|

Cost

& Management Accounting

(MGT-402)

VU

LESSON#

17

FACTORY

OVERHEAD COST

Overhead

Absorption Rate

After

preparing estimates of factory overhead

for production departments, the

next step is to

select

a

factory overhead absorption

base for each production

department. The base to be

selected for

this

purpose should be the principal

cost deriver of factory overhead of

the department.

Cost

Driver is defined as a measure of

activity the magnitude of which

influences if magnitude of

cost

of relevant cost objectives. In other

words Factory overhead application

base should be a

measure

of activity which has causal

relation with incurrence of

factory overhead.

The

most simple and direct

measure of activity of a manufacturing

concern is number of

units

produced.

It can be safely regarded as

the best cost driver

for the purpose of factory

overhead

absorption

in such situations where there is a mass

production of homogeneous units (i.e.

process

costing

industries) or where a few products are

produced in batches (i.e. batch costing

industries).

In

process costing industries like sugar, cement

etc. Kg. or a bag may be

regarded as unit of

output;

a

bottler may use a bottle or

a liter as a unit of output. In

bate costing industries the activity

is

measured

"in equivalent number of

units produced.

For

example, a chip-board factory

produces three grades of chip board

say A, B, and C and a

square

foot is used as the unit to

measure out put. Technical

estimates reveal that

factory overhead

cost

of one square foot of grade B

and grade C is respectively one-half

and one-fourth of grade

A.

In

other words proportion of

factory overhead cost of one

square foot of chip board among

the

three

grades is 4:2:1. Consequently,

for the purpose of factory

overhead absorption one

square

foot

of grade A, B, and C shall be regarded as

equivalent to 4 Sq, Ft. 2

Sq, Ft. and 1 Sq.

Ft.

respectively.

On

the other hand in job

costing industries each unit of output is

quite different from the

other.

For

example, a furniture manufacturer

produces chairs (study

chairs, office chairs, easy

chairs,

dining

chairs), tables. (study

tables. office tables,

dining tables, dressing

tables), beds (doubly

beds.

single

beds) and many other

items, each according to

specifications of customers. In such a

situation

because of the dissimilarities, a

unit of output can neither

be used to measure the

activity

nor

as base for factory overhead

absorption. Therefore, some

other common denominator

should

be

adopted to measure the

activity and as base for

applying factory overhead to the

products. Basis

generally

selected for this purpose

are listed below in descending

order of frequency of

use:

1.

Direct labor cost;

2.

Direct labor hours;

3.

Machine hours;

4.

Direct materials

cost;

5.

Prime cost.

No

hard and fast rule regarding

selection of the absorption

base can be prescribed.

However, two

guiding

principles in this respect are:

(i) the selected base

should give accurate results,

and (ii) cost

of

operating the base should

not be greater than the

benefit derived from

accuracy.

Many

times we find that factory

overhead cost fluctuates

with time spent on the

products or Jobs,

therefore,

direct labor hours and machine

hours are more suitable

cost derivers. But use of

direct

labor

hours or machine hours as factory

overhead absorption base

requires additional cost

and

clerical

efforts to collect data of

time spent on each job,

Consequently, for the sake

of

convenience,

management may decide to adopt direct

labor cost as base for

applying factory

overhead,

provided that it also gives

approximately correct results. Use of

direct materials cost as

factory

overhead absorption base is

rarely recommended because prices of

materials are subject to

violent

fluctuation as well as direct materials

cost seldom represents a

cost driver of

factory

overhead.

Same is the case with

prime cost as a base for

factory overhead

absorption.

115

Cost

& Management Accounting

(MGT-402)

VU

PRACTICE

QUESTION

Units

of output as the Absorption

Base.

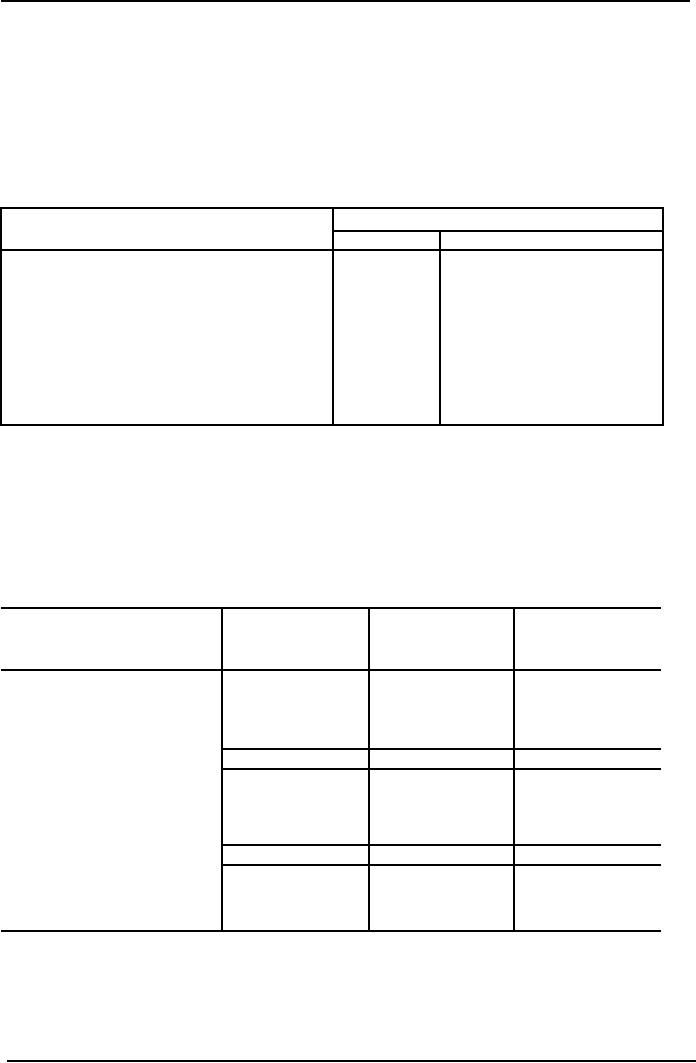

Babul

Bottlers produces "Bubble

Drink" which is filled in

bottles of three sizes i.e.

25 ml. 1 liter

and

5 liters. The firm assigns

factory overhead cost to its

products by using a predetermined

factory

overhead absorption rate

calculated on the basis of

units of output. Technical

studies reveal

that

proportion of factory overhead

incurred on one bottle of each

size mentioned above is

1:2:4

respectively.

Estimated production during the

coming year is as

follow:

Bottle

Size

Production

250

ml.

80,000

bottles

1

liter

70,000

bottles

5

liter

20,000

bottles

Estimated

factory overhead cost for

the coming year is Rs

360.000

Required:

Calculate predetermined factory overhead

rate for each size of

bottle.

Solution:

Bottle

Estimated

Points

Estimated

Estimated

Estimated Predetermine

Size

output

Assigned

Total

FOH

Per

FOH

for FOH rate

per

Bottles

Points

Point

Each

Size

Bottle

Rs.

Rs

Rs.

250

ml.

80,000

1

80,000

1.20

96,000

1.20

1

liter

70,000

2

140,000

1.20

168,000

2.40

5

liter

20,000

4

80,000

1.20

96,000

4.80

300,000

360,000

Notes:

Estimated

FOH per point= Total

FOH/Total point = Rs.

360.000/300.000 point

Estimated

FOH for each size

Predetermined FOH rate per

bottle=Rs. 1.20 = Estimated FOH

per

point

or Estimated points of each size =

Estimated FOH for each size/Estimated

output of each

size

Q.

2

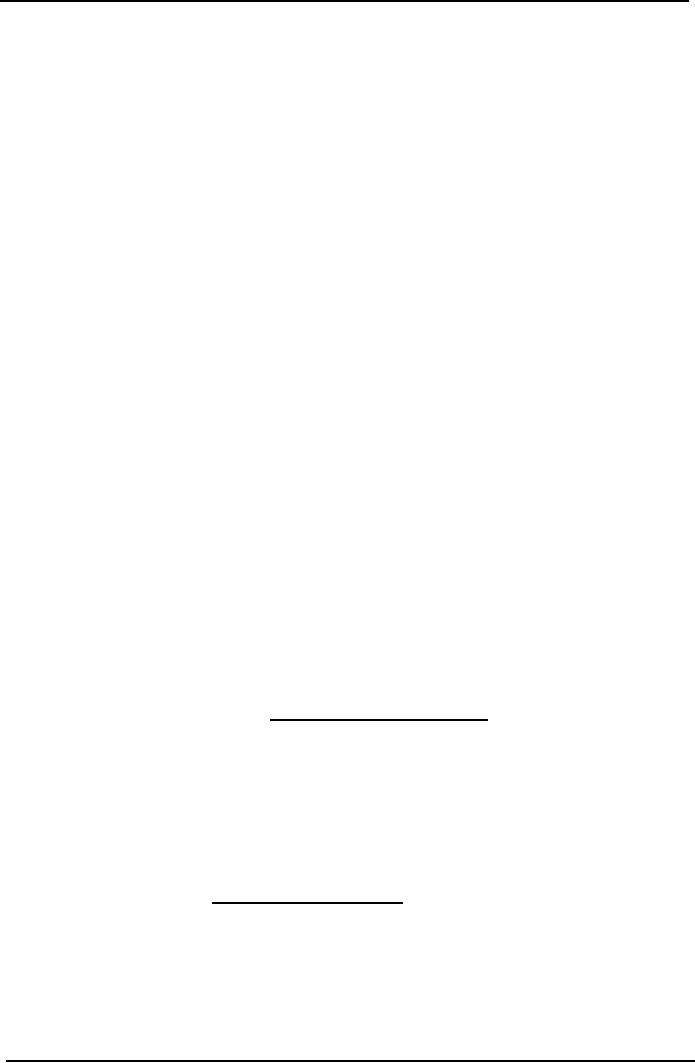

Following

figures are presented to you by

Alfa Manufacturing

Company.

Items

Budgeted

Figures for

Actual

Figures for operations

operations

During 2006

during

January 2006

Dept

A

Dept

B

Dept

A

Dept

B

Direct

materials (Rs )

Direct

6,000,000

2,400,000

50,000

250,000

labor

(Rs.)

1,500,000

1,200,000

145,000

105,000

Factory

overhead (Rs.)

1,200,000

1,800,000

14,000

9,500

Direct

labor hours

150,000

100,000

26,000

28,000

Machine

hours

300,000

360,000

Required:

116

Cost

& Management Accounting

(MGT-402)

VU

(i)

Calculate predetermined factory overhead

absorption rates for the

departments using five

different

bases. (Present your answer

by enlisting the rates in

descending order of approximate

frequency

of their use).

(ii)

Calculate total product cost

of output during January

2006 under all of the

three bases,

Solution:

(i)

Predetermined

Factory Overhead Absorption

Rates:

Predetermined

FOH Absorption Rates

FOH

Absorption Bases

Department

Department B

(1)

Direct labor cost

base

80%

150%

(2)

Direct labor hours

base

Rs.8

Rs

18

(3)

Machine hours base

Rs.4

Rs.

5

(4)

Direct materials cost

base

20%

75%

(5)

Prime cost base

16%

50%

NOTE:

FOH

absorption rate =

Estimated

FOH for the year x 100

(if base is in Rs)

Estimated

base for the

year

Total

Product Cost for January

2006

(1)

(2)

(3)

Particulars

Direct

Labor

Direct

Labor

Machine

Hours

Cost

Base

Hours

Base

Base

Department

A Direct

Rs.

450,000

Rs.

450,000

Rs.

450,000

materials

Direct

labor

145,000

145,000

145,000

Factory

overhead applied

116,000

112,000

104,000

Total

Department B: Direct

711,000

707,000

699,000

250,000

250,000

250,000

materials

Direct

Labor

105,000

105,000

105,000

Factory

overhead applied

157,500

171,000

140,000

Total

512,500

526,000

495,000

1,223,500

1,233,000

Total

product

cost

NOTES:

Factory

Overhead Applied:

Department

A:

(1)

Rs 145,000 x 80%

=

Rs. 116,000

117

Cost

& Management Accounting

(MGT-402)

VU

(2)

14,000 hours x Rs 8

=

Rs. 112,000

(3)

26,000 hours x Rs. 4

=

Rs, 104,000

Department

B:

(1)

Rs, 105.000 x 150%= Rs,

157,500

(2)

9.500 hours x Rs. 18

=

Rs. 171,000

(3)

28,000 hours x Rs. 5

=

Rs. 140,000

Selection

of Capacity Level

Capacity

Level means ability to produce.

The term is synonymous as

Activity Level or

Volume.

Industries

producing homogeneous units may

express their capacity level

in terms of units of

output,

whereas, Job costing industries may

measure it in terms of direct labor cost,

direct labor

hours,

machine hours etc.

For

the purpose of calculating predetermined factor

overhead absorption rate it is

necessary to

select

an appropriate capacity level at which

the cost and the

cost driver should be

estimated.

In

cost accounting literature we

find reference to following

types of capacity

levels.

Theoretical

Capacity

It

is the maximum capacity

level that could be achieved

if there

were

100% utilization of time.

This capacity level can

never be achieved because of

unavoidable

interruptions

e.g. Fridays, holidays, repair

and maintenance, machine breakdown,

electricity

breakdown,

shortage of materials, lack of

demand etc. Theoretical

capacity is the starting

point for

measurement

of practical capacity.

Practical

Capacity It is

the maximum capacity level

that can he attained under

efficient

working

conditions. When loss of

time due to unavoidable interruptions as

mentioned above, is

deducted

from theoretical capacity the remainder

is practical capacity.

Expected/Normal

Capacity

It

is the capacity level

expected to be attained during

the

accounting,

year. Expected/normal capacity is

dependent of market demand for the

products. It

may

be equal to or less than the

practical capacity.

Most

of the experts make a slight

difference between expected

and normal capacity. They

are of

the

opinion that normal capacity

is the average of expected

capacity over a number of

years. This

average

is used to smooth the

seasonal, cyclical and trend variations

over the years.

Selection

of an appropriate capacity level is

necessary because:

(1)

Fixed

factory overhead absorption

rate is inversely related

with capacity level i.e.

the fixed

rate

is higher at a lower capacity

level and it is lower at a

higher capacity

level,

(2)

Amount

of unabsorbed fixed factory

overhead at the end of an

accounting period is used

to

denote cost of failing to achieve

the target production i.e.

cost of unutilized capacity

(the idle

capacity

variance to be discussed later).

Practical

capacity is seldom selected

for the purpose of budgeting. It is

the expected/normal

capacity

that is used to budget or estimate

the costs. Long term

planning prospective advocates

selection

of normal capacity level.

However, on account of difficulties in

estimating with

reasonable

accuracy beyond one year.

expected actual capacity is

most commonly

adopted.

Following

practice question shows affects of

capacity level on factory

overhead, application rate

and

on the amount of unabsorbed

fixed factory

overhead.

118

Cost

& Management Accounting

(MGT-402)

VU

PRACTICE

QUESTION

At

beginning of the year 2006

Shahbaz & Co. estimated its

fixed factory overhead at

Rs. 350,000

and

variable factory overhead at

Rs. 500,000 for a normal

volume of 125,000 units.

Practical

volume

was estimated at 140,000

units per year. During

2006 the company could

produce only

100,000

units.

Required:

Compute each of the

following on the bases of

(i) Expected volume and (ii)

Practical

volume:

(a)

Predetermined factory overhead

application rate:

(b)

Amount of factory overhead

applied during 2006

and

Solution:

(a)

Predetermined Factory Overhead

Application Rate ;

Estimated

Factory Overhead

Estimated

Capacity Level

(i)

At normal capacity

(Rs.

350,000 Fixed + Rs 500,000 Variable) = Rs

6.80 per unit

125,000

units

(ii)

At practical capacity level

(Rs.

350,000 Fixed + Rs. 500,000 Variable) =

Rs 6.07 per unit

140,000

units

(b)

Factory

Overhead Applied During

2006:

Capacity

attained x Factory overhead application

rate at normal

capacity

(i)

Using the rate at expected

capacity

100.000

units x Rs 6.80 = Rs.

680,000

Blanket

Rate

A

blanket absorption rate is a

single rate of absorption

used throughout an organization's

production

facility and based upon its

total production costs and

activity.

The

use of a single blanket rate

makes the apportionment of

overhead costs unnecessary

since

the

total production costs are

to be used. How ever this is

not recommended for the

following

reasons:

·

It relies on a single activity

measure being appropriate for

the entire production

function.

·

It does not distinguish between

the miming costs of

particular activities or departments

when

absorbing

costs into cost

units.

Accounting

for Factory Overhead Cost

Factory

overhead cost includes indirect

materials cost, indirect

labor cost and other

indirect

manufacturing

costs.

Most

of the factory overhead cost

items are recorded

(identified) straight away as

factory overhead

cost;

these include some sort of

indirect material items, indirect

labor, electricity, insurance,

rent,

repair

etc. etc. Accounting entry

for these costs

is:

Factory

overhead control a/c

xxx

Bank/cash/accounts

payable a/c

xxx

Some

of the factory overhead cost

items are allocation or

transfer of cost from

another accounting

head.

Accounting entry for these

costs is:

Factory

overhead control a/c

xxx

Depreciation

a/c

xxx

Prepaid

rent a/c

xxx

Etc.

.

xxx

Applied

factory overhead is entered in

the work in process account. In

order to journalize

total

applied

factory overhead following

accounting entry is

passed:

119

Cost

& Management Accounting

(MGT-402)

VU

Work

in process control

a/c

xxx

Factory

overhead applied a/c

xxx

The

amounts are then posted to

relevant ledger accounts.

Actual

factory overhead continues to

accumulate on debit side of factory

overhead control

account

throughout the year and

applied factory overhead

cost on credit side of factory

overhead

applied

account. At the end of year

factory overhead applied

account is closed to factory

overhead

control

account by passing following

accounting entry:

Factory

overhead applied a/c

xxx

Factory

overhead control a/c

xxx

Actual

and applied overhead are

never equal. They could be

equal only when estimates of

factory

overhead

cost and the capacity

level prepared for calculating

the absorption rate are

100% correct.

In

practice it is impractical to achieve

this much accuracy. As a

result, after the close of

applied

account,

factory overhead control

account shows either a debit balance

representing under applied

factory

overhead or a credit balance representing

over applied factory

overhead.

Under

applied factory overhead

means that factory overhead

cost charged to production is

less

than

the actual factory overhead

and the cost of production

is understated.

On

the other hand over

applied factory overhead

means that factory overhead

charged to

production

is more than the actual

factory overhead and the

cost of production is

overstated.

This

under or over applied

balance is disposed off by adopting

anyone of the following

four

methods.

1.

Adjusting Cost of Entire

Production of the

Period.

This

is the most accurate method

and gives correct figures

for income determination and

for

balance

sheet. At the end of a year

total production of the year

stands divided into

a)

cost of goods sold,

b)

finished good inventory'

and

c)

work in process

inventory.

An

under or over absorbed

factory overhead means respectively

under or overstated cost

of

goods

sold, finished goods inventory

and work in. process

inventory. Therefore

mathematically

correct method is to adjust all of

these three accounts by

distributing under or

over

applied overhead to these accounts in

the proportion of their

respective balances.

Assume

that at the end of year

factory overhead control

account shows an over

applied

balance

of Rs. 100,000. Balances of

cost of goods sold, finished

goods and work in

process

control

accounts are Rs. 1,600,000

.Rs. 300,000 and Rs.

100,000 respectively. The over

applied

factory

overhead shall be disposed off by

passing following entry in

general journal.

Factory

overhead over-applied a/c

100,000

Cost

of goods sold a/c

80,000

Finished

goods a/c

15,000

Work

in process a/c

5,000

The

above entry closes factory

overhead control account and

reduces the balance of cost

of

goods

sold, finished goods, and

work in process control

accounts by the accounts by

which

these

are overstated. Had the

factory overhead cost under

absorbed, the above entry

would

have

been reversed.

1.

Closing the Variance to

Cost of Goods

Sold.

Posting

of under or over applied

factory overhead to the

subsidiary ledgers of finished

goods

and

work in process control accounts is a

tedious .job requiring much

clerical efforts

especially

in

job-order and batch costing industries,

Therefore, when the amount

of under or over

absorbed

factory' overhead is insignificant.

The cost accountants prefer to

close it only to cost

120

Cost

& Management Accounting

(MGT-402)

VU

of

goods sold. In this case the

entry to be passed in general

journal to dispose off an

over

applied

balance is as follow:

Factory

over head over-applied

a/c

xxx

Cost

of goods sold a/c

xxx

Obviously

the entry to dispose of an

under applied balance shall be

opposite to the above

entry.

This method though

theoretically not very

sound, is justified on the

ground of

convenience.

2.

Closing the Variance to

Income Statement.

Where

factory overhead variance is on

account of some abnormal

factors e.g. idle

capacity

caused

by strikes or lockouts, unlawful

spending, poor utilization of

production facilities,

mismanagement

in production etc. the

amount of variance is closed to

Income

Summary/Profit

and Loss Account. The

above noted factors result

in under absorption of

factory

overhead. The general

journal entry to dispose off

such under applied factory

overhead

is

as follow:

Income

summary/Profit & loss

a/c

xxx

Factory

overhead under-applied a/c

xxx

In

this case, cost of goods

sold at normal is deducted from

the net sales. The

resulting gross

profit

is termed as gross profit at normal.

Then from the gross

profit at normal amount

of

under

absorbed factory overhead is

deducted and the remainder is

called gross profit at

actual.

Alternatively

this amount of under

absorbed factory overhead

may also be deducted from

the

net

profit/income.

PRACTICE

QUESTION

City

Links Limited applies

factory overhead @ 60% of direct

labor cost. During the

year just

completed

following actual costs were

recorded:

Direct

labor cost

Rs.

580,000

Factory

overhead cost Rs.

428,000

At

the end of the year

following balances appear in

some of the control

accounts:

Cost

of goods sold

Rs.

1,750,000

Finished

goods

Rs.

500,000

Work

in process

Rs.

250,000

Required:

a)

Determine under or over

applied factory

overhead.

b)

Pass accounting entry to

close factory overhead

applied account at the end

of year.

c)

Pass accounting entries to

dispose off under or over

applied factory overhead in

following

cases:

i)

The variance is regarded as a

significant amount.

ii)

The variance is regarded as an

insignificant amount.

iii)

The variance is regarded as

cause by poor scheduling of production

and excessive

spending.

Solution:

(a)

Under or Over applied

Factory Overhead:

Actual

factory overhead

Rs.

428,000

Capacity

attained x application rate

Rs.

580,000 x 60%

348,000

Under

applied

80,000

(b)

Entry to Close Factory

Overhead Applied a/c:

Factory

overhead applied a/c

348,000

121

Cost

& Management Accounting

(MGT-402)

VU

Factory

overhead control a/c

348,000

Under

applied Factory overhead a/c

80,000

Factory

overhead control a/c

80,000

(c)

Entries to dispose off under

or over applied Factory

Overhead:

(i)

Cost

of goods sold a/c

56,000

Finished

goods a/c

16,000

Work

in process a/c

8,000

Factory

overhead under applied

a/c

80,000

Rs.

80,000

x

1,750

=Rs.

56,000

2,500

x

500

=Rs.

16,000

x

250

=Rs.

8,000

(ii)

Cost

of goods sold a/c

80,000

Factory

overhead under applied

a/c

80,000

(iii)

Income

summary a/c

80,000

Factory

overhead under applied

a/c

80,000

Factory

overhead variance means the

difference between actual

factory overhead incurred

and

factory

overhead applied during the

year. Under applied factory

overhead is regarded as an

unfavorable

sign because actual factory

overhead cost is greater

than the factory

overhead

absorbed

by the production, On the

other hand. Over applied

factory overhead is considered

as

favorable

sign because actual factory

overhead is less than the

factory overhead absorbed.

This

total

variance is analyzed to determine the

causes. The causes of

variance lie in the

following two

factors:

a)

The variance may be due to

the difference between capacity

level budgeted for

calculating

predetermined

factory overhead absorption

rate and the capacity

level actually attained

till

the

end of year: and

b)

The variance may be due to

the difference between factory

overhead budgeted for

capacity

attained

and the factory overhead

cost actually

incurred

If

the variance is caused by difference in

capacity i.e. the first

factor mentioned above, it is

called

Capacity

Variance or Volume

Variance.

On

the other hand, if the

variance is caused by difference in

budgeted and actual costs.

i.e. the

second

factor mentioned above, it is

called Budget Variance or

Spending

Variance

In

practice the total variance

is composed of both of these

two factors. The total

variance is

decomposed

into capacity variance and

budget variance in order to determine the

magnitude of

variance

caused by each of the two

factors listed above.

Capacity/Volume

Variance

Capacity

variance is on account of presence of

fixed factory overhead.

Predetermined factory

overhead

absorption rate is the sum

of fixed rate and variable

rate. We know that total

fixed

factory

overhead remains unchanged within a

designated range of activity

level and the fixed

rate

122

Cost

& Management Accounting

(MGT-402)

VU

changes

inversely with changes in

activity level Assume that

for an estimated activity

level of

50,000

machine hours budgeted factory

overhead is Rs. 150,000

which includes Rs 100.000 of

fixed

cost. The absorption rate

and its composition in this

case is as follow:

FOH

absorption rate:

Rs,

150,000/ 50.000 machine

hrs

=

Rs. 3 per machine hr.

The

fixed rate:

Rs.

100,000/50.000 machine hrs

=

Rs. 2 per machine hr.

The

variable rate:

Rs

3 per machine hr less Rs. 2

per machine hr = Rs. 1 per machine

hr.

It

is very easily understood

that Rs, 100.000 of fixed

factory overhead can be

absorbed only when

capacity

attained till the end of

year is 50,000 machine hours If

capacity attained is less

than the

budgeted

capacity it means an unfavorable

capacity variance, which

will be signified by unabsorbed

fixed

factory overhead. Assume

that the capacity attained

is 48,000 machine hours. At this

capacity

level

only Rs 96,000 of fixed

factory overhead is absorbed

(i.e. 48,000 hrs x Rs. 2)

and the under

absorbed

fixed cost of Rs 4,000(i.e.

Rs. 100,000 less Rs.

96,000) represents the

portion of factory

overhead

variance cause by unfavorable

capacity variance. Similarly, where

capacity attained is

more

than the budgeted capacity

it is a favorable capacity variance which

will be signified by over

absorbed

fixed factory overhead. In

other words capacity

variance can be computed by

multiplying

the

difference in capacity (budgeted and

attained) by the fixed rate.

The same result is obtained

by

taking.

the difference between

absorbed factory overhead

and budgeted factor*

overhead for

capacity

attained.

Budget/Spending

Variance

Budget

variance is the difference

between budgeted factory

overhead for capacity

attained and

actual

factory overhead incurred. It

represents either over-spending or

under-spending.

If

actual factory overhead is

more than the budgeted, it

is unfavorable budget variance. On

the

other

hand if actual factory

overhead is less than the

budgeted it is favorable budget

variance.

In

order to determine exact causes of budget

variance, the difference between

actual and budgeted

figures

of each item of factory

overhead is computed and

communicated to the responsible

person

for

the purpose of control. The

budget variance may be due to

fixed factory overhead items

or it

may

be due to the variable items

or the both.

Following

practice question explains the

computation and presentation of the

variance and its

analysis.

123

Cost

& Management Accounting

(MGT-402)

VU

PRACTICE

QUESTION

Shahzewaz

Associates prepared following

estimates for the year

2006.

Fixed

factory overhead

Variable

factory overhead

Direct

labor hours Actual results

for the year 19xx

were as follow:

Fixed

factory overhead

Rs.

450,000

Variable

factory overhead

Rs.

600,000

Direct

labor hours

200,000

Required:

Calculate

(i)

Total

factory overhead

variance.

(ii)

Capacity

variance.

(iii)

Budget

variance.

Solution:

(i)

Total

Factory Overhead

Variance

Actual

factory overhead

Fixed

FOH + Variable FOH

Rs.

450.000 + Rs. 680,000

Rs.

1,130,000

Absorbed

factory overhead

Capacity

attained x Absorption

rate

220,000

hours x Rs. 5.25

1,155,000

Over

applied

25,000

(ii)

Capacity

Variance

Absorbed

factory overhead (220,000 x

5.25)

Rs.

1.155.000

Budgeted

factory overhead for

capacity attained

Fixed

factory overhead + (Capacity

attained x Variable rate)

(Rs.

450,000 + 220,000 hours x

Rs. 3)

1,110,000

Favorable

45,000

(iii)

Budget

Variance

Budgeted

factory overhead for

capacity attained

Rs.

1,110,000

Actual

factory overhead

1,130,000

Unfavorable

20,000

Supporting

Calculations

Absorption

rate = (Rs 450.000 + Rs.

600,000)

200.000

direct labor hours

=

Rs. 5.25 per direct labor

hour

Variable

rate

=

Rs. 600.000

2,00,0000

direct labor hours

=

Rs. 3 per direct labor

hour

It

should be remembered here

that no definite conclusions can be

drawn only on the basis

of

factory

overhead variance analysis, as

presented above Analysis of factory

overhead variance is a

part

of whole process of variance

analysis whereby direct materials

variance and direct

labor

variance

are also computed and

analysed. Complete study of variance

analysis is a part of

advanced

courses

of cost accounting.

In

the above practice question

capacity attained in terms of direct

labor hours is greater than

the

budgeted

capacity. This seemingly favorable

capacity variance may, in

fact, be due to

unfavorable

factors.

For example, direct labor

may be less efficient and as

a result same quantity of

output is

124

Cost

& Management Accounting

(MGT-402)

VU

produced

by working greater number of

hours, or it may be due to defective

materials which

require

more conversion time and as

such the hours worked over

and above the budgeted

capacity

have

not resulted in extra output Similarly an

unfavorable budget variance may be on

account of

higher

spending on preventive repairs

and maintenance or higher spending on

training of workers,

which

is in effect beneficial for the

organisation.

Here

a practice question is discussed to

explain High and Low

Point Method. This method is

a

technique

to segregate fixed and

variable portions of a

total/semi-variable cost.

Practice

Question

Predetermined

factory overhead absorption

rate computed by AI-Nasr

Associates Rs. 6 per

machine

hour. Budgeted factory

overhead for activity level

of 150.000 machine hours is

Rs.

800,000

and for activity level of

100,000 machine hours it is Rs.

700,000. Actual factory

overhead

incurred

during the year is Rs.

710,000 at an actual volume of

120,000 machine hours.

Required:

(i)

Variable

factory overhead absorption

rate.

(ii)

Budgeted

fixed factory

overhead,

(iii)

Budgeted

activity level on which the

absorption rate is

based

(iv)

Over

or under absorbed factory

overhead.

(v)

Volume

variance

(vi)

Spending

variance

Solution:

(i)

Variable

Factory Overhead Absorption Rate:

Activity

Level

Budgeted

FOH

(Machine

Hours)

(Rs.)

High

150,000

800,000

Low

100,000

700.000

50,000

100,000

For

a change of 50,000 machine hour's m

activity level there is a

change of Rs, 100,000

in

budgeted

factory overhead. This

change in budgeted factory

overhead is due to variable

factory

overhead.

Therefore,

Variable

rate

=

Change

in budgeted FOH

Change

in activity level

Rs

100,000/50,000 machine hours

Rs.

2 per machine hour

125

Cost

& Management Accounting

(MGT-402)

VU

(ii)

Budgeted Fixed Factory

Overhead:

Total

FOH for 150,000 machine

hours

=

Rs. 800.000

Budgeted

variable FOH = 150,000 hrs Rs

2

=

Rs. 300,000

Budgeted

fixed FOH = Rs 800.000 less

Rs. 300,000

=

Rs. 500.000

OR

Total

FOH for 100.000 machine

hours

=

Rs 700.000

Budgeted

variable FOH =100.000 hrs x Rs.

2

=

Rs 200.000

Budgeted

fixed FOH = Rs, 700.000 less

Rs. 200,000

=Rs.

500.000

(iii)Budgeted

Activity Level

Budgeted

activity level = Fixed FOH

Fixed

rate

=

Rs. 500.000/ (Rs. 6 less

Rs. 2)

=125,000

machine hours

(iv)

Over or under absorbed

Factory Overhead:

Actual

factory overhead

Rs.

710.000

Absorbed

factory overhead

Actual

volume x FOH absorption

rate

120,000

hrs x Rs. 6

720.000

Over

absorbed

10,000

(v)

Volume

Variance:

Absorbed

factory overhead

Rs.

720,000

Budgeted

FOH for actual volume

Fixed

FOH + (Actual volume x Variable

rate)

Rs,

500.000 + (120.000 hrs, x

Rs. 2)

740,000

Unfavorable

20,000

(vi)

Spending

Variance:

Budgeted

FOH for actual volume

Rs.

740,000

Actual

factory overhead

710,000

Favorable

30,000

126

Table of Contents:

- COST CLASSIFICATION AND COST BEHAVIOR INTRODUCTION:COST CLASSIFICATION,

- IMPORTANT TERMINOLOGIES:Cost Center, Profit Centre, Differential Cost or Incremental cost

- FINANCIAL STATEMENTS:Inventory, Direct Material Consumed, Total Factory Cost

- FINANCIAL STATEMENTS:Adjustment in the Entire Production, Adjustment in the Income Statement

- PROBLEMS IN PREPARATION OF FINANCIAL STATEMENTS:Gross Profit Margin Rate, Net Profit Ratio

- MORE ABOUT PREPARATION OF FINANCIAL STATEMENTS:Conversion Cost

- MATERIAL:Inventory, Perpetual Inventory System, Weighted Average Method (W.Avg)

- CONTROL OVER MATERIAL:Order Level, Maximum Stock Level, Danger Level

- ECONOMIC ORDERING QUANTITY:EOQ Graph, PROBLEMS

- ACCOUNTING FOR LOSSES:Spoiled output, Accounting treatment, Inventory Turnover Ratio

- LABOR:Direct Labor Cost, Mechanical Methods, MAKING PAYMENTS TO EMPLOYEES

- PAYROLL AND INCENTIVES:Systems of Wages, Premium Plans

- PIECE RATE BASE PREMIUM PLANS:Suitability of Piece Rate System, GROUP BONUS SYSTEMS

- LABOR TURNOVER AND LABOR EFFICIENCY RATIOS & FACTORY OVERHEAD COST

- ALLOCATION AND APPORTIONMENT OF FOH COST

- FACTORY OVERHEAD COST:Marketing, Research and development

- FACTORY OVERHEAD COST:Spending Variance, Capacity/Volume Variance

- JOB ORDER COSTING SYSTEM:Direct Materials, Direct Labor, Factory Overhead

- PROCESS COSTING SYSTEM:Data Collection, Cost of Completed Output

- PROCESS COSTING SYSTEM:Cost of Production Report, Quantity Schedule

- PROCESS COSTING SYSTEM:Normal Loss at the End of Process

- PROCESS COSTING SYSTEM:PRACTICE QUESTION

- PROCESS COSTING SYSTEM:Partially-processed units, Equivalent units

- PROCESS COSTING SYSTEM:Weighted average method, Cost of Production Report

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Accounting for joint products

- COSTING/VALUATION OF JOINT AND BY PRODUCTS:Problems of common costs

- MARGINAL AND ABSORPTION COSTING:Contribution Margin, Marginal cost per unit

- MARGINAL AND ABSORPTION COSTING:Contribution and profit

- COST – VOLUME – PROFIT ANALYSIS:Contribution Margin Approach & CVP Analysis

- COST – VOLUME – PROFIT ANALYSIS:Target Contribution Margin

- BREAK EVEN ANALYSIS – MARGIN OF SAFETY:Margin of Safety (MOS), Using Budget profit

- BREAKEVEN ANALYSIS – CHARTS AND GRAPHS:Usefulness of charts

- WHAT IS A BUDGET?:Budgetary control, Making a Forecast, Preparing budgets

- Production & Sales Budget:Rolling budget, Sales budget

- Production & Sales Budget:Illustration 1, Production budget

- FLEXIBLE BUDGET:Capacity and volume, Theoretical Capacity

- FLEXIBLE BUDGET:ANALYSIS OF COST BEHAVIOR, Fixed Expenses

- TYPES OF BUDGET:Format of Cash Budget,

- Complex Cash Budget & Flexible Budget:Comparing actual with original budget

- FLEXIBLE & ZERO BASE BUDGETING:Efficiency Ratio, Performance budgeting

- DECISION MAKING IN MANAGEMENT ACCOUNTING:Spare capacity costs, Sunk cost

- DECISION MAKING:Size of fund, Income statement

- DECISION MAKING:Avoidable Costs, Non-Relevant Variable Costs, Absorbed Overhead

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS

- DECISION MAKING CHOICE OF PRODUCT (PRODUCT MIX) DECISIONS:MAKE OR BUY DECISIONS