|

GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts |

| << AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS |

| GOVERNMENT DEBT (Continued…):Starting with too little capital, >> |

Macroeconomics

ECO 403

VU

LESSON

35

GOVERNMENT

DEBT

Government

debt and the annual

budget deficit

·

When a

government spends more than

it collects in taxes, it borrows

from the private

sector

to finance the budget

deficit.

·

The

government

debt is an

accumulation of all past

annual deficits.

Components

of Domestic Debt

·

Permanent

Debt

Market

Loans

Federal

Government Bonds

Income

tax Bonds

National

Funds Bonds

Federal

investment Bonds

Prize

Bonds

·

Floating

Debt

Treasury

Bills

Market

Treasury Bills

·

Unfunded

Debts

Savings or

Deposit Certificates

Savings

Account

Postal

Life insurance

GP

Fund

Domestic

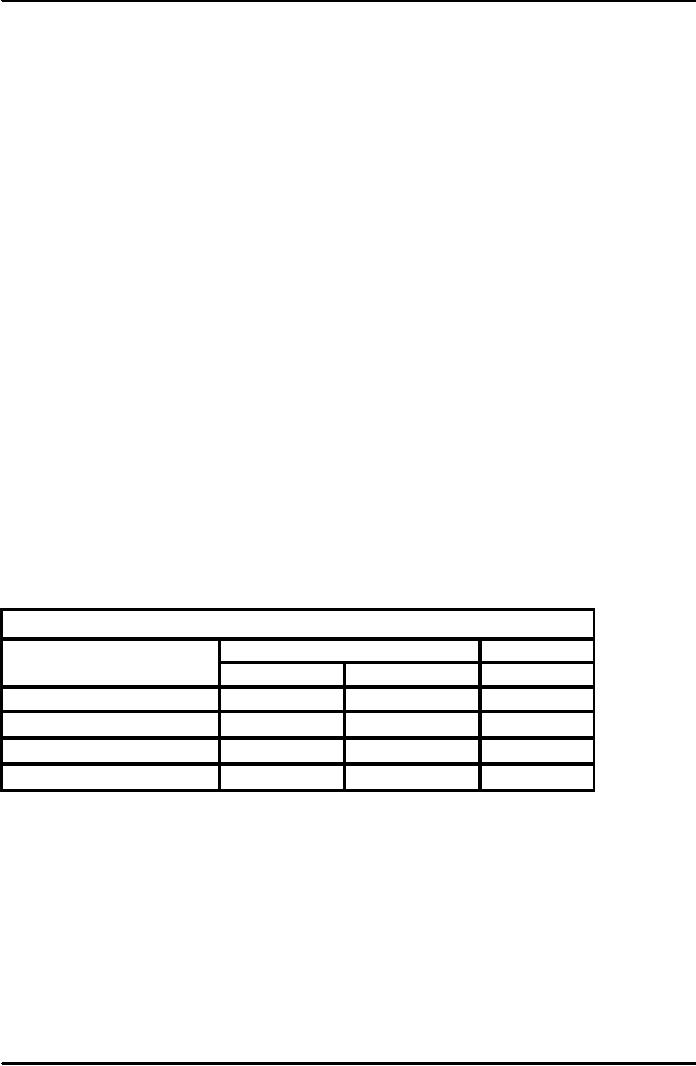

Debt Outstanding

million

rupees

STOCK

Flow

up to

30-Jun-04

31-Jan-05

31-Jan-05

A:Permanent

Debt

536,800

512,956

(23,844)

B:Floating

Debt

542,943

611,648

68,704

C:Unfunded

Debt

899,215

890,474

(8,741)

Total

(A + B + C)

1,978,958

2,015,078

36,120

163

Macroeconomics

ECO 403

VU

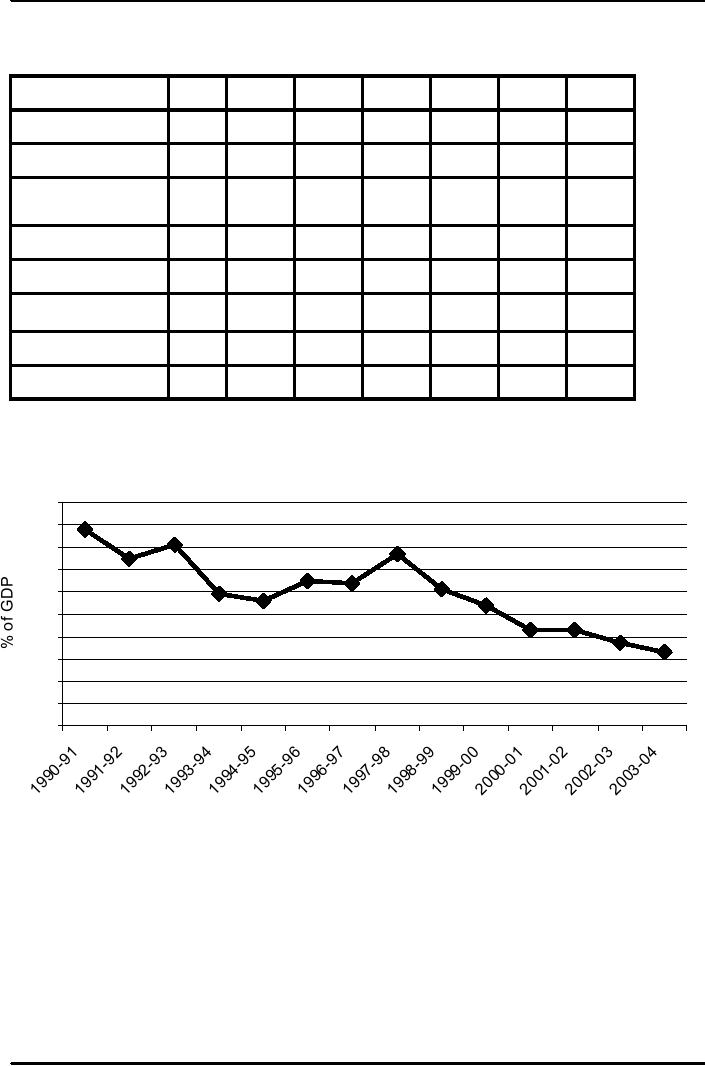

Trends

in Public Debt

Rs.

Billions

End

June

1990

1995

2000

2001

2002

2003

2004

Debt

payable in Rs

373.6

789.7

1575.9

1728.0

1715.2

1853.7

1921.4

%

of GDP 42.8

42.3

41.5

41.5

39.1

38.4

35.2

Debt

payable in

427.6

872.5

1670.4

2025.8

1984.1

1891.3

1927.1

Forex

%

of GDP 48.9

46.8

44.0

48.6

45.1

39.2

35.3

Total

Public Debt

801.2

1662.2

3246.4

3753.8

3699.3

3745.0

3848.5

Grants

33.4

40.5

83.1

114.2

42.6

Net

Public Debt

801.2

1662.2

3213.0

3713.3

3616.2

3630.8

3805.9

%

of GDP 91.7

89.1

84.7

89.2

82.2

75.3

69.7

Source:

Debt office, Ministry of

Finance

Budget

Deficit of Pakistan

(as

percentage of GDP)

10

9

8

7

6

5

4

3

2

1

0

Problems

in Measurement

Govt.

Budget Deficit = Govt.

Spending Govt.

Revenue

=

Amount of new debt

·

A

meaningful deficit...

Modifies

the real value of

outstanding public debt to

reflect current

inflation.

Subtracts

govt. assets from govt.

debt.

Includes

hidden liabilities that

currently escape detection in

the accounting

system.

Calculates a

cyclically-adjusted budget

deficit

164

Macroeconomics

ECO 403

VU

Inflation

·

Almost

all economists agree that

the government's indebtness

should be measured in

real

terms,

not in nominal terms. The

measured deficit should

equal the change in

the

government's

real debt, not the

change in its nominal

debt

·

However,

the commonly measured budget

deficit does not correct

for inflation

·

An

example

Suppose the

real government debt is not

changing. In other words, in

real terms, the

budget

is balanced

In this case,

the nominal debt must be

rising at the rate of

inflation. i.e.

ΔD / D = š

Where

š

is

the inflation rate and D is

the stock of government

debt

This

implies

ΔD = š

D

·

So

by looking at the change in

nominal debt ΔD, a budget

deficit of šD can be

reported

·

Hence

most economists believe that

the reported budget deficit

is overstated by the

amount

šD

·

Another

perspective

Govt.

budget deficit = govt.

Expenditure Govt.

Revenues

For

correct measurement of budget

deficit, the government

expenditure should

include

only

the real interest paid on

the debt (rD), not

the nominal interest paid

(iD)

Since

ir=š

Budget

deficit is overstated by šD

·

Example:

In

1979

Budget

deficit = $28

billions

š

=

8.6 %

Government

debt = $495 billion

Budget

Deficit overstated, šD = 0.086 x

495

=

$43 billion

So,

$28

- $43= $ 15 billion

surplus

Capital

Assets

·

An

accurate assessment of government's

budget deficit requires

accounting for the

govt.'s

assets

as well as liabilities

·

Particularly,

when measuring govt.'s

overall indebtness, we should

subtract government

assets

from government debt.

So

Govt.

budget deficit = change in

debt change in

assets

·

Individuals

and firms treat assets

and liabilities

symmetrically

·

Borrowing

to buy a house does not

amount to budget deficit,

because the increase

in

assets

(house) is offset by increase in

debt (lease rent) and

thus, no change in net

wealth

165

Macroeconomics

ECO 403

VU

·

A

budget procedure that

accounts for assets as well

liabilities is called capital

budgeting,

because

it takes into account the

changes in capital.

·

For

Example

The

government sells some of its

land or buildings and uses

the proceeds to reduce

the

budget

deficit

·

Under current

budget procedure, the

reported deficit would be

lower

·

Under capital

budgeting, reduction in debt

would be offset by a reduction in

assets

Similarly,

government borrowings to finance

purchase of capital assets

would not raise

budget

deficit

·

Problem

with capital

Budgeting

It is hard to

decide which government

expenditures should count as

capital

expenditures.

Uncounted

Liabilities

·

Measuring

budget deficit may be

misleading because it excludes

some govt.

liabilities.

Pension of

Govt. workers

Social security

system

·

Although

social security liabilities

can be differentiated from

government debt, yet

the

government

can always choose not to

repay all of its

debt.

The

Business Cycle

·

Changes

occur automatically in response to a

fluctuating economy.

·

Example:

Recession

Incomes

⇒ Personal

Taxes

Profits

⇒ Corporate

Taxes

Number of

needy persons ⇒

G

Budget

Deficit Increases

·

These

automatic changes are not

errors in measurement since

government truly borrows

in

such

situations.

·

But

this makes it difficult to

use deficit to monitor

changes in fiscal policy.

i.e the deficit

can

either

fall or rise either

because

Government

has changed its policy

or

Economy

has changed direction

·

Cyclically

adjusted (full employment)

budget deficit reflects

policy changes but not

the

current

stage of the business

cycle

166

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand