|

Strategic

Management MGT603

VU

Lesson

7

EXTERNAL

ASSESSMENT

Objectives:

This

lecture examines the tools

and concepts needed to conduct an

external strategic-management audit.

The

Nature of an External

Audit

Economic

Forces

External

Assessment:

Prediction

is very difficult, especially about

the future.

Neils

Bohr

External

Strategic Management Audit Is

also called:

1.

Environmental

scanning

2.

Industry

analysis

In

this lecture we will examine the tools

and concepts needed to conduct an

external strategic-management

audit

(sometimes called environmental

scanning or

industry

analysis). An

external

audit focuses

on identifying and

evaluating

trends and events beyond the

control of a single firm,

such as increased foreign

competition,

population

shifts to the Sunbelt, an aging

society, information technology, and the

computer revolution. An

external

audit reveals key

opportunities and threats

confronting an organization so that

managers can

formulate

strategies to take advantage of the

opportunities and avoid or

reduce the impact of threats.

This

chapter

presents a practical framework for

gathering, assimilating, and

analyzing external information.

Key

External Forces

External

forces can be

divided into five broad

categories:

Economic

forces;

Social,

cultural, demographic, and environmental

forces;

Political,

governmental, and legal

forces;

Technological

forces; and

Competitive

forces.

Relationships

among these forces and an

organization are depicted in Figure

External trends and

events

significantly

affect all products, services,

markets, and organizations in the

world.

Relationships

between Key External Forces

and an Organization are shown in the

above figure.

Changes

in external forces translate into

changes in consumer demand

for both industrial and

consumer

products

and services. External

forces affect the types of products

developed, the nature of positioning

and

market

segmentation strategies, the types of

services offered, and the

choice of businesses to acquire or

sell.

External

forces directly affect both

suppliers and distributors. Identifying

and evaluating external

opportunities

and threats enables

organizations to develop a clear mission,

to design strategies to

achieve

long-term

objectives, and to develop policies to

achieve annual

objectives.

28

Strategic

Management MGT603

VU

The

increasing complexity of business today

is evidenced by more countries'

developing the capacity

and

will

to compete aggressively in world

markets. Foreign businesses

and countries are willing to

learn, adapt,

innovate,

and invent to compete

successfully in the marketplace. There

are more competitive

new

technologies

in Europe and the Far East

today than ever before. American

businesses can no longer

beat

foreign

competitors with ease.

The

Nature of an External

Audit

The

purpose of an external audit is to develop a

finite list of opportunities

that could benefit a firm

and

threats

that should be avoided. As the term finite

suggests,

the external audit is not aimed at

developing an

exhaustive

list of every possible

factor that could influence the business;

rather, it is aimed at identifying

key

variables

that offer actionable

responses. Firms should be able to

respond either offensively or

defensively

to

the factors by formulating strategies

that take advantage of external

opportunities or that minimize the

impact

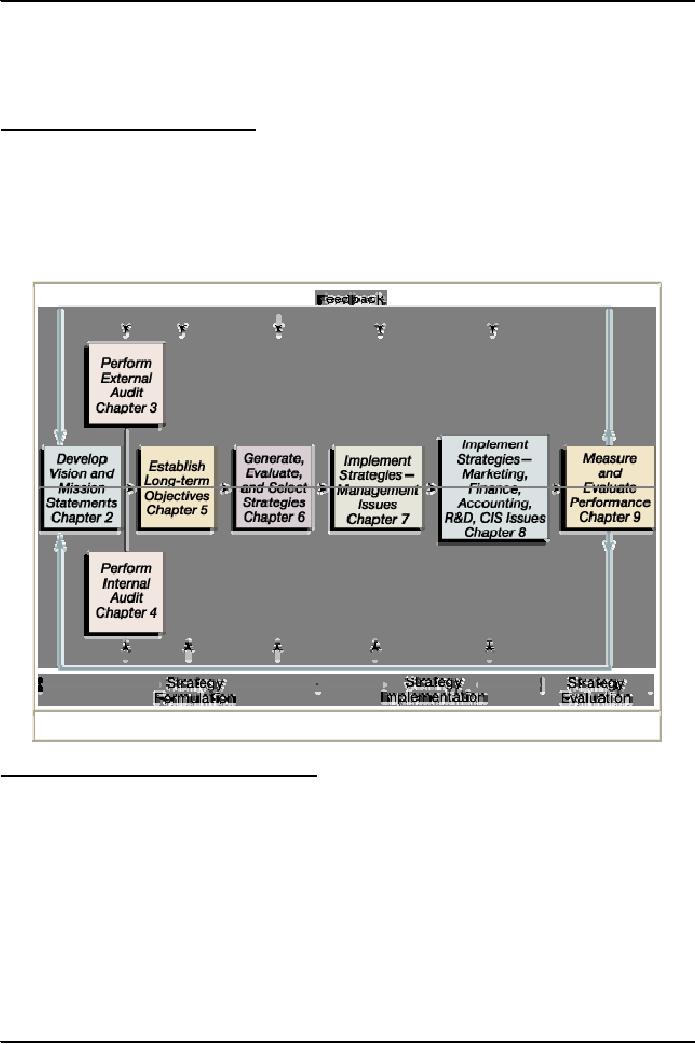

of potential threats. Figure below

illustrates how the external audit

fits into the

strategic-

management

process.

A

Comprehensive Strategic-Management

Model

The

Process of Performing an External

Audit

The

process of performing an external audit

must involve as many

managers and employees as

possible. As

emphasized

in earlier discussions, involvement in

the strategic-management process can

lead to

understanding

and commitment from organizational

members. Individuals appreciate having

the

opportunity

to contribute ideas and to

gain a better understanding of their

firm's industry, competitors, and

markets.

To

perform an external audit, a company

first must gather

competitive intelligence and information

about

social,

cultural, demographic, environmental, economic,

political, legal, governmental, and

technological

trends.

Individuals can be asked to

monitor various sources of

information such as key

magazines, trade

journals,

and newspapers. These

persons can submit periodic

scanning reports to a committee of

managers

charged

with performing the external audit. This

approach provides a continuous stream of

timely strategic

information

and involves many

individuals in the external-audit process.

The Internet provides another

source

for gathering strategic information, as

do corporate, university, and public

libraries. Suppliers,

distributors,

salespersons, customers, and competitors

represent other sources of

vital information.

29

Strategic

Management MGT603

VU

Once

information is gathered, it should be

assimilated and evaluated. A

meeting or series of meetings

of

managers

is needed to collectively identify the

most important opportunities

and threats facing the

firm.

These

key external factors should be listed on

flip charts or a blackboard. A

prioritized list of these

factors

could

be obtained by requesting all

managers to rank the factors

identified, from 1 for the

most important

opportunity/threat

to 20 for the least important

opportunity/threat. These key external

factors can vary

over

time and by industry. Relationships

with suppliers or distributors

are often a critical success

factor.

Other

variables commonly used include market

share, breadth of competing products,

world economies,

foreign

affiliates, proprietary and key

account advantages, price

competitiveness, technological

advancements,

population shifts, interest

rates, and pollution

abatement.

Freund

emphasized that these key

external factors should be:

Important

to achieving long-term and

annual objectives,

Measurable,

Applicable

to all competing firms, and

Hierarchical

in the sense that some will

pertain to the overall company and

others will be more

narrowly

focused on functional or divisional

areas.

A

final list of the most

important key external factors should be

communicated and distributed widely

in

the

organization. Both opportunities and

threats can be key external

factors.

Economic

Forces

Economic

factors have a direct impact on the

potential attractiveness of various

strategies. For example,

as

interest

rates rise, then funds

needed for capital expansion

become more costly or

unavailable. Also, as

interest

rates rise, discretionary

income declines, and the

demand for discretionary goods

falls. As stock

prices

increase, the desirability of equity as a source of

capital for market development

increases. Also, as

the

market rises, consumer and

business wealth expands. A summary of

economic variables that

often

represent

opportunities and threats

for organizations is provided in

Table given below.

Key

Economic Variables to Be

Monitored

∑

Shift

to a service economy in

the

United States

∑

Import/export

factors

∑

Availability

of credit

∑

Demand

shifts for different

categories of

∑

Level

of disposable income

goods

and services

∑

∑

Propensity

of people to spend

Income

differences by region

and

∑

consumer

groups

Interest

rates

∑

∑

Price

fluctuations

Inflation

rates

∑

∑

Money

market rates

Exportation

of labor and capital

from

∑

the

United States

Federal

government budget

∑

Monetary

policies

deficits

∑

∑

Gross

domestic product

trend

Fiscal

policies

∑

∑

Consumption

patterns

Tax

rates

∑

∑

European

Economic Community (ECC)

Unemployment

trends

∑

policies

Worker

productivity levels

∑

∑

Organization

of Petroleum Exporting

Value

of the dollar in world

Countries

(OPEC) policies

markets

∑

∑

Coalitions

of

Lesser

Developed

Stock

market trends

Countries

(LDC) policies

∑

Foreign

countries' economic

conditions

30

Table of Contents:

- NATURE OF STRATEGIC MANAGEMENT:Interpretation, Strategy evaluation

- KEY TERMS IN STRATEGIC MANAGEMENT:Adapting to change, Mission Statements

- INTERNAL FACTORS & LONG TERM GOALS:Strategies, Annual Objectives

- BENEFITS OF STRATEGIC MANAGEMENT:Non- financial Benefits, Nature of global competition

- COMPREHENSIVE STRATEGIC MODEL:Mission statement, Narrow Mission:

- CHARACTERISTICS OF A MISSION STATEMENT:A Declaration of Attitude

- EXTERNAL ASSESSMENT:The Nature of an External Audit, Economic Forces

- KEY EXTERNAL FACTORS:Economic Forces, Trends for the 2000ís USA

- EXTERNAL ASSESSMENT (KEY EXTERNAL FACTORS):Political, Governmental, and Legal Forces

- TECHNOLOGICAL FORCES:Technology-based issues

- INDUSTRY ANALYSIS:Global challenge, The Competitive Profile Matrix (CPM)

- IFE MATRIX:The Internal Factor Evaluation (IFE) Matrix, Internal Audit

- FUNCTIONS OF MANAGEMENT:Planning, Organizing, Motivating, Staffing

- FUNCTIONS OF MANAGEMENT:Customer Analysis, Product and Service Planning, Pricing

- INTERNAL ASSESSMENT (FINANCE/ACCOUNTING):Basic Types of Financial Ratios

- ANALYTICAL TOOLS:Research and Development, The functional support role

- THE INTERNAL FACTOR EVALUATION (IFE) MATRIX:Explanation

- TYPES OF STRATEGIES:The Nature of Long-Term Objectives, Integration Strategies

- TYPES OF STRATEGIES:Horizontal Integration, Michael Porterís Generic Strategies

- TYPES OF STRATEGIES:Intensive Strategies, Market Development, Product Development

- TYPES OF STRATEGIES:Diversification Strategies, Conglomerate Diversification

- TYPES OF STRATEGIES:Guidelines for Divestiture, Guidelines for Liquidation

- STRATEGY-FORMULATION FRAMEWORK:A Comprehensive Strategy-Formulation Framework

- THREATS-OPPORTUNITIES-WEAKNESSES-STRENGTHS (TOWS) MATRIX:WT Strategies

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- BOSTON CONSULTING GROUP (BCG) MATRIX:Cash cows, Question marks

- BOSTON CONSULTING GROUP (BCG) MATRIX:Steps for the development of IE matrix

- GRAND STRATEGY MATRIX:RAPID MARKET GROWTH, SLOW MARKET GROWTH

- GRAND STRATEGY MATRIX:Preparation of matrix, Key External Factors

- THE NATURE OF STRATEGY IMPLEMENTATION:Management Perspectives, The SMART criteria

- RESOURCE ALLOCATION

- ORGANIZATIONAL STRUCTURE:Divisional Structure, The Matrix Structure

- RESTRUCTURING:Characteristics, Results, Reengineering

- PRODUCTION/OPERATIONS CONCERNS WHEN IMPLEMENTING STRATEGIES:Philosophy

- MARKET SEGMENTATION:Demographic Segmentation, Behavioralistic Segmentation

- MARKET SEGMENTATION:Product Decisions, Distribution (Place) Decisions, Product Positioning

- FINANCE/ACCOUNTING ISSUES:DEBIT, USES OF PRO FORMA STATEMENTS

- RESEARCH AND DEVELOPMENT ISSUES

- STRATEGY REVIEW, EVALUATION AND CONTROL:Evaluation, The threat of new entrants

- PORTER SUPPLY CHAIN MODEL:The activities of the Value Chain, Support activities

- STRATEGY EVALUATION:Consistency, The process of evaluating Strategies

- REVIEWING BASES OF STRATEGY:Measuring Organizational Performance

- MEASURING ORGANIZATIONAL PERFORMANCE

- CHARACTERISTICS OF AN EFFECTIVE EVALUATION SYSTEM:Contingency Planning