|

EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION |

| << THE AGGREGATE SUPPLY CURVE:Inflation Shocks |

| SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY >> |

Money

& Banking MGT411

VU

Lesson

44

EQUILIBRIUM

AND THE DETERMINATION OF OUTPUT AND

INFLATION

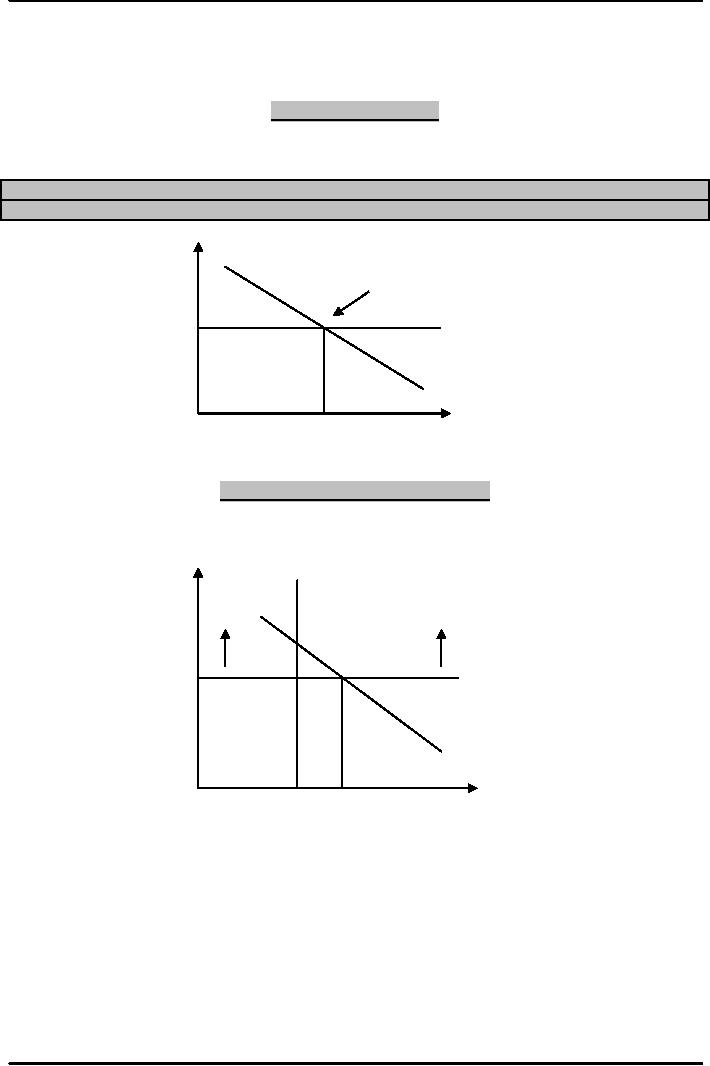

Short-Run

Equilibrium

Short-run

equilibrium is determined by the

intersection of the aggregate demand

curve with the

short-run

aggregate supply

curve.

Figure:

Short Run Equilibrium of Output

and Inflation

Inflation

and actual output are determined by the

intersection of the SRAS curve

with the ADC

Inflation

(š)

Short

run Equilibrium

Current

SRAS

Inflation

ADC

Actual

Output

Output

(Y)

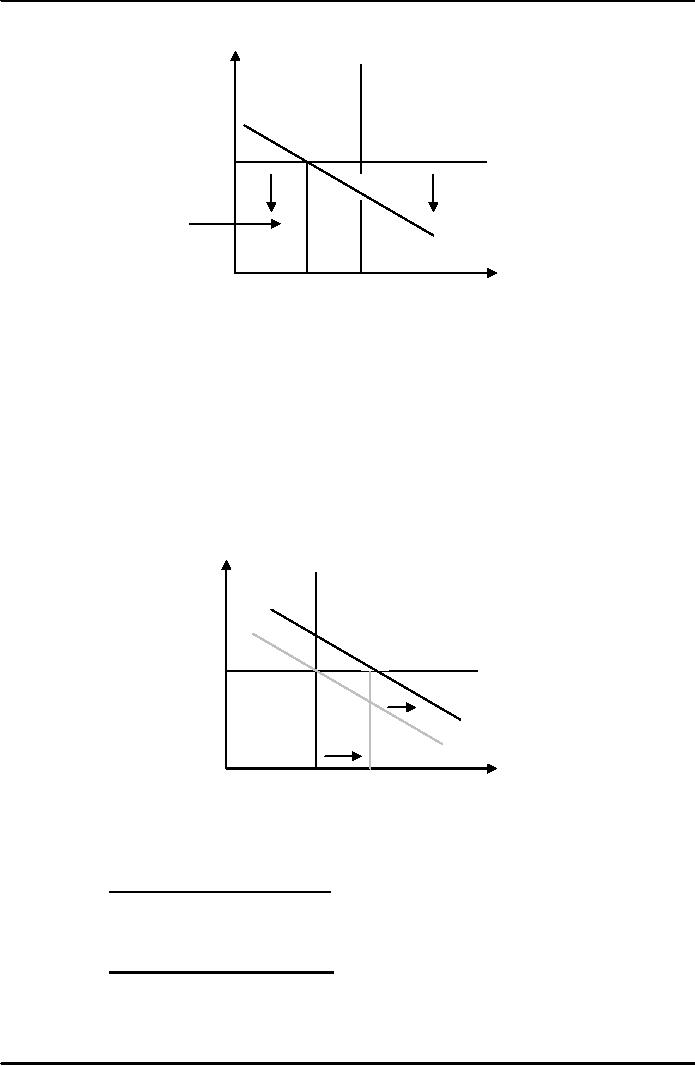

Adjustment

to Long-Run Equilibrium

When

current output exceeds

potential, the resulting expansionary gap

exerts upward

pressure

on

inflation, shifting the short-run

aggregate supply curve

upward, a process that continues

until

output

returns to potential; at this point

inflation stops

changing.

Inflation

(š)

LRAS

2

Current

1

Inflation

SRAS

Expansio

nary

Output

ADC

Gap

Potential

Current

Output

(Y)

Output

Output

If

current output is lower than

potential output, the resulting

recessionary gap places

downward

pressure

on inflation, causing the short-run

aggregate supply curve to

shift downward, and

once

again

the process continues until current

output returns to potential

139

Money

& Banking MGT411

VU

LRAS

Inflation

(š)

Current

1

Inflation

SRAS

2

Recessionary

ADC

Gap

Output

(Y)

Current

Potential

Output

Output

This

shows that the economy does

indeed have a self-correcting mechanism

and that the manner

in

which the short-run aggregate

supply curve shifts in

response to output gaps

reinforces our

conclusion

that the long-run aggregate

supply curve is

vertical

In

long-run equilibrium, current

output equals potential

output and current inflation is

steady

and

equal to target inflation, which

equals expected inflation

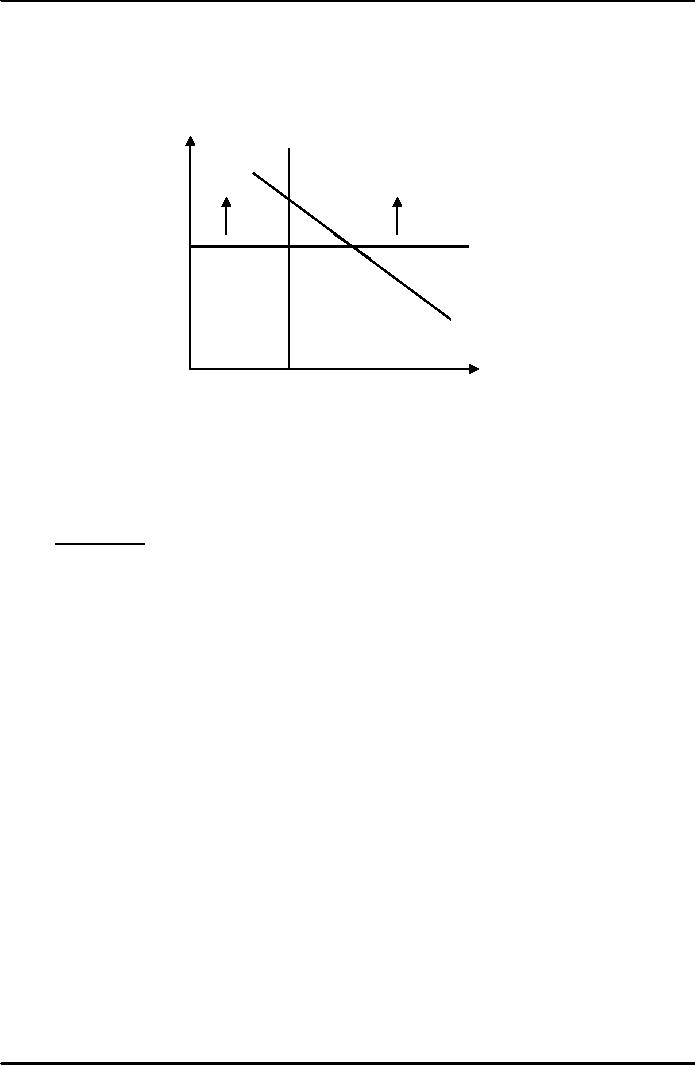

The

Impact of Shifts in Aggregate Demand on

Output and

Inflation

Suppose

aggregate demand shifted

right as a result of an increase in

government purchases.

At

first, current output rises

but inflation does not

change.

But

the higher level of output

creates an expansionary gap and the

short-run aggregate

supply

curve

starts to shift upward and

inflation rises

Inflation

(š)

LRAS

2

SRAS

Target

Inflation

(šT)

New

AD

Original

AD

Potential

Current

Output

(Y)

Output

Output

Short-Run

Equilibrium Inflation and

Output Following an Increase in Aggregate

Demand

1.

Start at Long-Run

Equilibrium

Y

= Potential Output

š

=

Target Inflation

2.

Aggregate Demand Shifts

Right

Original

AD shifts to New AD

Y

> Potential Output

Inflation

Is Unchanged

140

Money

& Banking MGT411

VU

Short-run

equilibrium moves from point

1 to point 2

Higher

inflation moves policymakers

along their reaction curve,

leading them to raise the

real

interest

rate and moving the economy upward along

the new aggregate demand

curve. Output

then

begins to fall back toward its

long-run equilibrium

level.

The

economy will settle at the point at which

the new aggregate demand

curve crosses the

long-

run

aggregate supply curve and

current output again equals

potential output

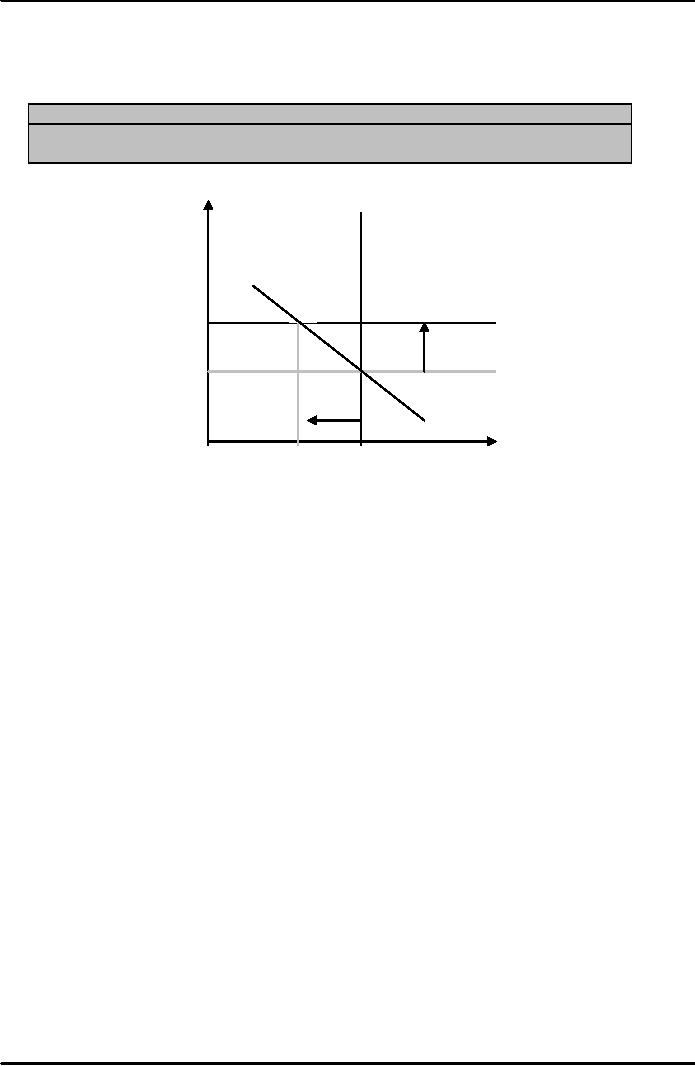

Inflation

LRAS

(š)

3

2

SRAS

Target

Inflation

(šT)

New

ADC

Potential

Output

(Y)

Output

Adjustment

of Short-Run Equilibrium Inflation

and Output Following an

Increase in Aggregate

Demand

Adjustment:

At

the Short-Run Equilibrium point

2:

Y

> Potential Output

SRAS

begins to shift up

Output

begins to fall

Inflation

begins to rise as economy moves along New

AD

With

no policy response, economy moves to

point 3, where Current inflation

>Target inflation

If

central bankers simply sit

and watch as the aggregate demand

curve shifts to the

right,

inflation

will rise

So

long as monetary policymakers

remain committed to their

original inflation target,

they will

need

to do something to get the economy back to the point where it

began--point "1"

An

increase in government purchases

raises the long term real

interest rate.

Policymakers

will compensate by shifting

their monetary policy

reaction curve to the

left,

increasing

the real interest rate at every level of

inflation

When

the monetary policy reaction

curve shifts, the aggregate

demand curve shifts with

it.

The

aggregate demand curve will

shift to the left, bringing the economy

back to long-run

equilibrium.

An

increase in aggregate demand

causes a temporary increase in

both output and

inflation.

A

decline in aggregate demand

causes a temporary decline in

both output and

inflation

This

discussion implies that

whenever we see a permanent increase in

inflation, it must be the

result

of monetary policy.

That

is, if inflation goes up or down and

remains at its new level,

the only explanation is

that

central

banker must be allowing it to

happen.

They

have changed their inflation

target, whether or not they

acknowledge the change

explicitly.

141

Money

& Banking MGT411

VU

The

Impact of Inflation Shocks on

Output and

Inflation

An

inflation shock shifts the

short-run aggregate supply

curve (such as an oil price

increase)

A

positive shock moves it to a

higher level, and the result

is higher inflation and lower

output, a

situation

called "stagflation".

Figure:

The Effects of a Positive

Inflation Shock on Short-Run

Equilibrium

A

positive inflation shock

shifts the short-run aggregate

supply curve upward,

moving

short

run equilibrium from point 1

to point 2. Inflation rises

and output falls.

Inflation

(š)

LRAS

2

New

SRAS

1

Old

SRAS

Target

Inflation

(šT)

ADC

Current

Potential

Output

(Y)

Output

Output

But

the decline in output exerts

downward pressure on inflation,

causing the short-run

aggregate

supply

curve to shift down

Inflation

falls and output rises until

the economy returns to the point where current

output

equals

potential output and inflation

equals the central bank's

target.

An

inflation shock has no

affect on the economy's long-run

equilibrium point; only a

change in

Potential

output or a change in the central

bank's inflation target can

accomplish that.

142

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY