|

Macroeconomics

ECO 403

VU

LESSON

22

ECONOMIC

GROWTH (Continued...)

Issues

under Consideration

·

Technological

progress in the Solow

model

·

Policies

to promote growth

·

Growth

empirics:

Confronting

the theory with

facts

·

Endogenous

growth:

Two

simple models in which the

rate of technological progress is

endogenous

Introduction

Previously,

in the Solow model

·

The

production technology was

held constant

·

Income

per capita was constant in

the steady state.

Neither

point is true in the real

world

Tech.

progress in the Solow

model

·

A

new variable: E = labor

efficiency

·

Assume:

Technological

progress is labor-augmenting: it

increases labor efficiency at

the exogenous

rate

g:

ΔE

g=

E

·

We

now write the production

function as:

Y

= F

(K

, L

× E

)

Where

L ×

E =

the number of effective

workers.

·

Hence,

increases in labor efficiency

have the same effect on

output as

increases

in the labor force.

·

Notation:

y

= Y/LE = output per

effective worker

k

= K/LE = capital per

effective worker

·

Production

function per effective

worker:

y

= f(k)

·

Saving

and investment per effective

worker:

s

y =

s

f(k)

88

Macroeconomics

ECO 403

VU

(δ

+ n +

g)k

= break-even investment:

the

amount of investment necessary to

keep k constant.

Consists

of:

δ

k

to

replace depreciating capital

n

k to

provide capital for new

workers

g

k to

provide capital for the

new "effective" workers

created by technological

progress

Δk

=

s

f(k)

-

(δ

+n

+g)k

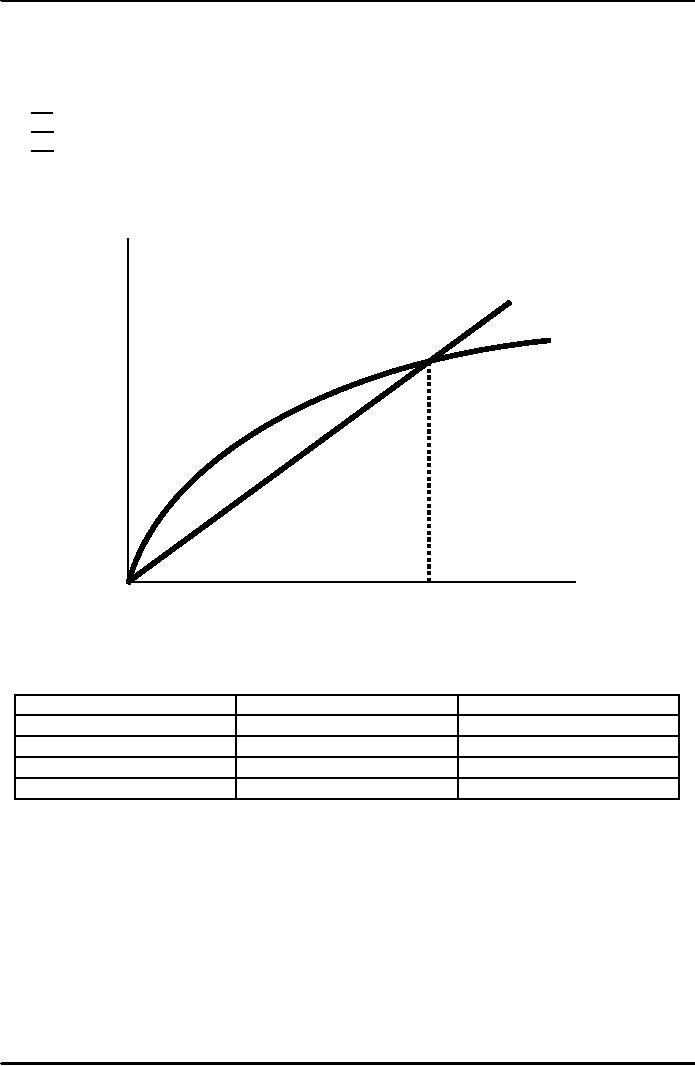

Investment,

break-even

investment

(δ

+n

+g

)

k

sf(k)

k*

Capital

per

worker,

k

Steady-State

Growth Rates in the Solow

Model with Tech.

Progress

Variable

Symbol

Steady-Steady

growth rate

k

=

K/

(L

×E

)

Capital

per effective worker

0

y

=

Y/

(L

×E

)

Output

per effective worker

0

(Y/

L

)

= y

×E

Output

per worker

g

Y

=

y

×E

×L

Total

output

n+g

The

Golden Rule

To

find the Golden Rule

capital stock,

express

c*

in

terms of k*:

=

y*

-

i*

c*

=

f(k*

)

-

(δ

+

n

+

g)

k*

c*

is

maximized when

MPK

= δ

+

n

+

g

or

equivalently,

MPK

-

δ =

n

+

g

89

Macroeconomics

ECO 403

VU

In

the Golden Rule Steady

State, the marginal product

of capital net of depreciation

equals the

population

growth rate plus the

rate of tech

progress.

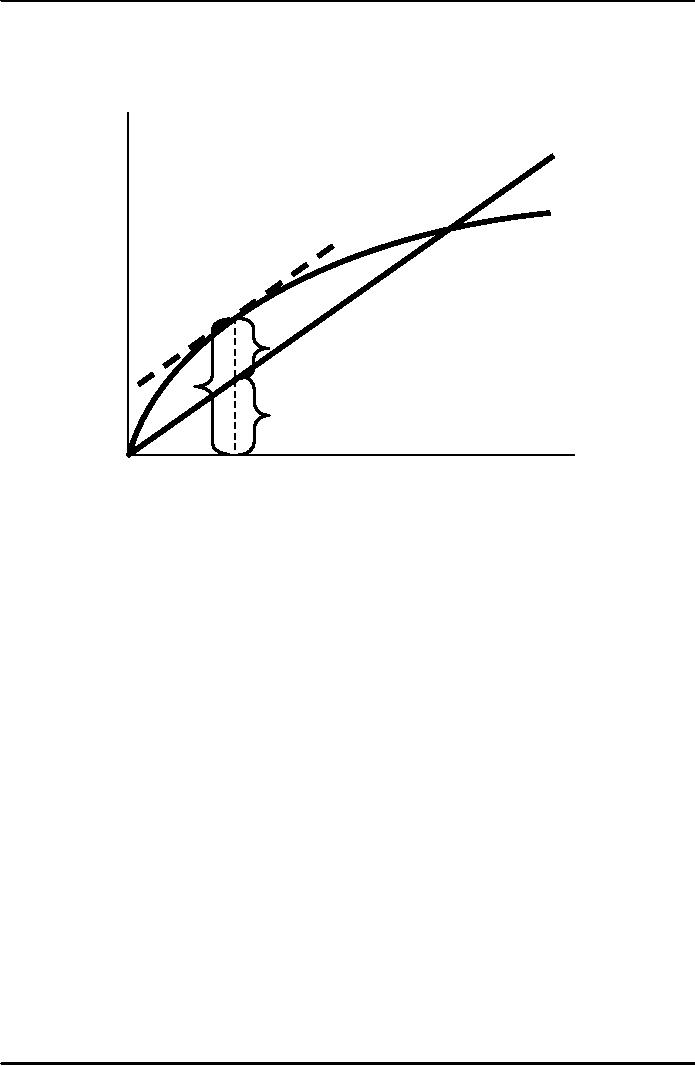

The

Golden Rule Capital

Stock

steady

state

(δ

+n+g)

k*

output

and

investment

f(k*)

C*gold

i*gold =

(δ+

n+g)k*gold

k*gold

steady-state

capital per

worker,

k*

Policies

to promote growth

Four

policy questions:

·

Are we

saving enough? Too

much?

·

What

policies might change the

saving rate?

·

How

should we allocate our

investment between privately

owned physical

capital,

public

infrastructure, and "human

capital"?

·

What

policies might encourage

faster technological

progress?

1.

Evaluating the Rate of

Saving

·

Use

the Golden Rule to determine

whether

our

saving rate and capital

stock are too high,

too low, or about

right.

·

To

do this, we need to

compare

(MPK

- δ

) to (n +

g).

·

If (MPK - δ ) > (n + g),

then we are below the

Golden Rule steady state

and should increase

s.

·

If (MPK - δ ) < (n + g),

then we are above the

Golden Rule steady state

and should reduce

s.

90

Macroeconomics

ECO 403

VU

To

estimate (MPK -

δ ), we

use three facts about an

economy;

1.

k = 2.5 y

the

capital stock is about 2.5

times one year's GDP.

2.

δ

k =

0.1 y

about

10% of GDP is used to

replace depreciating

capital.

3.

MPK ×

k =

0.3 y

Capital

income is about 30% of

GDP

So

1.

k

= 2.5 y

2.

δ

k =

0.1 y

3.

MPK ×

k =

0.3 y

To

determine δ

,

divided 2 by 1:

0.1

δk

0.1 y

⇒

δ =

=

0.04

=

2.5

k

2.5 y

To

determine MPK, divided 3 by

1:

MPK

×

k

0.3 y

0.3

⇒

=

MPK

=

=

0.12

k

2.5 y

2.5

Hence,

MPK -

δ =

0.12 -

0.04 =

0.08

·

Real

GDP grows an average of

3%/year,

so

n + g = 0.03

·

Thus,

in this economy,

MPK

- δ

=

0.08 > 0.03 = n + g

Conclusion:

The

economy is below the Golden

Rule steady state:

if

we increase saving rate of

this economy, the economy

will have faster growth

until it

reaches

to a new steady state with

higher consumption per

capita.

91

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand