|

AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…): |

| << AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky |

| AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…): >> |

Macroeconomics

ECO 403

VU

LESSON

25

AGGREGATE

DEMAND AND AGGREGATE SUPPLY

(Continued...)

How

shocking!!!

Shocks:

exogenous changes in aggregate

supply or demand

Shocks

temporarily push the economy

away from

full-employment.

A

demand shock

·

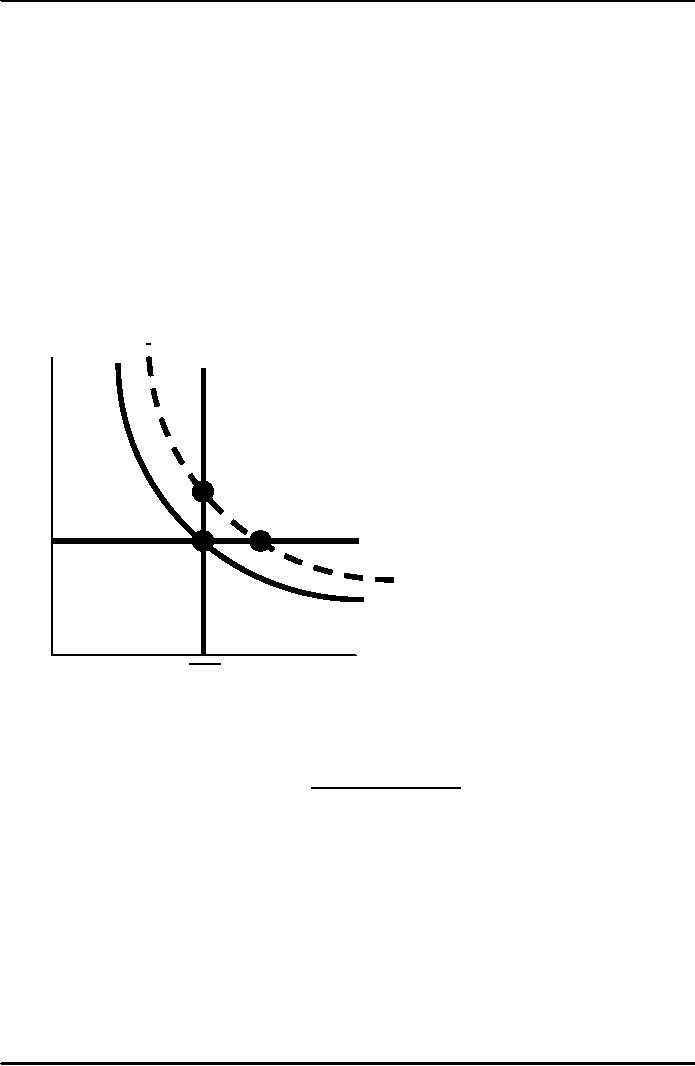

The

economy begins in long-run

equilibrium at point A. An increase in

aggregate demand,

due

to an increase in the velocity of

money, moves the economy

from point A to point

B,

where

output is above its natural

level. As prices rise,

output gradually returns to

its natural

rate,

and the economy moves

from point B to point

C.

LRAS

P

C

SRAS

B

AD'

A

AD

Y

Y

·

Exogenous

decrease in velocity

·

If

the money supply is held

constant, then a decrease in V

means people will be using

their

money

in fewer transactions, causing a

decrease in demand for goods

and services:

102

Macroeconomics

ECO 403

VU

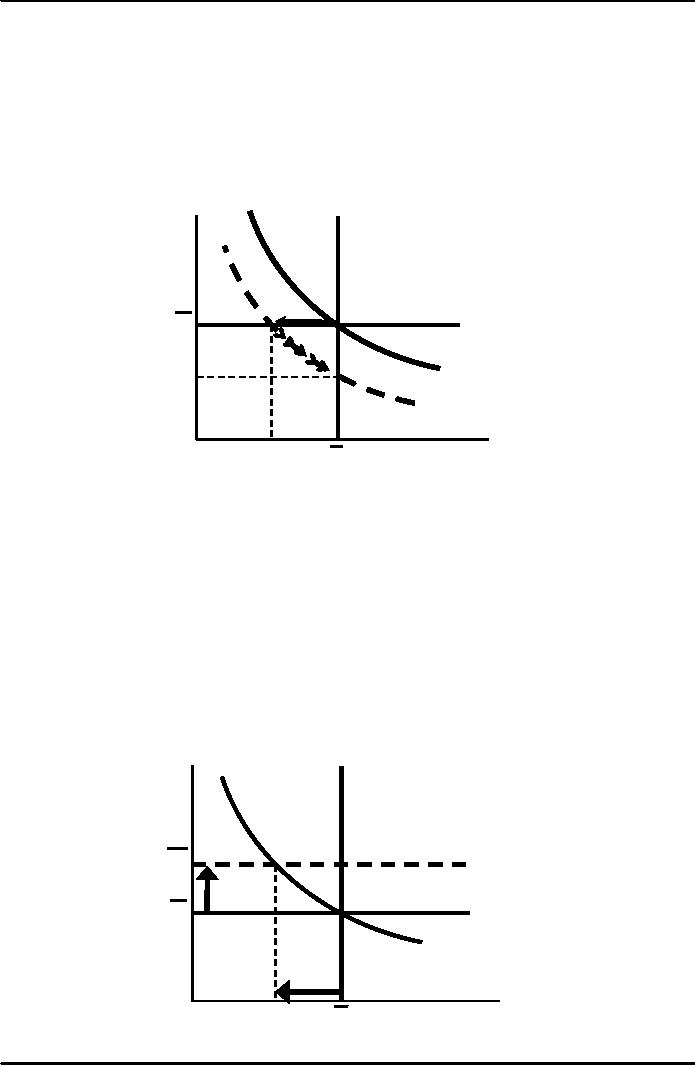

The

effects of a negative demand

shock

The

shock shifts AD left,

causing output and

employment to fall in the

short run. Over

time,

prices

fall and the economy

moves down its demand

curve toward

full-employment.

P

LRAS

A

B

SRAS

P

C

AD1

P2

AD2

Y

Y2

Y

Supply

shocks

A

supply shock alters

production costs,

affects

the prices that firms

charge.

(Also

price shocks)

Examples

of adverse supply

shocks:

·

Bad

weather reduces crop yields,

pushing up

food

prices.

·

Workers

unionize, negotiate wage

increases.

·

New

environmental regulations require

firms to reduce emissions.

Firms charge higher

prices

to help cover the costs of

compliance.

(Favorable

supply shocks lower costs

and prices)

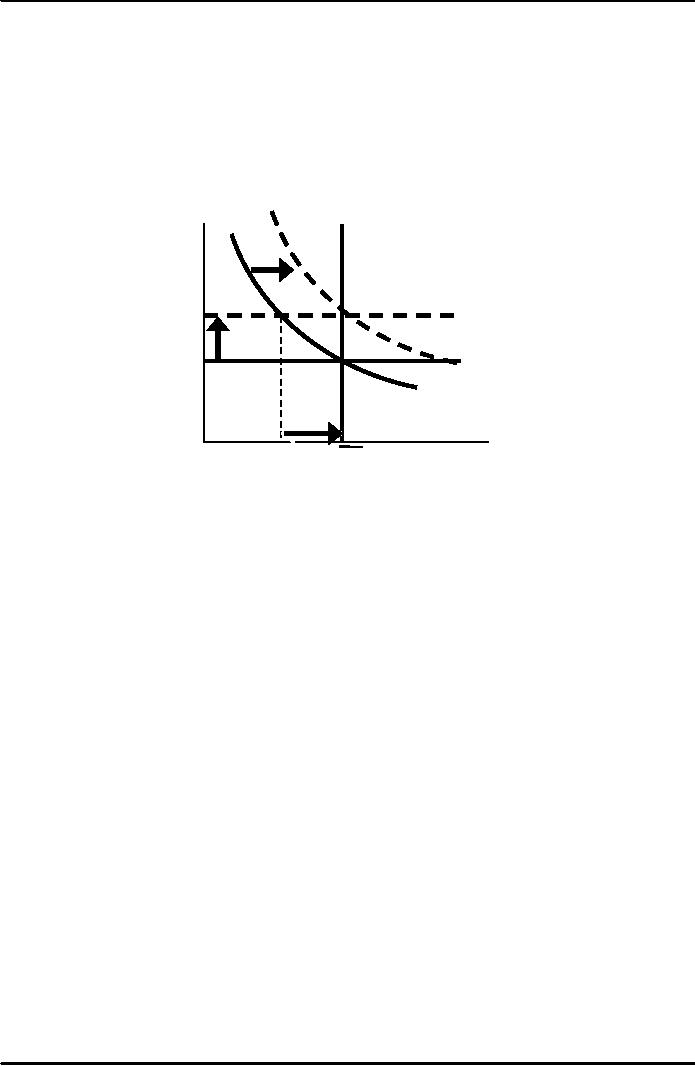

P

LRAS

B

SRAS2

P

2

A

SRAS1

P1

AD1

Y

Y2

Y

The

adverse supply shock moves

the economy to point

B.

103

Macroeconomics

ECO 403

VU

Stabilization

policy

·

def:

policy actions aimed at

reducing the severity of

short-run economic

fluctuations.

·

Example:

Using monetary policy to

combat the effects of

adverse supply

shocks:

But

central bank

accommodates

the

shock

by raising

aggregate

demand.

P

LRAS

B

SRAS2

C

P1

A

AD2

P2

AD1

Y

Y2

Y1

1

Results:

P

is

permanently higher, but

Y

remains

at its full-employment

level.

The

1970s oil shocks

·

Early

1970s: OPEC coordinates a

reduction in the supply of

oil.

·

Oil

prices rose

11%

in 1973

68%

in 1974

16%

in 1975

·

Such

sharp oil price increases

are supply shocks because

they significantly

impact

production

costs and prices.

104

Macroeconomics

ECO 403

VU

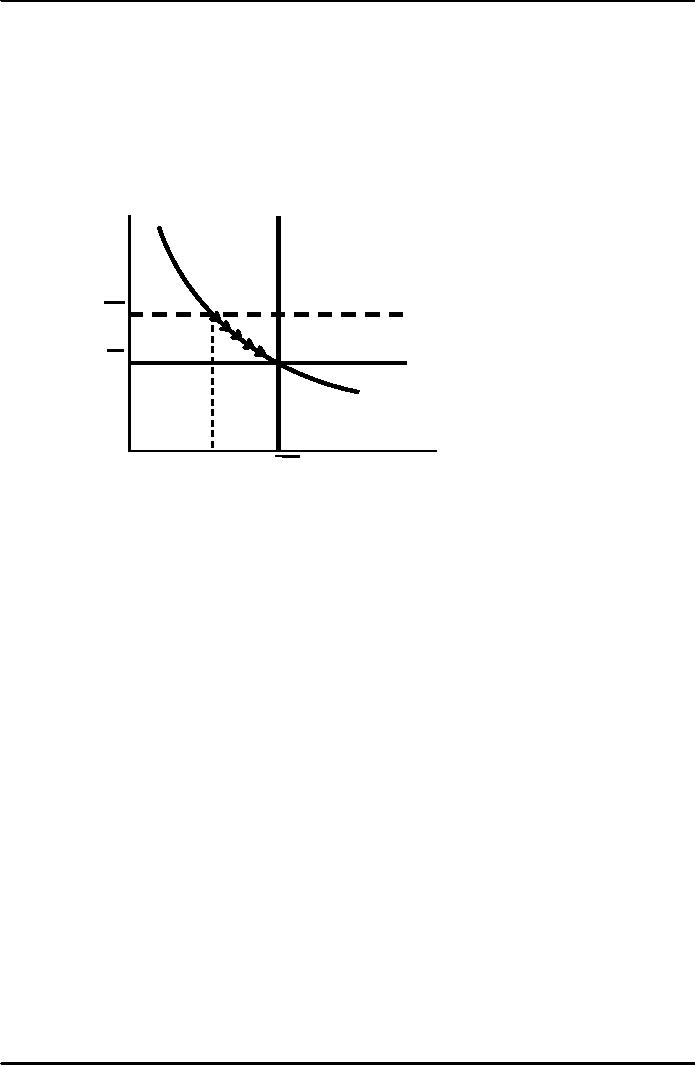

The

oil price shock shifts

SRAS up, causing output

and employment to fall. In

absence

of

further price shocks, prices

will fall over time

and economy moves back

toward full

employment.

P

LRAS

B

SRAS2

P

2

A

SRAS1

P1

AD1

Y

Y2

Y1

Predicted

effects of the oil price

shock:

·

Inflation

↑

·

Output ↓

·

Unemployment

↑

105

Macroeconomics

ECO 403

VU

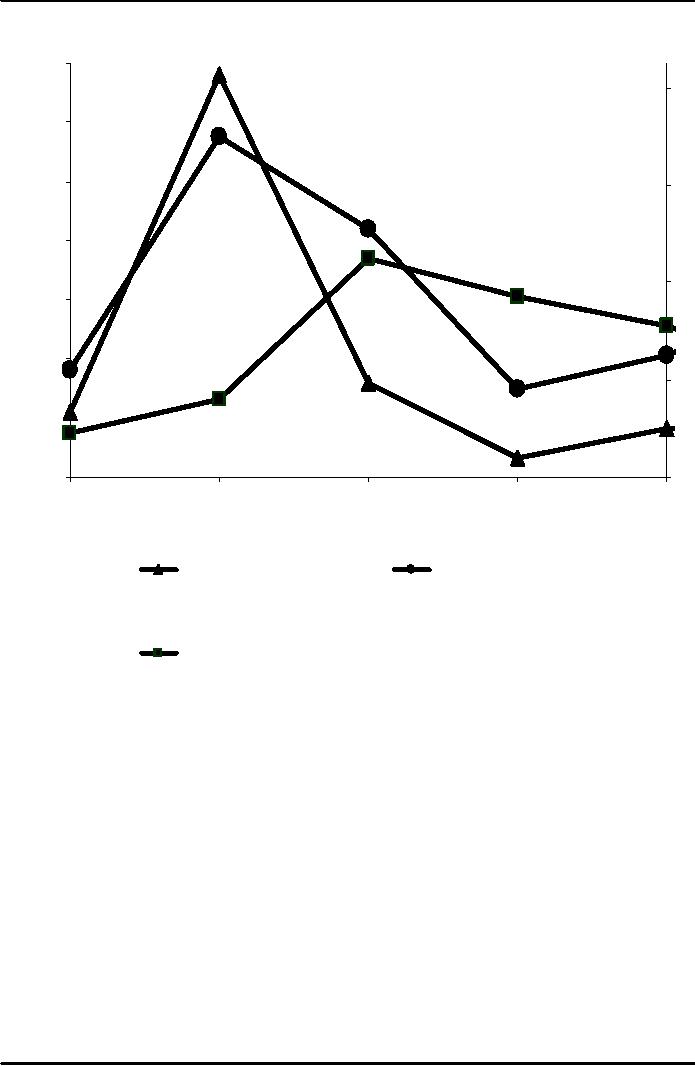

...and

then a gradual

recovery.

70%

12%

60%

50%

10%

40%

8%

30%

20%

6%

10%

0%

4%

1973

1974

1975

1976

1977

Change

in oil prices (lef t

scale)

Inf

lation rate-CPI (right

scale)

Unemployment

rate (right scale)

106

Macroeconomics

ECO 403

VU

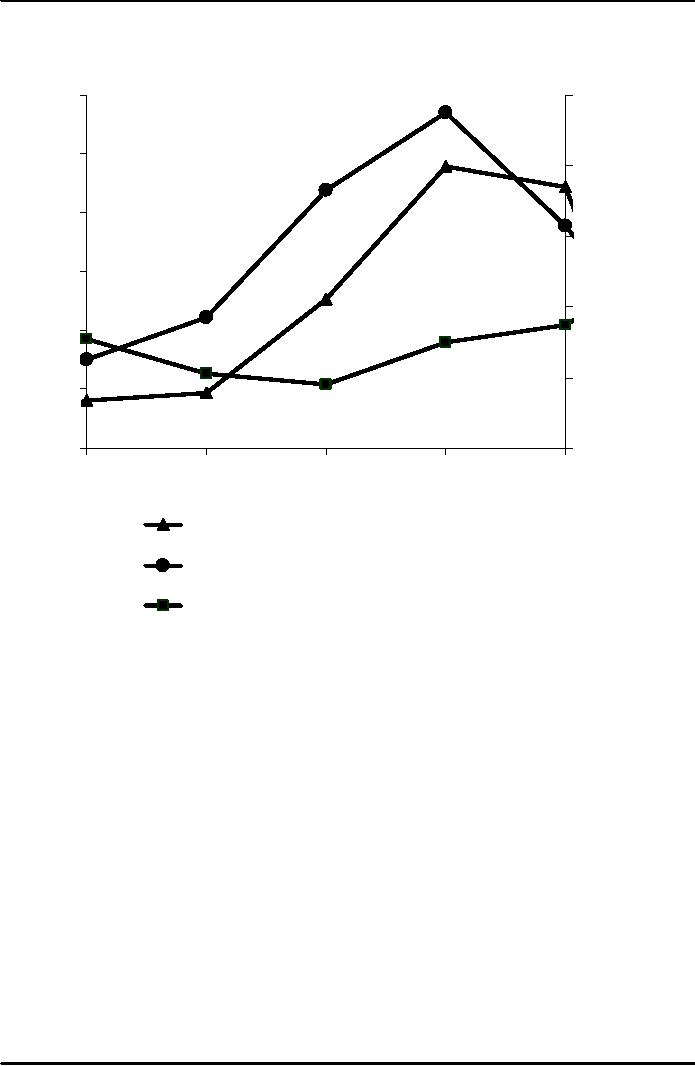

Late

1970s: As economy was

recovering, oil prices shot

up again, causing another

huge

supply

shock!!!

60%

14%

50%

12%

40%

10%

30%

8%

20%

6%

10%

0%

4%

1977

1978

1979

1980

1981

Change

in oil prices (left

scale)

Inflation

rate-CPI (right

scale)

Unemployment

rate (right scale)

107

Macroeconomics

ECO 403

VU

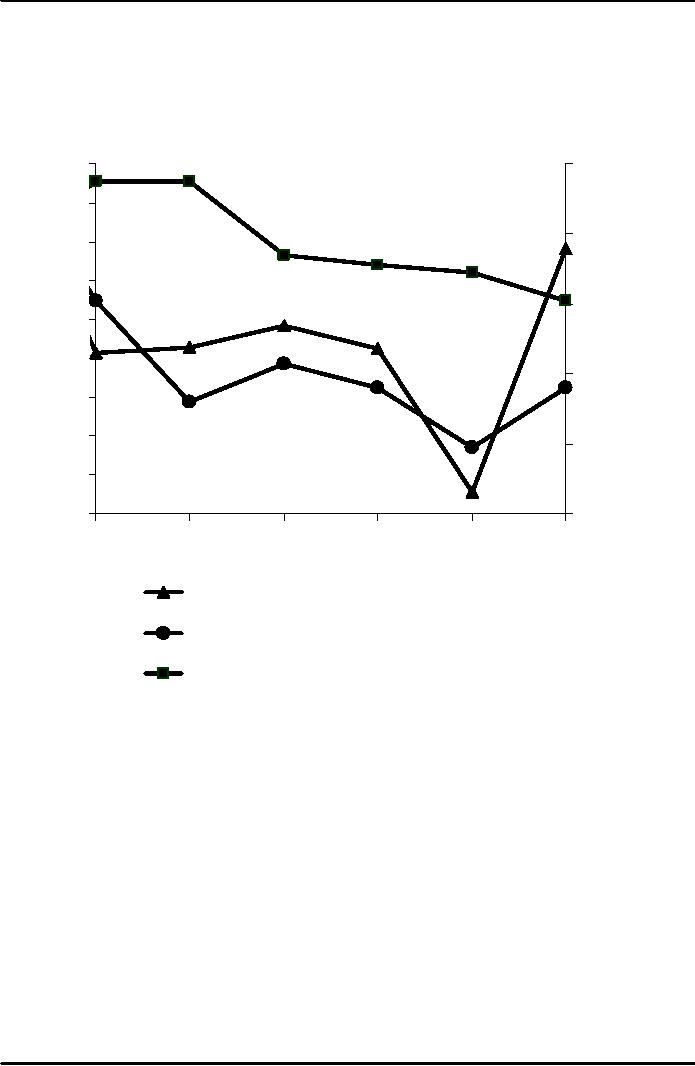

The

1980s oil shocks

1980s:

A favorable supply shock--a

significant fall in oil

prices.

As

the model would predict,

inflation and unemployment

fell:

40%

10%

30%

8%

20%

10%

6%

0%

-10%

4%

-20%

-30%

2%

-40%

0%

-50%

1982

1983

1984

1985

1986

1987

Change

in oil prices (left

scale)

Inflation

rate-CPI (right

scale)

Unemployment

rate (right scale)

Keynesian

theory of Income &

Employment

·

Model

of aggregate demand & aggregate

supply

·

Long

run

Prices

flexible

Output

determined by factors of production &

technology

Unemployment

equals its natural

rate

·

Short

run

Prices

fixed

Output

determined by aggregate

demand

Unemployment is

negatively related to

output

108

Table of Contents:

- INTRODUCTION:COURSE DESCRIPTION, TEN PRINCIPLES OF ECONOMICS

- PRINCIPLE OF MACROECONOMICS:People Face Tradeoffs

- IMPORTANCE OF MACROECONOMICS:Interest rates and rental payments

- THE DATA OF MACROECONOMICS:Rules for computing GDP

- THE DATA OF MACROECONOMICS (Continued…):Components of Expenditures

- THE DATA OF MACROECONOMICS (Continued…):How to construct the CPI

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- NATIONAL INCOME: WHERE IT COMES FROM AND WHERE IT GOES (Continued…)

- MONEY AND INFLATION:The Quantity Equation, Inflation and interest rates

- MONEY AND INFLATION (Continued…):Money demand and the nominal interest rate

- MONEY AND INFLATION (Continued…):Costs of expected inflation:

- MONEY AND INFLATION (Continued…):The Classical Dichotomy

- OPEN ECONOMY:Three experiments, The nominal exchange rate

- OPEN ECONOMY (Continued…):The Determinants of the Nominal Exchange Rate

- OPEN ECONOMY (Continued…):A first model of the natural rate

- ISSUES IN UNEMPLOYMENT:Public Policy and Job Search

- ECONOMIC GROWTH:THE SOLOW MODEL, Saving and investment

- ECONOMIC GROWTH (Continued…):The Steady State

- ECONOMIC GROWTH (Continued…):The Golden Rule Capital Stock

- ECONOMIC GROWTH (Continued…):The Golden Rule, Policies to promote growth

- ECONOMIC GROWTH (Continued…):Possible problems with industrial policy

- AGGREGATE DEMAND AND AGGREGATE SUPPLY:When prices are sticky

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…):

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND AND AGGREGATE SUPPLY (Continued…)

- AGGREGATE DEMAND IN THE OPEN ECONOMY:Lessons about fiscal policy

- AGGREGATE DEMAND IN THE OPEN ECONOMY(Continued…):Fixed exchange rates

- AGGREGATE DEMAND IN THE OPEN ECONOMY (Continued…):Why income might not rise

- AGGREGATE SUPPLY:The sticky-price model

- AGGREGATE SUPPLY (Continued…):Deriving the Phillips Curve from SRAS

- GOVERNMENT DEBT:Permanent Debt, Floating Debt, Unfunded Debts

- GOVERNMENT DEBT (Continued…):Starting with too little capital,

- CONSUMPTION:Secular Stagnation and Simon Kuznets

- CONSUMPTION (Continued…):Consumer Preferences, Constraints on Borrowings

- CONSUMPTION (Continued…):The Life-cycle Consumption Function

- INVESTMENT:The Rental Price of Capital, The Cost of Capital

- INVESTMENT (Continued…):The Determinants of Investment

- INVESTMENT (Continued…):Financing Constraints, Residential Investment

- INVESTMENT (Continued…):Inventories and the Real Interest Rate

- MONEY:Money Supply, Fractional Reserve Banking,

- MONEY (Continued…):Three Instruments of Money Supply, Money Demand