountable

to the public,

Transparent

in its policy actions,

Clear

in its communications with financial

markets and the public

97

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY