|

BRANCH ACCOUNTING 2 |

| << BRANCH ACCOUNTING 1 |

| ESSENTIALS OF PARTNERSHIP >> |

Advance

Financial Accounting

(FIN-611)

VU

LESSON

# 17

BRANCH

ACCOUNTING

(Foreign

branch)

Question

You

are required to prepare the

Trading and Profit and loss

Accounts and

consolidated

Balance Sheet of Ali Ltd. in Karachi and

its branch at Lahore.

Give

Journal

Entries for incorporation of Delhi

Branch Accounts in the head

office and

show

the Branch Account in head

office books after

incorporation therein the

assets

and

liabilities.

The

trial balances as on 31st December, 2006 are as

under:

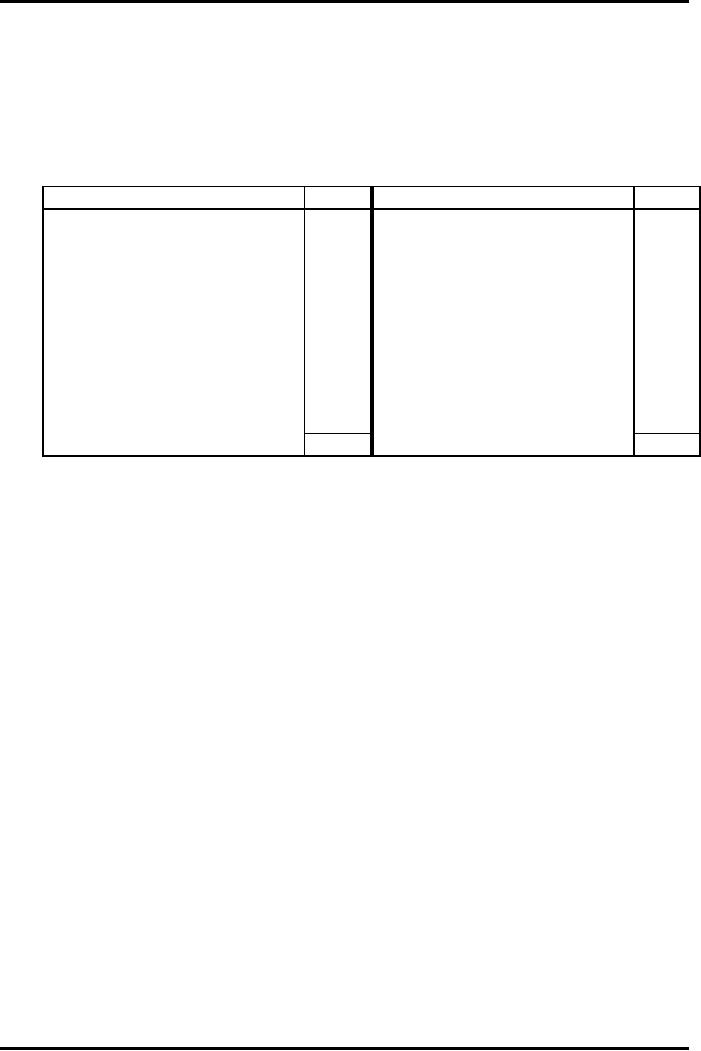

H.O.

Branch

H.O.

Branch

Particulars

Dr.

(Rs.) Dr. (Rs.)

Cr.

(Rs.)

Cr.

(Rs.)

Manufacturing

expenses

30,000

10,000

---

---

Salaries

30,000

10,000

---

---

Wages

1,00,000

40,000

---

---

Cash

in hand

10,000

2,000

---

---

Purchases

1,50,000

80,000

---

---

Capital

---

---

2,00,000

---

Goods

received from H.O.

---

15,000

---

---

Rent

8,000

4,000

---

---

General

expenses

20,000

5,000

---

---

Sales

---

---

4,50,000

1,50,000

Goods

sent to branch

---

---

15,000

---

Purchases

returns

---

---

5,000

1,000

Opening

stock

50,000

30,000

---

---

Discounts

earned

---

---

2,000

1,000

Machinery

at H.O.

1,50,000

---

---

---

Machinery

at Branch

50,000

---

---

---

Furniture

at H.O.

7,000

---

---

---

Furniture

at Branch

3,000

---

---

---

Debtors

40,000

15,000

---

---

Creditors

---

---

30,000

5,000

H.O.

account

---

---

---

54,000

Branch

account

54,000

---

---

---

TOTAL

7,02,000

2,11,000

7,02,000

2,11,000

Closing

stock at head office was

Rs. 40,000 and at branch Rs.

30,000. Depreciation is to

be

provided on machinery @ 20% and on

furniture @ 15%. Rent outstanding is

Rs. 599

(for

branch)

78

Advance

Financial Accounting

(FIN-611)

VU

Question

A

Peshawar Head Office has an

independent branch at Hyderabad.

From the

following

particulars, give Journal

Entries to close the books

of the Hyderabad

branch.

Show

also the Peshawar Head

Office Account in the branch

books.

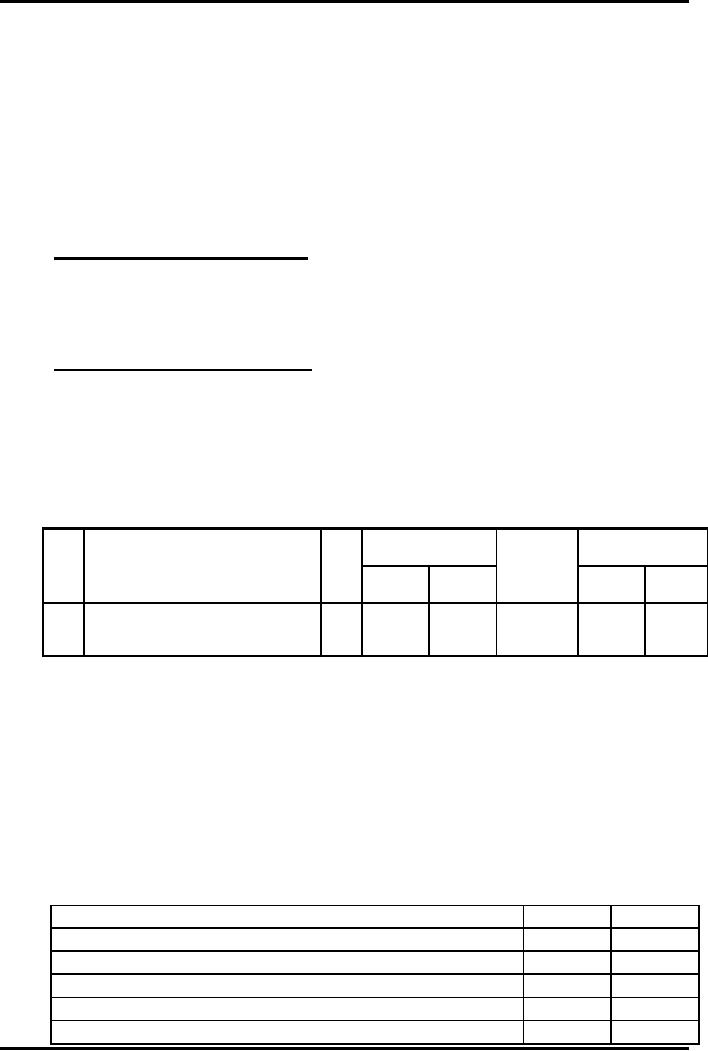

Particulars

Rs.

Particulars

Rs.

Stock

on 1st January

8,200

Creditors

2,700

Purchases

12,800

Sales

34,950

Wages

6,550

Head

office

14,000

Manufacturing

expenses

3,400

Discount

150

Rent

1,700

Purchase

returns

300

Salaries

5,500

Debtors

4,000

General

expenses

2,000

Goods

received from H.O.

7,200

Cash

at bank

750

52,100

52,100

a.

Closing stock at branch was

Rs. 14,350.

b.

The branch fixed assets

maintained at H.O. books were:

Machinery Rs. 25,000,

Furniture

Rs. 1,000. Depreciation was

to be allowed at 10% on Machinery

and

15%

on Furniture.

c.

Rent due was Rs.

150.

d. A

remittance of Rs. 4,000 made

by the branch on 28th December, 2006 was

received

by the Head Office on 4th January, 2007.

Foreign

Branches

When a

branch is established abroad. It is

called a Foreign Branch. The

accounting

arrangements

for a foreign branch are

exactly the same as for any

independent branch

up to

the Trial Balance. But in

this case accounts are

maintained in foreign currency

to

correspond

with the local conditions.

The main problem, which the

Head Office has to

face,

is the restatement of accounts

one currency into another. In

order to incorporate

the

Trial Balance of a foreign

branch in the books of the

Head Office. It must be

translated

(using appropriate exchange

rates) into the currency of

the Head Office.

Rules

for Conversion of Branch

Trial Balance when Exchange

Rates are

`Stable'

Exchange

rate is said to be stable, when it

does not vary to a great extent from

time to

time.

In this situation, a fixed

exchange rate can be used to

convert the branch

Trial

Balance

into the currency of the

Head Office with the

exception of (a) Remittances,

and

(b)

Head Office Current

Account.

79

Advance

Financial Accounting

(FIN-611)

VU

a.

Remittances: These are

converted at the actual

rates at which they were

made.

b.

Head Office Current Account:

The actual figures shown for

the Branch Current

Account

in the books of the Head

Office (after taking into

consideration in-

transit

items).

When

the foreign branch Trial

Balance is converted into local

currency, a new Trial

Balance

takes birth known as "Difference on

Exchange Account" is opened to

make

the

Trial Balance agree.

Closing

of Difference on Exchange

Account

i.

For

debit entry on trial

balance

Profit

and Loss Account

Dr.

OR

Exchange

Reserve Account

Dr. (if

any)

To

Difference on Exchange

Account

ii.

For

credit entry on trial

balance

Difference

on Exchange Account

Dr.

To

Exchange Reserve Account

(Big Differences)

(If

the difference is very small, it

can be credited to Profit &

Loss Account)

The

format of the new Trial

Balance of the branch is

generally drawn up as follows:

Foreign

Branch Converted Trial

Balance as at 31st

December,

2006

Sr.

Rate

Heads

of Accounts

L.F

Currency

Rupees

No.

of

Dr.

Cr.

Dr.

Cr.

Exchange

$

$

Rs.

Rs.

Question

Khan

Limited a company in Pakistan

manufacturing consumer goods,

has an overseas

branch

in Sydney managed by a local

agent.

The

products are sent in bulk to

the branch and invoiced at

cost plus freight.

Packing

materials

are purchased locally by the

branch.

The

branch keeps a complete set

of books in the local

currency Dollar

The

branch Trial Balance as at 31st December, 2006 sent to the

Head Office, was as

under:

Particulars

$

$

Raw

material from Head

Office

43,300

Purchases

Raw

material

43,300

Packing

30,240

Sales

1,40,800

80

Advance

Financial Accounting

(FIN-611)

VU

Wages

11,530

General

expenses

10,440

Balance

at bank

29,130

Stock

at 1st January,

2006

Raw

material

17,640

Packing

5,890

Local

agent balance due from him

18,210

Head

Office Account

Balance

at 1st January,

2006

14,900

Remittance

to Head Office on 30th June

17,800

Remittance

to Head Office on 31st December

20,000

Creditors

5,180

2,04,180

2,04,180

The

currency being relatively

stable, a fixed rate of

exchange $ 1 =

Rs. 40 is

adopted

for

accounting between the Head

Office and the branch except

for remittances.

The

rupee value of the

remittances at 30th

June

was Rs. 7,00,000 and on 31st December

was

Rs. 7,92,000.

On

29th December, 2006

Head Office debited the

branch with Rs. 1,60,000 in

respect of

a

shipment of raw material which was

in-transit on 31st

December,

2006. The

remittance

of $

20,000 from

the branch was not received

at Head Office until 3rd

January,

2007.

The

agent is entitled to a 10%

commission on the net profit

of the branch before

charging

either such commission or any

profit or loss on

exchange.

Stock

at the branch on 31st December, 2006 was: Raw

Materials $

6,560;

Packing $

6,480.

From

the above information you

are required to:

a.

Prepare the Branch Profit

and Loss Account in rupee for

the year ended 31st

December,

2006.

b.

Completer the entries in the

Branch Account in the Head

Office books,

bringing

down

the balance as at 1st January, 2007.

Solution

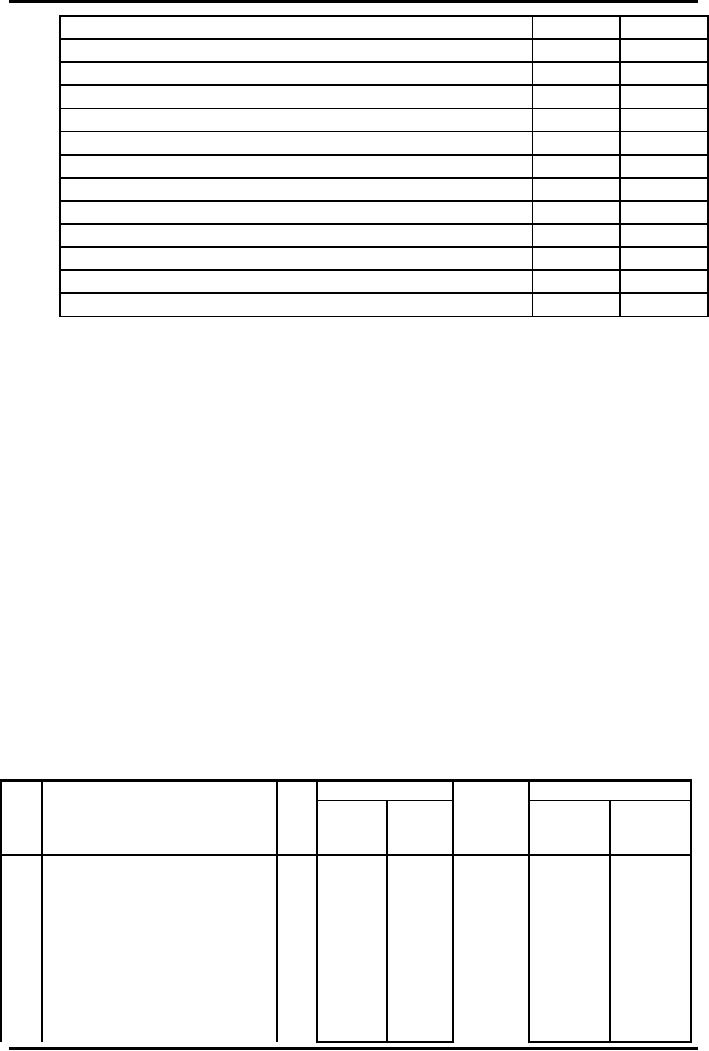

Sydney

Branch Converted Trial

Balance as at 31.12.2006

Currency

Rupees

Rate

Sr.

of

Heads

of Accounts

L.F

Dr.

Cr.

Dr.

Cr.

No.

Exchang

$

$

Rs.

Rs.

e

43,300

17,32,000

Purchases:

Raw Materials

-

12,09,600

Packing

30,240

-

Sales

1,40,80

56,32,000

4,61,200

Wages

0

11,530

4,17,200

General

Expenses

10,440

-

11,65,200

Bank

29,130

-

7,05,600

Stock:

Raw Materials

17,640

-

2,35,600

Packing

5,890

-

7,28,400

Local

agent (Debtors)

18,210

-

Head

Office Account (Note

1)

Actual

-

8,36,000

81

Advance

Financial Accounting

(FIN-611)

VU

Creditors

20,400

40

2,07,200

Difference

on Exchange

20,000

5,180

1,66,380

1,66,38

66,75,200

66,75,200

0

Closing

Stock: Raw Materials

6,560

40

2,62,400

Packing

6,480

40

2,59,200

Sydney

Branch Trading and Profit

and Loss Account for

the year ended

31.12.2006

Particulars

Rs.

Particulars

Rs.

To

Stock: Raw Materials

7,05,600

By Sales

56,32,000

Packing

2,35,600

By Closing Stock: Raw

2,62,400

To

Purchases: Raw Materials

17,32,000

Materials

2,59,200

Packing

12,09,600

Packing

To

Wages

4,61,200

To

Gross Profit c/d

18,09,600

61,53,600

61,53,600

To

General Expenses

4,17,600

By Gross Profit b/d

18,09,600

To

Difference on Exchange

20,000

To

Agent's Commission

1,39,200

To Net

Profit

12,32,800

18,09,600

18,09,600

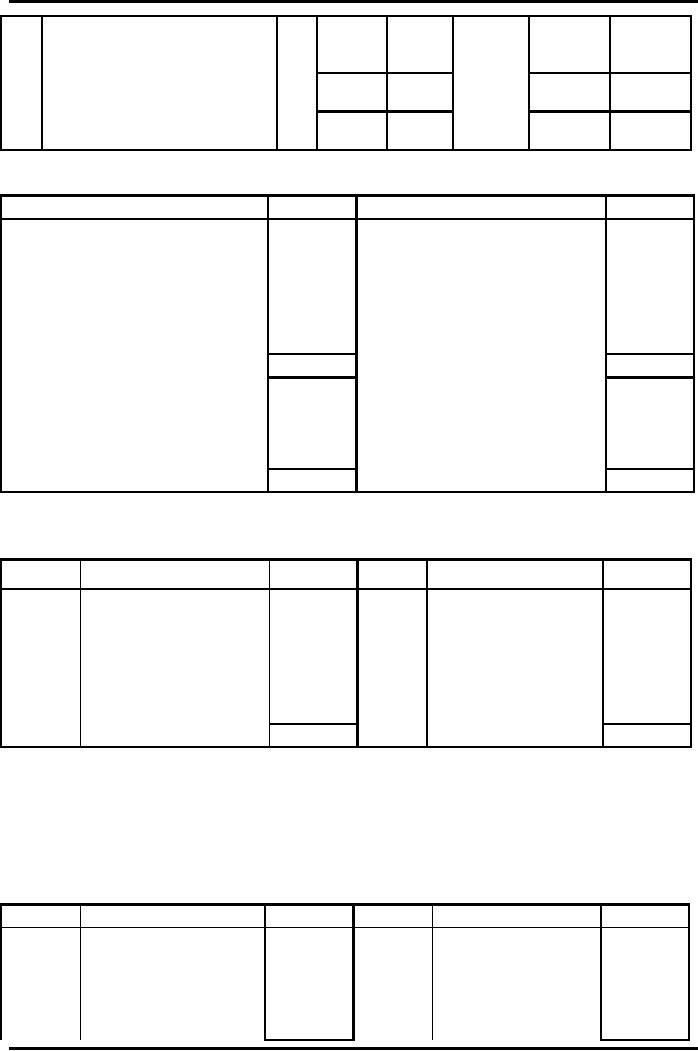

In

the Books of Head

Office

Sydney

Branch Account

.

Date

Particulars

Rs.

Date

Particulars

Rs.

31.12.06

To Balance b/d

5,96,000

By

Remittance

7,00,000

To

Goods sent to

17,32,000

By

Cash in-Transit

7,92,000

Branch

1,60,000

By

Goods

in-

1,60,000

To

Goods sent to

12,32,800

20,68,800

Transit

Branch

By

Balance c/d

To Net

Profit

37,20,800

37,20,800

Tutorial

Note: Before

branch Trail Balance is

converted, the Branch

Account in the

Head

Office books should be

updated by adjusting transit

items.

This

is required as the figures to be

used in the converted Trial

Balance are the

actual

balances

on Branch Current Account in

the Head Office Books.

Let us see how it is

done.

Memorandum

Sydney Branch

Account

Date

Particulars

Rs.

Date

Particulars

Rs.

01.01.06

To Balance b/d

5,96,000

30.06.06 By Bank

7,00,000

To

Goods sent to 17,32,000

29.12.06 By

Goods

in-

1,60,000

Branch

1,60,000

31.12.06 Transit

7,92,000

To

Goods sent to

By

Cash in-Transit

8,36,000

Branch

By

Balance c/d

82

Advance

Financial Accounting

(FIN-611)

VU

24,88,000

24,88,000

83

Table of Contents:

- ACCOUNTING FOR INCOMPLETE RECORDS

- PRACTICING ACCOUNTING FOR INCOMPLETE RECORDS

- CONVERSION OF SINGLE ENTRY IN DOUBLE ENTRY ACCOUNTING SYSTEM

- SINGLE ENTRY CALCULATION OF MISSING INFORMATION

- SINGLE ENTRY CALCULATION OF MARKUP AND MARGIN

- ACCOUNTING SYSTEM IN NON-PROFIT ORGANIZATIONS

- NON-PROFIT ORGANIZATIONS

- PREPARATION OF FINANCIAL STATEMENTS OF NON-PROFIT ORGANIZATIONS FROM INCOMPLETE RECORDS

- DEPARTMENTAL ACCOUNTS 1

- DEPARTMENTAL ACCOUNTS 2

- BRANCH ACCOUNTING SYSTEMS

- BRANCH ACCOUNTING

- BRANCH ACCOUNTING - STOCK AND DEBTOR SYSTEM

- STOCK AND DEBTORS SYSTEM

- INDEPENDENT BRANCH

- BRANCH ACCOUNTING 1

- BRANCH ACCOUNTING 2

- ESSENTIALS OF PARTNERSHIP

- Partnership Accounts Changes in partnership firm

- COMPANY ACCOUNTS 1

- COMPANY ACCOUNTS 2

- Problems Solving

- COMPANY ACCOUNTS

- RETURNS ON FINANCIAL SOURCES

- IASBíS FRAMEWORK

- ELEMENTS OF FINANCIAL STATEMENTS

- EVENTS AFTER THE BALANCE SHEET DATE

- PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 1

- ACCOUNTING POLICIES, CHANGES IN ACCOUNTING ESTIMATES AND ERRORS 2

- BORROWING COST

- EXCESS OF THE CARRYING AMOUNT OF THE QUALIFYING ASSET OVER RECOVERABLE AMOUNT

- EARNINGS PER SHARE

- Earnings per Share

- DILUTED EARNINGS PER SHARE

- GROUP ACCOUNTS

- Pre-acquisition Reserves

- GROUP ACCOUNTS: Minority Interest

- GROUP ACCOUNTS: Inter Company Trading (P to S)

- GROUP ACCOUNTS: Fair Value Adjustments

- GROUP ACCOUNTS: Pre-acquistion Profits, Dividends

- GROUP ACCOUNTS: Profit & Loss

- GROUP ACCOUNTS: Minority Interest, Inter Co.

- GROUP ACCOUNTS: Inter Co. Trading (when there is unrealized profit)

- Comprehensive Workings in Group Accounts Consolidated Balance Sheet