|

INDUSTRY ANALYSIS:Global challenge, The Competitive Profile Matrix (CPM) |

| << TECHNOLOGICAL FORCES:Technology-based issues |

| IFE MATRIX:The Internal Factor Evaluation (IFE) Matrix, Internal Audit >> |

Strategic

Management MGT603

VU

Lesson

11

INDUSTRY

ANALYSIS

Objectives:

The

EFE Matrix and five-force

model can help strategists

evaluate the market and

industry, but these

tools

must

be accompanied by good intuitive

judgment. Multinational firms especially

need a systematic and

effective

external-audit system because external

forces among foreign

countries vary so greatly. This

lecture

provides

you complete details of EFE

matrix as a component of SWOT

analysis.

Competitive

Intelligence Programs and competitive

analysis:

Systematic

and ethical process for

gathering and analyzing

information about the competition's

activities and general

business

trends

to further a business' own

goals.

Competitive

Analysis: Porter's Five-

Forces

Model

Potential

development

of

substitute products

Rivalry

among

Bargaining

power

Bargaining

power

Competing

firms

of

suppliers

of

consumers

Potential

entry of new

competitors

The

central point lays the

stress on rivalry of the competing firm.

This relates to the intensity of the

rivalry.

How

the firms compete with each

other and to what extent?

That should be taken into account

very

carefully.

Potential

entry for new competitors

shows a balance between

different firms competing in a market. It

also

refers

whenever a new partner enter

into a market he may become

threat for one and

opportunity for other

competing

partners. As all the new

entries and existing firms are competing

with each other so the

new

entry

will definitely make an effect on

every one transacting in the

market.

A

potential development of substitute products

also develops an environment of

competition in the market

among

the competing partners. As all firms want to

compete in term of quality and

substitute will lasts

for

longer

in the market if the quality of the

substitute will be greater than the

existing alternate. Other

factors

also

have a major impact on the

substitutes.

Collective

bargaining power of suppliers and

consumers: if vendors are

less in the market and

the

organizations

that have to purchase from

those vendors are more

then the demand for those

suppliers will

be

more as the firms have to purchase

from that less suppliers.

The reverse is the case if

suppliers are more

and

buyers are less. Then the

demand for those suppliers

will be less. Such

circumstances create

difficulties

in

bargaining.

These

above five components constitute the

basics elements for the

competitive analysis.

43

Strategic

Management MGT603

VU

Global

challenge:

International

Challenge faced by Pakistani

firms:

o

How

to gain and maintain exports to other

nations

o

How

to defend domestic markets against

imported goods

The

first challenge is the much

bigger in the sense that we

have to search for new

market and retain in

that

market

as the competition goes on increasing

with every passing second.

For this, we have to make

a

research

in the market that how to retain in

that market.

Second

challenge is also depends

upon the research that how

we can retain in that market

through

competition

and how to defend our market

with violation of exports

laws.

Industry

Analysis: The External Factor Evaluation

(EFE) Matrix

We

can prepare EFE matrix after

evaluating the key external factors

discuss in the later lectures. There

are

all

key factors which are

needed to be summarized in order to

make EFE matrix.

An

External

Factor Evaluation (EFE) Matrix

allows

strategists to summarize and

evaluate economic,

social,

cultural,

demographic, environmental, political, governmental,

legal, technological, and

competitive

information.

The EFE matrix consists of

five steps process.

Five-Step

process:

∑

List

key external factors (10-20)

Opportunities

& threats

You

have to prepare a list of

all external factors which

will affect the EFE matrix.

These factors should be

two

points to be kept in mind

these are opportunities and

threats.

∑

Assign

weight to each (0 to

1.0)

Sum

of all weights = 1.0

Now

you have to arrange them

according to their weight age

that which factor is most

important. It should

be

weight age in % ages. The

sum of the total of all the

factors should always be

one.

∑

Assign

1-4 rating to each

factor

∑

Firm's

current strategies response to the factor:

how well firms response to

these factors.

∑

Multiply

each factor's weight by its

rating

∑

Produces

a weighted score

How

the firm will respond to

these factors external factors.

Such criteria are known as

rating.

∑

Sum

the weighted scores for

each

Determines

the total weighted score for the

organization.

∑

Highest

possible weighted score for the

organization is 4.0; the lowest, 1.0.

Average = 2.5

Illustrated

in Table 3-11, the EFE Matrix

can be developed in five

steps:

1.

List key external factors as

identified in the external-audit process.

Include a total of from ten

to

twenty

factors, including both

opportunities and threats affecting the

firm and its industry.

List the

opportunities

first and then the threats.

Be as specific as possible, using

percentages, ratios,

and

comparative

numbers whenever

possible.

2.

Assign to each factor a weight

that ranges from 0.0

(not important) to 1.0 (very

important). The

weight

indicates the relative importance of that

factor to being successful in the firm's

industry.

Opportunities

often receive higher weights than

threats, but threats too

can receive high weights

if

they

are especially severe or threatening.

Appropriate weights can be determined by

comparing

successful

with unsuccessful competitors or by

discussing the factor and

reaching a group

consensus.

The sum of all weights

assigned to the factors must

equal 1.0.

3.

Assign a 1-to-4 rating to

each key external factor to indicate

how effectively the firm's current

strategies

respond to the factor, where 4 5

the

response is superior, 3 5

the

response is above average, 2 5

the

response

is average, and 1

5 the

response is poor. Ratings

are based on effectiveness of the

firm's

strategies.

Ratings are, thus, company

based, whereas the weights in

Step 2 are industry based.

It is

important

to note that both threats

and opportunities can

receive a 1, 2, 3, or 4.

4.

Multiply each factor's weight by

its rating to determine a

weighted score.

5.

Sum the weighted scores for

each variable to determine the total

weighted score for the

organization.

44

Strategic

Management MGT603

VU

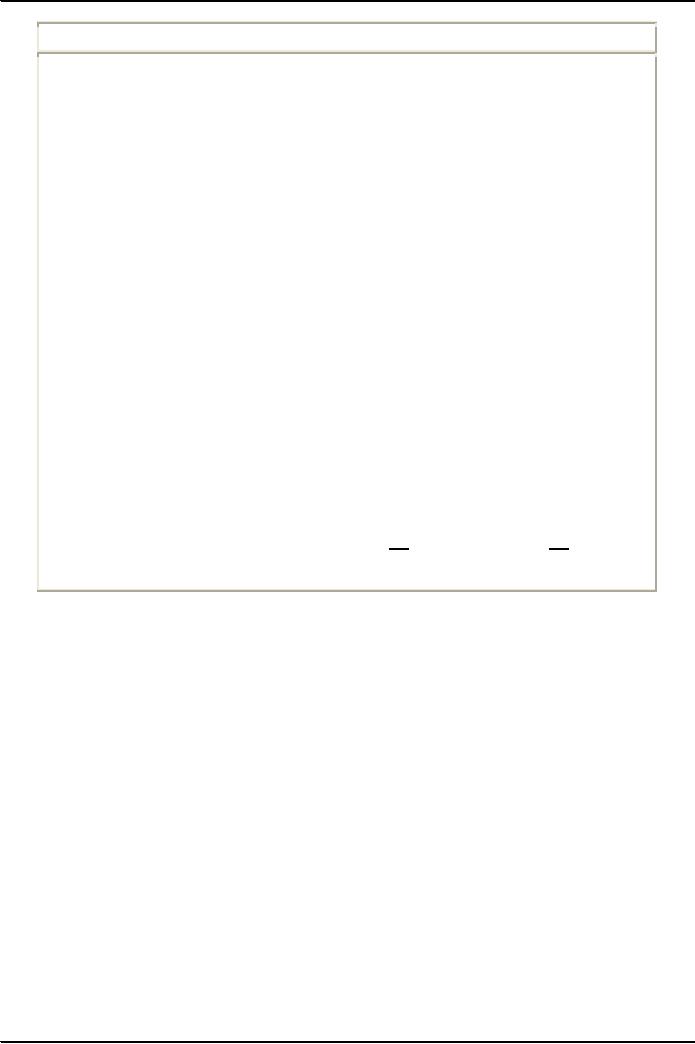

An

Example External Factor Evaluation

Matrix for UST,

Inc.

WEIGHTED

KEY

EXTERNAL FACTORS

WEIGHT

RATING

SCORE

Opportunities

1.

Global markets are practically untapped

by

.15

1

.15

smokeless

tobacco market

2.

Increased demand caused by

public banning of

.05

3

.15

smoking

3.

Astronomical Internet advertising

growth

.05

1

.05

4.

Pinkerton is leader in discount tobacco

market

.15

4

.60

5.

More social pressure to quit

smoking, thus

.10

3

.30

leading

users to switch to

alternatives

Threats

1.

Legislation against the tobacco

industry

.10

2

.20

2.

Production limits

on

tobacco

increases

.05

3

.15

competition

for production

3.

Smokeless tobacco market is

concentrated in

.05

2

.10

southeast

region of United States

4.

Bad media exposure from the

FDA

.10

2

.20

5.

Clinton administration

.20

1

.20

TOTAL

1.00

2.10

Regardless

of the number of key opportunities and

threats included in an EFE Matrix, the

highest possible

total

weighted score for an organization is 4.0

and the lowest possible

total weighted score is 1.0.

The

average

total weighted score is 2.5. A

total weighted score of 4.0

indicates that an organization is

responding

in

an outstanding way to existing opportunities

and threats in its industry.

In other words, the firm's

strategies

effectively take advantage of existing

opportunities and minimize the potential

adverse effect of

external

threats. A total score of

1.0 indicates that the firm's

strategies are not capitalizing on

opportunities

or

avoiding external threats.

An

example of an EFE Matrix is

provided in Table for UST,

Inc., the manufacturer of Skoal

and

Copenhagen

smokeless tobacco. Note that

the Clinton administration was considered

to be the most

important

factor affecting this industry, as indicated by the

weight of 0.20. UST was not

pursuing strategies

that

effectively capitalize on this

opportunity, as indicated by the rating of

1.01. The total weighted

score of

2.10

indicates that UST is below

average in its effort to

pursue strategies that

capitalize on external

opportunities

and avoid threats. It is

important to note here that

a thorough understanding of the

factors

being

used in the EFE Matrix is

more important than the

actual weights and ratings

assigned.

Total

weighted score of 4.0

=

Organization

response is outstanding to threats &

weaknesses

Total

weighted score of 1.0

=

Firm's

strategies not capitalizing on

opportunities or avoiding

threats

UST

(in the previous example), has a

total weighted score of 2.10

indicating that the firm is below

average

in

its effort to pursue

strategies that capitalize on external

opportunities and avoid

threats.

Note:

Understanding of

the factors used in the EFE

Matrix is more important

than the actual weights

and

ratings

assigned.

45

Strategic

Management MGT603

VU

This

is important to understand the factors

for which you are preparing

the EFE matrix than the weight

age

given

to the each factors.

The

Competitive Profile Matrix

(CPM)

The

Competitive Profile Matrix (CPM)

identifies a firm's major

competitors and their

particular strengths and weaknesses

in

relation

to a sample firm's strategic

position.

The

weights and total weighted

scores in both a CPM and

EFE have the same meaning.

However, the

factors

in a CPM include both internal

and external issues; therefore, the

ratings refer to strengths

and

weaknesses,

where 4 5 major strength, 3 5 minor

strength, 2 5 minor weakness,

and 1 5 major weakness.

There

are some important

differences between the EFE

and CPM. First of all, the critical

success factors in

a

CPM are broader; they do not

include specific or factual data

and even may focus on

internal issues. The

critical

success factors in a CPM

also are not grouped into

opportunities and threats as they

are in an EFE.

In

a CPM the ratings and total

weighted scores for rival firms

can be compared to the sample

firm. This

comparative

analysis provides important internal

strategic information.

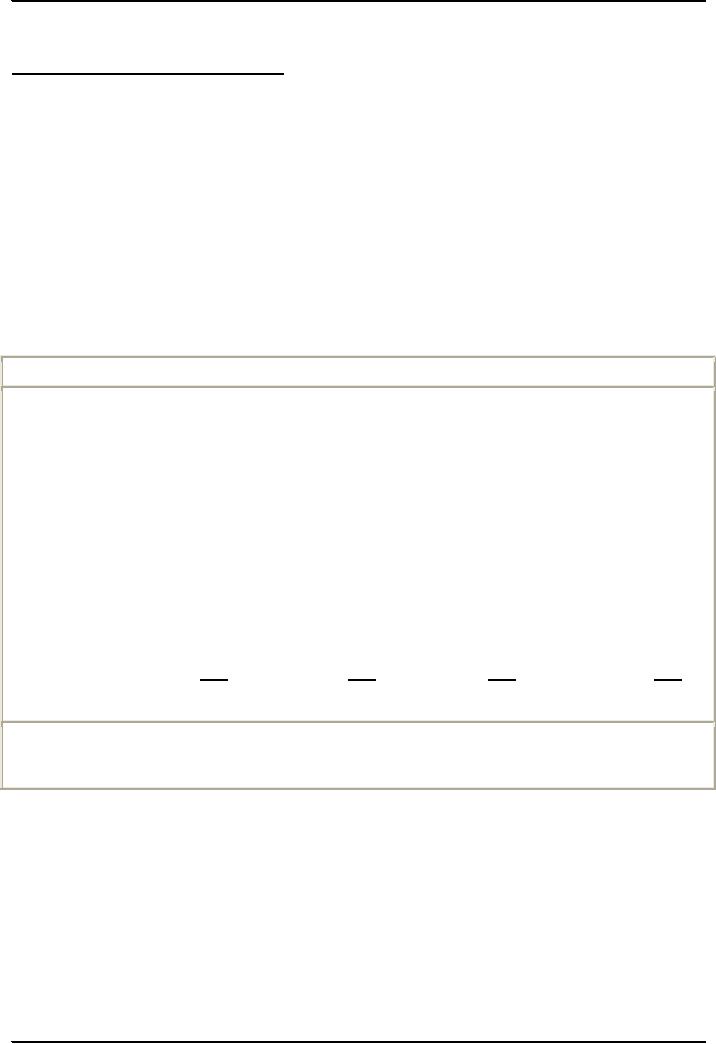

A

sample Competitive Profile

Matrix is provided in Table. In this

example, advertising and global

expansion

are

the most important critical success

factors, as indicated by a weight of 0.20.

Avon's and L'Oreal's

product

quality is superior, as evidenced by a

rating of 4; L'Oreal's "financial

position" is good, as indicated

by

a rating of 3; Procter & Gamble is the

weakest firm overall, as indicated by a

total weighted score of

2.80.

A

Competitive Profile Matrix

AVON

L'OREAL

PROCTER&GAMBLE

CRITICAL

SUCCESS

WEIGHT

RATING SCORE RATING SCORE

RATING

SCORE

FACTORS

Advertising

0.20

1

0.20

4

0.80

3

0.60

Product

Quality

0.10

4

0.40

4

0.40

3

0.30

Price

Competitiveness

0.10

3

0.30

3

0.30

4

0.40

Management

0.10

4

0.40

3

0.30

3

0.30

Financial

Position

0.15

4

0.60

3

0.45

3

0.45

Customer

Loyalty

0.10

4

0.40

4

0.40

2

0.20

Global

Expansion

0.20

4

0.80

2

0.40

2

0.40

Market

Share

0.05

1

0.05

4

0.20

3

0.15

TOTAL

1.00

3.15

3.25

2.80

Note:

(1)

The ratings values are as

follows: 1 = major weakness, 2 = minor

weakness, 3 = minor strength, 4

=

major

strength. (2) As indicated by the total

weighted score of 2.8, Competitor 3 is

weakest. (3) Only

eight

critical

success factors are included

for simplicity; this is too few in

actuality.

Other

than the critical success factors

listed in the example CPM,

other factors often included in

this

analysis

include breadth of product line, effectiveness of

sales distribution, proprietary or patent

advantages,

location

of facilities, production capacity and

efficiency, experience, union relations,

technological

advantages,

and e-commerce

expertise.

A

word on interpretation: Just

because one firm receives a

3.2 rating and another

receives a 2.8 rating in

a

Competitive

Profile Matrix, it does not

follow that the first firm

is 20 percent better than the

second.

Numbers

reveal the relative strength of firms,

but their implied precision

is an illusion. Numbers are

not

magic.

The aim is not to arrive at a

single number but rather to assimilate

and evaluate information in

a

meaningful

way that aids in decision

making.

46

Table of Contents:

- NATURE OF STRATEGIC MANAGEMENT:Interpretation, Strategy evaluation

- KEY TERMS IN STRATEGIC MANAGEMENT:Adapting to change, Mission Statements

- INTERNAL FACTORS & LONG TERM GOALS:Strategies, Annual Objectives

- BENEFITS OF STRATEGIC MANAGEMENT:Non- financial Benefits, Nature of global competition

- COMPREHENSIVE STRATEGIC MODEL:Mission statement, Narrow Mission:

- CHARACTERISTICS OF A MISSION STATEMENT:A Declaration of Attitude

- EXTERNAL ASSESSMENT:The Nature of an External Audit, Economic Forces

- KEY EXTERNAL FACTORS:Economic Forces, Trends for the 2000ís USA

- EXTERNAL ASSESSMENT (KEY EXTERNAL FACTORS):Political, Governmental, and Legal Forces

- TECHNOLOGICAL FORCES:Technology-based issues

- INDUSTRY ANALYSIS:Global challenge, The Competitive Profile Matrix (CPM)

- IFE MATRIX:The Internal Factor Evaluation (IFE) Matrix, Internal Audit

- FUNCTIONS OF MANAGEMENT:Planning, Organizing, Motivating, Staffing

- FUNCTIONS OF MANAGEMENT:Customer Analysis, Product and Service Planning, Pricing

- INTERNAL ASSESSMENT (FINANCE/ACCOUNTING):Basic Types of Financial Ratios

- ANALYTICAL TOOLS:Research and Development, The functional support role

- THE INTERNAL FACTOR EVALUATION (IFE) MATRIX:Explanation

- TYPES OF STRATEGIES:The Nature of Long-Term Objectives, Integration Strategies

- TYPES OF STRATEGIES:Horizontal Integration, Michael Porterís Generic Strategies

- TYPES OF STRATEGIES:Intensive Strategies, Market Development, Product Development

- TYPES OF STRATEGIES:Diversification Strategies, Conglomerate Diversification

- TYPES OF STRATEGIES:Guidelines for Divestiture, Guidelines for Liquidation

- STRATEGY-FORMULATION FRAMEWORK:A Comprehensive Strategy-Formulation Framework

- THREATS-OPPORTUNITIES-WEAKNESSES-STRENGTHS (TOWS) MATRIX:WT Strategies

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- BOSTON CONSULTING GROUP (BCG) MATRIX:Cash cows, Question marks

- BOSTON CONSULTING GROUP (BCG) MATRIX:Steps for the development of IE matrix

- GRAND STRATEGY MATRIX:RAPID MARKET GROWTH, SLOW MARKET GROWTH

- GRAND STRATEGY MATRIX:Preparation of matrix, Key External Factors

- THE NATURE OF STRATEGY IMPLEMENTATION:Management Perspectives, The SMART criteria

- RESOURCE ALLOCATION

- ORGANIZATIONAL STRUCTURE:Divisional Structure, The Matrix Structure

- RESTRUCTURING:Characteristics, Results, Reengineering

- PRODUCTION/OPERATIONS CONCERNS WHEN IMPLEMENTING STRATEGIES:Philosophy

- MARKET SEGMENTATION:Demographic Segmentation, Behavioralistic Segmentation

- MARKET SEGMENTATION:Product Decisions, Distribution (Place) Decisions, Product Positioning

- FINANCE/ACCOUNTING ISSUES:DEBIT, USES OF PRO FORMA STATEMENTS

- RESEARCH AND DEVELOPMENT ISSUES

- STRATEGY REVIEW, EVALUATION AND CONTROL:Evaluation, The threat of new entrants

- PORTER SUPPLY CHAIN MODEL:The activities of the Value Chain, Support activities

- STRATEGY EVALUATION:Consistency, The process of evaluating Strategies

- REVIEWING BASES OF STRATEGY:Measuring Organizational Performance

- MEASURING ORGANIZATIONAL PERFORMANCE

- CHARACTERISTICS OF AN EFFECTIVE EVALUATION SYSTEM:Contingency Planning