|

Cost

& Management Accounting

(MGT-402)

VU

LESSON#

3

FINANCIAL

STATEMENTS

Purpose

of preparing financial

statements

Financial

statements are prepared to demonstrate

financial results to the users of

financial

information.

These are the reports, which

are prepared by the

accounting department and

are

used

by the different people

inclusive of the

management.

According

to IASB framework:

"Financial

statements exhibit its users

the financial position,

financial performance, and

cash

inflow

and outflow analysis of an

entity."

Components

of Financial Statements

According

to IASB framework there are

five components of financial

statements:

Balance

Sheet:

Statement

of financial position at a given point

in

time.

Income

Statement:

Incomes

minus expenses for a given

time period

ending

at a specified date.

Statement

of changes in Equity:

Also

known as Statement of Retained Earnings

or

Equity

Statement.

Cash

Flows Statement:

Summarizes

inflows and outflows of cash

and cash

equivalents

for a given time period ending at

a

specified

date.

Notes

(to the accounts):

Includes

accounting policies, disclosures

and other

explanatory

information.

It

is not possible for all

the business entities to prepare

all of the components of the

financial

statements,

it depends upon the size,

nature and statutory requirements of

each of the entities

that

whether all components are

to be prepared or not.

For

example a small business entity

(like a washer man) does

not need to prepare statement

of

changes

in equity or notes to the accounts as the

size of information is very

little and not

complex

Financial

statements prepared by the Cost

Accountant

Cost

accounting department prepares

reports that help the

accounting department in preparing

final

accounts, these include;

·

Cost

of goods manufactured statement

·

Cost

of goods sold statement

Both

of the statements represent

production cost function or

the function of expenses

that are

incurred

to make the goods or

services available for sale.

It depends upon the form of

the

business

entity whether what should

be disclosed in these statements

and what should be

the

extent

of the details to be given into

these statements.

Forms

of business entities

Manufacturing

Entities

Manufacturing

entities purchase materials and

components and convert them

into finished

goods.

15

Cost

& Management Accounting

(MGT-402)

VU

Costing

department of these entities works

very much efficiently, a complete

cost accounting

system

is followed in manufacturing concerns in

which procedures of cost

accumulation,

methods

of product costing, process of calculating

per unit cost and

determining the cost

of

inventories

are defined.

Trading

Entities

Trading

entities purchase and then

sell tangible products without changing

their basic form.

Costing

department of these entities is not

involved in that much minute

calculations and

procedures.

It simply has to keep

records of the cost of goods

purchased and cost of

inventory.

Servicing

Entities

Servicing

entities provide services or intangible

products to their customers.

Costing

department of these entities is also

concerned with calculation of the

cost of service

provided.

Inventory of service is also determined

in this type of concerns.

Inventory

It

is the cost held in material &

supplies, work in process

and finished goods that

will provide

economic

benefits in future, it is also known as

stock.

Adjustment

for inventories is pivotal in

calculation of cost of goods sold.

The basic reason

for

its

adjustment is that profit

and loss account is prepared

on the basis of accrual

concept.

Adjustments

of opening and closing inventories in the

cost of production (for

manufacturing

entities),

cost of purchases (for

trading entities) is essential to match

the cost with its

revenue.

For

manufacturing entities inventories are

classified into three

categories:

1.

Material and supplies

inventory

2.

Work in process

inventory

3.

Finished goods inventory

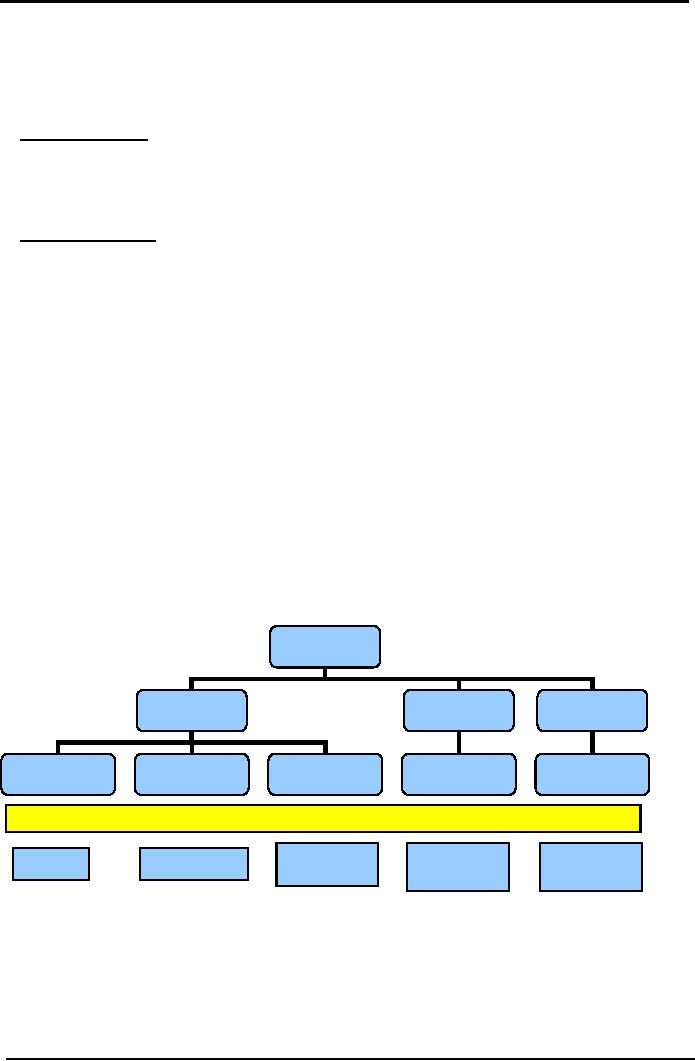

Following

is a self explanatory chart for

different categories of

inventories.

Inventory

Manufacturing

Trading

Services

Material

& supplies

Work

In Process

Finish

Goods

Purchased

Goods

Work

In Process

Inventory

Inventory

Inventory

Inventory

Inventory

LOCATIONS

Godown/

Showroom/

Workplace/

Store

Work-shop

Warehouse

Godown

Office

16

Cost

& Management Accounting

(MGT-402)

VU

Standard

format of the cost of goods

sold statement:

Entity

Name

Cost

of Goods Sold statement

for

the year ended_______

Rupees

Direct

Material Consumed

Opening

inventory

10,000

Add

Net Purchases

100,000

Material

available for use

110,000

Less

Closing inventory

20,000

Direct

Material used

90,000

Add

Direct labor

60,000

Prime

cost

150,000

Add

Factory overhead Cost

80,000

Total

factory cost

230,000

Add

Opening Work in

process

30,000

Cost

of good to be manufactured

260,000

Less

Closing Work in process

50,000

Cost

of good manufactured

210,000

Add

Opening finish goods

100,000

Cost

of good to be sold

310,000

Less

closing finish goods

10,000

Cost

of good to sold

300,000

(Important

tip for students)

To

prepare cost of goods sold statement,

firstly one needs to collect six

elements. Three of

these

belong

to the cost and three belong

to the inventory.

Six

Elements of Cost of Goods

Manufactured and Sold

Statement

Cost

Inventory

Material

& Supplies

Material

& Supplies

Labor

Work

in Process

FOH

Finished

goods

Following

is the stepwise calculation of

the information that is produced in

the cost of goods

sold

statement:

Material

Consumed

Rupees

Direct

material opening inventory

10,000

Add

Net purchases

100,000

Material

available for use

110,000

Less

raw material closing stock

20,000

90,000

Note:

Amount of net purchases comes up with the help of

following calculation:

Purchases

of direct material

Less

trade discounts and

rebates

Less

purchases returns

Add

carriage inward

17

Cost

& Management Accounting

(MGT-402)

VU

Add

other receiving and handling

cost

Prime

Cost

Direct

material Consumed

90,000

Add

Direct labor

60,000

150,000

Total

Factory Cost

Prime

cost

150,000

Add

Factory Overhead

Indirect

material

30,000

Indirect

labor

20,000

Electricity

bill

15,000

Rent

of factory

10,000

Depreciation

of plant

5,000

80,000

230,000

Note:

Factory overhead cost includes all

production costs except direct material,

direct labor and other

direct costs,

it

is completely indirect production

cost.

PRACTICE

QUESTIONS

Q.

1

Following

data relates to Zain &

Co,

Rupees

Opening

stock of raw material

80,000

Opening

stock of work in process

51,000

Purchases

of raw material

230,000

Direct

labor cost

94,000

Factory

overheads

79,000

Closing

stock of raw material

66,000

Closing

stock of work in process

44,000

Required:

1)

Prime cost

2)

Total Factory

cost

SOLUTION:

1)

Prime cost:

Rupees

Opening

stock of raw material

80,000

Add:

Purchases of raw material

230,000

Less:

Closing stock of raw material

(66,000)

Cost

of raw material consumed

244,000

Add:

Direct labor cost

94,000

Prime

cost/Direct cost

338,000

2)

Total Factory Cost:

Prime

cost

338,000

Add:

Factory overheads

76,000

Total

Manufacturing cost/Factory

cost

407,000

18

Cost

& Management Accounting

(MGT-402)

VU

Q.

2

Usama

manufacturing company submits the

following information on June

30,2005.

Raw

material inventory, July 1,

2004

25,000

Purchases

125,000

Power,

heat and light

3,500

Indirect

material purchased and consumed

5,500

Administrative

expenses

24,000

Depreciation

of plant

18,000

Purchases

returns

7,000

Fuel

expenses

29,000

Depreciation

of building

8000

Carriage

inwards

3,500

Bad

debts

2,500

Indirect

labor

4000

Other

manufacturing expenses

15,000

Raw

materials inventory, June

30,2005

26,000

Required:

1)Cost

of raw material

consumed.

2)

Factory overhead cost

SOLUTION:

1)

Cost

of raw material

consumed:

Raw

materials inventory, July 1

2004

25,000

Add:

purchases of materials

125,000

Less:

purchase returns

(7,000)

118,000

Add:

carriage inwards

3,500

Less:

materials inventory, June

30,2005

(26,000)

Cost

of materials consumed

120,500

3)

Factory

overhead cost:

Power,

heat and light

3,500

Indirect

material purchased and consumed

5,500

Depreciation

of plant

18,000

Indirect

labor

4,000

Fuel

expenses

29,000

Other

manufacturing expenses

15,000

Total

Factory cost

75,000

Q.

3 Following

data relates to Qasim &

Co,

Opening

stock of raw material

52,000

Opening

stock of work in process

46,000

Purchases

of raw material

255,000

Direct

labor cost

85,000

Factory

overheads

76,000

Closing

stock of raw material

61,000

Closing

stock of work in process

36,000

Required:

Prepare

a statement showing total manufacturing

cost.

19

Cost

& Management Accounting

(MGT-402)

VU

SOLUTION:

Qasim

& Co.

Cost

of goods manufactured statement

Opening

stock of raw material

52,000

Add:

Purchases of raw material

255,000

Less:

Closing stock of raw material

(61,000)

Cost

of raw material consumed

246,000

Add:

Direct labor cost

85,000

Prime

cost/Direct cost

331,000

Add:

Factory overheads

76,000

Manufacturing

cost/Factory cost

407,000

Q.

4

FNS

manufacturing company submits the

following information on June

30,2005.

Sales

for the year

450,000

Raw

material inventory, July

1,2004

15,000

Finished

goods inventory, July

1,2004

70,000

Purchases

120,000

Direct

labor

65,000

Power,

heat and light

2,500

Indirect

material purchased and consumed

4,500

Administrative

expenses

21,000

Depreciation

of plant

14,000

Selling

expenses

25,000

Depreciation

of building

7,000

Bad

debts

1,500

Indirect

labor

3,000

Other

manufacturing expenses

10,000

Work

in process, July

1,2004

14,000

Work

in process, June

30,2005

19,000

Raw

materials inventory, June

30,2005

21,000

Finished

goods inventory, June

30,2005

60,000

Required

2)

Calculate

cost of raw-material consumed

3)

Calculate

prime cost

4)

Calculate

total factory cost

20

Cost

& Management Accounting

(MGT-402)

VU

SOLUTION:

FNS

manufacturing company

Cost

of goods manufactured statement

For

the year ended June 30,

2005

Raw

materials inventory, July 1

2004

15,000

Add:

purchases of materials

120,000

Less:

materials inventory, June

30,2005

(21,000)

Cost

of materials consumed

114,000

Add:

direct labor

65,000

Prime

cost/Direct cost

179,000

Factory

overheads:

Power,

heat and light

2,500

Indirect

material purchased and consumed

4,500

Depreciation

of plant

14,000

Depreciation

of plant

3,000

Other

manufacturing expenses

10,000

34,000

Total

Manufacturing cost/Factory

cost

213,000

21

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS