|

AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise |

| << AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates |

| AGGREGATE SUPPLY:The sticky-price model >> |

Macroeconomics

ECO 403

VU

LESSON

32

AGGREGATE

DEMAND IN THE OPEN ECONOMY

(Continued...)

Why income

might not rise

·

The

central bank may try to

prevent the depreciation by

reducing the money

supply

·

The

depreciation might boost the

price of imports enough to

increase the price level

(which

would

reduce the real money

supply)

·

Consumers

might respond to the

increased risk by holding

more money.

Each

of the above would shift LM*

leftward.

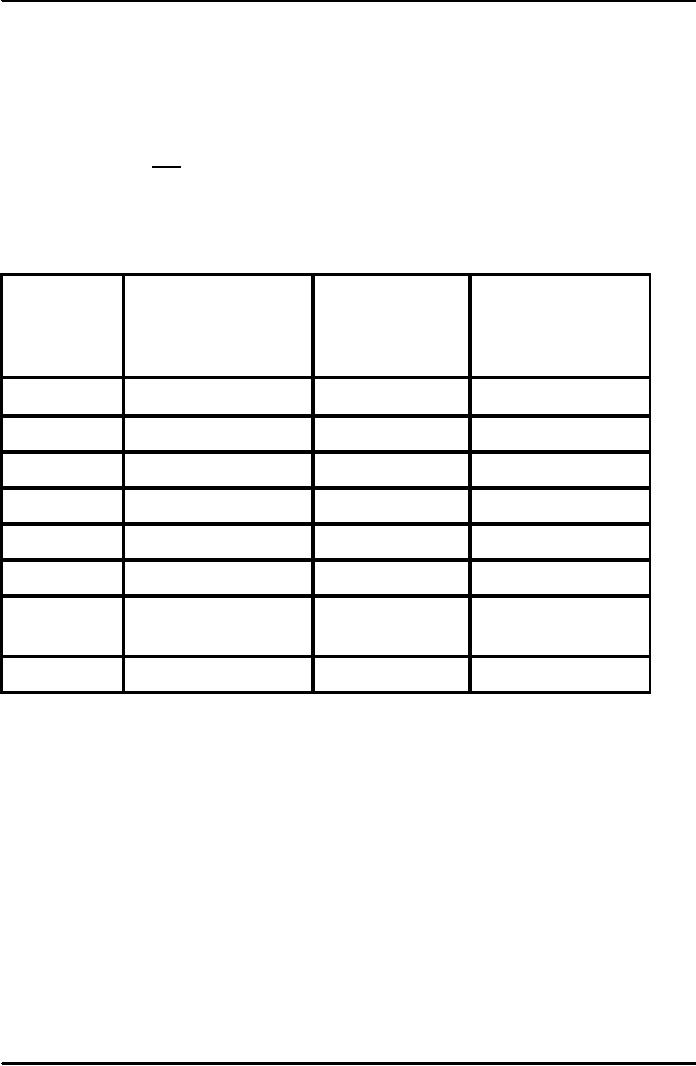

The

South East Asian

Crisis

stock

market %

nominal

GDP% change

exchange

rate% change

change

from 7/97 to

1997-98

from

7/97 to 1/98

1/98

Indonesia

-59.4%

-32.6%

-16.2%

Japan

-12.0%

-18.2%

-4.3%

Malaysia

-36.4%

-43.8%

-6.8%

Singapore

-15.6%

-36.0%

-0.1%

S.

Korea

-47.5%

-21.9%

-7.3%

Taiwan

-14.6%

-19.7%

n.a.

-1.2%

Thailand

-48.3%

-25.6%

(1996-97)

U.S.

n.a.

2.7%

2.3%

Floating

vs. Fixed Exchange

Rates

Argument

for floating rates:

·

Allows

monetary policy to be used to

pursue other goals (stable

growth, low

inflation)

Arguments

for fixed rates:

·

Avoids

uncertainty and volatility,

making international transactions

easier

·

Disciplines

monetary policy to prevent

excessive money growth &

hyperinflation

Mundell-Fleming

and the AD curve

·

Previously,

we examined the M-F model

with a fixed price level. To

derive the AD curve,

we

now

consider the impact of a

change in P in the M-F

model.

·

We

now write the M-F equations

as:

(IS* )

Y

= C

(Y

- T

) +

I (r

*) +

G + NX

(ε

)

151

Macroeconomics

ECO 403

VU

(LM* )

M

P = L

(r

*,Y

)

(Earlier,

we could write NX as a function of e

because e and ε

move in

the same direction

when

P is fixed.)

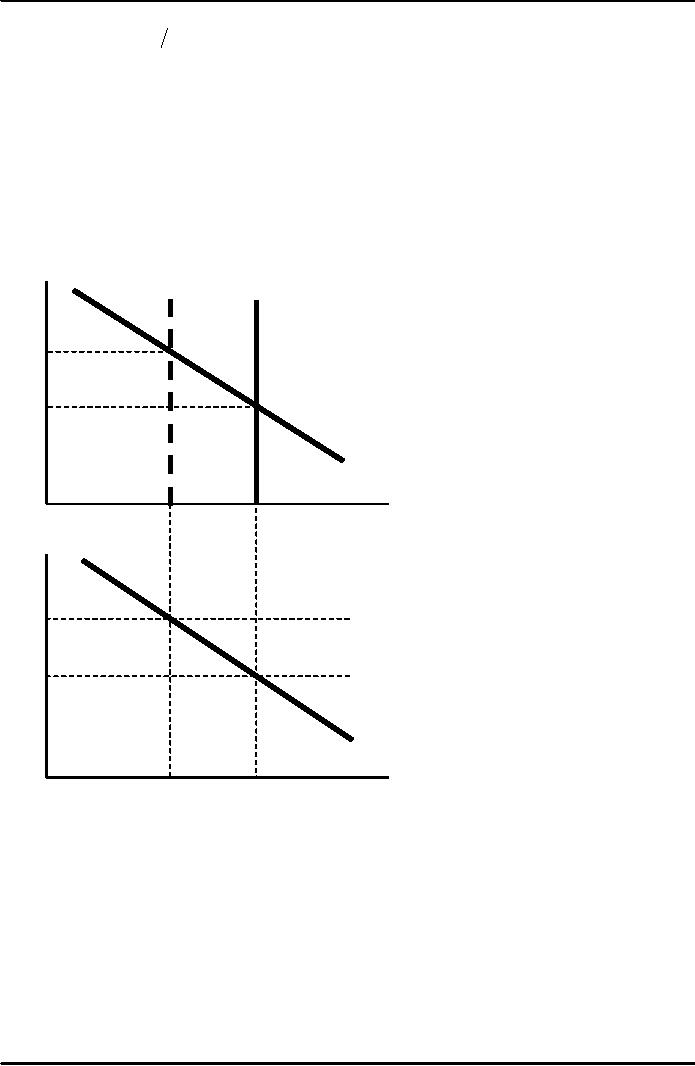

Deriving

the AD

curve

Why

AD curve has negative

slope:

↑P

⇒

↓(M/P)

⇒

LM shifts

left

⇒

↑ε

⇒

↓NX

⇒

↓Y

LM*(P2)

ε

LM*(P1)

ε2

ε1

IS*

Y1

Y

Y2

P

P2

P1

AD

Y

Y2

Y1

From

short run to the long

run

If

Y1 < Y then there is downward

pressure on prices. Over

time, P will move down,

causing

(M/P)↑

ε↓

NX

↑

Y↑

152

Macroeconomics

ECO 403

VU

LM*(P1)

ε

LM*(P2)

ε1

ε2

IS*

Y

Y1

Y

P

LRAS

P1

SRAS1

SRAS2

P2

AD

Y

Y1

Y

Large:

between small and

closed

·

Many

countries - including the

U.S. - are neither closed

nor small open

economies.

·

A

large open economy is in

between the polar cases of

closed & small

open.

·

Consider

a monetary expansion:

·

Like

in a closed economy,

ΔM > 0 ⇒

↓r ⇒ ↑I (though

not as much)

·

Like

in a small open

economy,

ΔM > 0 ⇒

↓ε ⇒ ↑NX

(though not as much)

153

Macroeconomics

ECO 403

VU

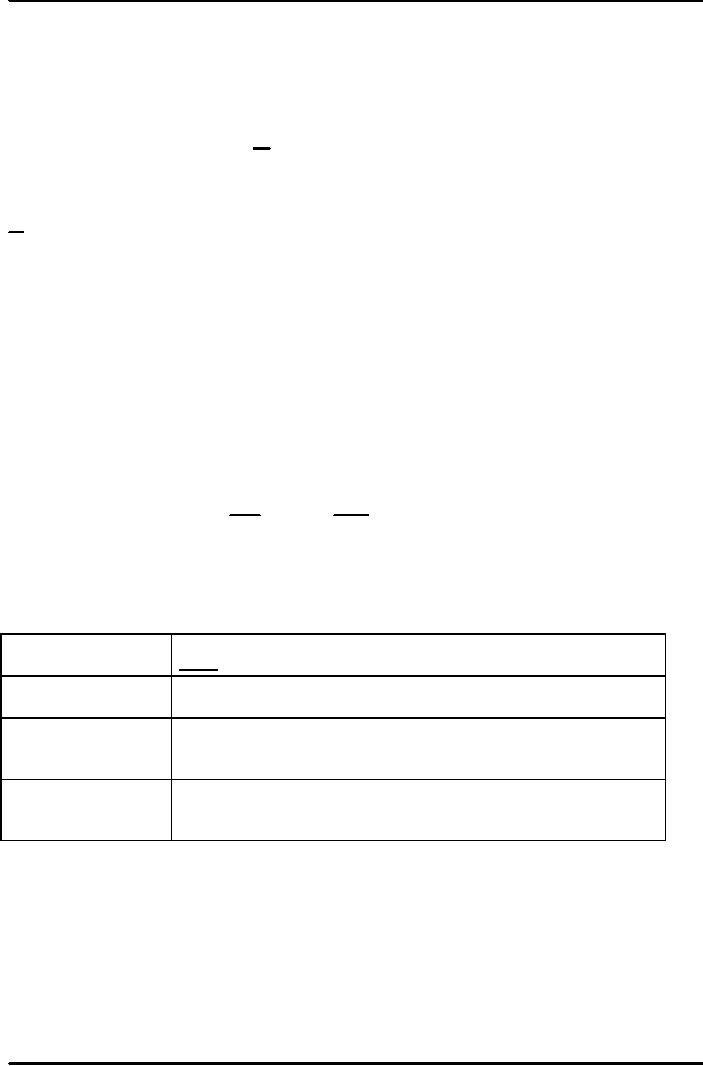

THREE

MODELS OF AGGREGATE

SUPPLY

·

The

sticky-wage model

·

The

imperfect-information model

·

The

sticky-price model

All

three models imply:

Y

= Y

+ α (P

- P

e )

Where:

Y

Aggregate

output

Y

Natural

rate of output

α

a

positive parameter

P

the

actual price level

e

P

the

expected price level

The

sticky-wage model

·

Assumes

that firms and workers

negotiate contracts and fix

the nominal wage before

they

know

what the price level

will turn out to

be.

·

The

nominal wage, W, they set is

the product of a target real

wage, ω, and

the expected

price

level:

W

= ω

×Pe

Pe

W

=ω×

⇒

P

P

If

Then

P

= Pe

Unemployment

and output are at their

natural rates

P

> Pe

Real

wage is less than its

target, so firms hire more

workers and

output

rises above its natural

rate

P

< Pe

Real

wage exceeds its target, so

firms hire fewer workers

and

output

falls below its natural

rate

154

Macroeconomics

ECO 403

VU

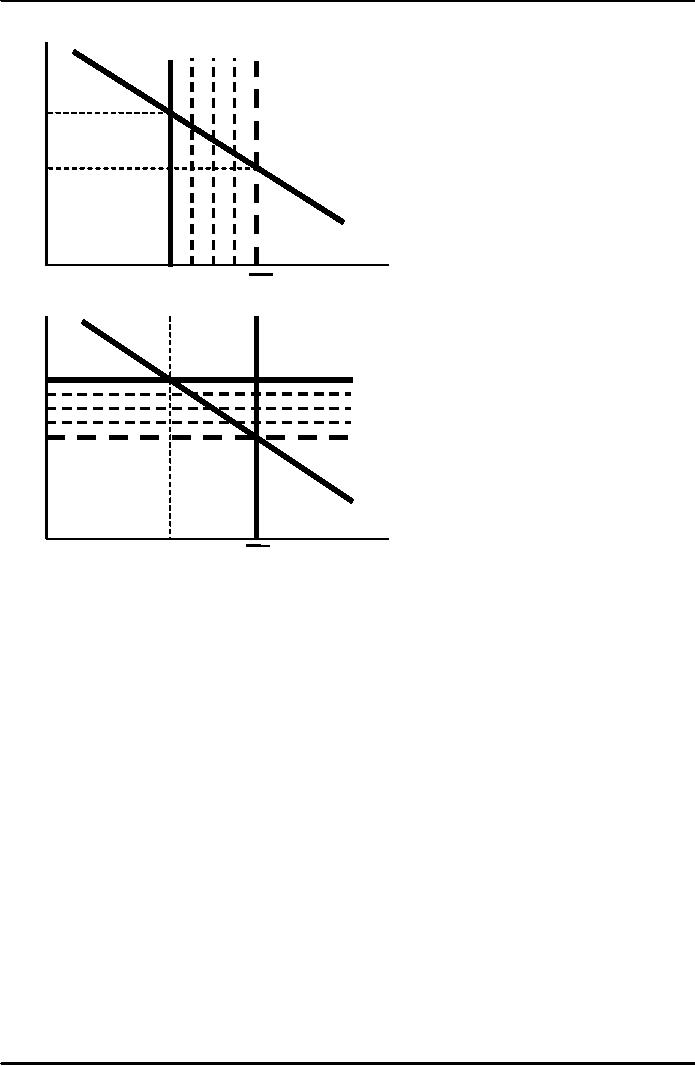

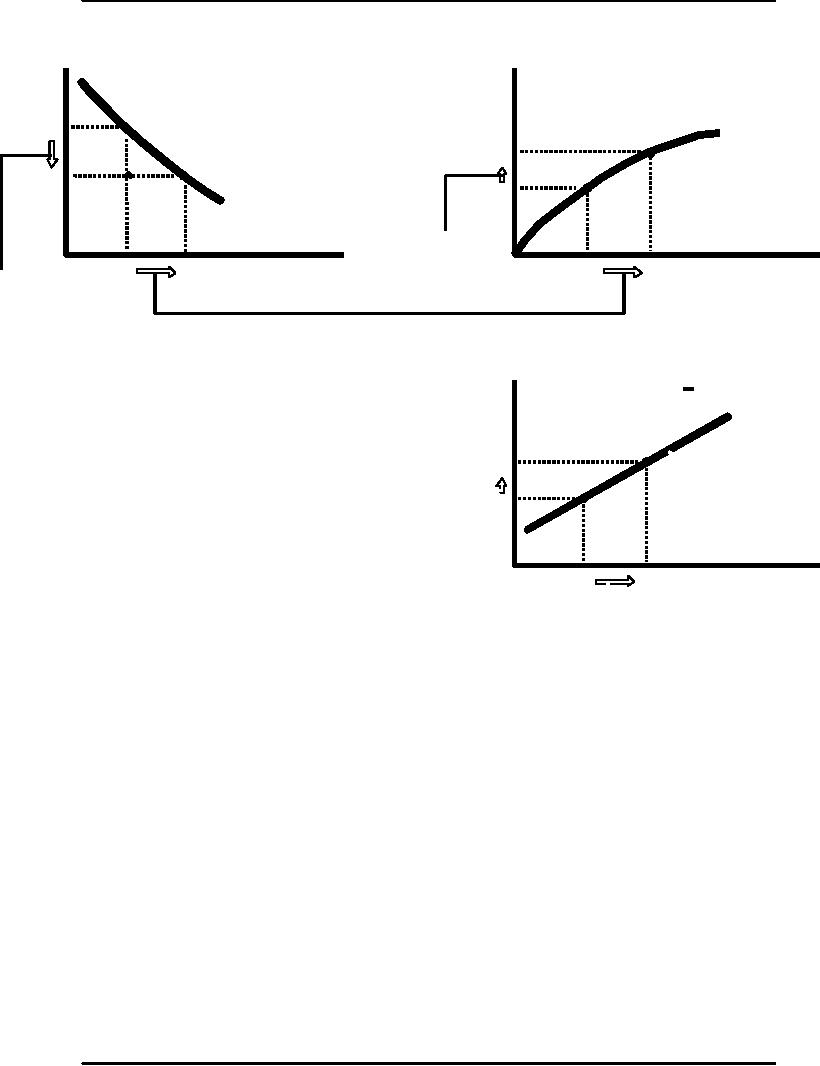

(a)

Labor Demand

(b)

Production Function

Real

wage,

Income,

Y

output,

W/P

W/P1

Y

= F (L )

Y

2

W/P2

Y

L

= Ld

(W/P

)

1

... output,.

.

4.

Labor,

Labor,

L

L

L

L

L

L

2.

. . . Reduces

1

2

1

2

the

real

wage

3....hich

raises

w

for

a given

employment. .

,

nominal

wage,.

.

(c)

Aggregate Supply

Price

level,

P

Y

= Y + α

(P

-P

e)

P

2

6.

The aggregate

supply

curve

P

1

summarizes

these

changes.

1.

An increase

in

the price

Income,

output,

Y

Y

Y

2

1

level.

.

...

and

income.

5.

The

sticky-wage model

·

Implies

that the real wage

should be counter-cyclical, it should

move in the opposite

direction

as output over the course of

business cycles:

In booms,

when P typically rises, the

real wage should

fall.

In recessions,

when P typically falls, the

real wage should

rise.

·

This

prediction does not come

true in the real

world:

155

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand