|

Cost

& Management Accounting

(MGT-402)

VU

LESSON#

11

LABOR

There

are three elements of

cost:

·

Material

·

Labor

·

FOH

Labor

costs constitute an important

part of production cost.

Labor cost is and element of

total

payroll

expense of an entity. Payroll

expense consists of:

·

Labor

cost

·

Administrative

staff expenses

·

Selling

and distribution staff

expenses

The

total labor cost incurred by

a manufacturing entity includes four

separate elements:

·

Direct

labor cost (this is expensed

on production and it is traceable in

the cost unit)

·

Indirect

labor cost (this is also

expensed on production but it is

not traceable in the

cost

unit)

·

Abnormal

labor cost (this is the

labor cost that is lost

because of break-down of power

and

machinery

etc.)

·

Labor

related cost (this includes

overtime pay, bonus pay, shift

allowances, and other

benefits)

From

the cost and management

accounting point of view,

the distinction between direct

labor

cost

and indirect labor cost is

very essential.

Direct

Labor Cost

Direct

labor cost is that portion

of salaries and wages which

can, as a practical matter, e

traced

with

and charged to a cost unit.

Thus the wages paid to

employees/workers engaged in

manufacturing

of a job or process like bricks, spinning

and weaving, are direct labor

cost.

Broadly

speaking, labor costs will

be direct if:

a.

There

is a direct relationship to the product

through a process,

b.

The

labor cost can be measured

in the light of this

relationship, and

c.

The

labor cost is sufficiently material

(significant) in amount.

However,

the main criterion of

determining the direct labor

cost is that if it is economically

and

conveniently

be identified /traced with a

product, it is a direct labor

cost.

Indirect

Labor Cost

These

are the costs which

are not identifiable with or

incurred directly in the

production of a

specific

goods or services but are

applicable to manufacturing activities generally,

salaries and

wages

paid to supervisors, foremen,

storekeepers, clerical staff member

will constitute the

indirect

labor costs. Mostly costs of

service departments, supervisory and

engineering

departments

are indirect labor

costs.

Salaries

& Wages

Salary

is a fixed amount of remuneration

paid to the employees after

a month or a year.

Wage

is remuneration of the employees/workers

who work on hourly or unit

produced basis.

Determining

Wage Rates

Wage

rates are determined on the

basis of requirements of a job. Job

analysis is

breaking up of a

job

into basic elements or operations

and studying them in detail

to find out the

duties,

responsibilities

and skills involved in

it.

69

Cost

& Management Accounting

(MGT-402)

VU

It

is a process of determining the

contents and characteristics of a

job, the conditions

under

which

performance is to be carried on, the

qualifications required in the worker, methods

and

techniques

used and other conditions

and skills involved. This

basic object of job analysis

is to

ascertain

the relative worth of each

job through an objective

evaluation so that

suitable

remuneration

can be fixed for each

Job and worker.

Advantages

of Job Analysis

a.

Job

analysis facilitates selection of

right type of workers

according to the job

requirements.

It helps in training the

workers accordingly.

b.

Job

analysis helps in fixing

suitable wage rates for

different jobs according to

their

characteristics,

skills required and hazards

involved.

c.

It

helps in Job evaluation and

merit rating thereby

improving the decision

making

ability

of the supervisory staff in regard to

transfer, promotion and

placement.

d.

Job

analysis facilitates the

settlement of disputes with

workers in regard to duties-

wages,

transfer and other disciplinary

action by providing complete requirements of

different

jobs.

e.

It

helps in placing employees on the

most suited jobs and thus

increasing their

satisfaction

and morale. It helps in reducing labor

turnover, absenteeism and

removes inequ-

alities

in wages and

salaries.

Time-Keeping

In

an industrial enterprise accurate

time keeping is very

essential, normally, recording of time

is

done

for two purposes:

a.

For

administrative and payroll purposes,

and

b.

For

cost analysis and

apportionment of overhead among different

departments.

Wages

to casual and temporary

workers are paid on time

basis while others are

paid on piece

rates

with minimum guaranteed

wages. Payment of wages to such

categories of workers is

dependent

on the proper recording of total

time spent by a worker in the

factory and on the

Job.

Purposes

of Time-Keeping

Recording

of time is essential for the

following purposes:

a.

Preparation

of Pay Rolls, where the

workers are paid on time

basis.

b.

.Meeting

the statutory requirements.

c.

For

internal administration, like increments, pension,

provident fund, gratuity and

leave

benefits.

d.

For

proper distinction between direct

and indirect costs, normal

time and overtime,

and

regular and late

comers.

e.

For

overhead rates, if based on

labor hours.

f.

For

enforcing regularity, discipline and

ensuring daily requirement of labor force

in the

factory.

Methods

of Time-keeping or Recording:

Following

are the usual methods of recording

attendance of workers at the

gate of a factory.

1)Manual

Methods:

A.

Attendance

Register, and

B.

Token

system

2)

Mechanical

Methods:

A.

Time

recording clock, and

B.

Dial

Time Recorders

3)

Electronic

Methods:

A.

Smart

card

70

Cost

& Management Accounting

(MGT-402)

VU

Manual

Methods

Attendance

Register method (Hand written

record):

Under

the method a register with

necessary columns like name,

identity no. of the employee

and

arrival

and departure time is maintained.

In

a large factory, separate

registers may be maintained for

each department but in a

small

factory

one register may serve the

needs of the entire

factory.

The

practice of recording attendance or roll

calls may conveniently be

adopted depending

upon

the

nature of employees and

their number. As soon as a worker

enters into the premises of

the

factory

the necessary entries in the

attendance register are completed

either by calling the

name

of

each worker or by some other

physical method.

Disk

or Token or Check

method:

Under

this method each worker is

allotted a metal disk or token

bearing his identification. On

each

disk the name and

number of the worker is

engraved or painted. All the tokens or

disks are

hung

on a board serially note the

arrival time of the

workers.

As

soon as a worker reports for

duty on the appointed time

he/she removes his/her disk

from

the

board and puts into a box.

Immediately after the

scheduled time for entering

into the

premises

of the factory the board is removed

and a list is prepared of

all such disks or tokens

not

collected

and dropped into the box by

the workers. The late comers

collect their disks and

hand

over

personally to the time keeper.

The list of late comers is

prepared separately. The tokens

not

removed

from the boards represent

the absentee workers.

Mechanical

Methods

Different

mechanical devices have been

designed for recording the

exact time of the

workers.

These

include:

a.

Clock Card

b.Dial

Time Records.

Clock

Card

The

attendance of workers in this

system is marked by a time recording

clock on a card each

worker

is given a clock card usually

for one week duration. These

clock cards are serially

arranged

and

kept in a tray at the gate

of the factory and as the

worker enters into the

gate he picks up

his/her

clock card from the

tray, puts it in the time

recording clock that records

the exact arrival

time

at the space provided on the

card against the particular

day.

This

process is repeated where the

worker leaves the factory

after his/her day's work.

Other

particulars

of time in respect of lunch,

late arrivals, early leaving and

overtime are printed in

red

so

as to distinguish these from normal

period spent in the factory.

This is very popular

method

of

recording the attendance of workers. The

format of clock card is given

below:

71

Cost

& Management Accounting

(MGT-402)

VU

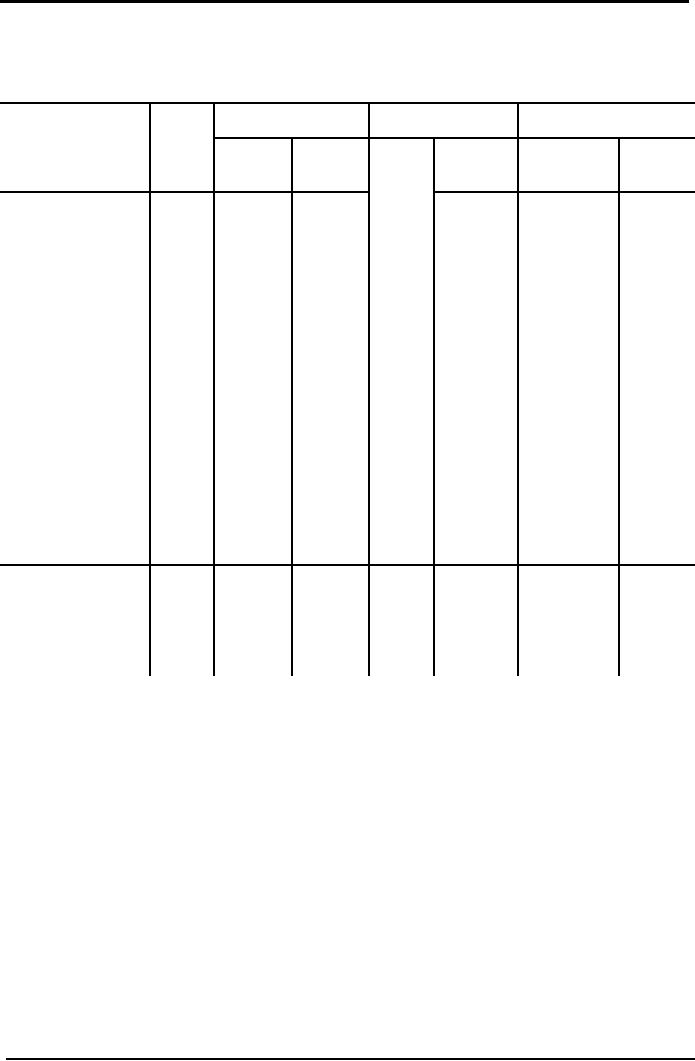

FUTURE

SHINE CO. LTD

Clock

Card

Worker's

Name____________ Department ___________ Token #

___________

Week______________

Days

Time

Regular-time

Over-time

Total-time

In

Out

In

Out

Normal

Over-

time

time

Monday

A.M.

P.M.

Tuesday

A.M.

P.M.

Wednesday

A.M.

P.M.

Thursday

A.M.

P.M.

Friday

A.M.

P.M.

Saturday

A.M.

P.M.

Sunday

A.M.

P.M.

Calculations

of

Normal

Over-

Rate

Amount

Deductions

Net

i

Hours

payable

Worked

Time

keeper____________ Foreman_______________ Payroll

Clerk ______________

Worker____________

72

Cost

& Management Accounting

(MGT-402)

VU

Electronic

Methods

In

the era of Information

Technology wastage of time is

considered as a sin. Although

manual

and

mechanical methods produce accurate results

but both are time

consuming methods. Same

results

with less time consumption

and lesser chance of errors

can be obtained with

the

application

of electronic devices. Now a days

clock cards have been

substituted with the

smart

cards.

Smart

Card

Clock

cards may be replaced by smart

cards. These record the same

information, but it is

recorded

on the magnetic strip on the

card. Smart cards may

also be used for other

purposes not

related

to the payroll.

Job

Time Sheets

For

proper labor cost analysis,

it is essential that the

worker records, in details,

his/her activities

of

production and time he/she

spends on each job

correctly. Time spent by a worker on

the job,

process

or activity may be recorded

manually, mechanically or electronically

depending upon the

nature

and size of the enterprise.

Recording of time spent by the worker on

the job is better

known

as time booking. The objects

of time booking are:

1.

To

ensure that the time

paid for is properly

utilized.

2.

To

ascertain the labor cost

for each individual job

and the cost of work

done

3.

To

determine the rate of absorption of

overhead expenses based on direct

labor and

machine

hour methods against each

job.

4.

To

ascertain and minimize idle

time.

5.

To

evaluate each employee's

performance by comparing the actual

time taken with the

budgeted

time.

For

achieving these objectives it is very

important that clear

instructions should be issued

and

proper

forms are designed for

recording work time.

73

Cost

& Management Accounting

(MGT-402)

VU

FUTURE

SHINE CO. LTD.

Daily

Time Sheet

Worker's

Name____________ Department ___________ Token #

___________

Date______________

Job

or

Work

Descriptio

Time

Total

Hours

Cost

work

done

n

of work

order.

On

Off

Ordin

Overti

Rate

Amount

Total

hours_____________

Workers______________

Total

cost_______________

Fore

man____________

PAYROLL

SYSTEM

The

payroll is a list of the

employees of the organization

and the money due to

each. A payroll

list

is produced each time that

employees are paid.

·

Wage earners are paid

weekly.

·

Salary earners are

paid monthly.

Sometimes,

employees earn a fixed

amount every week or every month.

Sometimes there are

variations

in the amount employees

earn, due to overtime payments or

bonuses or commissions

which

add to their pay.

GROSS

PAY AND NET PAY

DEDUCTIONS

The

total amount earned in a

week or month by an employee is

called his or her gross

pay.

This

is not the amount of money

that the employee receives,

because deductions are taken

away

from

the gross pay, and the

employee receives just the

gross pay less deductions.

This is known

as

the employee's net

pay.

The

deductions from pay are

usually a combination

of:

·

Statutory deductions and

·

Non-statutory or voluntary

deductions.

Statutory

deductions are

deductions from pay that are

made by law. In the Pakistan

income tax

is

taken away from gross pay

and paid to Income Tax

Department, which is the

main tax-

collecting

department of the

government.

77

Cost

& Management Accounting

(MGT-402)

VU

Income

tax is collected

from employees every time

they are paid, and

this system of tax

payment

is therefore known as Pay As You

Earn or PAYE. An employer is required by

law to

deduct

income tax from the wages

and salaries of all their

employees.

The

employer in effect acts as an

unpaid tax collection agent

for Income Tax

Department.

Non-statutory

deductions are

voluntary deductions from pay

that the employee

chooses

to

make. Examples of these

are:

·

Subscriptions to a trade union

·

Contributions by the employee to a

pension scheme.

Rupees

Gross

pay

***

Less:

Statutory

deductions

(***)

Non-statutory

deductions

(***)

Net

pay or take home"

pay

***

What

this means is that when an

employee is paid, he or she

receives the net pay or

take home

pay,

and the employer pays

the other amounts to other

organisations ('external agencies') such

as

Income

Tax Department, a trade

union and a pension scheme

organisation.

COST

OF LABOR TO THE EMPLOYER

Although

the employee only receives

the net pay, all the

deductions have to be paid to

other

organisations,

and it is the employer who

has to pay them. Therefore,

you might think that

the

total

cost of wages and salaries

to the employer is the total

of gross wages. In fact the

total cost

of

wages and salaries to an

employer is higher than the

total gross wages and

salaries. This is

because

there are two elements in

Provident Fund

Contributions.

·

There

are employees' provident

fund contributions. These

are a part of the

statutory

deductions

from gross pay,

·

There

are also employer's provident

fund contributions. These

are additional payments that

the

employer has to pay the

government.

The

amount payable is related to

the amount earned by the

employees, but it is nevertheless

an

additional

labor cost for the

employer.

To

an employer, the total cost

of wages and salaries is

therefore:

·

Gross

wages and salaries,

plus

·

Employer's

provident fund

contributions.

OTHER

DEDUCTIONS

The

employer and employee may

agree that other deductions

should be made from

the

employee's

salary. Examples are:

(a)

Pension contributions.

(b)

Deductions under the payroll

giving scheme (charity

giving).

(c)

Deductions under a payroll

savings scheme,

(d)

Trade Union subscriptions.

(e)

Deductions under Holiday Pay

schemes,

(f)

Certain other voluntary deductions

agreed by the employer (for

example, fees for use of

the

company

sports club).

78

Cost

& Management Accounting

(MGT-402)

VU

PRACTICE

QUESTION

The

following figures have been extracted

from a trader's records in

respect of wages and

salaries

for

July.

Rupees

(i)

Wages and salaries

(gross)

6,300

(ii)

Income tax

1,600

(iii)

Employees' pension contributions

600

(iv)

Employer's pension contributions

700

1

What

is the total amount the trader will

have to pay for wages and

salaries for July?

A

4,100

B

4,800

C

6,300

D

7,000

2

What

is the net pay received by

employees?

A

4,100

B

4,200

C

4,800

D

5,600

PROCESSING

THE PAYROLL

To

process the payroll, an

employer must, for each

employee:

Calculate

the gross

wage or

salary for the period.

1.

Calculate

the income

tax payable

out of these earnings.

2.

Calculate

the employee's

state benefit contributions that

are deductible.

3.

Calculate

the employer's

state benefit contributions. For

all employees collectively,

4.

the

employer must:

Calculate

any non-statutory

deductions.

5.

Prepare

a payslip

showing

the gross pay, deductions and

net pay.

6.

Make

the payment of net

pay to the

employee.

7.

Make

the payments

of all the deductions from

pay and the employer's state

benefit

8.

contributions

to the appropriate other

organisations.

Record

the payroll costs

in the

accounting system.

9.

PAYSLIPS

A

payslip will accompany each

payment of salary or wages to an

employee. It shows how

the

amount

paid has been arrived at,

how much income tax and

state benefit contributions

has been

deducted.

The provision of a payslip detailing

the income tax and provident

deductions is

another

responsibility of an employer as required by

the national law. Other

deductions will also

be

shown on the payslip.

Getting

a payslip means that even if

the employee receives wages

or salary payments directly

into

his

bank account, he is notified of the

payment and how much it is

by receiving the payslips,

Payslips

might be distributed to employees at

work, or posted to their

home address.

A

payslip must show details

of:

·

Gross

pay

·

Deductions

(itemized separately)

·

Net

pay (Net pay is sometimes

called 'take

home pay').

However,

there isn't a standard

layout for a payslip and so

payslips of different employers

can

look

very different.

An

example is shown

below.

79

Cost

& Management Accounting

(MGT-402)

VU

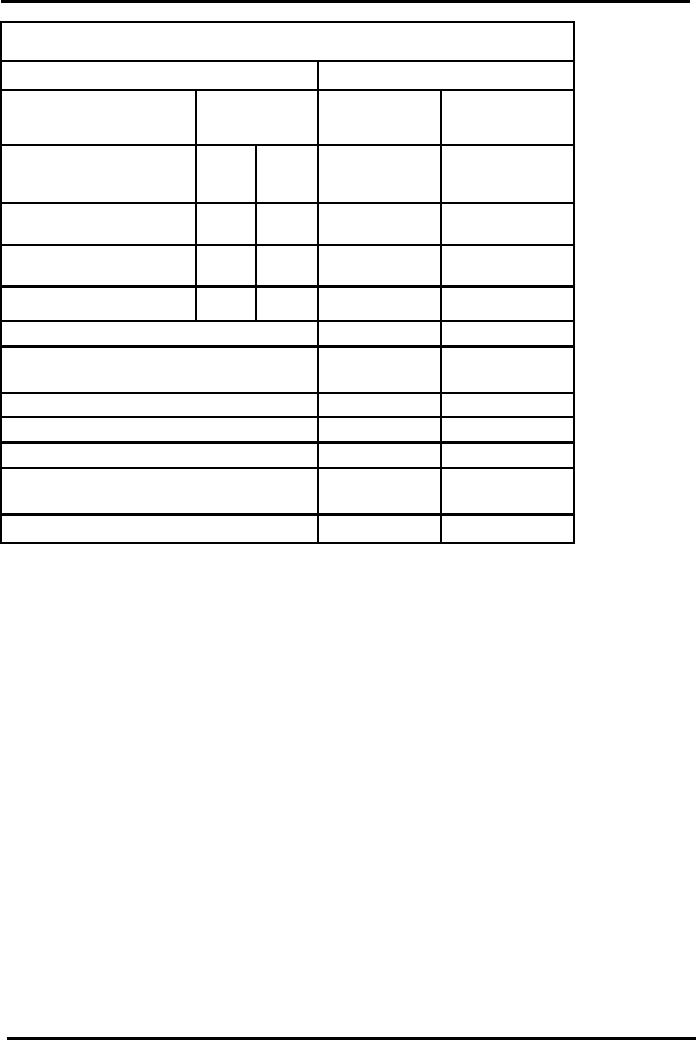

Silver

Glass Manufacturers

PAYSLIP

Employee:

Syed

Imam Din

Employee

#. 256

National

Tax Number:

Social

Date:

08-10-

Tax

period:

7296849-5

Security:

Y

06

week

40

45

Pay

For Week Ending:

Hou

Rate

Amount

Rs.

Year

To Date

October

8th.

rs

Rs.

Rs.

Basic

Pay

40.0

7.50

300.00

Overtime

5.0

15.00

75.00

Shift

Allowance

2

10.00

20.00

Gross

Pay

395.00

Pension

(Employer's

pension

15.00

contribution

Rs.25.00)

Trade

union subscription

10.00

Total

Pay

370.00

16,605.00

Income

Tax

57.92

2.711.32

Provident

Fund (Employer's

Cont

30.85

Rs.36,71)

NET

PAY

281.23

Content

of the Payslip

A

payslip must show certain

items, by law. Compulsory

items in the UK are:

·

The

employer's name

·

The

employee's name

·

The

date

·

The

total gross pay, showing the

calculation where it comprises different

elements

such

as bonuses, overtime

etc

·

The

employee's pension contribution (if

there is any)

·

Other

deductions from, or adjustments to, pay. If a

set amount is deducted each

pay

day

the breakdown need not be

shown, provided the employee

was given the details

earlier

·

Total

gross pay to date for

PAYE purposes

·

Total

tax paid to date in the

current tax year and

tax due this pay

day

·

National

Insurance contributions due

this pay day

·

Net

pay.

The

payslip may also show

additional information (and often does),

such as:

·

the

employee's Payroll

Number

·

the

employee's Social Security

Number

·

the

employee's National Tax

Number

·

the

total provident fund

contributions paid by the

employee in the tax year to

date

·

the

method of payment, such as `paid through

cheque or cash etc.'

80

Cost

& Management Accounting

(MGT-402)

VU

·

employer's

provident fund contribution

for the current

period

·

employer's

provident fund contribution

for the tax year to

date

MAKING

PAYMENTS TO EMPLOYEES

Most

employers will have a set

day on which employees

should be paid, and it is

the payroll

department's

responsibility to ensure that

wages are paid on the

correct due days.

Weekly

paid employees will be paid

at least once a week,

normally on the same day

each week.

Usually

the pay day will be

either Thursday or

Friday.

Monthly

paid employees will be paid

once a month, and there

will be a formula for

determining

the

pay day. For example, this

may be:

·

the

last day of the calendar

month

·

the

last Friday or Saturday of the

calendar month

·

the

same date each month, such

as the 26th.

Employees

may be paid their wages in

several ways:

·

in

cash (but this is now

very uncommon)

·

by

cheque

·

by

bank transfer

·

through

the Banks Automated Clearing

System (BACS).

PRACTICE

QUESTIONS

1

Which

of the following does not

appear on a payslip?

A.

Gross

weekly wage for the

employee

B.

Tax

paid to date by the employee

in the tax year

C.

Deductions

paid by the employee

D.

Details

of the employee's expected

pension.

2

Which

is the most convenient way

for a large employer to pay

salaries electronically?

A.

BACS

B.

Bank

transfer

C.

By

cash

D.

By

cheque.

Elements

of Gross Pay

The

amount of pay to which an

employee is entitled may be

earned in a variety of different

ways.

These

include:

(A)

Basic pay, such as:

a.

wages paid according to the

number of hours

worked

b.

Wages paid according to the

output of the

employee.

c.

salaries, for salaried

staff

(B)

Other pay, such as:

a.

overtime pay, for extra hours

worked by the

employee

b.

shift pay, to compensate for unsocial

hours.

(C)

Bonuses and commission, such

as:

a.

bonuses paid under

bonus schemes, based on

productivity, or profitability

b.

commission paid, normally based on

sales.

Rupees

81

Cost

& Management Accounting

(MGT-402)

VU

Basic

Pay

****

+

Bonus

****

+Overtime

payment

****

+Other

allowance

****

Gross

pay

****

-Statutory

deduction

(***)

-Non

Statutory deduction

(***)

Net

Pay

****

Payroll

Entries

Payroll

Preparation

Payroll

expenses

100

Deduction

of income tax

5

Payroll

Payable

95

Payroll

Distribution

Work

in process

20

FOH

30

Administrative

expense

40

Selling

expenses

10

Payroll

expenses

100

Payment

Accrued

payroll

95

Bank

95

82

Cost

& Management Accounting

(MGT-402)

VU

PRACTICE

QUESTION

Direct

Labor

15,000

Indirect

Labor

10,000

Sales

Salaries

7,000

Administrative

Salaries

8,000

Total

40,000

Deductions

Income

tax

4,000

Group

insurance

1,000

Required:

Pass

journal entries to record Payroll

expense and its

payment

Solution

1-

Payroll

expense

40,000

Income

tax (Payable)

4,000

Group

insurance (Payable)

1,000

Payroll

Payable

35,000

2-

Payroll

payable

35,000

Voucher

payable

35,000

3-

Voucher

payable

35,000

Bank

35,000

4-

Work

in process

15,000

FOH

10,000

Selling

expense

7,000

Administrative

8,000

Payroll

expenses

40,000

83

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS